In an era where record-breaking home prices and skyrocketing interest rates define the mortgage landscape, borrowers find themselves sidelined by prohibitive costs. With the purchase market at a standstill, mortgage lenders are grappling with how to sustain and grow their businesses. Navigating these turbulent waters requires innovative solutions that address the current market dynamics and pave the way for a more resilient and adaptive future.

Today, I’m sitting down with Ivan Ahmed, Director of Product Management for Experian’s Property Data solutions, to learn more about Experian’s Residential Property Attributes™, a new and exciting dataset that can significantly enhance mortgage marketing and mortgage lead generation strategies and drive business growth for lenders, particularly during these challenging times.

Question 1: Ivan, can you provide a brief overview of Residential Property Attributes and its relevance in today’s mortgage lending landscape?

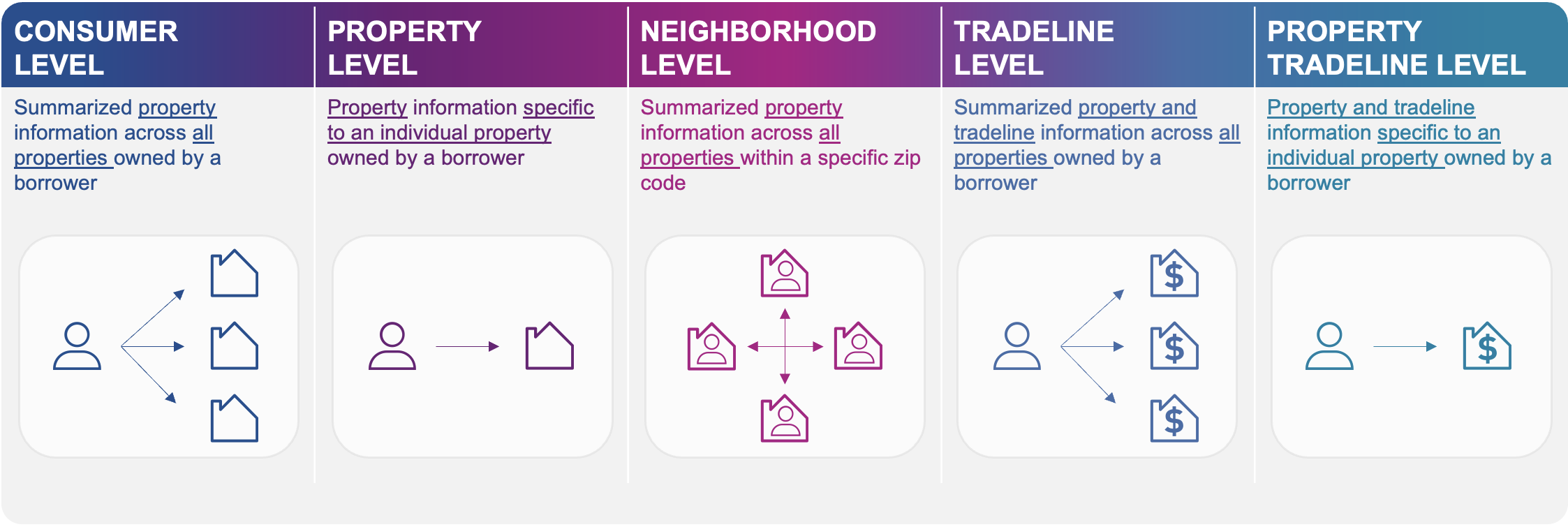

Answer 1: Absolutely. Residential Property Attributes is our latest product innovation designed to revolutionize how mortgage lenders approach marketing and growth decisions. It’s a robust dataset containing nearly 300 attributes that seamlessly integrates borrower property and tradeline information, providing a more holistic view of a borrower’s financial situation. This powerful dataset empowers lenders to make well-informed, impactful marketing decisions by refining campaign segmentation and targeting. Our attributes group into five categories:

Question 2: As a data-focused company, we frequently discuss the importance of leveraging data and analytics to enhance marketing performance with clients. Considering other data providers that offer property data analytics or credit behavior data, what makes our capabilities distinct?

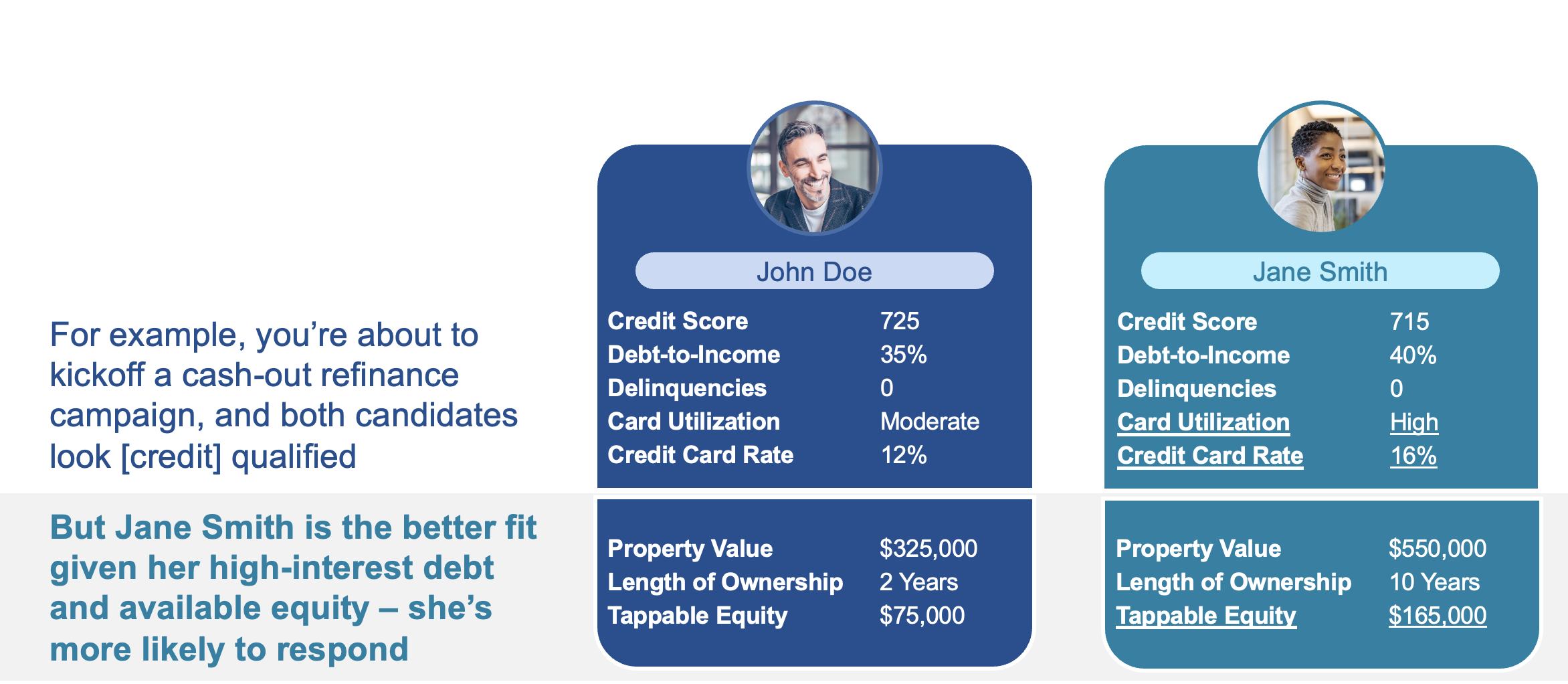

Answer 2: The defining feature of Residential Property Attributes is its integration with borrower tradeline data. Many lenders today focus primarily on credit behavior, but we consider property data analytics, a critical aspect, equally important. By merging these two components, we present lenders with a thorough and accurate understanding of their target borrowers. This combination is revolutionary for marketing leaders looking to boost campaign performance and return on investment (ROI).

Consider this scenario: On paper, two borrowers may seem homogenous, with similar credit scores, payment histories, and debt-to-income ratios. However, when you incorporate property-level insights, a striking disparity in their overall financial situations emerges. This level of insight prevents possible misdirection in marketing efforts.

Question 3: Could you share more about the practical benefits of Residential Property Attributes, especially regarding enhancing marketing performance?

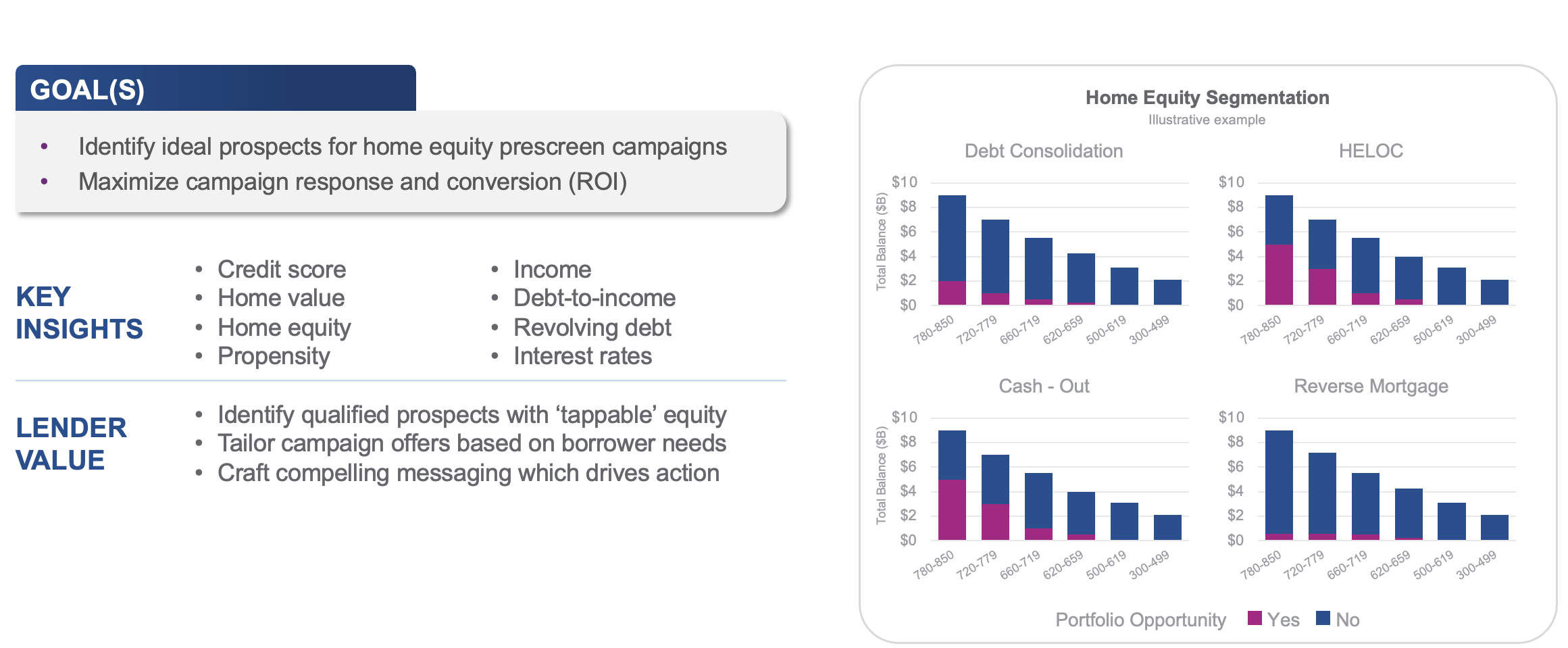

Answer 3: Residential Property Attributes is instrumental in amplifying performance. It enables precise audience segmentation, allowing lenders to tailor marketing campaigns to address specific borrower needs. Here are a few examples:

- Lenders can identify borrowers with over $100k in tappable equity and high-interest personal loans and credit card debt. These borrowers are ideal for a cash-out refinance campaign aimed at debt consolidation. They can use a similar approach for Home Equity Line of Credit (HELOC) or Reverse Mortgage campaigns.

- Another instance is the utilization of property listings data. This identifies borrowers who are actively selling their properties and may need a new mortgage loan. This insight, coupled with credit-based ‘in the market’ propensity scores, enables lenders to pinpoint highly motivated borrowers.

Such personalization improves engagement and enhances the borrower experience. The result is a marketing campaign that resonates with the audience, thus yielding higher response rates and conversions. The integrated view provided by Residential Property Attributes is the secret ingredient enabling lenders to maximize ROI by optimizing their marketing journey at every step.

Taking action

As we traverse today’s complex mortgage landscape, it’s clear that conventional methods fall short. As we face unprecedented challenges, adopting a holistic view of borrowers via Residential Property Attributes is not an option but a necessity. It’s more than a tool; it’s a compass guiding lenders towards more informed, resilient, and successful futures in the ever-changing world of mortgage lending.