Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

Financial Empowerment

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

Consumers around the world are increasingly reliant on a variety of Internet-connected devices for everything from banking to shopping to entertainment and media. Creating relevant on-line customer experiences and preventing fraud are large and growing business challenges.

41st Parameter’s patented device identification technology will enable Experian clients and their consumers to interact on the web effectively and securely, recognizing consumers to reduce fraud losses.

Consumers around the world are increasingly reliant on a variety of Internet-connected devices for everything from banking to shopping to entertainment and media. Creating relevant on-line customer experiences and preventing fraud are large and growing business challenges.

41st Parameter’s patented device identification technology will enable Experian clients and their consumers to interact on the web effectively and securely, recognizing consumers to reduce fraud losses.

If you’re anything like the millions of people who counted down the hours until the Breaking Bad series finale, then you too were sitting on the edge of your seat waiting to see how it would all end. But now that it’s all over, what do we have to keep the memories of a show that’s captivated us for the last five years?

Fans of the show don’t have to look too far to answer that question, as vehicles used during filming are now up for auction through ScreenBid, the world’s best source for certified authentic, screen-used Hollywood memorabilia and collectibles. Experian Automotive has also joined in the effort to preserve the show’s history, as it’s providing complimentary AutoCheck vehicle history reports on most of the Breaking Bad vehicles up for auction through the ScreenBid website.

If you’re anything like the millions of people who counted down the hours until the Breaking Bad series finale, then you too were sitting on the edge of your seat waiting to see how it would all end. But now that it’s all over, what do we have to keep the memories of a show that’s captivated us for the last five years?

Fans of the show don’t have to look too far to answer that question, as vehicles used during filming are now up for auction through ScreenBid, the world’s best source for certified authentic, screen-used Hollywood memorabilia and collectibles. Experian Automotive has also joined in the effort to preserve the show’s history, as it’s providing complimentary AutoCheck vehicle history reports on most of the Breaking Bad vehicles up for auction through the ScreenBid website.

Today Experian announced five high-level appointments to its North American Credit Services group. Filling these crucial leadership roles are five seasoned women who have a proven track record of success with Experian. These women include:

Today Experian announced five high-level appointments to its North American Credit Services group. Filling these crucial leadership roles are five seasoned women who have a proven track record of success with Experian. These women include:

Most people will tell you that they’re extremely proud when their hometown or current city accomplishes something. Hometown pride is why people are diehard fans for the local professional or college sports teams. Knowing that their city shines bright in any light, gives people a good feeling inside. With that said, people in the New York Metro area should have a strong sense of pride in how their businesses are performing. According to Experian’s Q2 Metro Business Pulse analysis, which looks at the top metropolitan areas in four key business credit categories, businesses in the New York area had the lowest average bankruptcy rates in the quarter, at just 0.28 percent. Those in the Nassau, NY; Baton Rouge, La; Honolulu; and Miami areas also have reason to be excited, as their businesses rounded out the top five with the lowest rates in this category.

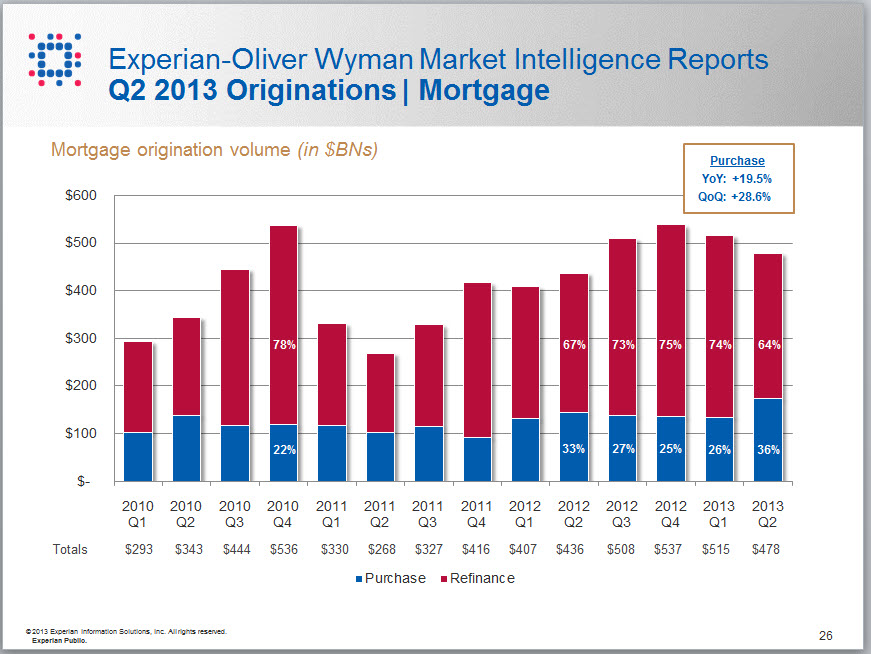

An analysis of trends shows that mortgage originations have increased by 10 percent from a year ago. More important, a look at the most recent completed quarter shows a 29 percent increase in home purchases from the prior quarter and a decrease in the number of refinances, suggesting a sustained recovery is beginning to come from purchases. These findings and others were part of the quarterly analysis from Experian that examines real-estate trends.

The key statistic in the real-estate market is the change in the ratios of refinances versus home purchases, with purchases making up a much greater proportion of the total origination volume. The data from Experian’s IntelliView product indicates that despite a 7 percent decrease from the previous quarter in refinancing activity, home purchases grew by 20 percent year over year and 29 percent quarter over quarter, and this is where we can begin to see some of the real-estate recovery taking place.”

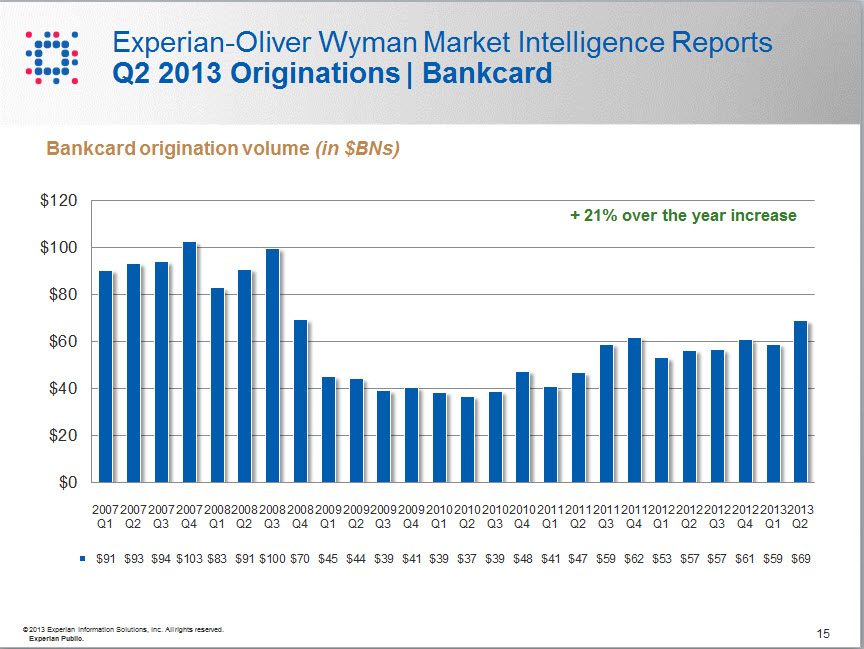

An Experian analysis of bankcard trends from Q2 2013 showed a 21 percent year-over-year increase in bankcard origination volumes, equating to $12 billion increase in new bankcard limits issued. Other insights offered by Experian, the leading global information services company, include record lows in early-stage bankcard delinquencies.

Bankcard originations continue to track with the recovery in terms of steady growth. While we may never hit the volumes we saw in 2007, the consistent growth rates that we are currently seeing in bankcard originations signal that the market is coming back online.

As you may have seen, 60 Minutes ran a story on the credit reporting industry tonight, and unfortunately, much of the story was inaccurate and misleading.

As we said when it first aired, many parts of the story did not accurately reflect the facts that have been validated by independent third party studies, the industry’s position or Experian’s position. As such, we would like to clarify our industry position and specific allegations about Experian’s practices.

>> Read More

As you may have seen, 60 Minutes ran a story on the credit reporting industry tonight, and unfortunately, much of the story was inaccurate and misleading.

As we said when it first aired, many parts of the story did not accurately reflect the facts that have been validated by independent third party studies, the industry’s position or Experian’s position. As such, we would like to clarify our industry position and specific allegations about Experian’s practices.

>> Read More

This guest post is from Benjamin Feldman (@BWFeldman), writer and content strategist at ReadyForZero.com, a company helping people get out of debt.

Is personal debt an impossible problem to fix? No way! Thousands – actually, millions – of people across the U.S. are struggling with personal debt right now, but the situation is not hopeless for any of them. I know, because just last year I was one of them. In January of last year, I had over $3,000 in credit card debt and a vowed to get it paid off before the year was over. I’m grateful that I was able to accomplish my goal and along the way I learned a few things that can help others who are still on their way to being debt free. If that includes you, keep reading to learn the 5 steps that will help you get out of debt:

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

You’re sitting at home thinking about opening up a new business…maybe you’re just planning on relocating an existing office…or maybe you’re looking to do business with a new vendor. Whatever the situation may be, you have to ask the question, which cities are primed for new business opportunity? Where are businesses performing at a high level? Are businesses in City A paying their bills faster than City B?

The past several years have been somewhat of an uphill climb for our country’s economy and this has impacted the default rates for consumer credit. However, now that we’re out of the recession, consumers are managing their credit back to pre-recession levels. In June 2013, the S&P/Experian Consumer Credit Default Indices, a monthly comprehensive measure of changes in consumer credit defaults, showed that default rates have fallen at a national level, as well as, in all four major buckets it tracks including, bankcard, auto, first mortgage and second mortgage. Additionally, the national composite and first mortgage defaults rates hit new post-recessions lows at 1.34 percent and 1.23 percent, respectively.

A recent study conducted by the Governing Institute and commissioned by Experian confirms that government benefit agencies can greatly improve their eligibility verification processes through automated data analytics. Historically, assorted health and human service programs have been compartmentalized, with each benefit agency having its own data collection system, eligibility requirements and program rules. The technology to streamline processing by allowing one agency to match its data against other content repositories, though available, has not been in place. The result has been frequent re-entry of information causing processing delays, slowing response time and increasing manual labor costs. These shortcomings have limited agencies’ ability to detect and combat fraud.

Experian Consumer Services (ECS) was recognized as the winner of the “Best in Class Call Center” category at the industry-leading Call Center Excellence Awards at the recent Call Center Week’s Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.

Experian Consumer Services (ECS) was recognized as the winner of the “Best in Class Call Center” category at the industry-leading Call Center Excellence Awards at the recent Call Center Week’s Awards Luncheon.

The winners were announced by CustomerManagementIQ.com, a division of the International Quality & Productivity Center (IQPC), in front of 1,200 customer service executives at the 14th Annual Call Center Week, the largest, most comprehensive call center event in the world.

The Experian Consumer Services call center is comprised of hundreds of employees who deliver a personalized experience assisting customers with credit- and identity theft-related issues. The center is built on the philosophy of E3: Exceptional Experiences Every time, which allows the team to retain internal and external customers, attract large partners and drive continuous improvement at every touch-point.