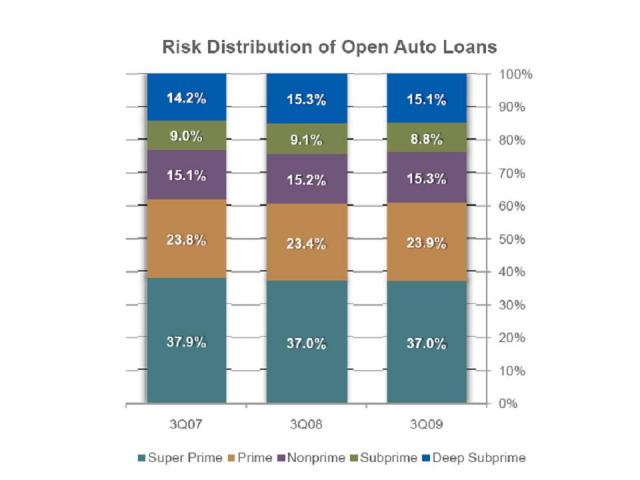

We’ve recently discussed management of risk, collections strategy, credit attributes, and the like for the bank card, telco, and real estate markets. This blog will provide insights into the trends of the automotive finance market as of third quarter 2009. In terms of credit quality, the market has been relatively steady in year-over-year comparisons. The subprime group saw the biggest change in risk distribution from 3Q08, with a -3.74 percent shift.

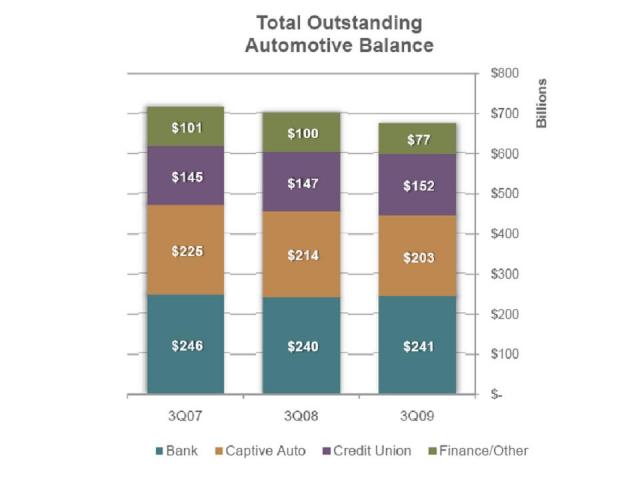

Overall, balances have declined to just over $673 billion (- 4 percent). In 3Q09, banks held the largest total of outstanding automotive balances of $241 billion (with captive auto next at $203 billion). Credit unions had the largest increase from 3Q08 (with $5 billion) and the finance/other group had the largest decrease in balances (- $23 billion).

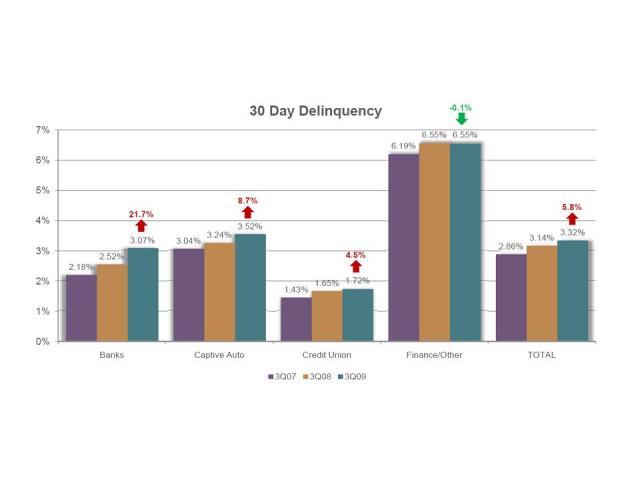

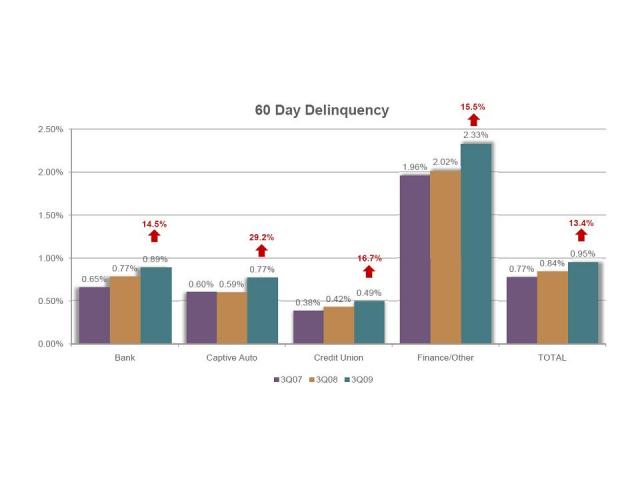

How are automotive loans performing? Total 30- and 60-day delinquencies are still on the rise, but the rate of increase of 30-day delinquencies appears to be slowing.

New originations are dominating in the Prime plus market (66 percent), up by 10 percent. Lending criteria has tightened and, as a result, we see scores on both new and used vehicles continue to increase. For new buyers, over 83 percent are Prime plus. For used buyers, over 53 percent are Prime plus. The average credit score changed from 762 in 3Q08 to 775 in 3Q09 — up 13 points for new vehicles. For used vehicles in the same time period: 670 to 684, up 14 points.

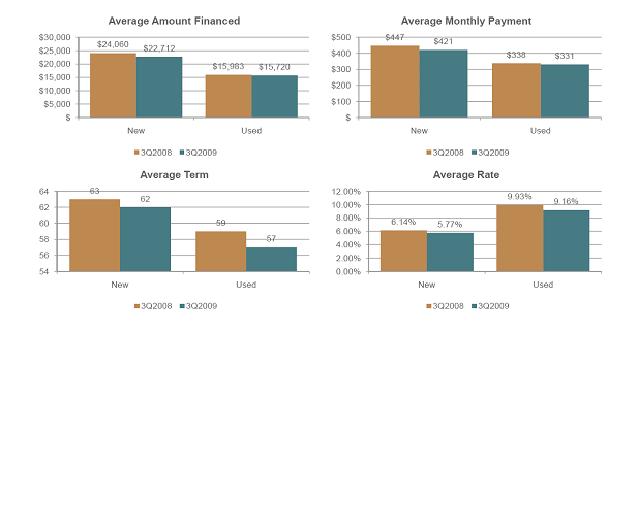

Lastly, let’s take a look at how financing has changed from 3Q08 to 3Q09. The financed amounts and monthly payments have dropped year-over-year as well as the average term and average rate.

Source: State of the Automotive Finance Market, Third Quarter 2009 by Melinda Zabritski, director of Automotive Credit at Experian and Experian-Oliver Wyman Market Intelligence Reports