Latest Posts

A recent Experian study found student loans have increased by 84% since the recession (from 2008 to 2014), surpassing credit card debt, home-equity loans and lines of credit, and automotive debt.

Driver of success: Mitigate auto lending risk A culture of learning is a key driver of success. Does your risk culture continue to adapt? There are many issues within auto lending that are unique to other financial services ecosystems: the direct versus indirect relationship, insights of the asset influencing the risk insights, new versus used vehicle transactions influencing risk and terms, and more. However, there is one universal standard common to all financial services cultures — change.. Change is constant, and an institution’s marketing and risk organizations need to be constantly learning to stay abreast of dealer, consumer, competitor and regulatory issues. No one has said it better than Jack Welch: “An organization’s ability to learn, and translate that learning into action rapidly, is the ultimate competitive advantage.” This statement was quickly followed by a command: “Change before you have to.” So the challenge for the portfolio manager is to ensure there are the system features, data sources, management reporting structures, data access features, analytic skills, broad management team skill sets, and employee feedback and incentive plans to drive the organization to a constant state of renewal. The challenge for many smaller and midsize lenders is to determine what systems and skills need to be in-house and what tasks are better left for a third party to handle. For consumer-level data, vehicle history and valuation data, and fraud alert flags, it seems reasonable to leverage solutions from established third parties: credit reporting agencies. After that, the solutions to the many other needs may be more specific to the lender legacy skill set and other support relationships: Are there strong in-house data-management and analytic skills? There is a significant difference between management information and data analysis driving policy and portfolio performance forecasts. Does the internal team have both? Is the current operating platform(s) feature-rich and able to be managed and enhanced by internal resources within tight time frames? Is the management team broadly experienced and constantly updating best-practice insights? Is the in-house team frequently engaged with the regulatory community to stay abreast of new mandates and initiatives? There is a solution. Experian® offers the data, software, solutions, management information, analytic solutions and consulting services to tie everything together for a lender-specific best configuration. We look forward to hearing from you to discuss how we can help.

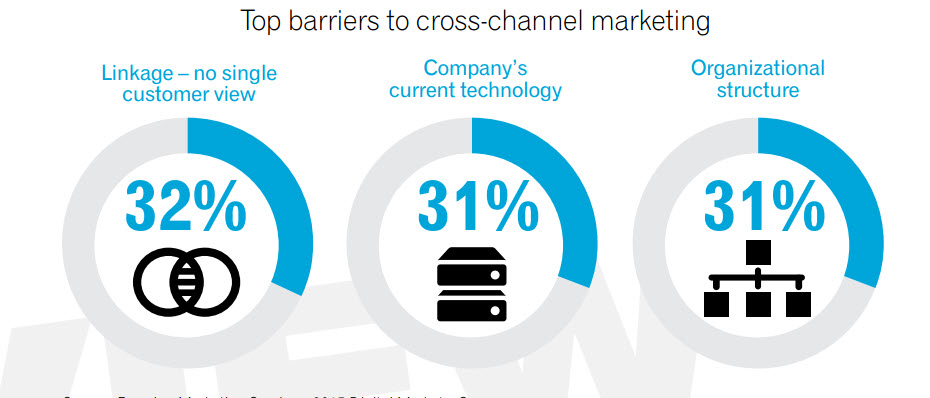

According to a recent Experian Marketing Services study, 99% of companies believe achieving a single customer view is important to their business, but only 24% have a single customer view today.

Financing my first car was a bittersweet feeling. I was thrilled at the thought of purchasing a new vehicle, yet I was dreading haggling the price with the dealer. As a millennial, I feared the rising prices for new cars, and knew that I needed to find a way to make the vehicle more affordable. That said, I decided to look at used cars. Clearly, I’m not the only car shopper going through this experience. Many consumers are exploring new options to keep their monthly payments down, whether it’s extending the length of their loan, or turning to leases. Sometimes it’s both. According to Experian Automotive’s Q2 2015 State of the Automotive Finance Market report, the average loan amount for a new vehicle reached $28,524, while the average loan amount for a used vehicle hit $18,671, a second quarter high and an all-time high, respectively. Subsequently, the increasing loan amounts also caused the average monthly payment for new ($483) and used ($361) vehicles to increase. Interestingly, the $122 difference in average monthly payment was also a second quarter high, furthering the need to make car payments affordable. As such, consumers continued to take out leases. During the second quarter, leasing accounted for 26.9 percent of all new vehicle transactions, reaching an all-time high. While leasing continues to be a popular option among car shoppers to keep monthly payments down, we’re beginning to see these consumers take it a step further. Sure 36-month term leases are still the most popular, however the percentage of leases extending past the 36 months into the 37- to 48-month range has increased by 18 percent. Furthermore, the average lease payment dropped $13 from a year ago, reaching $394. Findings from the report also showed that consumers continued to lengthen their loan terms, especially for used vehicles. The percentage of used vehicles financed for 73- to 84-months increased by 14.8 percent from Q2 2014 to reach 16.1 percent – the highest percentage of record. New vehicles financed for the same term length climbed 19.7 percent from the previous year to reach 28.8 percent. If the trend continues, we can only expect vehicles to become more expensive and harder to keep within budget. That said there are ways to keep monthly payments within reason. Just as I did, consumers will need to explore the different options available and work with the financing tool that best meets their needs. If they can do that, it will just be the sweet feeling of purchasing a car.

As Big Data becomes the norm in the credit industry and others, the seemingly non-stop efforts to accumulate more and more data leads me to ask the question - when is Big Data too much data? The answer doesn’t lie in the quantity of data itself, but rather in the application of it – Big Data is too much data when you can’t use it to make better decisions. So what do I mean by a better decision? From any number of perspectives, the answer to that question will vary. From the viewpoint of a marketer, maybe that decision is about whether new data will result in better response rates through improved segmentation. From a lender perspective, that decision might be about whether a borrower will repay a loan or the right interest rate to charge the borrower. That is one the points of the hype around Big Data – it is helping companies and individuals in all sorts of situations make better decisions – but regardless of the application, it appears that the science of Big Data must not just be based on an assumption that more data will always lead to better decisions, but that more data can lead to better decisions – if it is also the “right data”. Then how does one know when another new data source is helping? It’s not obvious that additional data won’t help make a better decision. It takes an expert to understand not only the data employed, but ultimately the use of the data in the decision-making process. It takes expertise that is not found just anywhere. At Experian, one of our core capabilities is based on the ability to distinguish between data that is predictive and can help our clients make better decisions, and that which is noise and is not helpful to our clients. Our scores and models, whether they be used for prospecting new customers, measuring risk in offering new credit, or determining how to best collect on an outstanding receivable, are all designed to optimize the decision making process. Learn more about our big data capabilities

According to the latest State of the Automotive Finance Market report, consumers are continuing to extend loan terms as a way to keep payments low.

A recent Experian study on data insights found that 83% of chief information officers see data as a valuable asset that is not being fully exploited within their organization, resulting in the need for more organizations to appoint a dedicated chief data officer (CDO).

While auto delinquencies declined slightly year over year (3.01% for accounts 30 days past due or greater in Q2 2015 versus 3.03% a year earlier), it is interesting to note the variance in delinquency by lender channel.

Protecting your customer The impact of fraud on the customer relationship Sadly fraudsters seem to always be one-step ahead of fraud-prevention strategies, causing organizations to play catch-up to the criminals. And as information security tightens and technologies evolve, so does the industrious nature of organized identity and online fraud. It should be no surprise then that fraud risk mitigation and management will continue to be an ongoing issue for organizations. But what continues to drive investment in identity management and online risk tools is the arms race across organizations to deliver superior customer experience and functionality. While the monetary cost of fraud losses can be high and rather detrimental, the impact of lost customers and overall reputational decline due to poor customer experiences can be higher. The key is finding the right balance between identifying and segmenting likely fraudulent customers across the vast majority of legitimate customers and transactions. I want to share a recent interactive eBook we launched which outlines the authentication and identity management balance with a focus on the consumer. We highlight current trends and what organizations should be thinking about and doing to protect their business, institution, or agency and customers. I hope you enjoy this look at the impact of fraud on the customer relationship.

Our clients are facing three primary issues when it comes to regulatory compliance: time resources knowledge Many are facing Matters Requiring Attention (MRA) and Matters Requiring Immediate Attention (MRIA) and don’t have the staff or the capacity to complete all of the work themselves within tight deadlines. They also want their limited resources to work on internal, proprietary initiatives to grow the business and maximize profit and return. These activities cannot be outsourced as easily as regulatory and compliance work, which is relatively easy to parse out and give to an external third party. Quite often, a level of independent oversight and effective challenge is also a requirement that can easily be solved through the use of an objective, external third party. A lot of the regulations are still relatively new, and there are still many issues and knowledge gaps our clients are facing. They have insight into their own organization only and quite often aren’t aware of or able to leverage industry best practice without the view of an external third party with broader industry knowledge and experience. In terms of best practice, it all really starts with the data, leading to the attributes used in models to create sound risk management strategies, manage capital adequacy, and ensure the safety and soundness of the overall U.S. and global financial system. The integrity of data reporting, dispute management and compliance with all applicable regulatory requirements need to be an enterprise-wide effort. In the area of attribute governance, there are three primary areas of focus: Attribution creation — definitions; logic, code and accuracy; and how to reduce implementation timelines. Monitoring and maintenance — looking for shifts in attributes and their potential impact and facilitating updates to attributes based upon changes in reporting and upgrades to newer versions of attributes as the credit environment changes, such as during the most recent mortgage crisis, where loan modification and associated attributes were created and took on increased importance. And last but definitely not least, documentation — We cannot say enough about the importance of documentation, especially to regulators. Documentation ensures accuracy and consistent application and must record all general conventions and limitations. For model risk management and governance, focus areas should follow the expanded Office of the Comptroller of the Currency (OCC) Guidance from Bulletin 2011-12. This guidance includes expanded requirements for model validations including not just standard back testing, but also benchmarking, effective challenge, sensitivity analysis and stress testing. It also expands the guidance beyond just validation to model development and usage, implementation, governance and controls. In response to these OCC expanded guidance requirements, one of our clients was seeking an industry expert to serve as an independent third party to 1) conduct industry best practice and benchmarking in areas of reject inference methodologies and 2) validate production models used for risk underwriting, line assignment, pricing and targeting. After a full review and assessment, we provided the client with a clear road map to improve the process to conduct reject inference through knowledge transfer and best practices. We established a best-in-class approach to annual model validations on a model inventory consisting of retail, small business and wealth segment portfolios. We also delivered expedited results that also identified alternative methods of validation that assess variability in point estimates, as well as comply with OCC requirements for precision, ranking and population measurement statistics. Through our work, the client was able to leverage Experian to establish a global approach to reject inference methodologies, to augment existing staffing and to offshore resources in a cost-effective manner. There are three primary areas of loss forecasting, stress testing and capital adequacy planning: International — Basel accord National — U.S. Dodd-Frank Act Stress Testing (DFAST), including Comprehensive Capital Analysis and Review (CCAR) supervisory review Internal — Allowance for Loan and Lease Losses requirements Although there are similarities, there are also important differences among each of these three requirements and practices. For these reasons, most financial institutions in the United States are still providing and managing them separately. This obviously creates a strain on internal staff and resources. One of our clients had an initial compliance strategy in place but did not have the sufficient in-house staff and resources required to create, document and review its modeling and stress testing to satisfy regulators and internal auditors. The organization needed a consultant that could work closely with its in-house team to support sophisticated models that were tailored to meet its specific compliance obligations. We worked closely with the client’s team to provide extensive consulting support for a complex set of loss-forecasting models and other tools, applying industry best practices to fully document the models. Throughout the process, our consulting team discovered and identified content gaps to help ensure that all documentation was complete. We also provided ad hoc analytics to support the client’s model development effort and strategic and tactical guidance on stress testing model development for compliance. This enabled the client to develop primary and challenge models for DFAST’s CCAR requirements, as well as internal stress scenarios. It also provided the client with the following tangible business benefits: balance compliance with maximum profitability and revenue; provided knowledge sharing and best practices to help empower client employees; helped refine models based on feedback from internal and external governance organizations; supported models with academic research to help align the correct model to the correct processes; and provided assistance with model implementation and application. Click here for a recent video I did on how capital-adequacy positions are becoming crucial in analyst recommendations.

Increased volume of fraud attempts during back to school shopping season Back to school shopping season will be the first time many consumers' use their chip-enabled credit cards and stores' new card readers. With the average K-12 family spending $630.36 per child in back to school shopping, and more than 1/3 shopping online, according to the National Retail Federation - is your fraud strategy prepared to handle the increased volume? And are you using a dynamic knowledge based authentication (KBA) solution that incorporates a wide variety of questions categories as part of your multi-faceted risk based authentication approach to fraud account management? Binary verification, or risk segmentation based on a single pass/fail decision is like trying to stay dry in a summer rain storm by wearing a coat. It’s far more effective to wear rubber boots and a use an umbrella, in addition to wearing a rain coat. Binary verification can occur based on evaluating identity elements with two outcomes –pass or fail – which could leave you susceptible to a crafty fraudster. When we recommend a risk based authentication approach, we take a more holistic view of a consumers risk profile. We advocate using analytics and weighting many factors, including identity elements, device intelligence and a robust knowledge-based authentication solution that work in concert to provide overall risk based decision. After all, the end-goal is to enable the good consumers to continue forward based, while preventing the fraudster from compromising your customer’s identity and infiltrating you’re your business.

According to the latest Experian-Oliver Wyman Market Intelligence Report, mortgage originations for Q2 2015 increased 56% over Q2 2014 — $547 billion versus $350 billion.

Protecting consumers from fraud this summer vacation It’s that time of year again – when people all over the U.S. take time away from life’s daily chores and embark upon that much-needed refresh: vacation! But just as fraud activity spikes during the holidays, evidence shows fraudster activity also surges during the summer, as the fraudster’s busy season is when we step away for some well-deserved rest and relaxation. With consumers on vacation, identity theft becomes easier. We all know someone who has been the victim of identity theft, resulting in fraudulent purchases on their credit card, or their bank accounts being emptied. Consumers are most likely to break from their normal spending habits, and credit card’s fraud analytics teams struggle to differentiate these changes in spending behavior for a family on vacation from a fraudster who has compromised dad’s identity. To make matter seven more challenging, consumers are less likely to take measures that will help minimize fraud while they are out of town, making the fraudster’s job easier. Identifying risky behaviors, or patterns outside of a consumer’s normal behavior when used in combination with a knowledge-based authentication session can help validate that the individual is indeed who they claim to be. A knowledge-based authentication solution with a wide variety of question types to complicate the fraudsters ability to pass should be part of a risk-based approach to on-going account management, especially when combined with a risk score and device intelligence. Take measures to incorporate a knowledge-based authentication solution with a diverse range of question types to help protect your business and your customers from being burned while on vacation, at least by fraudsters. For more on travel spending behavior and projections for summer 2015, click here.

According to a recent Experian analysis, millennials (ages 19–34) are now the largest segment of the U.S. population and are also the least credit savvy group.

Imagine the following scenario: an attacker acquires consumers’ login credentials through a data breach. They use these credentials to test account access and observe account activity to understand the ebbs and flows of normal cash movement – peering into private financial records – verifying the optimal time to strike for the most financial gain. Surveillance and fraud staging are the seemingly benign and often-transparent account activities that fraudsters undertake after an account has been compromised but before that compromise has been detected or money is moved. Activities include viewing balances, changing settings to more effectively cover tracks, and setting up account linkages to stage eventual fraudulent transfers. The unfortunate thing is that the actual theft is often the final event in a series of several fraudulent surveillance and staging activities that were not detected in time. It is the activity that occurs before theft that can severely undermine consumer trust and can devastate a brand’s reputation. Read more about surveillance, staging and the fraud lifecycle in this complimentary whitepaper.