Experian’s State of the Automotive Finance Market report shows the new auto loan amount financed in Q4 2015 was the highest on record since 2008.

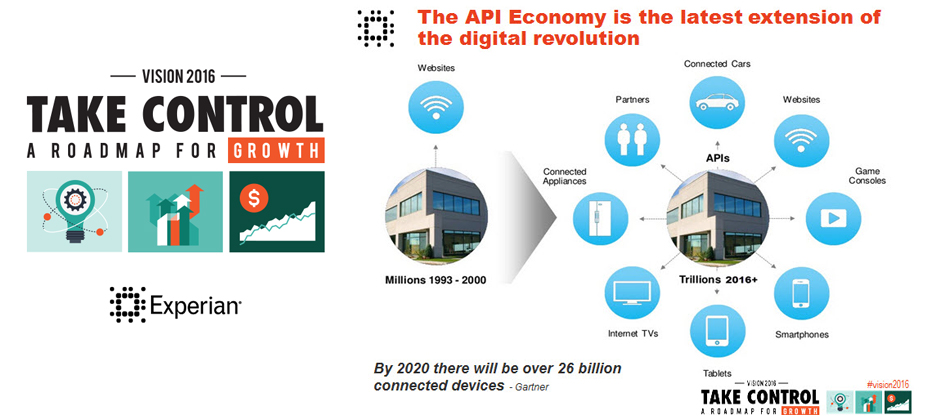

There is a revolution going on! We are in the midst of the second phase of the digital revolution and it is being fueled by API’s. API’s provide the access and mapping that allow access to and integration of the myriad of existing and new data sources available today. They do really helpful things like allow Uber to revolutionize the connection of riders to drivers as well as allow for quick, self-service credit decisions by integrating Experian data within Salesforce.com. Digital disruptors like Uber have scaled their business to massive size at breakneck speed because they can design, build and deploy solutions quickly. API’s and cloud computing play a central role in all of this. You will hear representatives from Uber share how API’s enabled the flow of Experian data through Salesforce.com enabling them to launch new business models, and enter new markets. Listen to Mike Myers as he shares a short overview of his Vision 2016 breakout session in this short video. Don’t miss this innovative Vision 2016 session! See you there.

Small business trade payment delinquencies can signal the beginning of business financial duress. However, sometimes these delinquencies are isolated events. Understanding the trade payment priorities of a business can lead to better business risk assessment. Experian understands commercial payment behaviors and can help clients more accurately interpret the risk of payment delinquencies for different kinds of trades. In his Vision 2016 breakout session “Which creditors get priority when businesses face a financial burden”, Sung Park, Analytics Consultant with Experian’s Decision Sciences discusses the types of trades or financial obligations that become delinquent first, and the conditions that most commonly signal overall business stress. What the audience will learn: The audience will have a better understanding of which type of trade delinquencies are likely isolated incidents and which ones are precursors of businesses facing a financial burden, and what actions can be taken proactively to mitigate risk. Don't miss your opportunity to catch these informative breakout sessions during Vision 2016.