Business Information Blog

The latest from our experts

Join the Experian experts for a review on recent small business credit performance Tuesday, March 4th, 10:00 a.m. Pacific

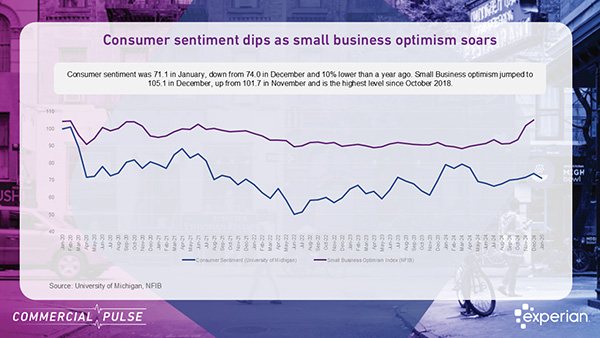

Commercial Pulse Report insights, including small business optimism vs consumer confidence, and the Experian Small Business Index.

The Experian Small Business Index (SBI) declined two points in December to 40.6, following an uptick in November 2025. Follow for updates.

AI is reshaping work, driving small business growth. Discover how AI, corporate shifts, and Gen Z are fueling an entrepreneurial boom.

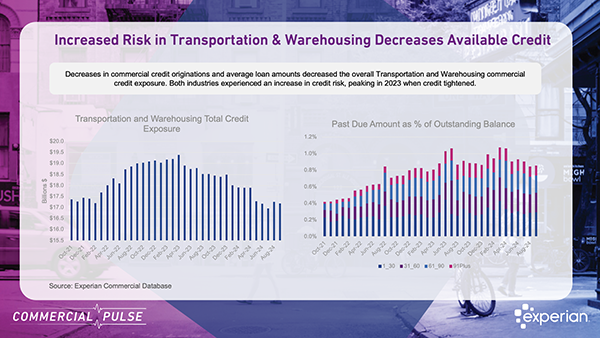

Fresh Insights from the latest Commercial Pulse Report, highlighting growth and credit challenges in U.S. transportation and warehousing.

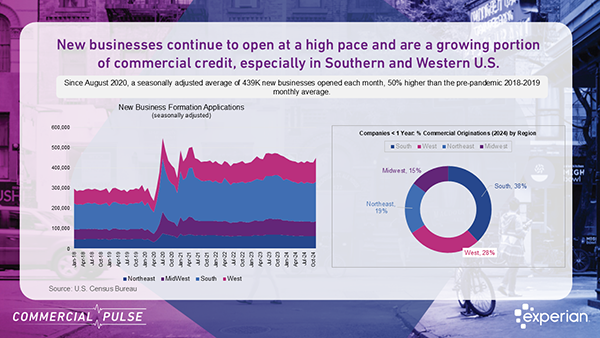

Use credit risk automation to capitalize on new business formation, expand digital relationships, and drive growth in a shifting economy.

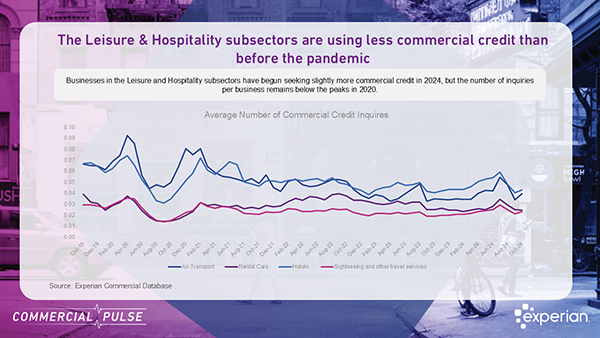

Explore Leisure & Hospitality trends in the commercial pulse report. Insights to help credit managers drive smarter decisions

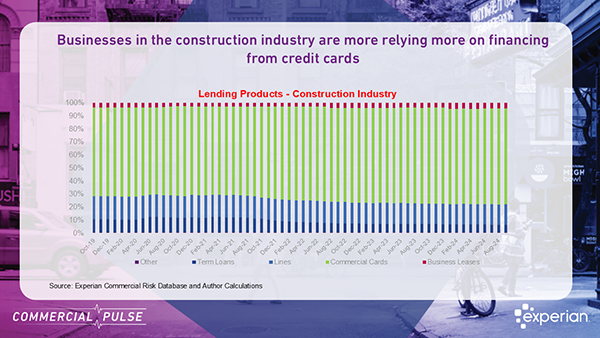

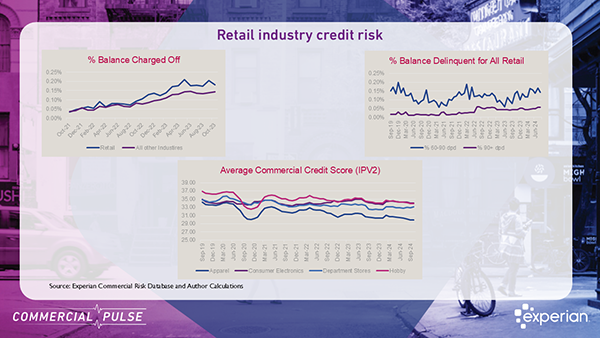

Discover industry-specific risk trends: Construction and Food Services face higher delinquencies, while Retail and Healthcare show stable performance. Learn more!

Small business credit performance resilient in Q3 as tariffs re-enter supply chains complicating an otherwise stable environment.

Experian’s Commercial Pulse report focuses on the dynamics of the housing business and construction companies in our November 26th issue.

The experts from Experian provided a review of Q3 2024 small business credit performance, along with a macroeconomic outlook.

Explore the latest retail insights from Experian’s Commercial Pulse Report: credit demand surges, lending tightens, and retail growth slows.