A tale of synthetic ID fraud

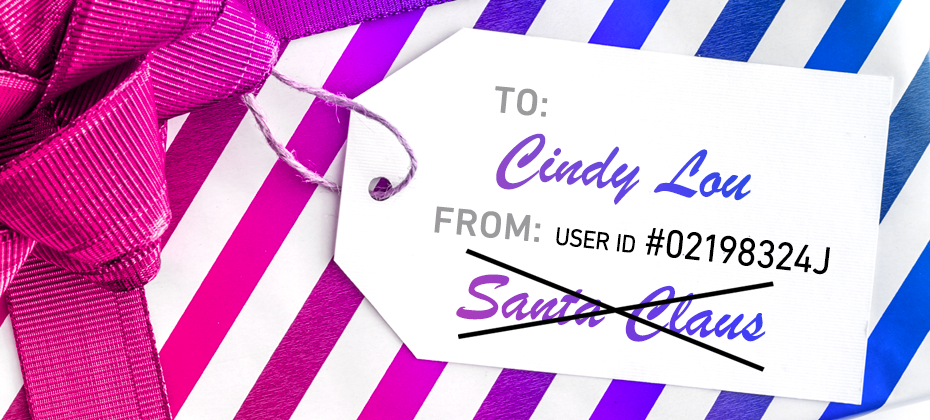

Synthetic ID fraud is an increasing issue and affects everyone, including high-profile individuals. A notable case from Ohio involved Warren Hayes, who managed to get an official ID card in the name of “Santa Claus” from the Ohio Bureau of Motor Vehicles. He also registered a vehicle, opened a bank account, and secured an AAA membership under this name, listing his address as 1 Noel Drive, North Pole, USA.

This elaborate ruse unraveled after Hayes, disguised as Santa, got into a minor car accident. When the police requested identification, Hayes presented his Santa Claus ID. He was subsequently charged under an Ohio law prohibiting the use of fictitious names.

However, the court—presided over by Judge Thomas Gysegem—dismissed the charge, arguing that because Hayes had used the ID for over 20 years, “Santa Claus” was effectively a “real person” in the eyes of the law. The judge’s ruling raised eyebrows and left one glaring question unanswered: how could official documents in such a blatantly fictitious name go undetected for two decades?

From Santa Claus to synthetic IDs: the modern-day threat

The Hayes case might sound like a holiday comedy, but it highlights a significant issue that organizations face today: synthetic identity fraud. Unlike traditional identity theft, synthetic ID fraud does not rely on stealing an existing identity. Instead, fraudsters combine real and fictitious details to create a new “person.” Think of it as an elaborate game of make-believe, where the stakes are millions of dollars.

These synthetic identities can remain under the radar for years, building credit profiles, obtaining loans, and committing large-scale fraud before detection. Just as Hayes tricked the Bureau of Motor Vehicles, fraudsters exploit weak verification processes to pass as legitimate individuals.

According to KPMG, synthetic identity fraud bears a staggering $6 billion cost to banks.To perpetrate the crime, malicious actors leverage a combination of real and fake information to fabricate a synthetic identity, also known as a “Frankenstein ID.”

The financial industry classifies various types of synthetic identity fraud.

- Manipulated Synthetics – A real person’s data is modified to create variations of that identity.

- Frankenstein Synthetics – The data represents a combination of multiple real people.

- Manufactured Synthetics – The identity is completely synthetic.

How organizations can combat synthetic ID fraud

A multifaceted approach to detecting synthetic identities that integrates advanced technologies can form the foundation of a sound fraud prevention strategy:

- Advanced identity verification tools: Use AI-powered tools that cross-check identity attributes across multiple data points to flag inconsistencies.

- Behavioral analytics: Monitor user behaviors to detect anomalies that may indicate synthetic identities. For instance, a newly created account applying for a large loan with perfect credit is a red flag.

- Digital identity verification: Implement digital onboarding processes that include online identity verification with real-time document verification. Users can upload government-issued IDs and take selfies to confirm their identity.

- Collaboration and data sharing: Organizations can share insights about suspected synthetic identities to prevent fraudsters from exploiting gaps between industries.

- Ongoing employee training: Ensure frontline staff can identify suspicious applications and escalate potential fraud cases.

- Regulatory support: Governments and regulators can help by standardizing ID issuance processes and requiring more stringent checks.

Closing thoughts

The tale of Santa Claus’ stolen identity may be entertaining, but it underscores the need for vigilance against synthetic ID fraud. As we move into an increasingly digital age, organizations must stay ahead of fraudsters by leveraging technology, training, and collaboration.

Because while the idea of Spiderman or Catwoman walking into your branch may seem amusing, the financial and reputational cost of synthetic ID fraud is no laughing matter.