The Federal Reserve increased interest rates at each of their last six meetings. The goal is to combat inflation with higher interest rates that make borrowing more expensive and saving more beneficial, thereby reducing consumer demand and spending so that prices stabilize.

Despite the interest rate hikes, consumers are still spending at a high rate and saving at a low rate yet October data show that inflation is beginning to subside.

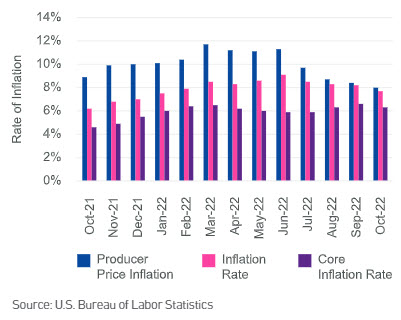

The October inflation rate of 7.7% is the lowest since January. However, the reduction was primarily driven by lower gas prices. Core inflation, excluding food and energy, decreased slightly to 6.3% from 6.6% in September. Producer price inflation (PPI), also

known as wholesale inflation, decreased for the fourth month in a row to 8% and is now the lowest since July 2021. For a while,

businesses have passed the higher costs to produce goods on to the consumers. With four consecutive months of declining PPI, there is hope that consumer prices will stabilize soon.

What I am watching:

Heading into the holiday season, it will be interesting to see if consumers continue to spend at high levels or if the headwinds

of higher prices, higher interest rates and lower savings create a drag on retail sales. According to the Adobe online shopping

forecast, retailers will offer record high holiday discounts for categories such as electronics, toys and computers in order to combat some of the pressures facing consumers.

In addition, many retailers built up inventories as they navigated supply chain constraints and will not want to carry excess inventories beyond the holiday season.