Welcome to the Experian Thought Leadership Hub

Gain insights into the fast-changing world of consumer and business data through our extensive library of resources.

50 resultsPage 1

Tip Sheet

Tip Sheet

This summary outlines important research findings that help lenders drive a more inclusive environment for customers, while mitigating risk.

A few takeaways:

White Paper

White Paper

Read the latest findings about "Closing the credit gap" white paper, and what they mean for financial inclusion and risk management.

Key insights:

Case Study

Case Study

Every lending decision you make relies on data, but what if that data only tells part of the story? Download our use case to meet two borrowers, Claudia and John, and discover how alternative data can help you:

Tip Sheet

Tip Sheet

Credit unions exist to serve all members of their communities. Yet millions of financially responsible individuals remain invisible to conventional scoring. Download our alternative data guide to discover:

White Paper

White Paper

Generative AI is a powerful force that’s driving higher efficiency and productivity in credit risk management for financial institutions. Read our latest white paper to discover how lenders can improve the credit risk management process to:

Video

Video

A strong credit risk decisioning strategy is crucial for any financial institution looking to stand out from the competition, book more high performing loans, and drive revenue. Lenders can achieve this by implementing next-gen AI technology to:

Watch this video to learn how you can level up your credit decisioning journey across the customer lifecycle with the Experian Ascend Platform.

Video

Video

GenAI is transforming the financial services industry by drastically improving productivity and efficiency. Experian Assistant, our award-winning GenAI solution, can help lending institutions:

Watch this video to discover how Experian Assistant can help your business unlock the full power of your data with less friction and faster results.

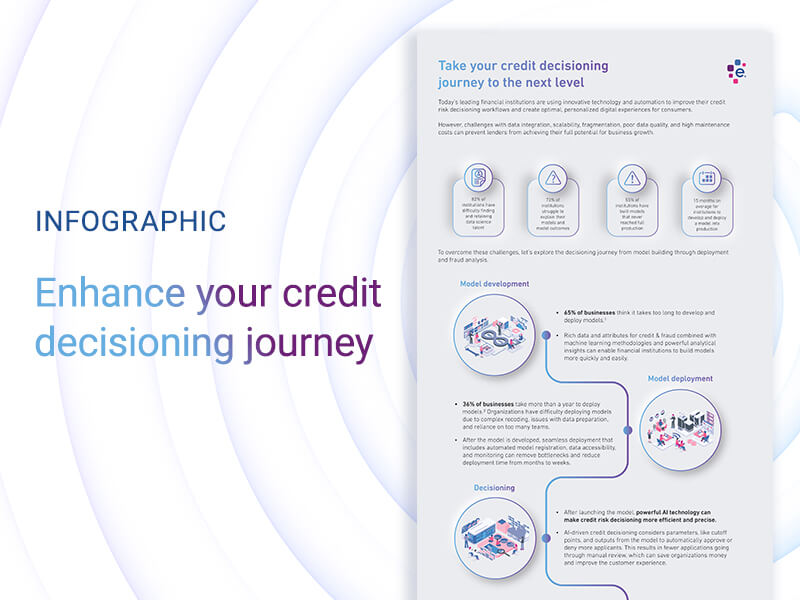

Infographic

Infographic

Financial institutions face several challenges during the credit decisioning process, such as poor data quality, scalability issues, data fragmentation, and high maintenance costs. Experian can help lending institutions enhance their credit decisioning journey at every step, through:

Discover how your organization can take your credit decisioning journey to the next level with the Experian Ascend Platform™.