Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

7 resultsPage 1

Report

Report

Learn how you can move beyond single-point employee benefit solutions and embrace a more holistic approach that combines:

Webinar

Webinar

In an era of economic uncertainty, resilience can seem out of reach, but Gen Z is flipping the script. Watch this webinar to explore:

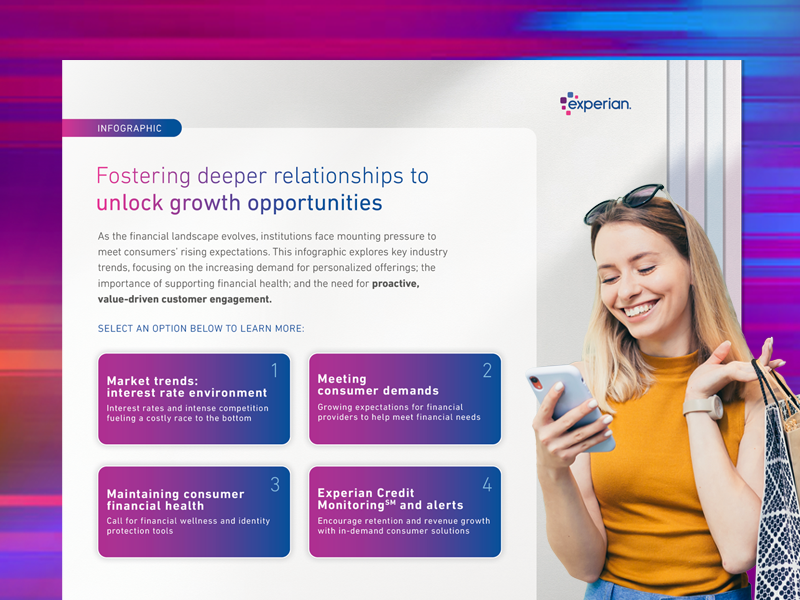

Infographic

Infographic

View our infographic to discover how you can increase revenue and empower your customers to stay informed, avoid delinquencies, and improve their financial well-being.

Here’s a sneak peek of what you’ll find:

eBook

eBook

In today's economic conditions, consumers' financial, mental, and physical health worries are on the rise. 42% of people claim money concerns have had a negative impact on their mental health.1

Consumers want to engage with companies that value them as a whole person, not a number. Traditional financial institutions and technology companies must fill in the financial literacy gap to establish and maintain strong consumer relationships.

Find new opportunities by offering actionable products that ease financial stress and guide consumers on their financial wellness journey.

Infographic

Infographic

Greater consumer engagement and broadening access to credit can be an important part of financial inclusion. Grow your business by leveraging credit-building solutions that help empower underserved communities.

eBook

eBook

Are you a small business owner navigating the process of establishing your business credit profile?

Experian is here with a helpful guide about business credit and how it works to help you on your journey. From understanding how business credit scores and Reports are originated, to employing best practices for building up a strong business credit report, the Experian Blueprint is here to assist you every step of the way.