Credit Lending

Driver of success: Mitigate auto lending risk A culture of learning is a key driver of success. Does your risk culture continue to adapt? There are many issues within auto lending that are unique to other financial services ecosystems: the direct versus indirect relationship, insights of the asset influencing the risk insights, new versus used vehicle transactions influencing risk and terms, and more. However, there is one universal standard common to all financial services cultures — change.. Change is constant, and an institution’s marketing and risk organizations need to be constantly learning to stay abreast of dealer, consumer, competitor and regulatory issues. No one has said it better than Jack Welch: “An organization’s ability to learn, and translate that learning into action rapidly, is the ultimate competitive advantage.” This statement was quickly followed by a command: “Change before you have to.” So the challenge for the portfolio manager is to ensure there are the system features, data sources, management reporting structures, data access features, analytic skills, broad management team skill sets, and employee feedback and incentive plans to drive the organization to a constant state of renewal. The challenge for many smaller and midsize lenders is to determine what systems and skills need to be in-house and what tasks are better left for a third party to handle. For consumer-level data, vehicle history and valuation data, and fraud alert flags, it seems reasonable to leverage solutions from established third parties: credit reporting agencies. After that, the solutions to the many other needs may be more specific to the lender legacy skill set and other support relationships: Are there strong in-house data-management and analytic skills? There is a significant difference between management information and data analysis driving policy and portfolio performance forecasts. Does the internal team have both? Is the current operating platform(s) feature-rich and able to be managed and enhanced by internal resources within tight time frames? Is the management team broadly experienced and constantly updating best-practice insights? Is the in-house team frequently engaged with the regulatory community to stay abreast of new mandates and initiatives? There is a solution. Experian® offers the data, software, solutions, management information, analytic solutions and consulting services to tie everything together for a lender-specific best configuration. We look forward to hearing from you to discuss how we can help.

Key drivers to auto financial services are speed and precision. What model year is your decisioning system? In the auto world the twin engineering goals are performance and durability. Some memorable quotes have been offered about the results of all that complex engineering. And some not so complex observations. The world of racing has offered some best examples of the latter. Here’s a memorable one: “There’s no secret. You just press the accelerator to the floor and steer left. – Bill Vukovich When considering an effective auto financial services relationship one quickly comes to the conclusion that the 2 key drivers of an improved booking rate is the speed of the decision to the consumer/dealer and the precision of that decision – both the ‘yes/no’ and the ‘at what rate’. In the ‘good old days’ a lender relied upon his dealer relationship and a crew of experienced underwriters to quickly respond to a sales opportunities. Well, these days dealers will jump to the service provider that delivers the most happy customers. But, for all too many lenders some automated decisioning is leveraged but it is not uncommon to still see a significantly large ‘grey area’ of decisions that falls to the experienced underwriter. And that service model is a failure of speed and precision. You may make the decision to approve but your competition came in with a better price at the same time. His application got booked. Your decision and the cost incurred was left in the dust – bin. High on the list of solutions to this business issue is an improved use of available data and decisioning solutions. Too many lenders still underutilize available analytics and automated decisions to deliver an improved booking rate. Is your system last year’s model? Does your current underwriting system fully leverage available third party data to reduce delays due to fraud flags. Is your ability to pay component reliant upon a complex application or follow-up requests for additional information to the consumer? Does your management information reporting provide details to the incidence and disposition of all exception processes? Are you able to implement newer analytics and/or policy modifications in hours or days versus sitting in the IT queue for weeks or months? Can you modify policies to align with new dealer demographics and risk factors? The new model is in and Experian® is ready to help you give it a ride. Purchase auto credit data now.

As Big Data becomes the norm in the credit industry and others, the seemingly non-stop efforts to accumulate more and more data leads me to ask the question - when is Big Data too much data? The answer doesn’t lie in the quantity of data itself, but rather in the application of it – Big Data is too much data when you can’t use it to make better decisions. So what do I mean by a better decision? From any number of perspectives, the answer to that question will vary. From the viewpoint of a marketer, maybe that decision is about whether new data will result in better response rates through improved segmentation. From a lender perspective, that decision might be about whether a borrower will repay a loan or the right interest rate to charge the borrower. That is one the points of the hype around Big Data – it is helping companies and individuals in all sorts of situations make better decisions – but regardless of the application, it appears that the science of Big Data must not just be based on an assumption that more data will always lead to better decisions, but that more data can lead to better decisions – if it is also the “right data”. Then how does one know when another new data source is helping? It’s not obvious that additional data won’t help make a better decision. It takes an expert to understand not only the data employed, but ultimately the use of the data in the decision-making process. It takes expertise that is not found just anywhere. At Experian, one of our core capabilities is based on the ability to distinguish between data that is predictive and can help our clients make better decisions, and that which is noise and is not helpful to our clients. Our scores and models, whether they be used for prospecting new customers, measuring risk in offering new credit, or determining how to best collect on an outstanding receivable, are all designed to optimize the decision making process. Learn more about our big data capabilities

Soaring in the solar energy utility market By: Mike Horrocks and Rod Everson The summer is a great time of the year - it kicks off summer and the time to enjoy the sunshine and explore! It is also for me the recognition that days now are only getting shorter and makes me think about my year goals and am I going to hit them. In this spirit of kicking off summer, I thought I would talk about three opportunities that the utility vertical could and should take advantage of. 1. The future of Solar Photovoltaics (PV) is just getting brighter A recent study called out an expected 25 percent jump in Solar PV installs over the previous year. This is jump is just another in a long line of solar install records. While the overall cost of these installs has dropped, one must ask whether the accessibility is there for everyone. The answer is not yet. A potential opportunity may come in the form of community solar as an advantage over rooftop solar. This scenario involves a utility installing an array of PV cells and then carving out a specific cell for an individual residential customer for lease, crediting his or her bill at a percentage of the cost. 2. Generations are bringing change Just as spring gives way to summer, summer will give way to fall. The same is true in the utility markets on many fronts. At a larger infrastructure scale, utilities have to think about the kind of plants and capital investments they want to make. Another report indicated that 60,000 megawatts of coal energy is going to be retired over the next four years. This obviously will change the capital decision making functions in the industry. At a more personal level, however, there are changes in the consumers and their behaviors as well. Are those changes being accounted for in your organization? Is the next generation of consumers and the products and services it will demand being formulated in your strategy? How will you identify those consumers and secure them as customers? For example, while electrical energy consumption has been decreasing, what would be the impact if there was a revolution in battery technology? What if charging an electric automobile battery became as fast as filling a tank of gas? What if the battery gave you the same mileage range as a tank of gas and did it at a lower cost per mile? Would electric usage spike? 3. Blackouts happen; be prepared The best-laid plans sometimes still cannot account for those acts of God that cause disruptions to the grid. Blackouts happen, and if you don’t have flashlights with new batteries, you will be left in the dark. The same uncertainty is inevitable in the utility vertical. In the 2015 PwC Power and Utility Survey, 3 percent of the respondents said that there would be minor disruptions in business models, with the rest saying the disruptions would range from moderate to very disruptive. In fact, more than 47 percent of respondents said the changes would be very disruptive. What kind of flashlight-and-fresh-batteries strategy will you employ when the lights go out? Are your decision strategies and risk-management practices based on outdated solutions or approaches? Consider whether your business can take advantage of these situations. If you’re not sure, let’s set aside some time to discuss it, and I can share with you how Experian has helped others. There are still many sunny days ahead, but act now before the seasons change and you and your strategies are left out in the cold.

Apple eschewed banks for a retailer focus onstage at their Worldwide Developers Conference (WWDC) when it spoke to payments. I sense this is an intentional shift – now that stateside, you have support from all four networks and all the major issuers – Apple understands that it needs to shift the focus on signing up more merchants, and everything we heard drove home that note. That includes Square’s support for NFC, as well as the announcements around Kohls, JCPenney and BJ’s. MasterCard's Digital Enablement Service (MDES) - opposite Visa’s Token Service - is the tokenization service that has enabled these partnerships specifically through MasterCard’s partners such as Synchrony – (former GE Capital) which brought on JCPenney, Alliance Data which brought on BJ’s, and CapitalOne which enabled Kohls. Within payments common sense questions such as: “Why isn’t NFC just another radio that transmits payment info?” or “Why aren’t retailer friendly payment choices using NFC?” have been met with contemptuous stares. As I have written umpteen times (here), payments has been a source of misalignment between merchants and banks. Thus – conversations that hinged on NFC have been a non-starter, for a merchant that views it as more than a radio – and instead, as a trojan horse for Visa/MA bearing higher costs. When Android opened up access to NFC through Host Card Emulation (HCE) and networks supported it through tokenization, merchants had a legitimate pathway to getting Private label cards on NFC. So far, very few indeed have done that (Tim Hortons is the best example). But between the top two department store chains (Macy’s and Kohls) – we have a thawing of said position, to begin to view technologies pragmatically and without morbid fear. It must be said that Google is clearly chasing Apple on the retailer front, and Apple is doing all that it can, to dig a wider moat by emphasizing privacy and transparency in its cause. It is proving to be quite effective, and Google will have to “apologize beforehand” prior to any merchant agreement – especially now that retailers have control over which wallets they want to work with – and how. This control inherits from the structures set alongside the Visa and MasterCard tokenization agreements – and retailers with co-brand/private label cards can lean on them through their bank partners. Thus, Google has to focus on two fronts – first to incentivize merchants to partner so that they bring their cards to Android Pay, while trying to navigate through the turbulence Apple has left in its wake, untangling the “customer privacy” knot. For merchants, at the end of the day, the questions that remain are about operating costs, and control. Does participation in MDES and VEDP tokenization services through bank partners, infer a higher cost for play – for private label cards? I doubt if Apple’s 15bps “skim off the top” revenue play translates to Private Label, especially when Apple’s fee is tied to “Fraud Protection” and Fraud in Private Label is non-existent due to its closed loop nature. Still – there could be an acquisitions cost, or Apple may plan a long game. Further, when you look at token issuance and lifecycle management costs, they aren’t trivial when you take in to context the size of portfolio for some of these merchants. That said, Kohls participation affords some clarity to all. Second, Merchants want to bring payments inside apps – just like they are able to do so through in-app payments in mobile, or on online. Forcing consumers through a Wallet app – is counter to that intent, and undesirable in the long scheme. Loyalty as a construct is tangled up in payments today – and merchants who have achieved a clean separation (very few) or can afford to avoid it (those with large Private label portfolios that are really ‘loyalty programs w/ payments tacked on’) – benefit for now. But soon, they will need to fold in the payment interaction in to their app, or Apple must streamline the clunky swap. The auto-prompt of rewards cards in Wallet is a good step, but that feels more like jerry rigging vs the correct approach. Wallet still feels very v1.5 from a merchant integration point of view. Wallet not Passbook. Finally, Apple branding Passbook to Wallet is a subtle and yet important step. A “bank wallet” or a “Credit Union wallet” is a misnomer. No one bank can hope to build a wallet – because my payment choices aren’t confined to a single bank. And even where banks have promoted “open wallets” and incentivized peers to participate – response has been crickets at best. On the flip side, an ecosystem player that touches more than a device, a handful of experiential services in entertainment and commerce, a million and a half apps – all with an underpinning of identity, can call itself a true wallet – because they are solving for the complete definition of that term vs pieces of what constitutes it. Thus – Google & Apple. So the re-branding while being inevitable, finds a firm footing in payments, looks toward loyalty and what lies beyond. Solving for those challenges has less to do with getting there first, but putting the right pieces in play. And Apple’s emphasis (or posturing – depending on who you listen to) on privacy has its roots in what Apple wants to become, and access, and store on our behalf. Being the custodian of a bank issued identity is one thing. Being a responsible custodian for consumer’s digital health, behavior and identity trifecta has never been entirely attempted. It requires pushing on all fronts, and a careful articulation of Apple’s purpose to the public must be preceded by the conviction found in such emphasis/posturing. Make sure to read our perspective paper to see why emerging channels call for advanced fraud identification techniques

Utilities have continued to evolve and are making better, faster decisions about customers signing up for new services. A combination of best practices with respect to data, analytics and technology is driving efficiency, lowering costs and ensuring all customers are treated equally. We will discuss three main areas where utilities have made significant advances: • Customer pinning — loss reduction by using match logic to identify consumers across different systems and platforms who may have existing past due amounts • Scoring — using specific models for risk segmentation to assist in the deposit decision • Decisioning — choosing systems with capabilities for effectively managing their business at the relationship level and is capable of using “pins” to automatically identifying customers who have past due amounts and using scores and other data to automate the deposit decision Customer Pinning Using customer pins in the account opening process is key to ensuring you are able to effectively identify consumers who are re-initiating service and may have unpaid balances. This enables you to identify the opportunity to consolidate past-due amounts before connecting new service for the consumer. It may also be used in the determination as to whether or not a deposit may be required. Clients see advantages with this process most often when consumers move out of and then back into a particular service market. Another case is when a customer changes their name as a result of marriage or divorce or is added to other existing billings. These customer pins or unique identifiers can be updated in batch in order to maintain the integrity of the account linking within your accounts receivable. Clients then ensure that with the account opening process the pin on the customer opening the account is retrieved from the consumer credit file system, then “matched” with a pin in the existing customer file that was obtained through the batch process. It can then be determined whether that customer owes an unpaid balance from a prior account. For optimal efficiency, this should be done by the same decisioning system that is performing the identity verification and deposit calculation for the account in a continuous workflow. Scoring and Deposits Increasingly, utilities are being authorized to use scores and credit data along with existing unpaid balances to determine if a deposit is warranted. If a score is used, generally a simple cut-off is used and if a score falls below the cut off a deposit is required, otherwise it is not. There are many types of scores in the market, but some have been developed specifically for use by energy utilities and similar service providers for the purpose of deposit determination. One of the characteristics to look for in a score for deposit determinations is the number of customers that can be scored. Generally, the more customers that can be scored the better as there may be many customers with thin or virtually no credit files that would be unscoreable using a traditional scoring model. Specific bureau attributes may enhance this process when scores are near cut offs, especially if a score falls slightly below the cut off. A decision engine may be able to use attributes to assist in supplying valuable data in a second review that may be requested by a customer who feels that they should not need to submit a deposit. Decisioning Platform Deploying new strategies to capture all the benefits of automating a fraud review, taking advantage of the custom pinning process, scoring and other attributes can be a challenge. However, the market has continued to evolve to enable large and small utilities to gain access to new tools to more effectively manage their business. There are now new solutions available, like PowerCurve OnDemand, that provide hosted data integration, incorporation of your existing customer files including pin numbers, workflow, decisioning and a simple integration with your existing technologies at a low cost of entry. Solutions like PowerCurve OnDemand combine ease of use, with powerful capabilities that are targeted to fit the needs of the utility industry. Learn more about how PowerCurve OnDemand can help your business.

Fraud Prevention: Gaining insight fraud throughout the customer lifecycle & future trends Earlier this week, I had the pleasure of chairing the annual Grad School session during CNP Expo 2015. The group was energized by the participation of the attendees and we hope that all gained insight into issues regarding fraud throughout the customer lifecycle as well as future trends in payments, identity and cross border growth. For those who were unable to join us in Orlando, the CNP Expo Grad School focused on the importance of creating a comprehensive fraud strategy to protect your organization throughout the customer lifecycle. To help articulate the varied fraud challenges posed at each stage, we brought an esteemed group of fraud experts, who collectively have served in the industry for over 100 years. We kicked off Grad School with Lawrence Baldwin, CIO of myNetWatchman. He described how fraudsters can transform low value credentials, which can be purchased on the black market for fractions of a cent, into high-value validated credentials that facilitate burgeoning Account Takeover attacks. Jeramie Driessen, a Sr. Risk Analyst in Experian’s Fraud and ID group, then delved into the challenges merchants need to address when evaluating new account opening for merchants and card issuers. Yours truly covered the various stages of Account Takeover and described the evolving fraud vectors that are targeting existing accounts. During part two of the three-hour Grad School, Angela Montoya, Product Management Analyst for Experian Fraud and ID, and David Stewart, Manager of Corporate Security at Virgin America, shared their insights about transaction fraud and dived deep into the nuances of sniffing out crime rings and setting up new fraud teams. We ended with Dan Elvester, Sr. Director of Business Development at Experian, sharing facts and market trends around ecommerce growth, cross-border expansion and emerging fraud tools just before Cherian Abraham, Sr. Consultant with Experian’s Global Consulting Practice, covered advanced topics regarding Apple Pay, Tokenization and the future of Identity Verification. Overall, the CNP Expo 2015 Grad School reinforced our central theme of creating a multi-layered fraud strategy that places controls not just on the monetary transactions executed on your website but also on the account management, origination and even acquisition phases of your customers’ lifecycle. Thanks again to our speakers and attendees for your engagement and interest in Experian’s ongoing efforts to stop fraud. To follow along the topics that were covered a copy of our grad school presentation can be viewed here:

At the start of the Vision 2015 Conference, Experian® announced a new dedicated enterprise Fraud and ID business in North America. This newly established business unit allows Experian, the leading global information services company, to more aggressively address the growing variety of fraud risk and identity management challenges businesses, financial institutions and government agencies face. “The rapid progression of wide-scale fraud and data breaches have led to a significant increase in identity theft related risk, and potential fraud losses on a larger scale than ever anticipated,” said Charles Chung, president of Decision Analytics, Experian North America. “For nearly two decades, we have been helping clients solve the difficult and ever-changing problems of fraud detection and identity management. Our core expertise was further enhanced by the recent acquisition of 41st Parameter which added device identification as another important layer of sophistication to our suite of fraud detection tools. Now the creation of a new fraud business unit brings all components of our Fraud and ID services together to better serve all markets through our innovative authentication techniques, advanced analytics and Big Data insights.” Having one comprehensive operation allows Experian to deliver greater value across its various addressable markets through customized approaches that balance privacy, security and compliance requirements with client reputation, customer experience, convenience and efficiency. The integration brings together a wide set of enterprise services ranging from identity and device risk assessment and anti–money laundering to consumer identity monitoring and alerts, letting Experian continue to proactively meet client needs surrounding the complex risks they face. Dr. Jon Jones has been appointed to lead the new business unit as senior vice president and general manager of Fraud and ID for Experian North America. “Data security and fraud management affect many industries as identity data has become so compromised that authenticating consumers through traditional means is not enough to safeguard against fraud. Modern fraud risks now absolutely require Big Data assets and the proven ability to derive predictive analytical capabilities to meet these challenges,” said Jones. “Today, online and mobile commerce, and customer demands for convenience and speed are intersecting with the increasing sophistication of criminal fraud networks. Experian’s new integrated fraud business delivers next-generation holistic fraud management services, leveraging our vast data landscape to identify customers’ risk for fraud even when no threat has been detected to stay ahead of the growing market demands.” Accounting for the real risk of identity compromise over time continues with the launch of Experian’s Identity Element NetworkSM which identifies real-time fraud volume and velocity linkages across multiple industries to predict when consumers are showing risk of identity compromise. Experian monitors and predicts when seemingly random identity element linkages become meaningful risk clusters, including: When an identity likely has been compromised When an identity is victim of a data breach When a transaction is part of an identity theft scheme, particularly an account takeover When consumers’ identities are exhibiting identity theft, visible by monitoring a broad portfolio of breached or compromised consumers "Cybercriminals continue to rapidly escalate their assault on sensitive data across a variety of industries, with no end in sight," said Julie Conroy, research director at Aite Group. "This requires fraud prevention capabilities to undergo a similar rapid evolution, with a new, more advanced approach to identity management sitting squarely in the middle of risk mitigation. Simple personally identifiable information is no longer enough to verify identity; the next wave of fraud and cybersecurity services needs to employ robust data and advanced analytical capabilities in order to make faster and more informed identity decisions." Experian’s Identity Element Network service can be utilized through its flagship fraud enterprise platform, Precise ID®, using its data assets and analytics alongside 41st Parameter’s FraudNet to deliver a comprehensive view of the Customer Life Cycle of traditional identity, device confidence and risk assessment. Learn more about Experian’s Big Data fraud service for breach identity compromise detection for your business.

By: Mike Horrocks The other day in the American Banker, there was an article titled “Is Loan Growth a Bad Idea Right Now?”, which brings up some great questions on how banks should be looking at their C&I portfolios (or frankly any section of the overall portfolio). I have to admit I was a little down on the industry, for thinking the only way we can grow is by cutting rates or maybe making bad loans. This downer moment required that I hit my playlist shuffle and like an oracle from the past, The Clash and their hit song “Should I stay or should I go”, gave me Sage-like insights that need to be shared. First, who are you listening to for advice? While I would not recommend having all the members of The Clash on your board of directors, could you have maybe one. Ask yourself are your boards, executive management teams, loan committees, etc., all composed of the same people, with maybe the only difference being iPhone versus Android?? Get some alternative thinking in the mix. There is tons of research to show this works. Second, set you standards and stick to them. In the song, there is a part where we have a bit of a discussion that goes like this. “This indecision's buggin' me, If you don't want me, set me free. Exactly whom I'm supposed to be, Don't you know which clothes even fit me?” Set your standards and just go after them. There should be no doubt if you are going to do a certain kind of loan or not based on the pricing. Know your pricing, know your limits, and dominate that market. Lastly, remember business cycles. I am hopeful and optimistic that we will have some good growth here for a while, but there is always a down turn…always. Again from the lyrics – “If I go there will be trouble, An' if I stay it will be double” In the American Banker article, M&T Bank CFO Rene Jones called out that an unnamed competitor made a 10-year fixed $30 million dollar loan at a rate that they (M&T) just could not match. So congrats to M&T for recognizing the pricing limits and maybe congrats to the unnamed bank for maybe having some competitive advantage that allowed them to make the loan. However if there is not something like that supporting the other bank…the short term pain of explaining slower growth today may seem like nothing compared to the questioning they will get if that portfolio goes south. So in the end, I say grow – soundly. Shake things up so you open new markets or create advantages in your current market and rock the Casbah!

Source: IntelliViewsm powered by Experian Sales of existing homes dropped 50% from the peak in August 2005 to the low point in July 2010. The spike in home sales in late 2009 and early 2010 was due to the large number of foreclosure sales as well as very low prices. Since 2010, sales have increased to almost to the level they were in 2000, before the financial crisis. However, the homeownership rate has steadily gone down. How could sales have picked up while the homeownership rate declined? Investors have entered the market snapping up single family homes and renting them. Therefore, the recent good news in the existing home market has been driven by investors, not homeowners. But as I point out below, this is changing. Looking at the homeownership rate by age, shown in the table below, it is clear that since the crisis the rate has declined most for people under 45. The potential for marketing is greatest in this cohort as the numbers indicate a likely demand for housing. Homeownership Rate by Age Source: U.S. Census Bureau and Haver Analytics as reported on the Federal Reserve Bank of St. Louis Fred database The factors that have impeded growth, described above, are beginning to reverse which, along with pent-up demand, will present an opportunity for mortgage originators in 2015. Home prices have risen in 246 of the 277 cities tracked by Clear Capital.With prices going up, investors have begun to back away from the market, resulting in prices increasing at a slower rate in some cities but they are still increasing.Therefore the perception that homeownership is risky will likely change.In fact, in some areas, such as California’s coastal cities, sales are strong and prices are going up rapidly. Lenders and regulators are recognizing that the stringent guidelines put in place in reaction to the crisis have overly constrained the market.Fannie Mae and Freddie Mac are reducing down payment requirements to as low as 3%.FHA is lowering their guarantee fee, reducing the amount of cash buyers need to close transactions.Private securitizations, which dried up completely, are beginning to reappear, especially in the jumbo market. As unemployment continues to go down, consumer confidence will rise and household formation will return to more normal levels which result in more sales to first time homebuyers, who drive the market.According to Lawrence Yun, chief economist for the National Association of Realtors, “…it’s all about consistent job growth for a prolonged period, and we’re entering that stage.” The number of houses in foreclosure, according to RealtyTrac, has fallen to pre-crisis levels.This drag on the market has, for the most part, cleared and as prices continue to inflate, potential buyers will be motivated to buy before homes become unaffordable.Despite the recent increases, home prices are still, on average, 23% lower than they were at the peak. Focusing marketing dollars on those people with the highest propensity to buy has always been a challenge but in this market there are identifiable targets. “Boomerangs” are people who owned real estate in the past but are currently renting and likely to come back into the market.Marketing to qualified former homeowners would provide a solid return on investment. People renting single family houses are indicating a lifestyle preference that can be marketed to. Newly-formed households are also profitable targets. The housing market, at long last, appears to be finally turning the corner and normalizing. Experian’s expertise in identifying the right consumers can help lenders to pinpoint the right people on whom marketing dollars should be invested to realize the highest level of return. Click here to learn more.

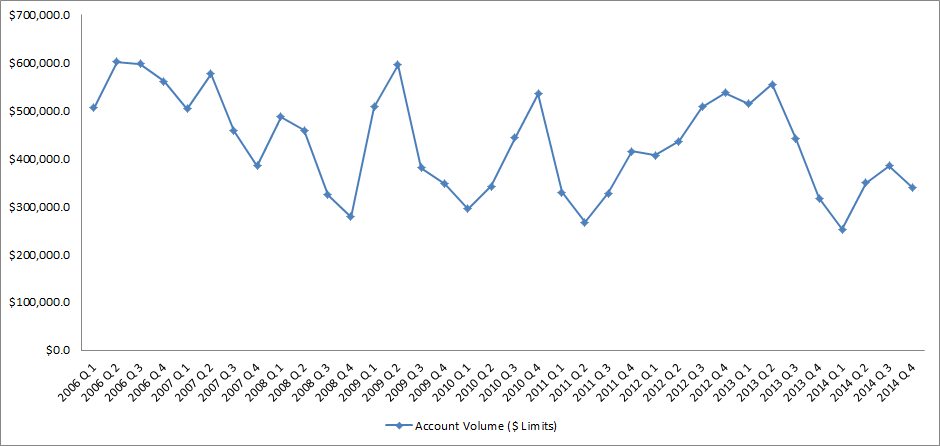

End-of-Draw approaching for many HELOCs Home equity lines of credit (HELOCs) originated during the U.S. housing boom period of 2006 – 2008 will soon approach their scheduled maturity or repayment phases, also known as “end-of-draw”. These 10 year interest only loans will convert to an amortization schedule to cover both principle and interest. The substantial increase in monthly payment amount will potentially shock many borrowers causing them to face liquidity issues. Many lenders are aware that the HELOC end-of-draw issue is drawing near and have been trying to get ahead of and restructure this debt. RealtyTrac, the leading provider of comprehensive housing data and analytics for the real estate and financial services industries, foresees this reset risk issue becoming a much bigger crisis than what lenders are expecting. There are a large percentage of outstanding HELOCs where the properties are still underwater. That number was at 40% in 2014 and is expected to peak at 62% in 2016, corresponding to the 10 year period after the peak of the U.S. housing bubble. RealtyTrac executives are concerned that the number of properties with a 125% plus loan-to-value ratio has become higher than predicted. The Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, the Federal Deposit Insurance Corporation, and the National Credit Union Administration (collectively, the agencies), in collaboration with the Conference of State Bank Supervisors, have jointly issued regulatory guidance on risk management practices for HELOCs nearing end-of-draw. The agencies expect lenders to manage risks in a disciplined manner, recognizing risk and working with those distressed borrowers to avoid unnecessary defaults. A comprehensive strategic plan is vital in order to proactively manage the outstanding HELOCs on their portfolio nearing end-of-draw. Lenders who do not get ahead of the end-of-draw issue now may have negative impact to their bottom line, brand perception in the market, and realize an increase in regulatory scrutiny. It is important for lenders to highlight an awareness of each consumer’s needs and tailor an appropriate and unique solution. Below is Experian’s recommended best practice for restructuring HELOCs nearing end-of-draw: Qualify Qualify consumers who have a HELOC that was opened between 2006 and 2008 Assess Viability Assess which HELOCs are idea candidates for restructuring based on a consumer’s Overall debt-to-income ratio Combined loan-to-value ratio Refine Offer Refine the offer to tailor towards each consumer’s needs Monthly payment they can afford Opportunity to restructure the debt into a first mortgage Target Target those consumers most likely to accept the offer Consumers with recent mortgage inquiries Consumers who are in the market for a HELOC loan Lenders should consider partnering with companies who possess the right toolkit in order to give them the greatest decisioning power when restructuring HELOC end-of-draw debt. It is essential that lenders restructure this debt in the most effective and efficient way in order to provide the best overall solution for each individual consumer. Revamp your mortgage and home equity acquisitions strategies with advanced analytics End-of-draw articles

By: Kyle Enger, Executive Vice President of Finagraph Small business remains one of the largest and most profitable client segments for banks. They provide low cost deposits, high-quality loans and offer numerous cross-selling opportunities. However, recent reports indicate that a majority of business owners are dissatisfied with their banking relationship. In fact, more than 33 percent are actively shopping for a new relationship. With limited access to credit after the worst of the financial crisis, plus a lack of service and attention, many business owners have lost confidence in banks and their bankers. Before the financial crisis, business owners ranked their banker number three on the list of top trusted advisors. Today bankers have fallen to number seven – below the medical system, the president and religious organizations, as reported in a recent Gallup poll, “Confidence in Institutions.” In order to gain a foothold with existing clients and prospects, here is a roadmap banks can use to build trust and effectively meet the needs to today’s small business client. Put feet on the street. To rebuild trust, banks need to get in front of their clients face to face and begin engaging with them on a deeper level. Even in the digital age, business customers still want to have face-to-face contact with their bank. The only way to effectively do that is to put feet on the street and begin having conversations with clients. Whether it be via Skype, phone calls, text, e-mail or Twitter – having knowledgeable bankers accessible is the first step in creating a trusting relationship. Develop business acumen. Business owners need someone who is aware of their pain points, can offer the correct products according to their financial need, and can provide a long-term plan for growth. In order to do so, banks need to invest in developing the business and relationship acumen of their sales forces to empower them to be trusted advisors. One of the best ways to launch a new class of relationship bankers is to start investing in educational events for both the bankers and the borrowers. This creates an environment of learning, transparency and growth. Leverage technology to enhance client relationships. Commercial and industrial lending is an expensive delivery strategy because it means bankers are constantly working with business owners on a regular basis. This approach can be time-consuming and costly as bankers must monitor inventory, understand financials, and make recommendations to improve the financial health of a business. However, if banks leverage technology to provide bankers with the tools needed to be more effective in their interactions with clients, they can create a winning combination. Some examples of this include providing online chat, an educational forum, and a financial intelligence tool to quickly review financials, provide recommendations and make loan decisions. Authenticate your value proposition. Business owners have choices when it comes to selecting a financial service provider, which is why it is important that every banker has a clearly defined value proposition. A value proposition is more than a generic list of attributes developed from a routine sales training program. It is a way of interacting, responding and collaborating that validates those words and makes a value proposition come to life. Simply claiming to provide the best service means nothing if it takes 48 hours to return phone calls. Words are meaningless without action, and business owners are particularly jaded when it comes to false elevator speeches delivered by bankers. Never stop reaching out. Throughout the lifecycle of a business, its owner uses between 12 and 15 bank products and services, yet the national product per customer ratio averages around 2.5. Simply put, companies are spreading their banking needs across multiple organizations. The primary cause? The banker likely never asked them if they had any additional businesses or needs. As a relationship banker to small businesses, it is your duty to bring the power of the bank to the individual client. By focusing on adding value through superior customer experience and technology, financial institutions will be better positioned to attract new small business banking clients and expand wallet share with existing clients. By implementing these five strategies, you will create closer relationships, stronger loan portfolios and a new generation of relationship bankers. To view the original blog posting, click here. To read more about the collaboration between Experian and Finagraph, click here.

By: Linda Haran Complying with complex and evolving capital adequacy regulatory requirements is the new reality for financial service organizations, and it doesn’t seem to be getting any easier to comply in the years since CCAR was introduced under the Dodd Frank Act. Many banks that have submitted capital plans to the Fed have seen them approved in one year and then rejected in the following year’s review, making compliance with the regulation feel very much like a moving target. As a result, several banks have recently pulled together a think tank of sorts to collaborate on what the Fed is looking for in capital plan submissions. Complying with CCAR is a very complex, data intensive exercise which requires specialized staffing. An approach or methodology to preparing these annual submissions has not been formally outlined by the regulators and banks are on their own to interpret the complex requirements into a comprehensive plan that will ensure their capital plans are accepted by the Fed. As banks work to perfect the methodology used in this exercise, the Fed continues to fine tune the requirements by changing submission dates, Tier 1 capital definitions, etc. As the regulation continues to evolve, banks will need to keep pace with the changing nature of the requirements and continually evaluate current processes to assess where they can be enhanced. The capital planning exercise remains complex and employing various methodologies to produce the most complete view of loss projections prior to submitting a final plan to the Fed is a crucial component in having the plan approved. Banks should utilize all available resources and consider partnering with third party organizations who are experienced in both loss forecasting model development and regulatory consulting in order to stay ahead of the regulations and avoid a scenario where capital plan submissions may not be accepted. Learn how Experian can help you meet the latest regulatory requirements with our Loss Forecasting Model Services.

Do you really know where your commercial and small business clients stand financially? I bet if you ask your commercial lending relationship managers they will say they do - but do they really? The bigger question is how you could be more tied into to your business clients so that you could give them real advice that may save their businesses. More questions?? Nope, just one answer. Finagraph with Experian’s Advisor for relationship lending is a perfect setup to gather data that you currently are using within your financial institution that can then be matched that up with real financial spreads from the accounting systems that your business client use in their everyday process. By comparing the two sources of records you can get a true perspective on where your business clients stands and empower your relationship managers like ever before.

The follow blog is by Kyle Enger, Executive Vice President of Finagraph With the surge of alternative lenders, competition among banks is stronger than ever. But what exactly does that mean for the everyday banker? It means business owners want more. If you’re only meeting your clients once a year on a renewal, it’s not good enough. In order to take your customer service to the next level, you need to become a trusted advisor. Someone who understands where your clients are going and how to help them get there. If you’re not investing in your clients’ business by taking the following actions, they may have one foot out the door. 1. Understand your clients’ business One of the biggest complaints from business owners is that bankers simply don’t understand their business. A good commercial banker should be well-versed in their borrower’s company, competitors and the industry. They should be willing to get to know their business, commit to them, stop by to check-in and provide a proactive plan to avoid future risks. 2. Utilize technology for your benefit The majority of recent bank innovations have been used to make the customer experience more convenient, but not necessarily the more helpful. We’ve seen everything from mobile remote deposit capture to online banking to mobile payments – all of which are keeping customers from interacting with the bank. Contrary to what many think, technology can be used to create strong relationships by giving bankers information about their customers to help serve them better. Using new software programs, bankers can see information like the current ratio, quick ratio, debt-to-equity, gross margin, net margin and ROI within seconds. 3. Heighten financial acumen Banks have access to a vast amount of customer financial data, but sometimes fail to use this information to its full potential. With insight into consumer purchasing behavior and business’ financial history, banks should be able to cater products and services to clients in a personalized manner. However, many lenders walk into prospect meetings without knowing much about the business. Their mode of operation is solely focused on trying to secure new clients by building rapport – they are what we call surface bankers. A good banker will educate clients on what they need to know such as equity, inventory, cash flow, retirement planning and sweep accounting. They should also know about new technology and consult borrowers on intermediate financing, terming out loans that are not revolving, or locking in with low interest rates. Following, they will bring in the right specialist to match the product according to their clients’ needs. 4. Go beyond the price Many business owners make the mistake of comparing banks based on cost, but the value of a healthy banking relationship and a financial guide is priceless. So many bankers these days are application gatherers working on a transactional basis, but that’s not what business owners need. They need to stop looking at the short-term convenience of brands, price and location, and start considering the long-term effects a trusted financial advisor can make on their business. 5. A partner in your business, not a banker “Sixty percent of businesses are misfinanced using short-term money for long-term use,” according to the CEB Business Banking Board. In other words, there are many qualified candidates in need of a trusting banker to help them succeed. Unbeknownst to many business owners, bankers actually want to make loans and help their clients’ business grow. Making this known is the baseline in building a strong foundation for the future of your career. Just remember to ask yourself – am I being business-centric or bank-centric? To view the original blog posting, click here. To read more about the collaboration between Experian and Finagraph, click here.