There are many factors attributing to the success of dealerships. When it comes to dealers, empirical guidance is a great way to study effective advertising. Experian brought Auto, Targeting, and the Dealer Positioning System capabilities together in a nationwide study to answer the ultimate question: what drives sales?

The answers can be found in Experian’s 2018 Attribution Study. This is a wide-ranging, dealer-focused sales-driven attribution study that analyzed a few key variables. We deployed 187,701 tracking pixels to devices in 41,012 distinct households, focused on 15 digital metrics to learn about shopper behavior, and tied that digital shopping data to 2,436 vehicle sales.

An industry first, Experian’s ability to combine automotive registration data, sales data, and website analytics and online behavior data puts us in a position to do something that very few companies can do. We use the household identifiers to not only see who bought a car and who bought specifically from a participating dealer, but also how they shopped the dealer’s site. Our ability to accurately identify a household’s digital behavior is based on the fact that we are a source compiler of the data and have it sitting under one roof. Others that attempt to provide this type of insight need to contract out for registrations, sales data imports from the dealership, website analytics, household identifiers, or all the above, which generally adds time to the insights.

Using our sales-based approach, we can deliver unbiased attribution. Sales-based attribution is attributing credit to different advertising sources/campaigns based on actual vehicle sales – including those targeted consumers that may have purchased outside of the dealership. This is the Holy Grail of attribution for car dealers since it ties an offline activity such as buying a car back to the online advertising that’s taking up most their budgets every month. Because of that offline-online disconnect, sales-based attribution is difficult.

Other automotive attribution models are typically focused on website conversions or website behavior – “what advertising can I attribute website leads to” (conversions) or “what advertising is driving users who follow the behavior that I think shows they’re likely to buy from my dealership” (website behavior.)

What are the takeaways?

We found three takeaways from our study. First off, we look at shopper behavior instead of isolating KPIs. Later we will discuss how traditional website metrics do not tie-in to sales. Second, we look at optimizing your paid advertising. Finally, we look at third-party investments. Although third parties drive sales, they may not be your sales.

Looking at shopper behavior, not isolated KPI’s

Traditional website metrics don’t tell the sales story for dealers. Traditional conversion stats are equal for buyers vs. all traffic such as VDPs or page views What this means is on average, buyers converted at a lower rate than overall website traffic. Looking solely at form submissions, hours and directions pageviews, and mobile clicks-to-call, don’t give the best view of what advertising is driving sales. With that, 98% of buyer traffic never submitted a form or went to the hours and directions page. This is a typical website conversion that dealers, vendors, and advertising agencies focus on. Since traditional web metrics don’t tell the story, there is another way. These are called High-Value Users, or HVU. They purchase at a 34% higher rate than overall traffic although they make up 11% of all traffic.

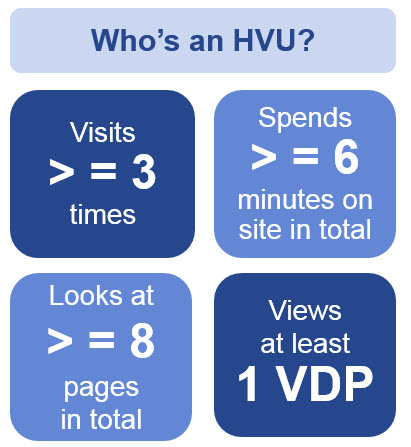

High-Value Users are an Experian derived KPI. What makes someone an HVU are four different measurements.

- They must visit a website at least three times

- Spend at least six minutes on the site in total

- View at least eight pages in total

- View at least one VDP

High-Value Users correlates to sales better than Vehicle Detail Page or VDP metrics. In this study, the correlation for VDP was measured at .595 which is rated a medium correlation. Meanwhile, HVU scored a .698 which is rated a high correlation. Looking at many different behavioral KPIs, like we do with our High-Value User (HVU) metric, correlates better to sales than just looking at how many VDPs you had. Driving more VDPs won’t necessarily help sales. But driving more HVUs is more likely to correlate with more sales. This also gets back to the attribution discussion above: Experian sales-based attribution is the best, and Experian’s HVUs are a good method for web-based attribution.

From this attribution study, High-Value Users are a vital group for dealers to utilize. In our next post, we will go over the second and third takeaways from the attribution study: optimizing paid advertising and evaluating third-party investments.