Unsecured lending is increasing. And everyone wants in.

Unsecured lending is increasing. And everyone wants in.

Not only are the number of personal loans increasing, but the share of those loans originated by fintech companies is increasing.

According to Experian statistics, in August 2015, 890 new trades were originated by fintechs (or 21% of all personal loans). Two years later, in August 2017, 1.1 million trades belonged to fintechs (making up 36% of trades). This increase is consistent over time even though the spread of average loan amount between traditional loans and fintech is tightening.

While convenience and the ability to apply online are key, interest rates are the number one factor in choosing a lender. Although average interest rates for traditional loans have stabilized, fintech interest rates continue to shift higher – and yet, the upward momentum in fintech loan origination continues.

So, who are the consumers taking these loans?

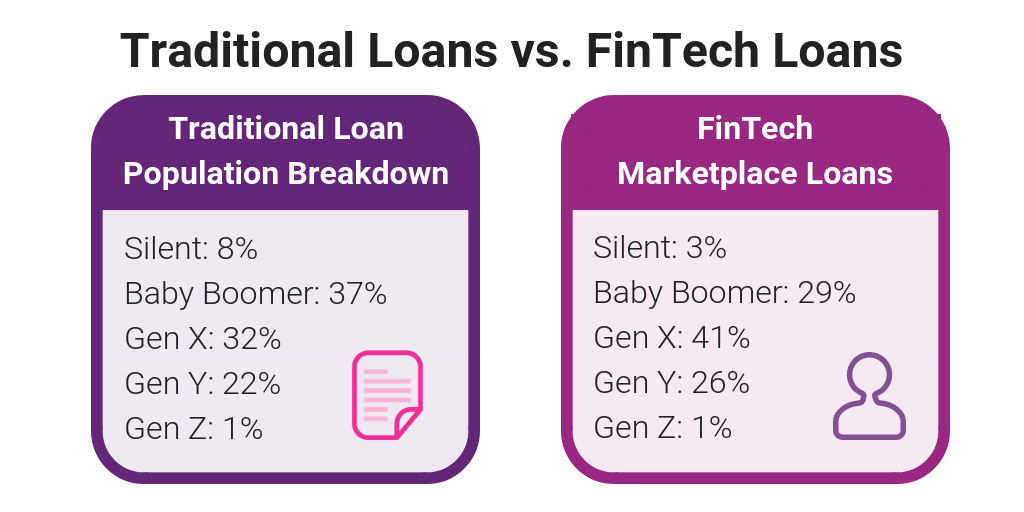

A common misconception about fintechs is that their association with market disruption, innovation and technology means that they appeal vastly to the Millennial masses. But that’s not necessarily the case.

Boomers represent the second largest group utilizing fintech Marketplace loans and, interestingly, Boomers’ average loan amount is higher than any other generational group – 85.9% higher, in fact, from their Millennial counterparts.

The reality is the personal loan market is fast-paced and consumers across the generational spectrum appear eager to adopt convenience-based, technology-driven online lending methods – something to the tune of $35.7 million in trades.

For more lending insights and statistics, download Experian’s Q2 2018 Personal Loans Infographic here.

Learn More About Online Marketplace Lending Download Lending Insights