Tech & Innovation

At Experian, we are continually innovating and using technology to find solutions to global issues, modernize the financial services industry and increase financial access for all.

Financial Empowerment

Our deep commitment to social and financial inclusion is reflected in our workplace culture, our partnerships and our efforts to break down the barriers to financial equity.

Financial Health

Our initiatives are dedicated to getting tools, resources and information to underserved communities so that consumers can best understand and improve their financial health.

Latest Posts:

The FTC has advocated for the creation of a central website where marketing information service providers (FTC calls them “data brokers”) would be listed, with links to these companies, their privacy policies and also choice options, giving consumers the capability to review/amend the data that companies maintain.

The FTC claims that such a website would bring needed transparency to the practices of companies that are not well-known to consumers. However, the proposal raises many more questions than it answers.

The FTC first discussed this proposal in its 2012 report, entitled “Protecting Consumer Privacy in an Era of Rapid Change: Recommendations for Businesses and Policymakers,” and FTC Commissioners and staff have repeatedly cited the need for a centralized website in testimony before Congress and speeches to stakeholder groups. The proposal was also referenced in December 2013 reports issued by the Government Accountability Office (GAO) and Senate Commerce Committee.

The FTC has advocated for the creation of a central website where marketing information service providers (FTC calls them “data brokers”) would be listed, with links to these companies, their privacy policies and also choice options, giving consumers the capability to review/amend the data that companies maintain.

The FTC claims that such a website would bring needed transparency to the practices of companies that are not well-known to consumers. However, the proposal raises many more questions than it answers.

The FTC first discussed this proposal in its 2012 report, entitled “Protecting Consumer Privacy in an Era of Rapid Change: Recommendations for Businesses and Policymakers,” and FTC Commissioners and staff have repeatedly cited the need for a centralized website in testimony before Congress and speeches to stakeholder groups. The proposal was also referenced in December 2013 reports issued by the Government Accountability Office (GAO) and Senate Commerce Committee.

Every organization that touches consumer data is responsible for creating and maintaining consumer trust writes Rick Erwin, President of Targeting at Experian Marketing Services, in a recent issue of Direct Marketing News. Erwin, a direct marketing industry veteran and DMA board member, challenges the data industry at large to adopt strict guidelines and business principles that further consumer trust and effective data stewardship. Most organizations within the data industry realize the need for greater consumer education around privacy, but how do we address that need and put it into practice? At Experian Marketing Services, for example, we are guided by balance, accuracy, security, integrity and communications, the five tenets of our Global Information Values.

Most consumers (89 percent) agree that credit plays an important role when buying a home or a car but only 73 percent recognize that identity fraud could affect their ability to get loans with favorable interest rates, according to a new survey from Experian Consumer Services. In addition, more than half of big-ticket purchasers fail to check their credit at any point in the buying process, which leads to surprises when it comes time to close the deal. “Identity fraud is real and affects consumers at very important times of life,” said Ken Chaplin, senior vice president of marketing for Experian Consumer Services. “In today’s environment, it’s especially important that consumers check their credit regularly to spot signs of fraud, understand better what affects their credit and make decisions that will help them be in the best position possible when it comes time to buy their dream home or car.”

Agreement extends Experian data and consulting services to ProAct clients Experian®, the leading global information services company, today announced an agreement with Ser Technology, developer of ProAct, a Web-based business intelligence consumer lending analysis and data warehousing solution. The agreement integrates Experian’s Global Consulting Practice expertise with ProAct providing SerTechnology’s credit union clients a 360 degree portfolio view, improving efficiency in the delivery of portfolio risk management decisioning. “We’re excited to collaborate and work more closely with Experian,” said Douglas White, executive vice president of business development at Ser Technology. “Credit unions are overwhelmed with increased risk management compliance burdens as well as executing strategic portfolio risk management strategies. With Experian, credit unions can now leverage ProAct and Experian data and business consulting for strategic portfolio risk management solutions.”

Experian North America CEO Victor Nichols recently was recognized by the Consumer Credit Counseling Services of Orange County, California, as its 2014 Community Hero of the Year for his commitment to consumer financial literacy.

Mr. Nichols and Experian are proud to have been honored with this award. Experian has long been committed to consumer financial literacy and removing the mystery surrounding credit reports and scores, and that commitment has not wavered.

Experian North America CEO Victor Nichols recently was recognized by the Consumer Credit Counseling Services of Orange County, California, as its 2014 Community Hero of the Year for his commitment to consumer financial literacy.

Mr. Nichols and Experian are proud to have been honored with this award. Experian has long been committed to consumer financial literacy and removing the mystery surrounding credit reports and scores, and that commitment has not wavered.

Experian is excited to participate in the 2014 Sundance Film Festival in Park City, Utah! We’re lucky to have some great stars stopping by our Experian Coffee Bar to answer some questions about their films. Check out the action on Sundance Channel on the following days and times:

Experian is excited to participate in the 2014 Sundance Film Festival in Park City, Utah! We’re lucky to have some great stars stopping by our Experian Coffee Bar to answer some questions about their films. Check out the action on Sundance Channel on the following days and times:

Experian’s State of Credit report recently highlighted the credit savviness of four generational groups, and showed how differently they manage their financial obligations. As you’d expect, there were several intriguing findings, so we extended the research to see how these same generational groups would differ when it comes to buying a vehicle. In a recent analysis of market trends in the automotive industry, Experian Automotive looked at vehicle registrations, and examined the car buying habits of Millennials (up to 32 years old), Generation X (33-48 years old), Baby Boomers (49-67 years old) and the Silent Generation (68-85 years old).

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

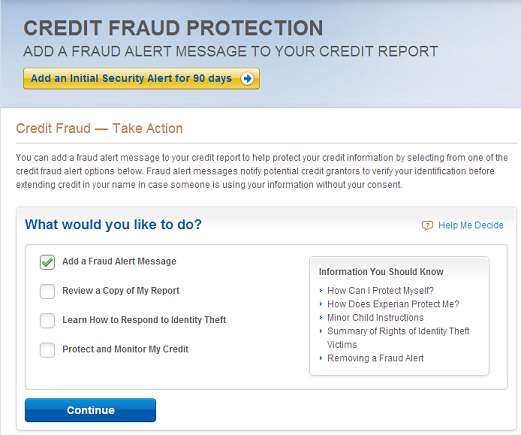

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

When a criminal steals your account number and security code, they often are planning to use that account to make purchases. Your credit report is not consulted for purchase transactions.

So, in such cases, you should consider contacting your card issuer and request a new account number. At minimum, you should check your account online to see if there has been any activity which you do not recognize.

If the criminal’s goal is to open new accounts in your name, then it is likely that one of your three credit reports would be accessed by the potential lender. In that case, you may want to consider adding an alert to your reports.

Fraud alerts are special statements consumers can have added to their credit report if they have reason to believe they may be a fraud victim or know that they have been victimized.

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

News of the Target stores security breach has caused many people to ask what they can do to protect themselves from misuse of their stolen identification information.

The system of fraud alerts that has been in place for decades in the credit reporting systems was designed specifically to help people who are identity theft victims, or have reason to believe they may be, to stop credit fraud resulting from that identity theft.

In the Target incident and similar data breaches, neither a temporary security alert nor a fraud victim statement on your credit report will stop the thief from using your credit card account.

But the alerts may help protect affected consumers from new credit fraud if the identity thief attempts to open new credit accounts using their stolen information.

These services are available at no charge to anyone who is a victim of identity theft, or who has reason to believe they may be a victim:

As Senior Vice President of Government Affairs and Public Policy at Experian, I had the opportunity to testify today before the Senate Committee on Commerce, Science and Transportation. As always, we continue to welcome the Committee’s interest in the marketing data industry.

In the spirit of cooperation, our goal is to help the Committee understand the role our data services play in the economy and in the lives of consumers.

Specifically, here are some key points we have shared to help inform the Committee’s work and interest in better understanding the marketplace:

Experian believes responsible information sharing enhances economic productivity in the United States and provides many benefits to consumers. Economists have stated the manner in which US companies collect and share consumer information among affiliated entities and third parties is the key ingredient to our nation’s productivity, innovation and ability to compete in the global marketplace.

As Senior Vice President of Government Affairs and Public Policy at Experian, I had the opportunity to testify today before the Senate Committee on Commerce, Science and Transportation. As always, we continue to welcome the Committee’s interest in the marketing data industry.

In the spirit of cooperation, our goal is to help the Committee understand the role our data services play in the economy and in the lives of consumers.

Specifically, here are some key points we have shared to help inform the Committee’s work and interest in better understanding the marketplace:

Experian believes responsible information sharing enhances economic productivity in the United States and provides many benefits to consumers. Economists have stated the manner in which US companies collect and share consumer information among affiliated entities and third parties is the key ingredient to our nation’s productivity, innovation and ability to compete in the global marketplace.

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

With less than a month left in the year, what does your to-do list look like? Finish holiday shopping? Jotting down your resolutions for the new year? Or perhaps you plan on heading down to the car dealership to take advantage of the great end of year sale offers. If it’s the latter of the three, you might just be in luck, because it’s a very good time to purchase a new vehicle.

According to Experian Automotive’s Q3 State of Automotive Finance Market report, the average interest rate for a new vehicle loan hit 4.27 percent, down from 4.53 percent a year ago. This marks the lowest rate we have seen, since Experian began publicly reporting the data in 2008.

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register’s top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian’s success.”

It was extremely gratifying to see Experian named a Top Workplace by the Orange County Register this week.

No surprise to me. (Though I may be partial.)

To be sure, this is an important milestone. Although we have been part of the Orange County community for 40+ years, this is the first time we have participated in the Top Workplaces Survey. Additionally – and importantly – this was a recognition that was earned by the feedback of our employees who genuinely appreciate their work environment and the Experian culture. That means we, as a company, are putting the right focus on our our employees – or as we prefer to call them, our team members.

It was further gratifying when Steve Churm, vice president of the OC Register and Freedom Communications, said: “The Orange County Register’s top workplace initiative identifies 100 companies that truly understand the essential link between a positive corporate culture and bottom line performance and growth. Experian is one of those great companies in the heart of Orange County that recognize their key assets are their employees, and that their well-being and growth drives Experian’s success.”