Key takeaways:

- Changes to Medicaid, Medicare and the Affordable Care Act provisions in H.R. 1 are expected to increase financial pressure across the healthcare system.

- Hospitals could face higher uncompensated care costs and a growing administrative burden as millions lose coverage and payer rules grow more complex.

- Revenue cycle leaders should focus on strengthening eligibility checks, improving claims accuracy, and automating operations to remain financially resilient.

On July 4, the budget reconciliation bill known as the “One Big Beautiful Bill Act” was signed into law, introducing sweeping changes to Medicaid, Medicare and Affordable Care Act (ACA) marketplace plans. At almost 900 pages, H.R. 1 sets out new eligibility, coverage and funding rules that will reshape how hospitals are reimbursed.

This article explains what revenue cycle leaders need to know about the reforms and offers practical strategies for maintaining financial stability.

Understanding the healthcare implications of H.R. 1

The healthcare provisions in H.R. 1 reflect a broader push by lawmakers to contain federal spending and return more control to states. While the reforms are framed as efforts to improve fiscal sustainability, they also introduce new financial risks for hospitals, particularly those serving low-income and high-utilization populations.

How does the Act affect Medicaid?

Enrollment

H.R. 1 makes major changes to Medicaid enrollment, with direct implications for hospital revenue and patient coverage. Starting in 2027, states will be required to run automated eligibility checks every six months for Medicaid expansion adults, and cross-check against federal databases to remove ineligible or deceased enrollees. The Act pauses implementation of a federal rule related to streamlining enrollment in Medicaid and the Children’s Health Insurance Program.

Eligibility

Eligibility rules are also changing. A new community engagement requirement will require some enrollees to demonstrate that they work, volunteer, or are in education for at least 80 hours a month, unless exempted.

While aimed at reducing fraud, waste and misuse, changes to eligibility and enrollment could result in more patients losing coverage and increase churn and care gaps – particularly among vulnerable populations. Uncertainty around citizenship status could deter patients from seeking care, and even affect staffing in hospitals that serve immigrant communities.

Cost-sharing and funding

To ensure beneficiaries have a financial stake in their care, the law introduces cost-sharing requirements for some enrollees. Providers will need to be ready to help patients understand their costs and adjust collections workflows accordingly.

There are also new financial penalties for states that fail to recover overpayments, and limits on how provider taxes and supplemental payments can be used to boost federal matching funds. Over time, these provisions could constrain how hospitals are reimbursed for Medicaid services, especially in non-expansion states.

How does the Act affect Medicare?

For Medicare, the Act offers some short-term financial relief along with longer-term reductions. Outpatient providers will see a 2.5% increase to the Medicare Physician Fee Schedule in 2026, partially offsetting inflation and COVID-related losses. However, spending cuts of 4% per year are projected to reduce Medicare funding by more than $500 billion over eight years, beginning in 2026.

In addition, the law brings Medicare eligibility in closer alignment to Medicaid, by restricting access for individuals without verified lawful status or sufficient residency history. It also delays until 2035 a rule that would have made it easier for low-income beneficiaries to enroll in Medicare Savings Programs. The Congressional Budget Office (CBO) estimates that this means 1.38 million fewer beneficiaries will be covered by MSPs.

How does the Act affect the ACA?

One of the most immediate concerns for hospitals involves the end of enhanced premium subsidies for low-income ACA marketplace plan enrollees. Unless Congress steps in, these will expire at the end of 2025, making coverage less affordable for many. This comes as insurers prepare to increase premiums by an average of 15% in 2026, the most significant rise since 2018.

H.R. 1 also modifies eligibility and repayment rules around subsidies. Subsidies will no longer be available to individuals disenrolled from Medicaid due to immigration status. Starting in 2027, most enrollees in marketplace plans will need to verify their eligibility for premium tax credits each year, effectively ending automatic re-enrollment. Without these subsidies, over 4 million people are likely to be uninsured in 2034.

For hospitals, this means more self-pay patients, delayed collections and higher uncompensated care, especially in areas with large working-age populations.

Financial risks: Medicaid cuts and rising uncompensated care

The CBO projects that over 10 million people could lose health coverage by 2034 due to combined Medicaid and ACA reforms. This is a major financial risk for hospitals, particularly safety-net and rural providers. The Center for American Progress suggests thatuncompensated care costs could increase by at least $36 billion by 2034– a figure that will be especially painful in the context of reduced federal funding.

Some newly uninsured patients may not seek alternative coverage, potentially leading to higher emergency department use. Those with ongoing health needs are more likely to find new coverage, but hospitals could still see a smaller insured population overall, and it could well be one that is older, sicker and more expensive to treat.

Revenue cycle teams should prepare for an increase in self-pay volumes and greater demand for charity care and financial assistance. Organizations in high-Medicaid regions may need to reassess cost estimation tools, financial assistance screening and collections workflows to manage the effects.

See how Patient Financial Clearance is helping Community Health System prepare for a potential rise in uninsured patients in 2026 by automating eligibility verification and coverage screening.

Strengthening front-end access and eligibility workflows

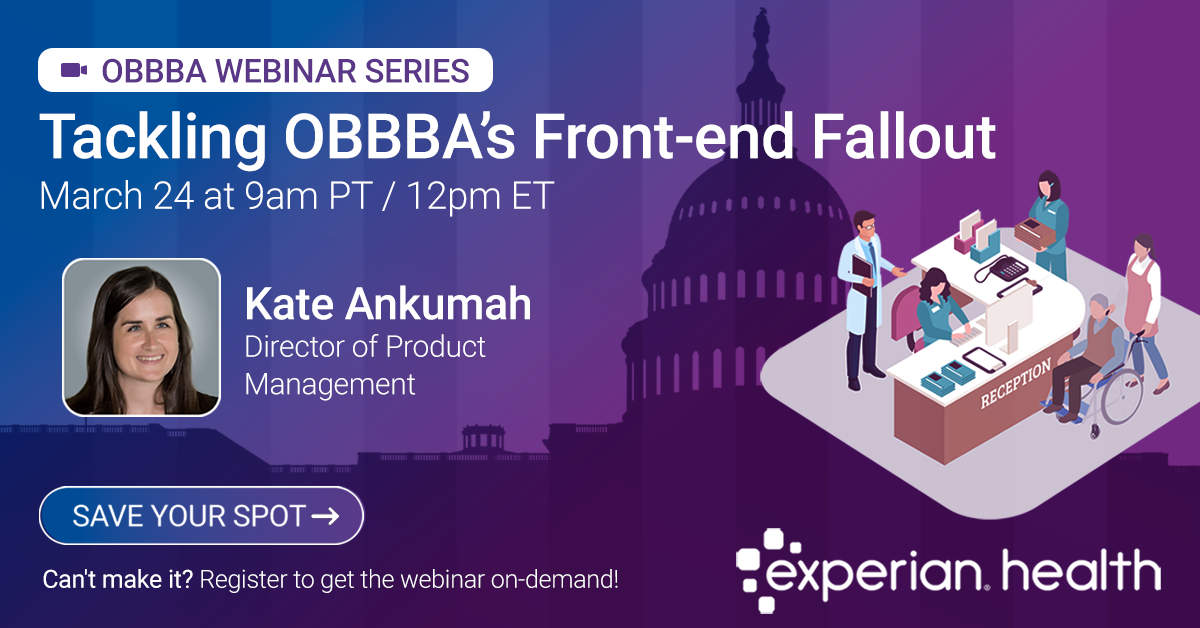

Jason Considine, President at Experian Health, says that providers can be proactive in ensuring their revenue cycle operations are ready to adapt and scale, if and when the time comes:

“It’s an uncertain time. However, as we wait to see how the changes to coverage and reimbursement play out in practice, providers aren’t just looking for predictions. They need actionable strategies. Strengthening front-end eligibility and financial clearance processes is one of the most immediate ways to reduce risk and support patients through coverage transitions. Experian Health helps organizations do that by offering automated tools that uncover hidden coverage, verify eligibility in real time, and provide clear, accurate patient estimates.”

Here are a few examples:

- Getting eligibility right. Patient Access Curator™ uses artificial intelligence to run multiple data checks at once, covering eligibility verification, coordination of benefits, Medicare Beneficiary Identifiers, demographics and coverage discovery.

- Minimizing the risk of uncompensated care. Patient Financial Clearance uses real-time data to identify patients who may qualify for charity care and recommends suitable payment plan options, while minimizing manual work for staff.

- Helping patients figure out their financial obligations. Patient Payment Estimates draws on real-time data, including insurance coverage, payer contract terms and provider pricing, to give patients an accurate breakdown of their treatment costs. This improves transparency and reduces the risk of missed payments.

Optimizing claims and collections in a tighter reimbursement environment

In addition to strengthening front-end processes, providers need to ensure their back-end operations are ready to handle the ups and downs. Denied claims are already a major challenge for providers: in Experian Health’s 2024 State of Claims survey, 73% said denials are increasing and 77% report more frequent payer policy changes. More than half have seen a rise in claims errors, highlighting an opportunity for improvement. As automation and AI continue to advance, healthcare providers have a chance to improve claims management and reduce denials. Embracing these solutions can reduce the costly burden of reworking claim denials and improve cash flow.

If claims workflows are already struggling, providers can’t afford any extra friction. However, the H.R. 1 reforms will likely increase the administrative burden and make timely reimbursement even harder to secure. This makes digital transformation increasingly urgent.

Some priorities to tackle with automation and analytics include:

- Improving first-pass claim accuracy. AI Advantage™– Predictive Denials uses artificial intelligence, machine learning and predictive analytics to scan claims before they are submitted to root out errors and flag high-risk submissions so they can be corrected. It analyzes historical payment data and real-time payer behavior to determine whether a claim is likely to be rejected, so staff can work faster and more efficiently to increase clean claim rates.

- Streamlining claims management. ClaimSource® helps providers manage the entire claim cycle from a single application. Voted Best in KLAS for Claims Management and Clearinghouse for the last two years, the platform automates claim submission to reduce manual work and support cleaner submissions. It performs customizable edits, formats and submits claims, and allows staff to create custom work queues for greater efficiency.

- Using data to optimize collections. Collections Optimization Manager uses data-driven insights to help revenue cycle management (RCM) teams focus on the right accounts and collect more, faster. By segmenting patients based on their propensity to pay and screening out accounts unlikely to yield returns (such as deceased, bankrupt or charity accounts) the tool helps reduce the cost to collect and saves valuable staff time.

Preparing for volatility with scalable technology

Revenue cycle teams can’t control policy changes or budget decisions, but they can control the systems that keep their operations running. Experian Health’s end-to-end revenue cycle solutions are designed to support this kind of operational resilience. From coverage discovery to claims analytics, scalable platforms give providers the flexibility to respond quickly to financial disruptions using consistent and familiar technology.

“When so much is out of your hands, the smartest move is to focus on what you can control. Scalable tech gives RCM leaders that control, so when payer rules shift or self-pay volumes spike, they’re ready to respond without slowing down,” says Considine. “It also helps them stay ready for compliance shifts and respond faster to regulatory changes without overhauling their workflows.”

Readiness today protects financial resilience tomorrow

The H.R. 1 bill has introduced significant changes across Medicaid, Medicare and the Affordable Care Act. New eligibility requirements, adjustments to reimbursement formulas, reduced subsidies and greater administrative complexity are all expected to influence how patients access coverage and how care is financed moving forward.

While the long-term impact will vary by market and patient population, disruption is coming. Hospitals and health systems that rely on outdated workflows or fragmented technology will face growing challenges in managing changing coverage patterns and rising uncompensated care.

As the specific effects of the “One Big Beautiful Bill” become clearer, revenue cycle leaders will be tasked with making fast choices under pressure. How will coverage changes affect patient behavior? What happens to reimbursement if eligibility gaps widen? The focus won’t just be on protecting revenue, but also on supporting patients who may be confused or anxious about what the new rules mean for them. The ability to track changes and adapt accordingly will be a competitive advantage for providers looking to stay ahead.

Find out how Experian Health can help hospitals prepare for reforms by modernizing revenue cycle operations and reducing exposure to revenue loss.