Fintech

Fintech

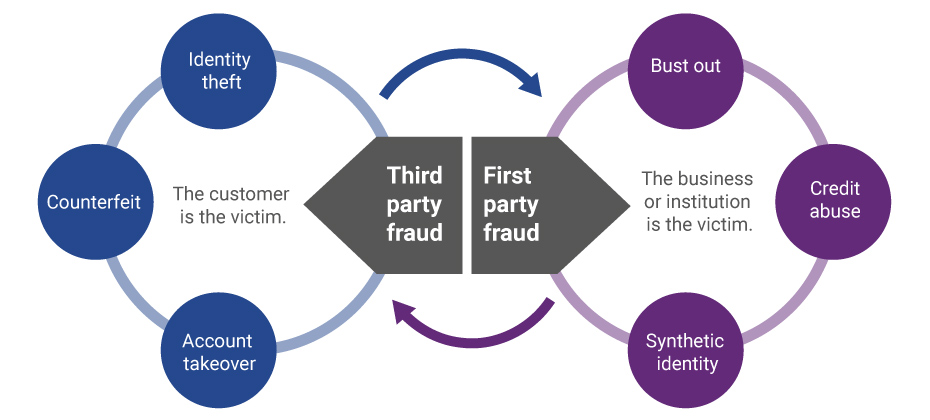

Evolution of first-party fraud to third Third-party and first-party schemes are now interchangeable, and traditional fraud detection practices are less effective in fighting these evolving fraud types. Fighting this shifting problem is a challenge, but it isn’t impossible. To start, incorporate new and more robust data into your identity verification program and provide consistent fraud classification and tagging. Learn more>

It should come as no surprise that the process of trying to collect on past-due accounts has been evolving. We’ve seen the migration from traditional mail and outbound calls, to offering an electronic payment portal, to digital collections and virtual negotiators. Being able to get consumers who have past-due debt on the phone to discuss payments is almost impossible. In fact, a recent informal survey divulged a success rate of a 15% contact rate to be considered the best by several first-party collectors; most reported contact rates in the 8%-range. One can only imagine what it must be like for collection agencies and debt buyers. Perhaps, inviting the consumer to establish a non-threatening dialog with an online system can be a better approach? Now that collectors have had time to test virtual collections, we’ve collected some data points. Conversion rates, revisits, and time of day An analysis of several clients found that on average 52% of consumers that visit a digital site will proceed to a payment schedule if the right offer is made. 21% of the visits were outside the core hours of 8 a.m. to 8 p.m., an indication that consumers were taking advantage of the flexibility of reaching out at any time of the day or night to explore their payment and settlement options. The traditional business hours don’t always work. Here is where it really gets interesting, and invites a clear comparison to the traditional phone calls that collectors make trying to get the consumer to commit to a payment plan on the line. Of the consumers that committed to a payment plan, only 56% did it in a single visit. The remaining 44% that committed to payments did so mostly later that day, or on a subsequent day. This strongly suggests they either took time to check their financial status, or perhaps asked a friend or family to help with the payment. In other words, rather than refusing to agree to an instantaneous agreement pressured by a collector, the consumer took time to reflect and decide what was the best course of action to settle the amount due. On a similar note, the attrition rate of “Promises to Pay” were 24% lower using online digital solutions versus the traditional collector phone call. This would be consistent with more time to agree to a payment plan that could be met, rather than weakly agreeing to a collector phone call just to get the collector off the phone. Another possible reason for a lower attrition rate may be that a well-defined digital collection solution can send out reminders to consumers via email or text in advance of the next scheduled payment, so that the consumer can be reminded to have the funds available when the next payment hits their account. For accounts where settlement offers are part of the mix, a higher percentage of balances is being resolved versus the collection floor. In fact, the average payment improvement is 12% over what collectors tend to get on the collections floor. The reason for this significant change is unclear, but the suspicion is that a digital collection solution will negotiate stronger than a collector, who is often moving to the bottom of an acceptable range too soon. What's next? Further assessing the consumer’s needs and capabilities during the negotiation session will undoubtedly be a theme going forward. Logical next steps will include a “behind-the-scenes” look at the consumer’s entire credit picture to help the creditor craft an optimal settlement amount that both the consumer can meet, and at the same time optimizes recovery. Potential impact to credit scores will also come into the picture. Depending on where the consumer and his past-due debt is in the credit lifecycle, being able to reasonably forecast the negative impact of a missed payment can act as an additional argument for making a past-due or delinquent payment now. As more financial institutions test this new virtual approach, we anticipate customer satisfaction and resolutions will continue to climb.

We use our laptops and mobile phones every day to communicate with our friends, family, and co-workers. But how do software programs communicate with each other? APIs--Application Programming Interfaces--are the hidden backbone of our modern world, allowing software programs to communicate with one another. Behind the scenes of every app and website we use, is a mesh of systems “talking” to each other through a series of APIs. Today, the API economy is quickly changing how the world interacts. Everything from photo sharing, to online shopping, to hailing a cab is happening through APIs. Because of APIs, technical innovation is happening at a faster pace than ever. We caught up with Edgar Uaje, senior product manager at Experian, to find out more about APIs in the financial services space. What exactly are APIs and why are they so important? And how do they apply to B2B? APIs are the building blocks of many of our applications that exist today. They are an intermediary that allows application programs to communicate, interact, and share data with various operating systems or other control programs. In B2B, APIs allow our clients to consume our data, products, and services in a standard format. They can utilize the APIs for internal systems to feed their risk models or external applications for their customers. As Experian has new data and services available, our clients can quickly access the data and services. Are APIs secure? APIs are secure as long as the right security measures are put in place. There are many security measures that can be utilized such as authentication, authorization, channel encryption and payload encryption. Experian takes security seriously and ensures that the right security measures are put in place to protect our data. For example, one of the recent APIs that was built this year utilizes OAuth, channel encryption, and payload encryption. The central role of APIs is promoting innovation and rapid but stable evolution, but they seem to only have taken hold selectively in much of the business world. Is the world of financial services truly ready for APIs? APIs have been around for a long time, but they are getting much more traction recently. Financial tech and online market place lending companies are leading the charge of consuming data, products, and services through APIs because they are nimble and fast. With standard API interfaces, these companies can move as fast as their development teams can. The world of financial services is evolving, and the time is now for them to embrace APIs in day-to-day business. How can APIs benefit a bank or credit union, for example? APIs can benefit a bank or credit union by allowing them to consume Experian data, products, and services in a standard format. The value to them is faster speed to market for applications (internal/external), ease of integration, and control over the user’s experience. APIs allow a bank or credit union to quickly develop new and innovative applications quickly, with the support of their development teams. Can you tell us more about the API Developer Portal? Experian will publish the documentation of our available APIs on our Developer Portal over time as they become available. Our clients will have a one-stop shop to view available APIs, review API documentation, obtain credentials, and test APIs. This is simplifying data access by utilizing REST API, making it easier for our clients.

School is nearly back in session. You know what that means? The next wave of college students is taking out their first student loans. It’s a milestone moment – and likely the first trade on the credit file for many of these individuals. According to the College Board, the average cost of tuition and fees for the 2016–2017 school year was $33,480 at private colleges, $9,650 for state residents at public colleges, and $24,930 for out-of-state residents attending public universities. So really, regardless of where students go, the cost of a college education is big. In fact, from January 2006 to July 2016, the Consumer Price Index for college tuition and fees increased 63 percent. So, unless mom and dad did a brilliant job saving, chances are many of today’s students will take on at least some debt to foot the college bill. But it’s not just the young who are consumed by student loan debt. In Experian’s latest State of Student Lending report, we dive into how the $1.4 trillion in student loan debt for Americans is impacting all generations in regards to credit scores, debt load and delinquencies. The document additionally looks at geographical trends, noting which states have the most consumers with student loan debt and which ones have the least. Overall, we discovered 13.4% of U.S. consumers have one or more student loan balances on their credit file with an average total balance of $34k. Additionally, these consumers have an average of 3.7 student loans with 1.2 student loans in deferment. The average VantageScore® credit score for student loan carriers is 650. As we looked across the generations, every group – from the Silents (age 70+) to Gen Z (oldest are between 18 to 20) had some student loan debt. While we can make assumptions that the Silents and Boomers are likely taking out these loans to support the educational pursuits of their children and grandchildren, it can be mixed for Gen X, who might still be paying off their own loans and/or supporting their own kids. Gen X members also reported the largest average student loan total balance at $39,802. Gen Z, the newest members to the credit file, have just started to attend college, thus their generation has the largest percent of student loan balances in deferment at 77%. Their average student loan total balance is also the lowest of all generations at $11,830, but that is to be expected given their young ages. In regards to geographical trends, the Northern states tended to sport the highest average student loan total balances, with consumers in Washington D.C. winning that race with $52.5k. Southern states, on the other hand, reported higher percentages of consumers with student loan balances 90+ days past due. South Carolina, Louisiana, Mississippi, Arkansas and Texas held the top spots in the delinquency category. Access the complete State of Student Lending report. Data from this report is representative of student loan data on file as of June 2017.

Many institutions take a “leap of faith” when it comes to developing prospecting strategies as it pertains to credit marketing. But effective strategies are developed from deep, analytical analysis with clearly identified objectives. They are constantly evolving – no setting and forgetting. So what are the basics to optimizing your prospecting efforts? Establish goals Unfortunately, far too many discussions begin with establishing targeting criteria before program goals are set. But this leads to confusion. Developing targeting criteria is kind of like squeezing a balloon; when you restrict one end, the other tends to expand. Imagine the effect of maximizing response rates when soliciting new loans. If no other criteria are considered, you could end up targeting high-risk individuals who cannot get approved elsewhere. Obviously, we’re not interested in increasing originations at all cost; risk must be understood as well. But this is where things get complicated. Lower-risk consumers tend to be the most coveted, get the best offers, and therefore have lower response rates and margins. Simplicity is best The US Navy developed the KISS acronym (keep it simple, stupid) in the 1960s on the philosophy that complexity increases the probability of error. This is largely true in targeting methodologies, but don’t mistake limiting complexity for simplicity. Perhaps the most simplistic approach to prescreen credit marketing is using only risk criteria to set an eligible population. Breaking a problem down to this single dimension generally results in low response rates and wasted budget. Propensity models and estimated interest rates are great tools for identifying consumers that are more likely to respond. Adding them as an additional filter to a credit-qualified population can help increase response rates. But what about ability to pay? So far we’ve considered propensity to open and risk (the latter being based on current financial obligations). Imagine a consumer with on-time payment behavior and a solid credit score who takes a loan only to be unable to meet their obligations. You certainly don’t want to extend debt that will cause a consumer to be overextended. Instead of going through costly income verification, income estimation models can assist with identifying the ability to repay the loan you are marketing. Simplicity is great, but not to the point of being one-dimensional. Take off the blindfold Even in the days of smartphones and GPS navigation, most people develop a plan before setting off on a road trip. In the case of credit marketing, this means running an account review or archive analysis. Remember that last prescreen campaign you ran? What could have happened with a more sophisticated targeting strategy? Having archive data appended to a past marketing campaign allows for “what if” retrospective analysis. What could response rates have been with a propensity tool? Could declines due to insufficient income have been reduced with estimated income? Archive data gives 20/20 hindsight to what could have been. Just like consulting a map to determine the shortest distance to a destination or the most scenic route, retrospective analysis on past campaigns allows for proactive planning for future efforts. Practice makes perfect Even with a plan, you probably still want to have the GPS running. Traffic could block your planned route or an unforeseen detour could divert you to a new path. Targeting strategies must continually be refined and monitored for changes in customer behavior. Test and control groups are essential to continued improvement of your targeting strategies. Every campaign should be analyzed against the goals and KPIs established at the start of the process. New hypotheses can be evaluated through test populations or small groups designed to identify new opportunities. Let’s say you typically target consumers in a risk range of 650-720, but an analyst spots an opportunity where consumers with a range of 625-649 with no delinquencies in the past 12 months performs nearly at the rate of the current population. A small test group could be included in the next campaign and studied to see if it should be expanded in future campaigns. Never “place bets” Assumptions are only valid when they are put to the test. Never dive into a strategy without testing your hypothesis. The final step in implementing a targeting strategy should be the easiest. If goals are clearly understood and prioritized, past campaigns are analyzed, and hypotheses are laid out with test and control groups, the targeting criteria should be obvious to everyone. Unfortunately, the conversation usually starts at this phase, which is akin to placing bets at the track. Ever notice that score breaks are discussed in round numbers? Consider the example of the 650-720 range. Why 650 and not 649 or 651? Without a test and learn methodology, targeting criteria ends up based on conventional wisdom – or worse, a guess. As you approach strategic planning season, make sure you run down these steps (in this order) to ensure success next year. Establish program goals and KPIs Balance simplicity with effectiveness Have a plan before you start Begin with an archive Learn and optimize In God we trust, all others bring data

School’s out, and graduation brings excitement, anticipation and bills. Oh, boy, here come the student loans. Are graduates ready for the bills? Even before they have a job lined up? With lots of attention from the media, I was interested in analyzing student loan debt to see if this is a true issue or just a headline grab. There’s no shortage of headlines alluding to a student loan crisis: “How student loans are crushing millennial entrepreneurialism” “Student loan debt in 2017: A $1.3 trillion crisis” “Why the student loan crisis is even worse than people think” Certainly sounds like a crisis. However, I’m a data guy, so let’s look at the data. Pulling from our data, I analyzed student loan trades for the last four years starting with outstanding debt — which grew 21 percent since 2013 to reach a high of $1.49 trillion in the fourth quarter of 2016. I then drilled down and looked at just student loan trades. Created with Highstock 5.0.7Total Number of Student Loans TradesStudent Loan Total TradesNumber of trades in millions174,961,380174,961,380182,125,450182,125,450184,229,650184,229,650181,228,130181,228,130Q4 2013Q4 2014Q4 2015Q4 2016025M50M75M100M125M150M175M200MSource: Experian (function(){ function include(script, next) {var sc=document.createElement("script");sc.src = script;sc.type="text/javascript";sc.onload=function() {if (++next < incl.length) include(incl[next], next);};document.head.appendChild(sc);}function each(a, fn){if (typeof a.forEach !== "undefined"){a.forEach(fn);}else{for (var i = 0; i < a.length; i++){if (fn) {fn(a[i]);}}}}var inc = {},incl=[]; each(document.querySelectorAll("script"), function(t) {inc[t.src.substr(0, t.src.indexOf("?"))] = 1;});each(Object.keys({"https://code.highcharts.com/stock/highstock.js":1,"https://code.highcharts.com/adapters/standalone-framework.js":1,"https://code.highcharts.com/highcharts-more.js":1,"https://code.highcharts.com/highcharts-3d.js":1,"https://code.highcharts.com/modules/data.js":1,"https://code.highcharts.com/modules/exporting.js":1,"http://code.highcharts.com/modules/funnel.js":1,"http://code.highcharts.com/modules/solid-gauge.js":1}),function (k){if (!inc[k]) {incl.push(k)}});if (incl.length > 0) { include(incl[0], 0); } function cl() {if(typeof window["Highcharts"] !== "undefined"){new Highcharts.Chart("highcharts-79eb8e0a-4aa9-404c-bc5f-7da876c38b0f", {"chart":{"type":"column","inverted":true,"polar":false,"style":{"fontFamily":"Arial","color":"#333","fontSize":"12px","fontWeight":"normal","fontStyle":"normal"}},"plotOptions":{"series":{"dataLabels":{"enabled":true},"animation":true}},"title":{"text":"Student Loan Total Trades","style":{"fontFamily":"Arial","color":"#333333","fontSize":"18px","fontWeight":"bold","fontStyle":"normal","fill":"#333333","width":"792px"}},"subtitle":{"text":"","style":{"fontFamily":"Arial","color":"#666666","fontSize":"16px","fontWeight":"normal","fontStyle":"normal","fill":"#666666","width":"792px"}},"exporting":{},"yAxis":[{"title":{"text":"Number of trades in millions","style":{"fontFamily":"Arial","color":"#666666","fontSize":"16px","fontWeight":"normal","fontStyle":"normal"}},"labels":{"format":""},"type":"linear"}],"xAxis":[{"title":{"style":{"fontFamily":"Arial","color":"#666666","fontSize":"16px","fontWeight":"normal","fontStyle":"normal"},"text":""},"reversed":true,"labels":{"format":"{value:}"},"type":"linear"}],"series":[{"data":[["Total Student Loans",174961380]],"name":"Q4 2013","turboThreshold":0,"_colorIndex":0,"_symbolIndex":0},{"data":[["Total Student Loans",182125450]],"name":"Q4 2014","turboThreshold":0,"_colorIndex":1,"_symbolIndex":1},{"data":[["Total Student Loans",184229650]],"name":"Q4 2015","turboThreshold":0,"_colorIndex":2,"_symbolIndex":2},{"data":[["Total Student Loans",181228130]],"name":"Q4 2016","turboThreshold":0,"_colorIndex":3,"_symbolIndex":3}],"colors":["#26478d","#406eb3","#632678","#982881"],"legend":{"itemStyle":{"fontFamily":"Arial","color":"#333333","fontSize":"12px","fontWeight":"normal","fontStyle":"normal","cursor":"pointer"},"itemHiddenStyle":{"fontFamily":"Arial","color":"#cccccc","fontSize":"18px","fontWeight":"normal","fontStyle":"normal"},"layout":"horizontal","floating":false,"verticalAlign":"bottom","x":0,"align":"center","y":0},"credits":{"text":"Source: Experian"}});}else window.setTimeout(cl, 20);}cl();})(); Over the past four years, student loan trades grew 4 percent, but saw a slight decline between 2015 and 2016. The number of trades isn’t growing as fast as the amount of money that people need. The average balance per trade grew 17 percent to $8,210. Either people are not saving enough for college or the price of school is outpacing the amount people are saving. I shifted the data and looked at the individual consumer rather than the trade level. Created with Highstock 5.0.7Student Loan Average Balance per Trade4.044.043.933.933.893.893.853.85Q4 2013Q4 2014Q4 2015Q4 201600.511.522.533.544.5Source: Experian (function(){ function include(script, next) {var sc=document.createElement("script");sc.src = script;sc.type="text/javascript";sc.onload=function() {if (++next < incl.length) include(incl[next], next);};document.head.appendChild(sc);}function each(a, fn){if (typeof a.forEach !== "undefined"){a.forEach(fn);}else{for (var i = 0; i < a.length; i++){if (fn) {fn(a[i]);}}}}var inc = {},incl=[]; each(document.querySelectorAll("script"), function(t) {inc[t.src.substr(0, t.src.indexOf("?"))] = 1;});each(Object.keys({"https://code.highcharts.com/stock/highstock.js":1,"https://code.highcharts.com/adapters/standalone-framework.js":1,"https://code.highcharts.com/highcharts-more.js":1,"https://code.highcharts.com/highcharts-3d.js":1,"https://code.highcharts.com/modules/data.js":1,"https://code.highcharts.com/modules/exporting.js":1,"http://code.highcharts.com/modules/funnel.js":1,"http://code.highcharts.com/modules/solid-gauge.js":1}),function (k){if (!inc[k]) {incl.push(k)}});if (incl.length > 0) { include(incl[0], 0); } function cl() {if(typeof window["Highcharts"] !== "undefined"){new Highcharts.Chart("highcharts-66c10c16-1925-40d2-918f-51214e2150cf", {"chart":{"type":"column","polar":false,"style":{"fontFamily":"Arial","color":"#333","fontSize":"12px","fontWeight":"normal","fontStyle":"normal"},"inverted":true},"plotOptions":{"series":{"dataLabels":{"enabled":true},"animation":true}},"title":{"text":"Student Loan Average Number of Trades per Consumer","style":{"fontFamily":"Arial","color":"#333333","fontSize":"18px","fontWeight":"bold","fontStyle":"normal","fill":"#333333","width":"356px"}},"subtitle":{"text":"","style":{"fontFamily":"Arial","color":"#666666","fontSize":"16px","fontWeight":"normal","fontStyle":"normal","fill":"#666666","width":"356px"}},"exporting":{},"yAxis":[{"title":{"text":"","style":{"fontFamily":"Arial","color":"#666666","fontSize":"14px","fontWeight":"normal","fontStyle":"normal"}},"type":"linear","labels":{"format":"{value}"}}],"xAxis":[{"title":{"style":{"fontFamily":"Arial","color":"#666666","fontSize":"14px","fontWeight":"normal","fontStyle":"normal"}},"type":"linear","labels":{"format":"{}"}}],"colors":["#26478d","#406eb3","#632678","#982881","#ba2f7d"],"series":[{"data":[["Average Trades per Consumer",4.04]],"name":"Q4 2013","turboThreshold":0,"_colorIndex":0},{"data":[["Average Trade per Consumer",3.93]],"name":"Q4 2014","turboThreshold":0,"_colorIndex":1},{"data":[["Average Trade per Consumer",3.89]],"name":"Q4 2015","turboThreshold":0,"_colorIndex":2},{"data":[["Average Trades per Consumer",3.85]],"name":"Q4 2016","turboThreshold":0,"_colorIndex":3}],"legend":{"floating":false,"itemStyle":{"fontFamily":"Arial","color":"#333333","fontSize":"12px","fontWeight":"bold","fontStyle":"normal","cursor":"pointer"},"itemHiddenStyle":{"fontFamily":"Arial","color":"#cccccc","fontSize":"18px","fontWeight":"normal","fontStyle":"normal"},"layout":"horizontal"},"credits":{"text":"Source: Experian"}});}else window.setTimeout(cl, 20);}cl();})(); The number of overall student loan trades per consumer is down to 3.85, a decrease of 5 percent over the last four years. This is explained by an increase in loan consolidations as well as the better planning by students so that they don’t have to take more student loans in the same year. Lastly, I looked at the average balance per consumer. This is the amount that consumers, on average, owe for their student loan trades. Created with Highstock 5.0.7Balance in thousands ($)Quarterly $USD Debt per ConsumerQ4 Student Loan TrendsAverage Student Loan Debt Balance per Consumer27,93427,93429,22629,22630,52330,52332,06132,061Q4 2013Q4 2014Q4 2015Q4 201605,00010,00015,00020,00025,00030,00035,000Source: Experian (function(){ function include(script, next) {var sc=document.createElement("script");sc.src = script;sc.type="text/javascript";sc.onload=function() {if (++next < incl.length) include(incl[next], next);};document.head.appendChild(sc);}function each(a, fn){if (typeof a.forEach !== "undefined"){a.forEach(fn);}else{for (var i = 0; i < a.length; i++){if (fn) {fn(a[i]);}}}}var inc = {},incl=[]; each(document.querySelectorAll("script"), function(t) {inc[t.src.substr(0, t.src.indexOf("?"))] = 1;});each(Object.keys({"https://code.highcharts.com/stock/highstock.js":1,"https://code.highcharts.com/adapters/standalone-framework.js":1,"https://code.highcharts.com/highcharts-more.js":1,"https://code.highcharts.com/highcharts-3d.js":1,"https://code.highcharts.com/modules/data.js":1,"https://code.highcharts.com/modules/exporting.js":1,"http://code.highcharts.com/modules/funnel.js":1,"http://code.highcharts.com/modules/solid-gauge.js":1}),function (k){if (!inc[k]) {incl.push(k)}});if (incl.length > 0) { include(incl[0], 0); } function cl() {if(typeof window["Highcharts"] !== "undefined"){Highcharts.setOptions({lang:{"thousandsSep":","}});new Highcharts.Chart("highcharts-0b893a55-8019-4f1a-9ae1-70962e668355", {"chart":{"type":"column","inverted":true,"polar":false,"style":{"fontFamily":"Arial","color":"#333","fontSize":"12px","fontWeight":"normal","fontStyle":"normal"}},"plotOptions":{"series":{"dataLabels":{"enabled":true},"animation":true}},"title":{"text":"Average Student Loan Balance per Consumer","style":{"fontFamily":"Arial","color":"#333333","fontSize":"18px","fontWeight":"bold","fontStyle":"normal","fill":"#333333","width":"308px"}},"subtitle":{"text":"","style":{"fontFamily":"Arial","color":"#666666","fontSize":"16px","fontWeight":"normal","fontStyle":"normal","fill":"#666666","width":"792px"}},"exporting":{},"yAxis":[{"title":{"text":"Balance numbers are in thousands ($)","style":{"fontFamily":"Arial","color":"#666666","fontSize":"16px","fontWeight":"normal","fontStyle":"normal"}},"labels":{"format":"{value:,1f}"},"reversed":false}],"xAxis":[{"title":{"style":{"fontFamily":"Arial","color":"#666666","fontSize":"16px","fontWeight":"normal","fontStyle":"normal"},"text":"Balance in thousands ($)"},"labels":{"format":"{value:}"},"type":"linear","reversed":true,"opposite":false}],"series":[{"data":[["Average Balance per Consumer",27934]],"name":"Q4 2013","turboThreshold":0,"_colorIndex":0},{"data":[["Average Balance per Consumer",29226]],"name":"Q4 2014","turboThreshold":0,"_colorIndex":1},{"data":[["Average Balance per Consumer",30523]],"name":"Q4 2015","turboThreshold":0,"_colorIndex":2},{"data":[["Average Balance per Consumer",32061]],"name":"Q4 2016","turboThreshold":0,"_colorIndex":3}],"colors":["#26478d","#406eb3","#632678","#982881"],"legend":{"itemStyle":{"fontFamily":"Arial","color":"#333333","fontSize":"12px","fontWeight":"bold","fontStyle":"normal","cursor":"pointer"},"itemHiddenStyle":{"fontFamily":"Arial","color":"#cccccc","fontSize":"18px","fontWeight":"normal","fontStyle":"normal"}},"lang":{"thousandsSep":","},"credits":{"text":"Source: Experian"}});}else window.setTimeout(cl, 20);}cl();})(); Here we see a growth of 15 percent over the last four years. At the end of 2016, the average person with a student loan balance had just over $32,000 outstanding. While this is a large increase, we should compare it with other purchases: This balance is no more than a person purchasing a brand-new car without a down payment. While we’re seeing an increase in overall outstanding debt and individual loan balances, I’m not yet agreeing that this is the crisis the media portrays. If students are educated about the debt that they’re taking out and making sure that they’re able to repay it, the student loan market is performing as it should. It’s our job to help educate students and their families about making good financial decisions. These discussions need to be had before debt is taken out, so it’s not a shock to the student upon graduation.

Millennials have long been the hot topic over the course of the past few years with researchers, brands and businesses all seeking to understand this large group of people. As they buy homes, start families and try to conquest their hefty student loan burdens, all will be watching. Still, there is a new crew coming of age. Enter Gen Z. It is estimated that they make up ¼ of the U.S. population, and by 2020 they will account for 40% of all consumers. Understanding them will be critical to companies wanting to succeed in the next decade and beyond. The oldest members of this next cohort are between the ages of 18 and 20, and the youngest are still in elementary school. But ultimately, they will be larger than the mystical Millennials, and that means more bodies, more buying power, more to learn. Experian recently took a first look at the oldest members of this generation, seeking to gain insights into how they are beginning to use credit. In regards to credit scores, the eldest Gen Z members sported a VantageScore® credit score of 631 in 2016. By comparison, younger Millennials were at 626 and older Millennials were at 638. Given their young age, Gen Z debt levels are low with an average debt-to-income at just 5.7%. Their tradelines largely consist of bankcards, auto and student loans. Their average income is at $33.8k. Surprisingly, there was a very small group of Gen Z already on file with a mortgage, but this figure was less than .5%. Auto loans were also small, but likely to grow. Of those Gen Z members who have a credit file, an estimated 12% have an auto trade. This is just the beginning, and as they age, their credit files will thicken, and more insights will be gained around how they are managing credit, debt and savings. While they are young today, some studies say they already receive about $17 a week in allowance, equating to about $44 billion annually in purchase power in the U.S. Factor in their influence on parental or household purchases and the number could be closer to $200 billion! For all brands, financial services companies included, it is obvious they will need to engage with this generation in not just a digital manner, but a mobile manner. They are being raised in an era of instant, always-on access. They expect a quick, seamless and customized mobile experience. Retailers have 8 seconds or less — err on the side of less — to capture their attention. In general, marketers and lenders should consider the following suggestions: Message with authenticity Maintain a long-term vision Connect them with something bigger Provide education for financial literacy and of course Keep up with technological advances. Learn more by accessing our recorded webinar, A First Look at Gen Z and Credit.

Mitigating synthetic identities Synthetic identity fraud is an epidemic that does more than negatively affect portfolio performance. It can hurt your reputation as a trusted organization. Here is our suggested 4-pronged approach that will help you mitigate this type of fraud: Identify how much you could lose or are losing today to synthetic fraud. Review and analyze your identity screening operational processes and procedures. Incorporate data, analytics and cutting-edge tools to enable fraud detection through consumer authentication. Analyze your portfolio data quality as reported to credit reporting agencies. Reduce synthetic identity fraud losses through a multi-layer methodology design that combats both the rise in synthetic identity creation and use in fraud schemes. Mitigating synthetic identity fraud>

On June 7, the Consumer Financial Protection Bureau (CFPB) released a new study that found that the ways “credit invisible” consumers establish credit history can differ greatly based on their economic background. The CFPB estimated in its May 2015 study "Data Point: Credit Invisibles" that more than 45 million American consumers are credit invisible, meaning they either have a thin credit file that cannot be scored or no credit history at all. The new study reviewed de-identified credit records on more than one million consumers who became credit visible. It found that consumers in lower-income areas are 240 percent more likely to become credit visible due to negative information, such as a debt in collection. The CFPB noted consumers in higher-income areas become credit visible in a more positive way, with 30 percent more likely to become credit visible by using a credit card and 100 percent more likely to become credit visible by being added as a co-borrower or authorized user on someone else’s account. The study also found that the percentage of consumers transitioning to credit visibility due to student loans more than doubled in the last 10 years. CFPB’s research highlights the need for alternative credit data The new study demonstrates the importance of moving forward with inclusion of new sources of high-quality financial data — like on-time payment data from rent, utility and telecommunications providers — into a consumer’s credit file. Experian recently outlined our beliefs on the issue in comments responding to the CFPB’s Request for Information on Alternative Data. As a brand, we have a long history of using alternative credit data to help lenders make better lending decisions. Extensive research has shown that there is an immense opportunity to facilitate greater access to fair and affordable credit for underserved consumers through the inclusion of on-time telecommunications, utility and rental data in credit files. While these consumers may not have a traditional credit history, many make on-time payments for telephone, rent, cable, power or mobile services. However, this data is not typically being used to enhance traditional credit files held by the nationwide consumer reporting agencies, nor is it being used in most third-party or custom credit scoring models. Further, new advances in financial technology and data analytics through account aggregation platforms are also integral to the credit granting process and can be applied in a manner to broaden access to credit. Experian is currently using account aggregation software to obtain consumer financial account information for authentication and income verification to speed credit decisions, but we are looking to expand this technology to increase the collection and utilization of alternative data for improving credit decisions by lenders. Policymakers should act to help credit invisible consumers While Experian continues to work with telecommunications and utility companies to facilitate the furnishing of on-time credit data to the nationwide consumer reporting agencies, regulatory barriers continue to exist that deter utility and telecommunications companies from furnishing on-time payment data to credit bureaus. To help address this issue, Congress is currently considering bipartisan legislation (H.R. 435, The Credit Access and Inclusion Act of 2017) that would amend the FCRA to clarify that utility and telecommunication companies can report positive credit data, such as on-time payments, to the nation' s credit reporting bureaus. The legislation has bipartisan support in Congress and Experian encourages lawmakers to move forward with this important initiative that could benefit tens of millions of American consumers. In addition, Experian believes policymakers should more clearly define the term alternative data. In public policy debates, the term "alternative data" is a broad term, often lumping data sources that can or have been proven to meet regulatory standards for accuracy and fairness required by both the Fair Credit Reporting Act and the Equal Credit Opportunity Act with data sources that cannot or have not been proven to meet these standards. In our comment letter, Experian encourages policymakers to clearly differentiate between different types of alternative data and focus the consumer and commercial credit industry on public policy recommendations that will increase the use of those sources of data that have or can be shown to meet legal and societal standards for accuracy, validity, predictability and fairness. More info on Alternative Credit Data More Info on Alternative Financial Services

The 1990s brought us a wealth of innovative technology, including the Blackberry, Windows 98, and Nintendo. As much as we loved those inventions, we moved on to enjoy better technology when it became available, and now have smartphones, Windows 10 and Xbox. Similarly, technological and modeling advances have been made in the credit scoring arena, with new software that brings significant benefits to lenders who use them. Later this year, FICO will retire its Score V1, making it mandatory for those lenders still using the old software to find another solution. Now is the time for lenders to take a look at their software and myriad reasons to move to a modern credit score solution. Portfolio Growth As many as 70 million Americans either have no credit score or a thin credit file. One-third of Millennials have never bothered to apply for a credit card, and the percentage of Americans under 35 with credit card debt is at its lowest level in more than 25 years, according to the Federal Reserve. A recent study found that Millennials use cash and debit cards much more than older Americans. Over time, Millennials without credit histories could struggle to get credit. Are there other data sets that provide a window into whether a thin file consumer is creditworthy or not? Modern credit scoring models are now being used in the marketplace without negatively impacting credit quality. For example, the VantageScore® credit score allows for the scoring of 30 million to 35 million more people consumers who are typically unscoreable by other traditional generic credit models. The VantageScore® credit score does this by using a broader, deeper set of credit file data and more advanced modeling techniques. This allows the VantageScore® credit score model to more accurately predict unique consumer behaviors—is the consumer paying his utility bill on time?—and better evaluate thin file consumers. Mitigate Risk In today’s ever-changing regulatory landscape, lenders can stay ahead of the curve by relying on innovative credit score models like the VantageScore® credit score. These models incorporate the best of both worlds by leaning on innovative scoring analytics that are more inclusive, while providing marketplace lenders with assurances the decisioning is both statistically sound and compliant with fair lending laws. Newer solutions also offer enhanced documentation to ease the burden associated with model risk management and regulatory compliance responsibilities. Updated scores Consumer credit scores can vary depending on the type of scoring model a lender uses. If it's an old, outdated version, a consumer might be scored lower. If it's a newer, more advanced model, the consumer has a better shot at being scored more fairly. Moving to a more advanced scoring model can help broaden the base of potential borrowers. By sticking to old models—and older scores—a sizable number of consumers are left at a disadvantage in the form of a higher interest rate, lower loan amount or even a declined application. Introducing advanced scoring models can provide a more accurate picture of a consumer. As an example, for many of the newest consumer risk models, like FICO Score 9, a consumer’s unpaid medical collection agency accounts will be assessed differently from unpaid non-medical collection agency accounts. This isn't true for most pre-2012 consumer risk score versions. Each version contains different nuances for increasing your score, and it’s important to understand what they are. Upgrading your credit score to the latest VantageScore® credit score or FICO solution is easier than you think, with a switch to a modern solution taking no longer than eight weeks and your current business processes still in place. Are you ready to reap the rewards of modern credit scoring?

There are about as many definitions for people-based marketing as there are companies using the term. Each company seems to skew the definition to fit their particular service offering. The distinctions are vast, and especially for financial services companies running regulated campaigns, they can be incredibly important. At Experian, we define people-based marketing in its purest form: targeting at the individual level across channels. This is a practice we’re very familiar with in offline marketing, having honed arguably one of the most accurate views of U.S. consumers over the past three decades. And now we’re taking those tried and true principals and applying them to digital channels. It’s not as easy as it sounds. The challenge with people-based marketing With direct mail, people-based marketing was easy. Jane Doe lives at 123 Main St. If I want to reach her, I can simply send her a direct mail piece at that address. To help, I can utilize any number of services, including the National Change of Address database, to know where to reach her if she ever moves. People-based marketing through digital channels is exponentially more difficult. While direct mail has one signal with which you use to identify a consumer (the address), digital channels offer countless signals. And not all of those signals can be used, either individually or in conjunction with other signals, to reliably tie a consumer to a persistent offline ID. A prime example of this is cookies. The problem with cookies A cookie, in and of itself, isn’t the problem. The problem is the linkage. How was a cookie associated with the person to whom the ad is being served? As marketers, we need to make sure that we are reaching the right people with the right ad … and more importantly not reaching those people who have opted out. This is especially true in the world of regulated data, where you need to know who you are targeting. And cookie-based linkage is controlled by a handful of companies, many of which are walled gardens who don’t share how they link offline people to online cookies and don’t collect this information directly. They rely on other third-party websites to gather PII, and connect it to their cookies. In some cases, the data is very accurate (especially with transaction data). In some cases, it is not (think websites that collect PII when giving surveys, offering coupons, etc.). In short, in order for you to use cookie-based targeting accurately, you need to have insight into the source of the base linkage data that was used to connect the offline consumer record to the online cookie. This same concept applies to all forms of digital linkage that drive people-based marketing. Why does people-based marketing matter in digital credit marketing? With campaigns that utilize non-regulated data, such as “Invitation to Apply” campaigns that are driven from demographic and psychographic data, the consequences of not reaching the consumer you meant to target are negligible. But with campaigns that utilize regulated data, you must ensure you’re targeting the exact consumer you meant to reach. More importantly, you must make sure you’re not targeting an ad to a consumer who had previously opted out of receiving offers driven with regulated data (prescreen offers, for example). Even if you’ve already delivered a direct mail piece with the same offer, this doesn’t negate your responsibility to reach only approved consumers who have not opted out. --- Bottom line, the world of 1:1 marketing is growing more sophisticated, and that’s a good thing. Marketers just need to understand that while regulated data can be powerful, they must also take great responsibility when handling it. The data exists to deliver firm offers of credit to your very specific target in all-new mediums. People-based marketing has its place, and it can now be done in a compliant, digitally-savvy way – in the financial services space, nonetheless. Register for our webinar on Credit Marketing Strategies to Drive Today's Digital Consumer.

The final day of Vision 2017 brought a seasoned group of speakers to discuss a wide range of topics. In just a few short hours, attendees dove into a first look at Gen Z and their use of credit, ecommerce fraud, the latest in retail, the state of small business and leadership. Move over Millennials – Gen Z is coming of credit age Experian Analytics leaders Kelley Motley and Natasha Madan gave audience members an exclusive look at how the first wave of Gen Z is handling and managing credit. Granted most of this generation is still under the age of 18, so the analysis focused on those between the ages of 18 to 20. Yes, Millennials are still the dominant generation in the credit world today, standing strong at 61 million individuals. But it’s important to note Gen Z is sized at 86 million, so as they age, they’ll be the largest generation yet. A few stats to note about those Gen Z individuals managing credit today: Their average debt is $12,679, compared to younger Millennials (21 to 27) who have $65,473 in debt and older Millennials (28 to 34) who sport $121,460. Given their young age, most of Gen Z is considered thin-file (less than 5 tradelines) Average Gen Z income is $33,000, and average debt-to-income is low at 5.7%. New bankcard balances are averaging around $1,574. As they age, acquire mortgages and vehicles, their debt and tradelines will grow. In the meantime, the speakers provided audience members a few tips. Message with authenticity. Think long-term with this group. Maintain their technological expectations. Build trust and provide financial education. State of business credit and more on the economy Moody’s Cris deRitis reiterated the U.S. economy is looking good. He quoted unemployment at 4.5%, stating “full employment is here.” Since the recession, he said we’ve added 15 million jobs, noting we lost 8 million during the recession. The great news is that the U.S. continues to add about 200,000 jobs a month, and that job growth is broad-based. Small business loans are up 10% year-to-date vs. last year. While there has been a tremendous amount of buzz around small business, he adds that most job creation has come from mid0size business (50 to 499 employees). The case for layered fraud systems Experian speaker John Sarreal shared a case study that revealed by layering on fraud products and orchestrating collaboration, a business can go from a string 75% fraud detection rate to almost 90%. Additionally, he commented that Experian is working to leverage dark web data to mine for breached identity data. More connections for financial services companies to make with mobile and social Facebook speaker Olivia Basu reinforced the need for all companies to be thinking about mobile. “Mobile is not about to happen,” she said. “Mobile is now. Mobile is everything. You look at the first half of 2017 and we’re seeing 40% of all purchases are happening on mobile devices.” Her challenge to financial services companies is to make marketing personal again, and of course leverage the right channels. Experian Sr. Director of Credit Marketing Scott Gordon commented on Experian’s ability to reach consumers accurately – whether that be through direct or digital delivery channels. A great deal of focus has been around person-based marketing vs. leveraging the cookie. -- The Vision conference was capped off with a keynote speech from legendary quarterback and Super Bowl MVP Tom Brady. He chatted about the details of this past season, and specifically the comeback Super Bowl win in February 2017. He additionally talked about leadership and what that means to creating a winning team and organization. -- Multiple keynote speeches, 65 breakout sessions, and hours of networking designed to help all attendees ready themselves for growing profits and customers, step up to digital, regulatory and fraud challenges, and capture the latest data insights. Learn more about Experian’s annual Vision conference.

Risk analysts are insatiable consumers of big data who require better intelligence to develop market insights, evaluate risk and confirm business strategies. While every credit decision, risk assessment model or marketing forecast improves when it is based on better, faster and more current data, leveraging large data sets can be challenging and unproductive. That’s why Experian added a new functionality to its Analytical Sandbox, giving clients the flexibility they need to analyze big data efficiently. Experian’s Analytical Sandbox now utilizes H2O –an open source machine learning and deep learning platform that can model and predict with high accuracy billions of rows of high-dimensional data from multiple sources in various formats. Through machine learning and advanced predictive modeling, the platform enables Experian to better provide on-demand data insights that empowers analysts with high-quality intelligence to inform regional trends, provide consumer transactional insight or expose marketing opportunities. As a hosted service, Sandbox is offered as a plug-and-play, meaning no internal development is required. Clients can instantly access the data through a secure Web interface on their desktop, giving users access to powerful artificial and business intelligence tools from their own familiar applications. No special training is required. “AI monetizes data,” said SriSatish Ambati, CEO of H2O.ai. “Our partnership with Experian democratizes and delivers AI to the wider community of financial and risk analysts. Experian's analytics sandbox can now model and predict with high accuracy billions of rows of high-dimensional data in mere seconds.” Through H2O and the Experian Sandbox, machine learning and predictive analytics are giving risk managers from financial institutions of all sizes the ability to incorporate machine learning models into their own big data processing systems.

In just a few short hours, Vision attendees immersed themselves into the depths of the economy, risk models, specialty finance data, credit invisibles, student loan data, online marketplace lending and more. The morning kicked off with one of the most respected and trusted macroeconomists in the U.S., Diane Swonk. With a rap sheet filled with advising central banks and multinational companies, Swonk treated a packed house to a look back on what has transpired in the U.S. economy since the Great Recession, as well as launching into current state and speculating on the months ahead. She described the past decade not as “lost, but rather lagging.” She went onto to say this past year was transitional, and while markets slowed slightly during the months leading up the U.S. presidential election, good things are happening: We’ve finally broken out of the 2% wage rut Recruiting on college campuses has picked up The labor force is growing Debt-to-income levels have returned to where they were prerecession and Investment is coming back. “I believe we’ll see growth over 2% this year,” said Swonk. Still, change is underway. She commented on how the way U.S. consumer spending is changing, and of course we’re seeing a restructuring in the retail space. While JC Penney announces store closings, you simultaneously see Amazon moving from “click to brick,” dabbling in the opening of some actual storefronts. Globally, she said the economy is the strongest it has been in eight years. She closed by noting there is a great deal of political change and unrest in the world today, but says, “Never underestimate our abilities when we tap our human capital.” -- More than 100 attendees filled a room to hear about the current trends and the future of online lending with featured guests from Oliver Wyman, Marlette Funding and Lending USA. While speakers commented on the “hiccup” in the space last year with some layoffs and mergers, volume has continued to double every year for the past several years with roughly $40 billion in cumulative originations today. Panelists discussed the use of alternative data to decision, channel bias, the importance of partnerships and how the market will see fewer and fewer players offering just one product specialty. “It is expensive to acquire customers, so you don’t just want to have one product to sell, but rather a range,” said Sharat Shankar of Lending USA. -- The numbers in the student lending universe are astounding. In a session focused on the U.S. student loan market, new Experian data reveals there is $1.49 billion in total student loan outstandings. In fact, total outstandings have grown 21% over the past four years, while the number of trades have only grown 4%. Costs are skyrocketing. The average balance per trade has grown 17% over the past four years. “We don’t ration education in this country,” said Joe DePaulo of College Ave. Student Loans. “We give everyone access to liquidity when it comes to federal student loans – and it’s not like that in other countries.” While DePaulo notes the access is great, offering many students the opportunity to obtain higher education, he says the problem is with disclosures. Guardians are often the individuals filling out the FAFSA, but the students inherit the loans. Students, he says, rarely understand how much their monthly payment will ultimately be after graduation. For every $10,000 in student loans, he says that will generally equate to a $100 monthly payment. -- Tomorrow, Vision attendees will be treated to more breakout sessions and a concluding keynote with legendary quarterback Tom Brady.

So many insights and learnings to report after the first full day of 2017 Vision sessions. From the musings shared by tech engineer and pioneer Steve Wozniak, to a panel of technology thought leaders, to countless breakout sessions on a wide array of business topics … here’s a look at our top 10 from the day. A mortgage process for the digital age. At last. In his opening remarks, Experian President of Credit Services Alex Lintner asked the audience to imagine a world when applying for a mortgage simply required a few clicks or swipes. Instead of being sent home to collect a hundred pieces of paper to verify employment, income and assets, a consumer could click on a link and provide a few credentials to verify everything digitally. Finally, lenders can make this a reality, and soon it will be the only way consumers expect to go through the mortgage process. The global and U.S. economies are stable. In fact, they are strong. As Experian Vice President of Analytics Michele Raneri notes, “the fundamentals and technicals look really solid across the countries.” While many were worried a year ago that Brexit would turn the economy upside down, it appears everything is good. Consumer confidence is high. The Dow Jones Index is high. The U.S. unemployment rate is at 4.7%. Home prices are up year-over-year. While there has been a great deal of change in the world – politically and beyond – the economy is holding strong. The rise of the micropreneur. This term is not officially in the dictionary … but it will be. What is it? A micropreneur is a business with 0 to 4 employees bringing in no more than $200k in annual revenue. But the real story is that numbers show microbusiness are improving on many fronts when it comes to contribution to the economy and overall performance compared to other small businesses. Keep an eye on these budding business people. Fraud is running fierce. Synthetic identity losses are estimated in the hundreds of millions annually, with 50% year-over year growth. Criminals are now trying to use credit cleaners to get tradelines removed from used Synthetic IDs. Oh, and it is essential for businesses to ready themselves for “Dark Web” threats. Experts advise to harden your defenses (and play offense) to keep pace with the criminal underground. As soon as you think you’ve protected everything, the criminals will find a gap. The cloud is cool and so are APIs. A panel of thought leaders took to the main stage to discuss the latest trends in tech. Experian Global CIO Barry Libenson said, “The cloud has changed the way we deliver services to our customers and clients, making it seamless and elastic.” Combine that with API, and the goal is to ultimately make all Experian data available to its customers. Experian President of Decision Analytics Steve Platt added, “We are enabling you to tap into what you need, when you need it.” No need to “rip and replace” all your tech. Expect more regulation – and less. A panel of regulatory experts addressed the fast-changing regulatory environment. With the new Trump administration settling in, and calls for change to Dodd-Frank and the Consumer Financial Protection Bureau (CFPB), it’s too soon to tell what will unfold in 2017. CFPB Director Richard Cordray may be making a run for governor of Ohio, so he could be transitioning out sooner than the scheduled close of his July 2018 term. The auto market continues to cruise. Experian’s auto expert, Malinda Zabritski, revealed the latest and greatest stats pertaining to the auto market. A few numbers to blow your mind … U.S. passenger cars and light trucks surpassed 17 million units for the second consecutive year Most new vehicle buyers in the U.S. are 45 years of age or older Crossover and sport utility vehicles remain popular, accounting for 40% of the market in 2016 – this is also driving up finance payments since these vehicles are more expensive. There are signs the auto market is beginning to soften, but interest rates are still low, and leasing is hot. Defining alternative data. As more in the industry discuss the need for alternative data to decision, it often gets labeled as something radical. But in reality, alternative data should be simple. Experian Sr. Director of Government Affairs Liz Oesterle defined it as “getting more financial data in the system that is predicted, validated and can be disputed.” #DeathtoPasswords – could it be a reality? It’s no secret we live in a digital world where we are increasingly relying on apps and websites to manage our lives, but let’s throw out some numbers to quantify the shift. In 2013, the average U.S. consumer had 26 online accounts. By 2015, that number increased to 118 online accounts. By 2020, the average person will have 207 online accounts. When you think about this number, and the passwords associated with these accounts, it is clear a change needs to be made to managing our lives online. Experian Vice President David Britton addressed his session, introducing the concept of creating an “ultimate consumer identity profile,” where multi-source data will be brought together to identify someone. It’s coming, and all of us managing dozens of passwords can’t wait. “The Woz.” I guess you needed to be there, but let’s just say he was honest, opinionated and notes that while he loves tech, he loves it even more when it enables us to live in the “human world.” Too much wonderful content to share, but more to come tomorrow …