Business Information Blog

The latest from our experts

Account takeover fraud is plaguing commercial lenders, we explain how to takle it in its many forms so you can protect small business clients.

Bankruptcies and collections are on the rise since mid 2022. Pandemic-related relief and forgiveness suppressed collections for most of 2021 and the first half of 2022.

A credit study of a regional utility found significant unscored small businesses despite positive payment history, a case for data contribution.

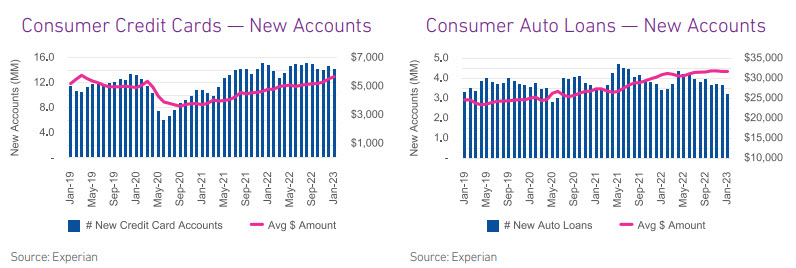

Consumers are borrowing to maintain spending levels even though higher interest rates make borrowing more expensive.

The Q4 2022 report has just been released, the report is a great tool for keeping tabs on the quarterly credit performance of millions of small businesses.

Stay informed on small business credit performance by attending the quarterly business credit review webinar and the latest Main Street Report insights.

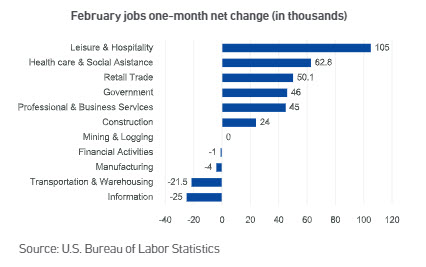

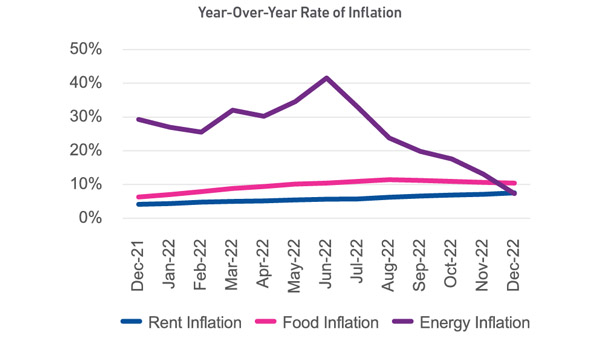

So far, the economy has been extremely resilient, with Q4 GDP coming in above expectations at 2.9%, inflation cooling, supply chain issues easing, and unemployment remaining low.

We are pleased to announce the publication of our Winter 2023 Beyond the Trends report, the report contains fresh insights on small businesses and consumers

Happy New Year! The burning question for 2023 is whether the U.S. economy will fall into recession.

In this post we discuss automated reject inferencing and how it can help credit departments grow commercial accounts without taking on more risk.

Get the latest Commercial Pulse Report from Experian. Our analysts break down the latest trends to give you insight every 2 weeks.

Commercial loan fraud is an urgent market issue for lenders working with SMBs, our analysis and recommendations for mitigating the problem.