The market is inevitably changing, and while batch and daily alerts are still effective in tackling client and consumer challenges, you are probably seeing more real-time alerts.

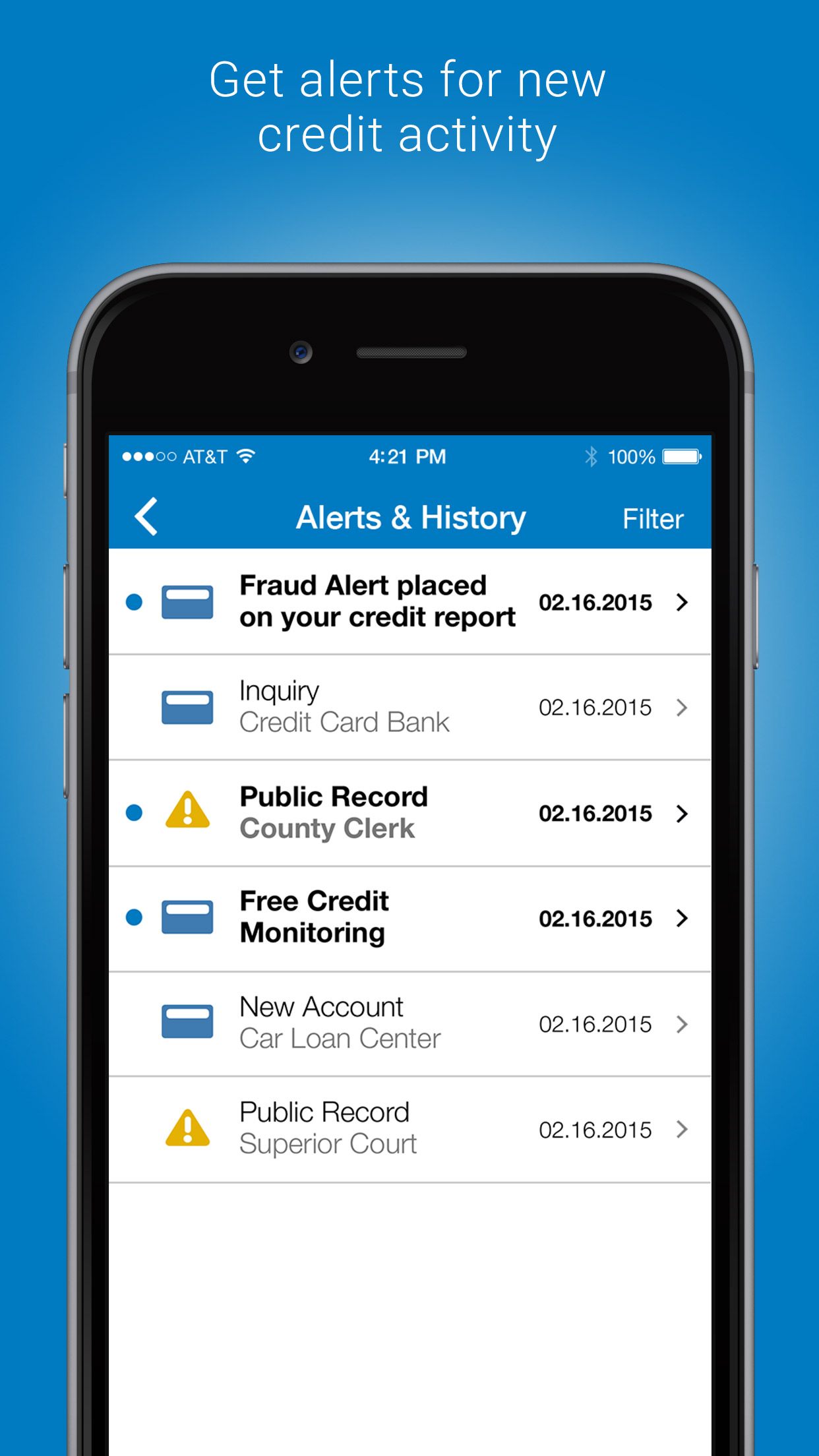

Perhaps you were at the auto dealership applying for a car loan and you got an instant alert on your mobile app revealing there was an inquiry pulled on your credit report. Or maybe you applied for a credit card online and instead of waiting for weeks to see if you got approved, you receive notification on the spot.

It’s official. We live in a world where we want immediate and instant feedback, communication, and decisions. From a client’s perspective, this means getting a credit-event alert on a customer now vs. 24 hours later. Delays can sometimes mean the difference of losing or retaining a customer.

means getting a credit-event alert on a customer now vs. 24 hours later. Delays can sometimes mean the difference of losing or retaining a customer.

In a recent Experian survey, findings revealed consumers expect to be notified of changes to their credit profile as they occur in real time. In fact, 90 percent of Experian Members said they place a “high value on real-time alerts.”

To meet these consumer expectations, clients can consider implementing a trigger solution to offer real-time notifications on inquiries, securityalerts and consumer disputes. These triggering events are pushed in real-time as opposed to a 24- to 48-hour turnaround when using standard daily triggers.

What are inquiry and security alert triggers?

Inquiry triggers cover 13 different industries and also fraud, theft, and active-duty military alerts. They are designed specifically for financial institutions that wish to monitor their existing customer base for account management, and for consumers wanting immediate awareness, education, and protection of their credit.

How do real-time triggers work in the consumer dispute process?

Dispute updates can be pushed out to the consumer in real-time as opposed to the standard dispute process that takes up to 30 days to receive an update. These triggers also include freeze, thaw and lift alerts pushed in real-time as opposed to the typical 24- to 48-hour turnaround when using standard daily triggers. These alerts are designed specifically for consumers wanting immediate awareness, education, and protection of their credit.

Other than the speed of delivery, are there any other differences between daily vs. real-time triggers?

Instead of having the files run nightly with the trigger report being sent to the client every morning through a STS delivery method, the real-time events are pushed via Cloud or STS delivery method. Clients can retrieve these events at their own pace. Implementation time takes around two weeks.

Are there additional opportunities to utilize real-time triggers?

In addition to real-time inquiry alerts designed for companies to monitor their existing customer base for retention purposes, Experian also offers real-time inquiry alerts for prospecting and marketing purposes. This means financial institutions can identify which consumers are shopping for new credit in real-time. As a result, immediate firm offers of credit or cross-sell offers could be sent to consumers before it’s too late.