What Is Direct Deposit?

Quick Answer

Direct deposit is an electronic payment method where funds are automatically transferred into your bank account. It’s a secure and convenient way to receive money without using physical checks.

Direct deposit is an electronic transfer of money directly to a bank account. It's commonly used to transfer money from an employer to an employee's bank account to avoid printing and issuing checks.

Read on for what you need to know about how to set up direct deposit and how long you may have to wait for your money to appear in your bank account, plus how you can get early direct deposit.

What Is Direct Deposit?

Direct deposit is a secure and convenient electronic transfer method that transfers money directly into your bank account using the automated clearing house (ACH) network. Instead of waiting for a physical check that you have to manually deposit, the funds are automatically credited to your account, saving you time and effort.

Employers commonly use direct deposit to pay salaries and wages to employees. Government agencies also use it to pay tax refunds, Social Security benefits, pensions and other government payments. You can even use direct deposit to receive rental income and dividends.

How Does Direct Deposit Work?

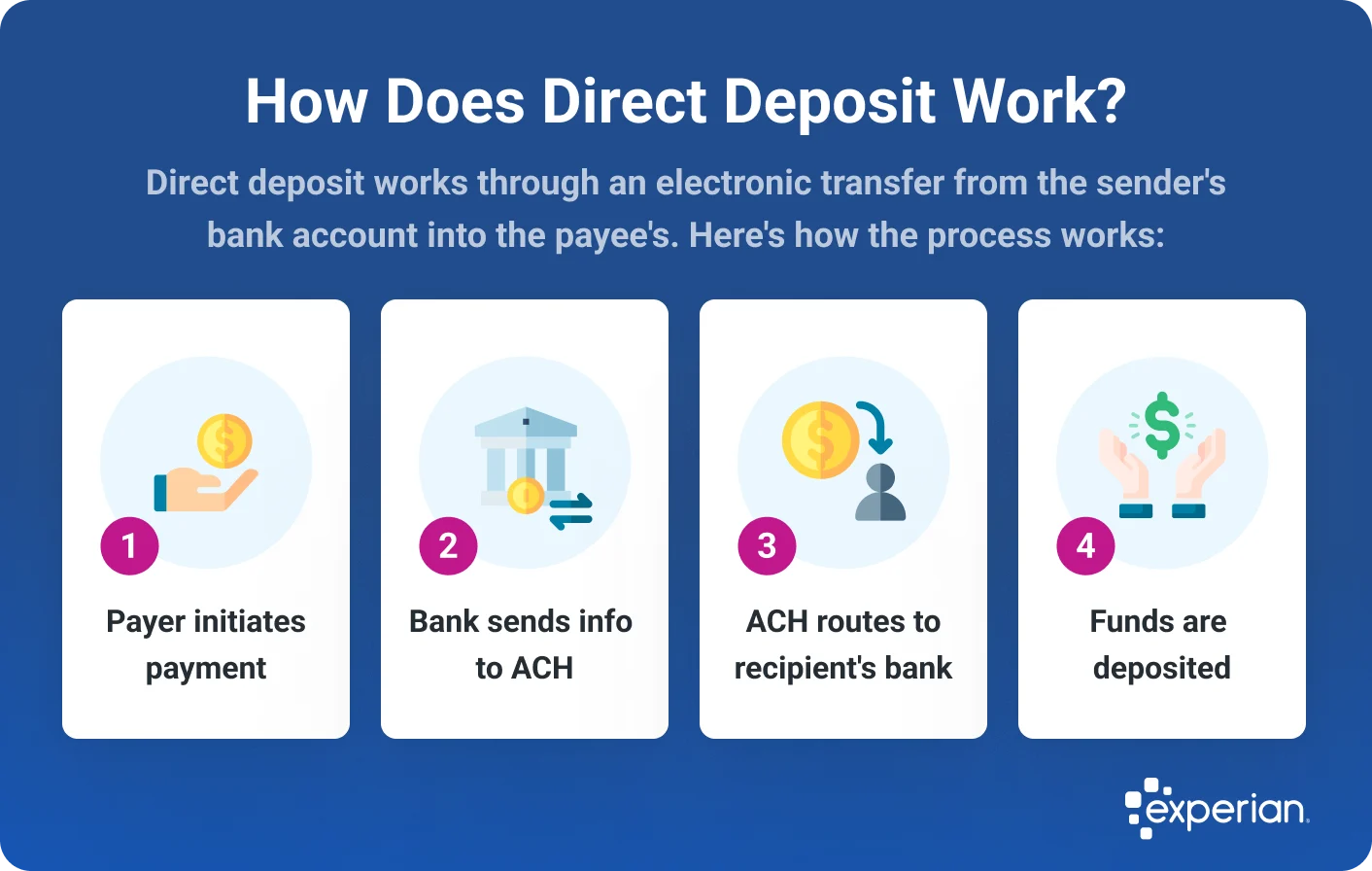

Direct deposit works through an electronic transfer from the sender's bank account into the payee's. Here's how the process works:

- The payer submits payment instructions to their bank, often using a payroll provider.

- The payer's bank sends these deposit instructions to the ACH for processing.

- The ACH relays the deposit details to the recipient's bank.

- The payment amount is debited from the payer's account and credited to the recipient's account.

You may also be able to benefit from earning a bonus when you open a new account and set up direct deposit.

Learn more: Benefits of Direct Deposit

How Long Does Direct Deposit Take?

Direct deposit typically takes one to three business days from the time the deposit information is submitted. While your bank may receive a notification of an incoming transfer almost immediately, the actual movement of funds between accounts requires a few days to process. As long as your employer submits the payment information in advance, you can expect to receive your deposit by 9 a.m. on your payday.

Holidays and weekends may affect direct deposit timing. The ACH network doesn't process payments on non-business days, which could delay movement of funds. If deposit instructions are sent close to or on these days, it could cause a delay in availability of your funds. Your bank might be able to see a pending transfer, but the money won't be accessible until the transaction is fully completed—unless your bank offers early direct deposit (more on that below).

How to Get Early Direct Deposit

Early direct deposit allows you to access your funds up to two days sooner. Rather than waiting for the payment to fully clear, the money is available as soon as your bank receives notification from your employer or government agency.

Example: If your payday is every other Friday, your pay could show up in your bank account on Wednesday. However, it's important to note that early direct deposit is not guaranteed and its availability may vary from one bank to another.

Enrollment is typically automatic if your bank offers early direct deposit and the feature is available for your account type. Your bank may allow you to control your early direct deposit enrollment through the mobile app or your online account. Check with your bank for availability.

Here are examples of financial institutions that offer early direct deposit:

- Ally

- Axos

- Capital One

- Chase

- Chime

- Citizens Bank

- Current Bank

- Fifth Third Bank

- Freedom First

- Go2Bank

- Green Dot

- Huntington Bank

- KeyBank

- Lending Club Bank

- Navy Federal Credit Union

- One

- One United Bank

- PenFed Credit Union

- Regions Bank

- Revolut

- SchoolsFirst Credit Union

- SoFi

- State Employees' Credit Union

- USAA

- Varo

- Wealthfront

- Wells Fargo

Learn more: How Do Bank Holidays Affect Direct Deposit?

How to Set Up Direct Deposit

You can easily set up direct deposit by following these steps:

1. Gather Your Bank and Account Information

Start by getting your bank's name and routing number, and your account number. You can find this information on the bottom of your checks (the first nine digits are the routing number, followed by your account number), within your online banking portal or by contacting your bank's customer service.

2. Obtain a Direct Deposit Form

This form gives your employer authorization to deposit funds directly into your account. You can obtain a form from your employer's HR or payroll department or from your bank. Some employers use an online system where you can enter your direct deposit details electronically.

3. Complete the Direct Deposit Form

You'll typically need to provide the following details:

- Your full name

- Your bank's name and address

- Your bank's routing number

- Your account number (specify whether it's a checking or savings account)

- Your employer's name and address (if you're using a bank-provided form)

- If your employer allows, you can choose to split your direct deposit between multiple accounts. Specify the percentage or flat amount to be deposited in each account. Or, you can have your entire check deposited into one account.

4. Include a Voided Check

Some employers ask for a voided check to verify your account information. Simply write "Void" across a blank check and include it with your direct deposit form.

5. Submit the Completed Form

Give the completed form to your HR or payroll department. Even if you're using a bank-provided form, it should still be submitted to your employer.

6. Monitor Your Bank Account for the First Deposit

It may take one to two pay cycles for direct deposit to become active. Continue to check your bank account to verify the deposit is correctly set up. In the meantime, you may receive a paper check until the direct deposit setup is complete.

Manage Your Finances

Compare checking accounts

Find a digital checking account with intro bonuses, low or no monthly fees and see current APY on checking.

Featured Account

ADDITIONAL FEATURES

- Build credit by paying bills like utilities, streaming services and rentø

- $50 bonus with direct deposit‡

- No monthly fees, no minimums‡

- Secure & FDIC insured up to $250,000§

- Zero liability for fraudulent purchases¶

- 55,000+ no-fee ATMs worldwide**

- Deposit cash at popular retailers#

- Live customer support 7 days a week

Frequently Asked Questions

The Bottom Line

Direct deposit makes it convenient to access your money quickly, easily and securely. While there are non-bank alternatives for receiving direct deposits, a bank account offers more services, lower fees and insurance.

The Experian Smart Money™ Digital Checking Account & Debit Card can help you build credit without debt by linking to Experian Boost®ø, which gives you credit for eligible bill payments after three months of payments. You'll also pay no monthly fees¶ and have access to more than 55,000 fee-free ATMs worldwide**. See terms at experian.com/legal.

Earn more with a high-yield savings account

Make your money work harder with a high-yield savings account—earn higher returns with easy access to your funds.

Compare accountsAbout the author

LaToya Irby is a personal finance writer who works with consumer media outlets to help people navigate their money and credit. She’s been published and quoted extensively in USA Today, U.S. News and World Report, myFICO, Investopedia, The Balance and more.

Read more from LaToya