Today’s consumer lending environment is more dynamic and competitive than ever, with renewed focus on personal loans, marketplace lending and the ever-challenging credit card market. One of the significant learnings from the economic crisis is how digging deeper into consumer credit data can help provide insights into trending behavior and not just point-in-time credit evaluation. For example, I’ve found consumer trending behavior to be very powerful when evaluating risks of credit card revolvers versus transactors. However, trended data can come with its own challenges when the data isn’t interpreted uniformly across multiple data sources.

To address these challenges, Experian® has developed trended attributes, which can provide significant lift in the development of segmentation strategies and custom models. These Trended 3DTM attributes are used effectively across the life cycle to drive balance transfers, mitigate high-risk exposure and fine-tune strategies for customers near score cutoffs.

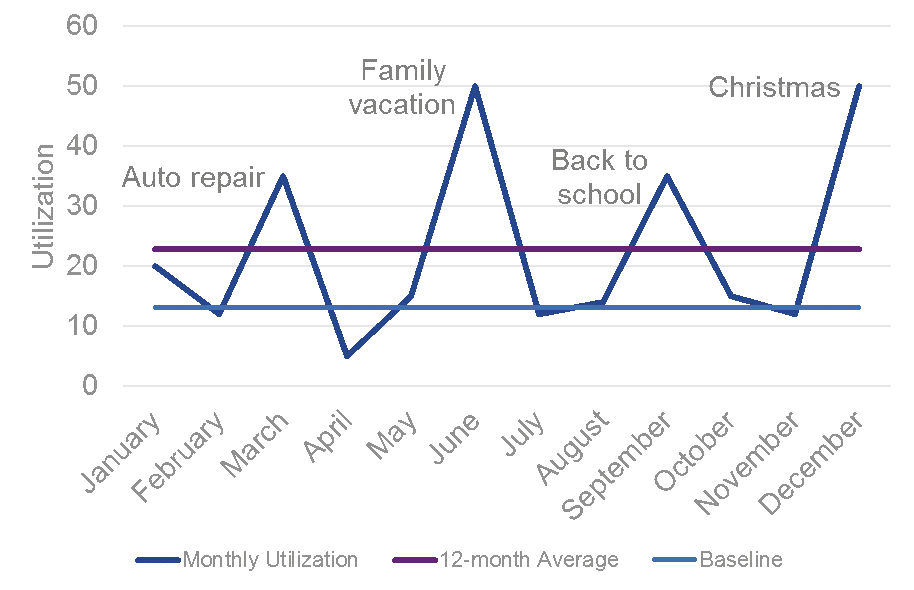

One of the things I look for when exploring new trended data is the ability to further understand payment velocity. These characteristics go far beyond revolver and transactor flags, and into the details of consumer usage and trajectory. As illustrated in the chart, a consumer isn’t easily classified into one borrowing persona (revolver, transactor, etc.) or another — it’s a spectrum of use trends. Experian’s Trended 3D provides details needed to understand payment rates, slope of balance growth and even trends in delinquency. These trends provide strong lift across all decisioning strategies to improve your business performance.

One of the things I look for when exploring new trended data is the ability to further understand payment velocity. These characteristics go far beyond revolver and transactor flags, and into the details of consumer usage and trajectory. As illustrated in the chart, a consumer isn’t easily classified into one borrowing persona (revolver, transactor, etc.) or another — it’s a spectrum of use trends. Experian’s Trended 3D provides details needed to understand payment rates, slope of balance growth and even trends in delinquency. These trends provide strong lift across all decisioning strategies to improve your business performance.

In recent engagements with lenders, new segmentation tools and data for the development of custom models is at the forefront of the conversation. Risk managers are looking for help leveraging new modeling techniques such as machine learning, but often have challenges moving from prior practices. In addition, attribute governance has been a key area of focus that is addressed with Trended 3D, as it was developed using machine learning techniques and is delivered with the necessary documentation for regulatory conformance. This provides an impressive foundation, allowing you to integrate the most advanced analytics into your credit decisioning.

Alternative data isn’t the only source for new consumer insights. Looking at the traditional credit report can still provide so much insight; we simply need to take advantage of new techniques in analytics development. Trended attributes provide a high-definition lens that opens a world of opportunity.