Experian’s latest annual State of Credit analysis provides insight into the differences in credit habits by generation. While the youngest group, Millennials, appear to be novice credit managers, Generation Xers have the highest amount of average debt, are slowest to make payments on time and tied with Millennials for highest percentage of credit utilized.

The results of the study reinforce the importance of lenders providing transparent consumer education on credit scores and responsible credit behavior.

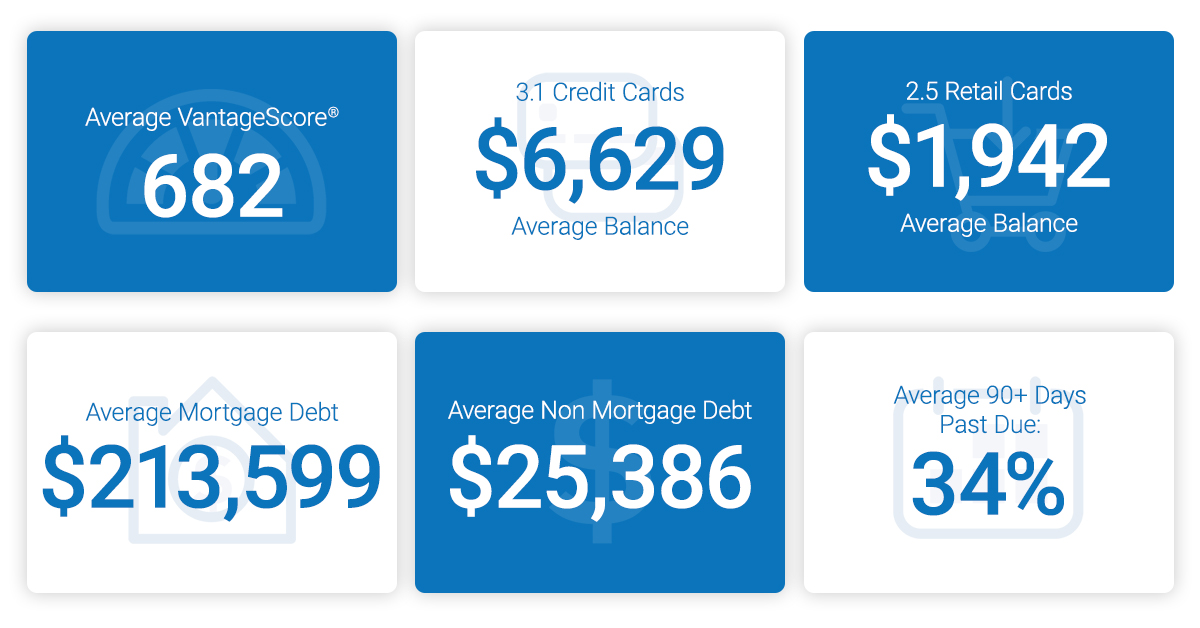

|

Snapshot of generational debt differences |

|||

|

Baby Boomers |

Generation |

Millennials (19 to 29) |

|

| VantageScore® credit score |

700 |

653 |

628 |

| Average debt |

$29,317 |

$30,039 |

$23,332 |

| Average balance of bankcards |

$5,347 |

$5,343 |

$2,682 |

| Average revolving utilization |

30% |

37% |

37% |

| Late payments |

0.33 |

0.61 |

0.58 |

Download our recent Webinar: It’s a new reality … and time for a new risk score