Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

Financial Empowerment

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

Today’s data-driven world creates exciting new opportunities, but also new challenges. Many of us see the promise of being able to make more intelligent decisions by fully understanding our customers and the needs of the marketplace. There are data scientists that can do incredible analysis to give us new insights into areas we didn’t think were possible.

Today’s data-driven world creates exciting new opportunities, but also new challenges. Many of us see the promise of being able to make more intelligent decisions by fully understanding our customers and the needs of the marketplace. There are data scientists that can do incredible analysis to give us new insights into areas we didn’t think were possible.

Erin Lowry, the founder of Broke Millennial, gives her perspective on millennials and credit using Experian data.

Experian Marketing Services unveiled a new, more predictive and addressable Experian Marketing Suite at its 2015 Client Summit in Las Vegas, Nev.

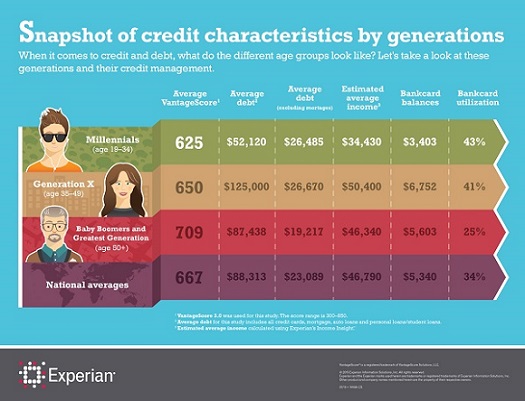

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

Millennials, also known as Generation Y (ages 19-34) are now the largest segment of the U.S. population, and according to a recent Experian analysis, also take the title for being the least credit savvy when compared to previous generations. The study revealed that millennials’ average credit score is 625, and their average debt excluding mortgages is $26,485.

In the video and presentation, Craig Boundy, CEO of Experian North America, discusses how big data is being used as a force for good. Good for consumers, good for business and good for society.He shares his perspective how Experian’s work in data and analytics has real-life applications.

Addressing the issue of identity management has become a top priority for marketers. The fact is that their customers are represented by dozens of identities – both known and unknown – in today’s digital world. According to new research published in our recently published 2015 Digital Marketer Report, linking identity data is now the #1 challenge for marketers around the world, up from fourth place just a year ago. Further, 89% of marketers report having challenges creating a single customer view.

If you were to survey American consumers whether or not they would like to be their own boss and successfully run their own business, I would imagine that a good majority would probably say yes. There is something empowering about the thought of setting your own hours and controlling your own destiny, but many people don’t actually take the steps to make that dream a reality.

If you were to survey American consumers whether or not they would like to be their own boss and successfully run their own business, I would imagine that a good majority would probably say yes. There is something empowering about the thought of setting your own hours and controlling your own destiny, but many people don’t actually take the steps to make that dream a reality.

Today, Experian’s global Fraud and Identity business released its analysis of client transaction data from the 2014 holiday season, showing an 80 percent reduction in the number of manual reviews among online merchants using the company’s fraud and identity products and services compared with the industry average. These results and other observations indicate that a customer-centric approach to fraud prevention would be more effective for many online merchants, leading the company to recommend five best practices for online merchants preparing for the 2015 holiday season.

Some of my fondest memories on road trips as a child were the games we were able to play. I’m sure many kids played “I Spy” and did “Sing-a-longs,” but my go-to game was “Slug Bug” (It’s a game where you get points for spotting a Volkswagen Beetle). While it’s been quite some time since I’ve played the game, I still find myself very aware of the different types of vehicles around me.

Some of my fondest memories on road trips as a child were the games we were able to play. I’m sure many kids played “I Spy” and did “Sing-a-longs,” but my go-to game was “Slug Bug” (It’s a game where you get points for spotting a Volkswagen Beetle). While it’s been quite some time since I’ve played the game, I still find myself very aware of the different types of vehicles around me.

Health information security breaches and identity theft have become an epidemic with losses occurring across the country.

In fact, according to a recent Ponemon Institute study sponsored by the Medical Identity Fraud Alliance, medical ID theft has increased by 21.7 percent since 2013. Additionally, data from the Department of Health and Human Services indicates that health data on more than 120 million people has been compromised in more than 1,100 separate breaches since 2009.

Health information security breaches and identity theft have become an epidemic with losses occurring across the country.

In fact, according to a recent Ponemon Institute study sponsored by the Medical Identity Fraud Alliance, medical ID theft has increased by 21.7 percent since 2013. Additionally, data from the Department of Health and Human Services indicates that health data on more than 120 million people has been compromised in more than 1,100 separate breaches since 2009.

With rising insurance costs, deductibles and copays, some people struggle to afford the out-of-pocket expense that can come with seeking medical treatment. Because of this, some consumers decide not to seek treatment, which could have negative effects on their health and overall well-being.

With rising insurance costs, deductibles and copays, some people struggle to afford the out-of-pocket expense that can come with seeking medical treatment. Because of this, some consumers decide not to seek treatment, which could have negative effects on their health and overall well-being.

A recent study conducted by Experian showed that a majority of vacationers overspend their budgets and rely on credit cards to provide extra funds. At the extreme end, more than half of millennial vacationers (52 percent) lean heavily on their credit cards, racking up vacation debt they’ll be repaying long after their trip comes to an end.