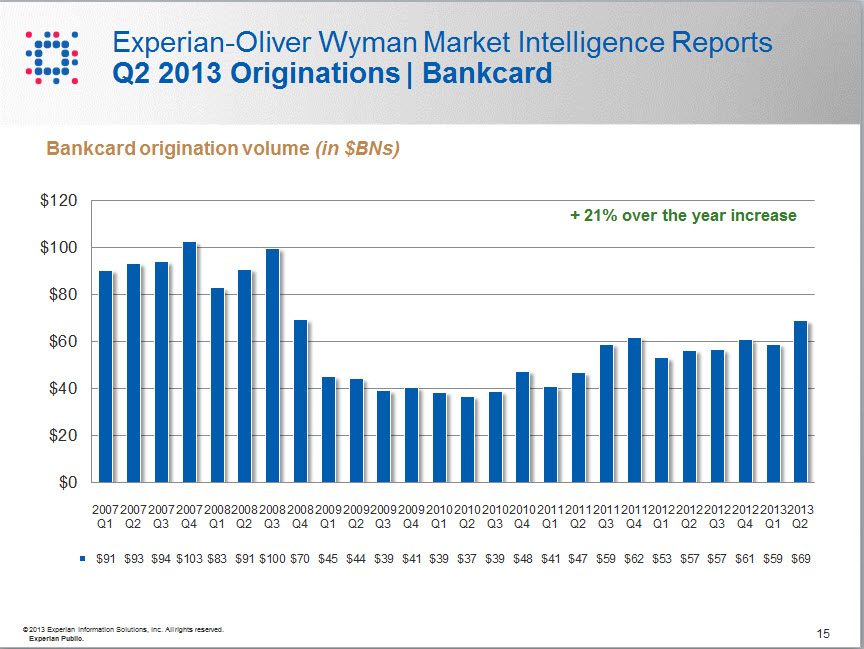

An Experian analysis of bankcard trends from Q2 2013 showed a 21 percent year-over-year increase in bankcard origination volumes, equating to $12 billion increase in new bankcard limits issued. Other insights offered by Experian, the leading global information services company, include record lows in early-stage bankcard delinquencies.

Bankcard originations continue to track with the recovery in terms of steady growth. While we may never hit the volumes we saw in 2007, the consistent growth rates that we are currently seeing in bankcard originations signal that the market is coming back online.

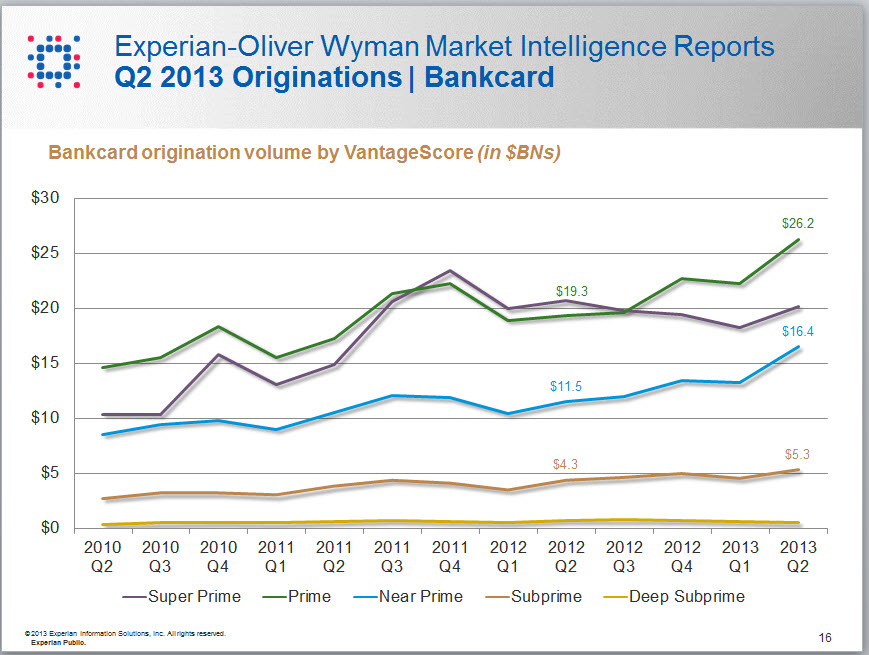

In looking at bankcard originations by VantageScore®, the year-over-year growth in originations has largely been driven by the prime and near-prime segments, comprising almost the entire $12 billion increase in new credit limit dollars originated. This trend points to the fact that prime and near-prime consumers are accepting the offers being extended to them and that lenders are continuing to lend a little deeper to drive bankcard growth.

Equally important is that prime and near-prime bankcard utilization rates are not as high as they were a year ago. This is a positive trend, because it shows that despite an increase in new bankcard users, consumers are managing their credit wisely.

The analysis of bankcard delinquency and overall risk exposure also continues to support the steady recovery of the bankcard market. Charge-off rates are significantly down, to an annualized rate of 3.9 percent, with early-stage delinquencies coming in at historic lows of 0.9 percent of balances for the quarter. Additionally, total risk exposure has dropped $3 billion from the previous quarter in 2013. These trends are a positive sign for overall economic recovery and evidence that the post-recession growth in the bankcard market is not coming at the expense of increased delinquencies.

The data for this insight and analysis was provided by Experian’s IntelliView (SM) product. IntelliView data is sourced from the information that supports the Experian-Oliver Wyman Market Intelligence Reports and is easily accessed through an intuitive, online graphical user interface, which enables financial professionals to extract key findings from the data and integrate them into their business strategies. This unique data asset does this by delivering market intelligence on consumer credit behavior within specific lending categories and geographic regions.