Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

157 resultsPage 1

Report

Report

As the credit card landscape evolves, understanding how consumers and businesses are adapting has never been more important.

Our second annual State of Credit Cards Report provides a timely update on key market dynamics and dives into an often-overlooked segment within credit card portfolios: business accounts.

Key takeaways:

The Regional Economic Health Tracker examines consumer health across the four U.S. census regions. It highlights how regional dynamics, from data center growth to housing costs and credit conditions, are shaping household finances today.

Report

Report

Gain actionable insights from Experian’s 2026 State of the U.S. Housing Market Report:

Report

Report

Despite tariff headwinds in 2025, the U.S. economy exceeded expectations and is positioned for continued growth. Improving credit dynamics point to a stronger lending environment in 2026.

Report

Report

The longest U.S. government shutdown has paused official labor data, but private-sector insights reveal key trends shaping the job market. Alternative sources show slowing job creation, modestly higher unemployment, and signs of resilience consistent with the Fed’s outlook.

Webinar

Webinar

As we step closer to 2026, all eyes remain on the economic outlook, the labor market and consumer health. Experian’s Chief Economist Joseph Mayans, Director of Fintech Gavin Harding and Solution Insights Director Amanda Roth, will provide a look into:

Video

Video

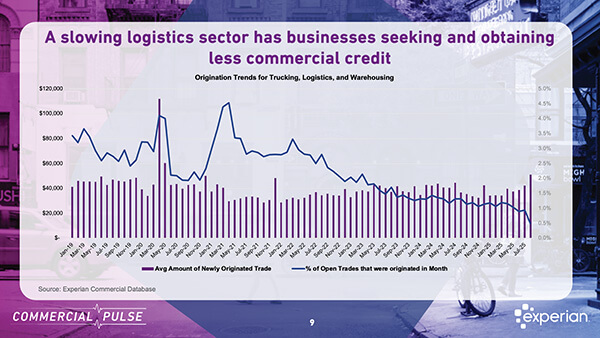

As the U.S. economy continues to recalibrate post-pandemic, the transportation and warehousing segments of the logistics sector are signaling caution. While the broader logistics industry has remained in expansion mode, Experian’s latest Commercial Pulse Report reveals that delinquencies are rising—an early warning of growing risk in two of the economy’s most critical subsectors.

Check out the full report to see how these trends could impact your strategy!

Report

Report

The U.S. economy continues to surprise with its resilience - growth forecasts are improving, equity markets are hitting new highs, and fears of an imminent recession are fading. Joseph Mayans’ Vision 2025 session, “Navigating 2026: Global Macro Shifts, U.S. Credit Trends and the Evolving Lending Landscape,” explored the economic forces shaping the next year - from the AI-driven equity boom to structural vulnerabilities in the white-collar labor market. His key takeaway: while AI innovation is fueling growth and optimism, it also introduces new dependencies and risks that will define the next economic chapter.

Highlights:

White Paper

White Paper

Explore Experian’s latest State of Student Loans white paper to uncover key trends, borrower insights, and the evolving impact of student debt on financial health. Learn how data-driven solutions can help lenders and consumers navigate today’s student loan landscape.

Key considerations include: