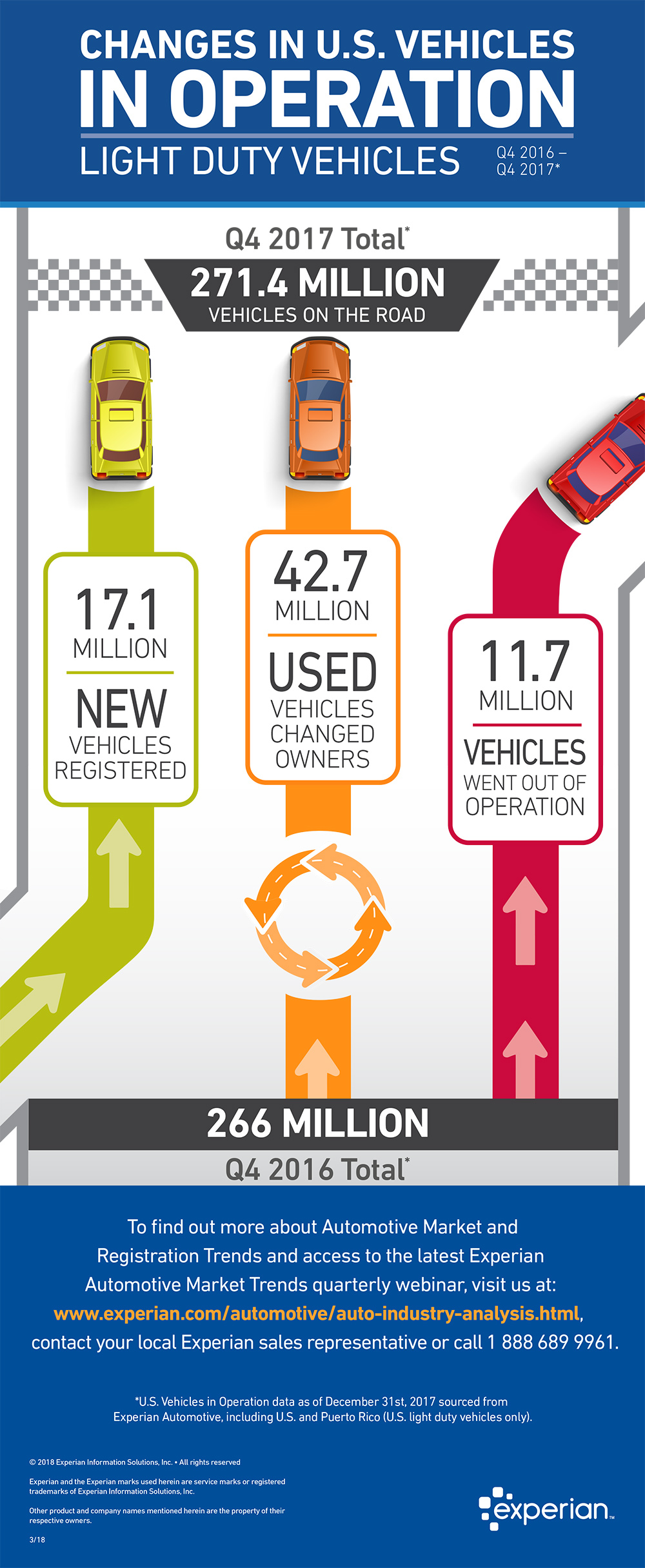

Changes in U.S. Vehicles in Operation: Q4 2016 – Q4 2017

by Guest Contributor 1 min read March 15, 2018

Related Posts

We’re excited to share that Experian Automotive’s client Hamlin & Associates and Honda World have been named winners of the 2025 Automotive News / Ad Age Global Automotive Marketing Award for Best Use of Data — an honor that celebrates meaningful, measurable impact. Why this work stood out Hamlin & Associates' client, Honda World of Louisville, KY, faced a clear challenge: re-engage customers and recover declining service revenue, particularly for vehicles with open recalls. Hamlin & Associates approached the problem with a simple belief: clean, accurate data leads to better outcomes for customers and dealerships alike. They began with data hygiene, then enriched each vehicle record using Experian Automotive’s Recall VIN Verification solution. This created a precise view of who owned which vehicles, which recalls were still open, and when repairs could be completed — all essential to a smooth customer experience. A smarter, more human outreach strategy Over the course of a year, Hamlin delivered four waves of direct mail designed to cut through the noise. Each letter: Spoke directly to the customer Highlighted their specific vehicle Explained the recall in clear language Showed how easy it was to book a free repair The result was a data-driven communication plan grounded in trust and simplicity — and it worked Results that show what’s possible 26% response rate 1,953 repair orders $811,834 in service revenue Thousands of customers are now driving safer vehicles These outcomes reflect more than campaign performance. They demonstrate what happens when dealers, agencies, and data partners collaborate to guide individuals toward safer, more informed decisions. In their words John Hamlin, Hamlin & Associates:“Clean data builds trust. When we combine our hygiene process with Experian Automotive insights, dealers uncover opportunities they never knew they had.” Mike Porro, Honda World:“They keep it simple, and data-driven ‘simple’ gets done. We follow the process, train our staff, and see the results.” Looking ahead We’re proud to celebrate Hamlin & Associates and Honda World for showing what’s achievable when data, insight, and clear communication come together. Their work helps people stay safe, strengthens customer relationships, and sets a new standard for recall outreach. Congratulations to the entire team — and here’s to helping even more drivers move forward Learn more about how to enrich your first-party data with Recall VIN Verification insights!

by Trish Radaj 1 min read December 18, 2025

Experian Automotive Series | What Auto Marketers Are Prioritizing in the Second Half of 2025 As we close out our four-part series on what auto marketers are prioritizing in the second half of 2025, we’re shifting gears from strategy to execution. It’s time to explore how marketers are operationalizing data, seeking clarity, and building emotional connections that deepen relationships with customers. With the end of the year’s competitive automotive landscape, clarity and connection aren’t just buzzwords—they’re the cornerstones of growth and loyalty for 2026. Let’s start by exploring how clarity empowers today’s marketers to steer their strategies with control. Clarity: Putting marketers in the driver’s seat Data-guided auto marketers who leverage data insights have a clearer understanding of where consumers are on their car-buying journey. You can learn whether car buyers are gearing up for: A longer commute and want an electric vehicle (or a hybrid vehicle).1 Expanding their family and want a top-tier safety rating with cargo space. Factoring in market trends and wanting to be more economical.2 Creating a new and loyal customer base requires dealers, marketers, and OEMs to focus on clarity and connection. This will be more relevant than ever in the final days of 2025. Gone are the days when dealers and agencies used platforms and tools they did not understand. More businesses are simplifying their services and products by offering guides, Artificial Intelligence (AI) tools, tutorials, consultants, and webinars. At Experian Automotive, we're here to do just that, bringing clarity to our auto solutions, such as the Experian Marketing Engine (EME). While the EME tool has robust and dynamic data, two of our most widely used features — AutoAudiences and AutoInsights — stand out for their impact. Let’s break them down in the simplest way: AutoInsights helps marketers define where, what, and how. AutoAudiences helps reach who to target and when they might be in the market. For further clarification, savvy marketers leverage AutoInsights to strategize and understand their market, then activate AutoAudiences to curate marketing opportunities. With these tools empowering clarity, it’s equally important to focus on building genuine connections with car shoppers. Connection: Personalized experiences that drive sales Building a strong connection starts by truly understanding what consumers need and where they are on their car-buying journey. It’s important to know how consumers plan to use their vehicle and how they have serviced their cars in the past (or how they plan to service them in the future). By focusing on these details, marketers and dealerships can create more meaningful relationships and deliver helpful, relevant experiences that customers value. On the journey to better connections, consider your customers’ communication preferences, 2026 plans, and affordability.3 “Human connection...separates good stores from great ones,” notes Dealer Principal, Matt Birckhead at Sir Walter Chevrolet4 , while General Manager, Michael Wood at Jaguar Land Rover Virginia Beach collaborates with his Digital Director, Ryan Montville, to generate vehicle specs and feature descriptions that connect emotionally with target buyers 5 Key Takeaway: Automotive marketers who leverage data-informed clarity and authentic customer connection are best positioned to drive growth and loyalty in the final days of 2025 into 2026. By using innovative tools like Experian Marketing Engine, focusing on consumer needs, and personalizing every interaction, dealerships, agencies, and OEMs can optimize campaigns and foster lasting relationships. Mastering clarity with data and building emotional connections are the keys to success in automotive marketing today. Ready for clarity and connection with Experian data? Lead the way in creating customer-first experiences that fuel long-term growth. Connect with Experian Automotive and start driving measurable impact. Learn More https://www.coxautoinc.com/insights-hub/q3-2025-ev-sales-report-commentary/ https://www.experian.com/automotive/auto-credit-webinar-form https://news.dealershipguy.com/p/inside-q4-s-new-vehicle-trends-and-how-dealers-are-adjusting-2025-10-28 https://news.dealershipguy.com/p/one-price-vs-negotiation-what-four-operators-say-really-builds-trust-and-gross-2025-10-16 https://news.dealershipguy.com/p/5-powerful-chatgpt-hacks-car-dealers-are-using-to-supercharge-their-business-insights-2025-09-19

by Chanté O’Neill 1 min read November 11, 2025

Executive Summary The July 2025 housing market reveals a landscape of shifting consumer behaviors, evolving lender strategies, and continued strength in borrower performance—especially within home equity. Origination volumes have dipped slightly, but direct marketing, particularly through Invitation to Apply (ITA) campaigns, is accelerating. As key players exit the space, gaps are opening across both marketing and origination, creating clear opportunities for agile institutions. This phase signals both caution and potential. The winners will be those who refine their marketing, sharpen segmentation, and deploy smarter risk monitoring in real time. TL;DR Risk Profile: Mortgage and HELOC delinquencies remain low. Slight increases in 90+ DPD are not yet cause for concern. Mortgage Originations: Modestly down, but marketing remains aggressive. Invitation to Apply (ITA) volumes outpacing prescreen. Home Equity Originations: Stable originations, competitive marketing volumes. ITA volumes outpacing prescreen similar to mortgage. Opportunity: Targeted direct mail and refined segmentation are growth levers in both mortgage and home equity. Risk Environment: Resilient Yet Watchful Experian’s July data shows both mortgage and home equity delinquencies hovering at historically low levels. Early-stage delinquencies dropped in June, while late-stage (90+ days past due) nudged upward—still below thresholds signaling broader distress. HELOCs followed a similar path. Early-stage movement was slightly elevated but well within acceptable ranges, reinforcing borrower stability even in a high-rate, high-tariff environment. Takeaway: Creditworthiness remains strong, especially for real estate–backed portfolios, but sustained monitoring of 90+ DPD trends is smart risk management. Home Equity: Volume Holds, Competition Resets Home equity lending is undergoing a major strategic reshuffle. With a key market participant exiting the space, a significant share of both marketing and originations is now in flux. What’s happening: Direct mail volumes in home equity nearly match those in first mortgages—despite the latter holding larger balances. ITA volumes alone topped 8 million in May 2025. Total tappable home equity stands near $29.5 trillion, underscoring a massive opportunity.(source: Experian property data.) Lenders willing to recalibrate quickly can unlock high-intent borrowers—especially as more consumers seek cash flow flexibility without refinancing into higher rates. Direct Mail and Offer Channel Trends The continued surge in ITA campaigns illustrates a broader market pivot. Lenders are favoring: Controlled timing and messaging Multichannel alignment Improved compliance flexibility May 2025 Mail Volumes: Offer Type Mortgage Home Equity ITA 29.2M 25.8M Prescreen 15.6M 19.0M Strategic Insights for Lenders 1. Invest in Personalized Offers Drive better response rates with prescreen or ITA campaigns. Leverage data assets like Experian ConsumerView for ITA’s for robust behavioral and lifestyle segmentation. For prescreen, achieve pinpoint-personalization with offers built on propensity models, property attributes, and credit characteristics. 2. Seize the Home Equity Opening Use urgency-based messaging to attract consumers searching for fast access to equity—without the complexity of a full refi. Additionally, as mentioned above, leverage propensity, credit, and property (i.e. equity) data to optimize your marketing spend. 3. Strengthen Risk Controls Even in a low-delinquency environment, vigilance matters. Account Review campaigns, custom scorecards, and real-time monitoring help stay ahead of rising 90+ DPD segments. 4. Benchmark Smarter Competitive intelligence is key. Evaluate offer volumes, audience segmentation, and marketing timing to refine your next campaign. FAQ Q: What does the exit of a major home equity player mean? A: It leaves a significant gap in both marketing activity and borrower targeting. Lenders able to act quickly can capture outsized share in a category rich with equity and demand. Q: How should lenders respond to the evolving risk profile? A: Continue to monitor performance closely, but focus on forward-looking indicators like trended data, income verification, and alternative credit signals. Conclusion The housing market in July 2025 presents a clear message: the fundamentals are sound, but the strategies are shifting. Those ready to optimize outreach by making smarter use of data will seize a disproportionate share in both mortgage and home equity. Want to stay ahead? Connect with Experian Mortgage Solutions for the insights, tools, and strategies to grow in today’s evolving lending environment.

by David Fay 1 min read August 29, 2025

Subscribe to our Auto blog

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.