Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

Financial Empowerment

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

![5 Tips to Avoid a Financial “Burn” On Your Summer Getaway [Infographic]](https://www.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

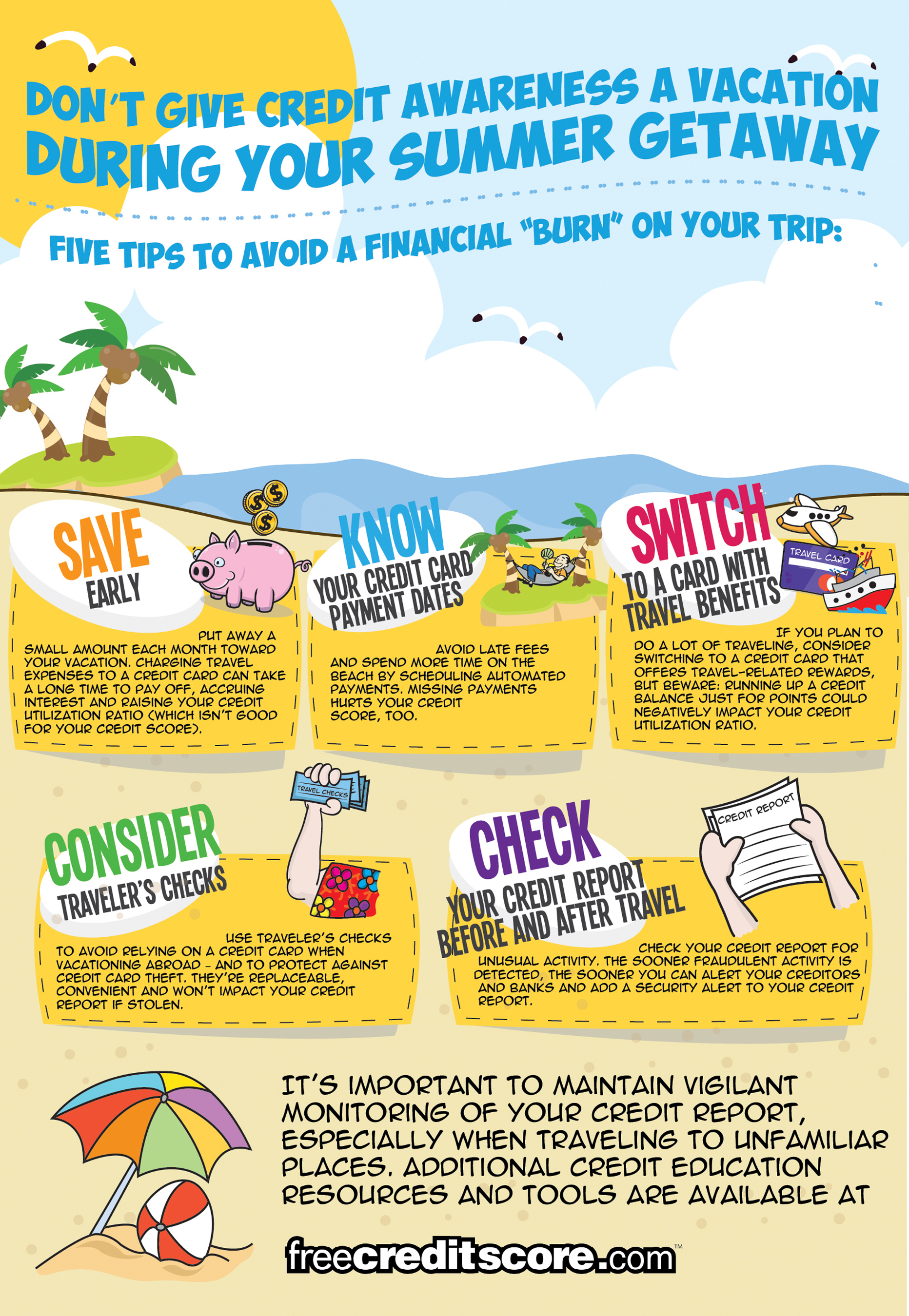

Summer officially arrives on June 21. The busiest travel season of the year is on the horizon, and freecreditscore.com™ wants to help travelers mitigate post-vacation credit debt that can impact their credit long after a vacation ends. Here are five tips to avoid the pitfalls of a post-vacation credit sunburn:

Further evidence of economic recovery throughout the nation, an Experian trends analysis of new mortgages and bankcards from Q1 2013 showed a 16 percent year-over-year increase in mortgage origination volume and a 20 percent increase in bankcard limits. Other insights offered by Experian, include evidence of a strong rebound in the Midwest as well as unprecedented lows in bankcard delinquencies.

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Experian has provided World Omni Financial Corp. (World Omni) with a flexible decision management solution based on its PowerCurve™ and Attribute Toolbox™ software that will streamline the processing and decisioning of automotive finance applications.

“We needed a decision management solution, and Experian could deliver cost-effective, robust technology that quickly and seamlessly integrated with our loan origination system. This tool will enable us to grow our automotive finance business,” said Bill Shope, vice president of Portfolio Management at World Omni Financial Corp. “The solution also needed to be flexible enough to provide us with long-term support and growth capabilities as customer needs and market dynamics change.”

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Most people shopping for a new car ask themselves that question all the time. In fact, there are many questions that surround whether to buy or lease a vehicle. What are the benefits of one over the other? Would my payment be lower if I leased? What if I decided to buy the car after, would there be a penalty?

Recently, these questions became very real to me when I found myself having to shop for a new car following the untimely death of my husband’s previous vehicle. The deceased was the typical “Dude” car – huge engine, power everything and it was bright yellow. For the new car, I wanted him to get something a bit more sensible; He wanted everything he had before and then some. So, as you can imagine, shopping was a lot of fun (insert sarcasm here).

Consumers are can now be notified when their personal information is being used in an authentication transaction, allowing them to assess whether or not they recognize and expect their identity to be in review by a business. The service enables consumers to respond to the notification, and in cases of potential fraud, to be directed to seamless and effective resolution assistance.

![The Great Credit Divide: Men vs. Women [Infographic]](https://www.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

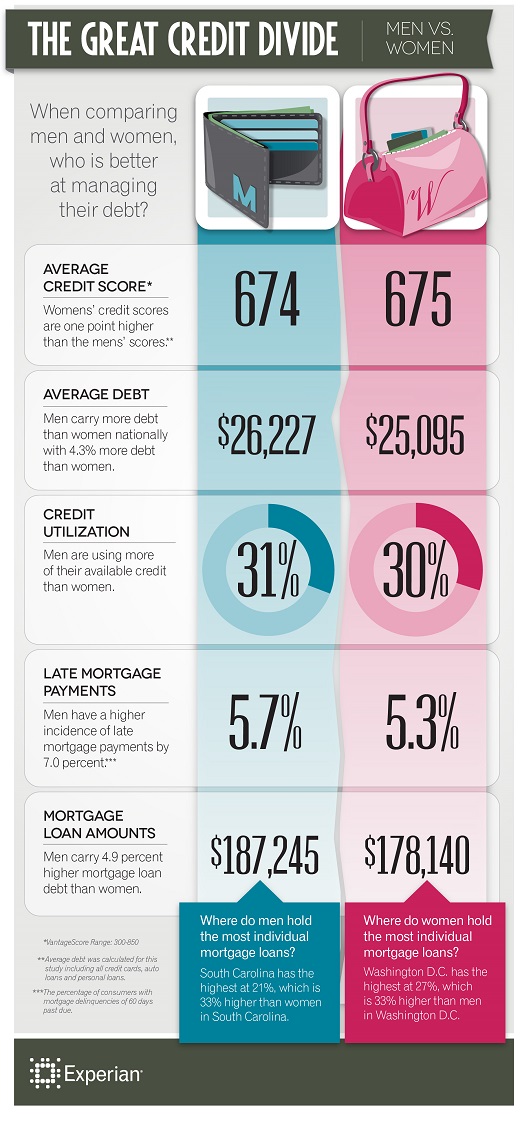

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt.

When it comes to credit, who is winning the battle between men and women? The latest credit trends study, released today from global information services company Experian, compares the financial differences between men and women, revealing that, overall, women are better at managing their money and debt. For the first time, Experian® analyzed credit scores, average debt, utilization ratios, mortgage amounts and mortgage delinquencies of men and women in the United States. While the national credit scores only vary slightly — with a one point difference — other differences between the population of men and women include the following:

- Men have 4.3 percent more debt than women

- Men have a 2 percent higher credit utilization amount

- Mortgage loan amounts for men are 4.9 percent higher

- Men have a higher incidence of late mortgage payments by 7 percent

![Give Yourself Some Credit [Infographic]](https://www.experian.com/blogs/news/wp-content/uploads/default-post-image.png)

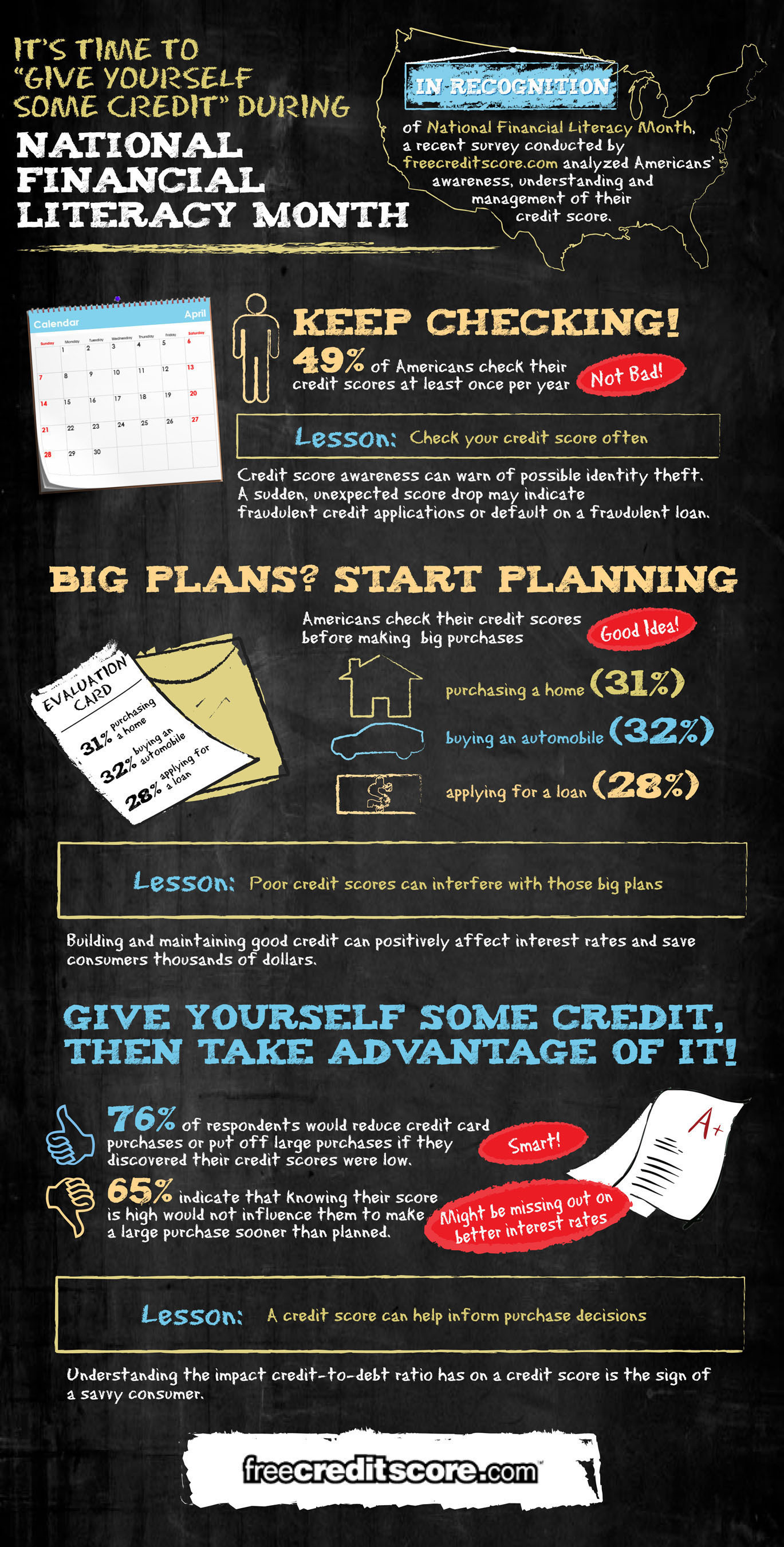

In the spirit of National Financial Literacy Month, freecreditscore.com created this infographic to share some simple credit tips:

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When Kermit the frog said, “It’s not that easy being green,” he may not have been referring to the automotive market, but he may have been on to something.

Hybrid/alternative power vehicles are one of the smallest segments in the U.S., and have only just recently achieved a little more than one percent of the total vehicles in operation. However, according to Experian Automotive’s recently released Earth Day report, the segment has witnessed steady market share growth, increasing by 40.9 percent since 2011.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

When I think of large, successful companies, a couple of thoughts come to mind; excellent customer service, constant innovation and the unmistakable ability to attract new customers. While each of these is important in its own right, some would argue, the mark of a truly successful company is one that satisfies its existing customers, and keeps them coming back for more.

In our recently released Loyalty and Market Trends Report, we found that Ford did just that, as they passed GM and Toyota to take the top spot in corporate loyalty during Q4 2012. During the time period, 47.9 percent of the customers who owned a Ford vehicle returned to market to buy another Ford or Lincoln.

Experian IntelliView data is sourced from the information that supports the Experian Market Intelligence Brief reports.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.

Organizations across a range of industries and geographies are facing an increasingly complex, new business environment. As a result, they have a desire to implement originations and customer acquisition strategies quickly and at low risk.

The acquisition enables Experian to package Decisioning Solutions’ powerful and proven multitenant, multilingual software with its consumer and commercial data, analytical expertise, and identity proofing and authentication technologies, all from a robust and flexible SaaS model. This will allow small, medium and large organizations to make secure, on-demand, analytics-based customer decisions so they can achieve and sustain significant growth.