All posts by Editor

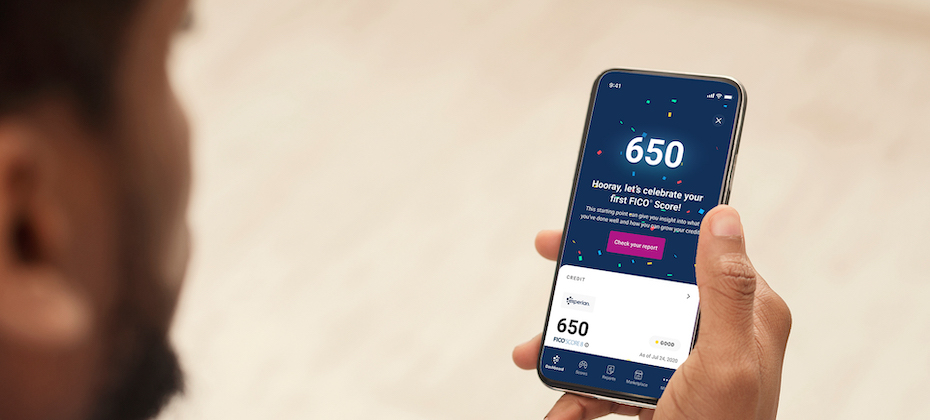

For the past several years, we’ve been on a journey to improve financial access for millions of people around the world. We’ve made it our job to help consumers get the best financial outcomes. This focus on consumers defines us and informs everything we do. In 2019, we reshaped how consumers access credit with Experian Boost™. Since then, nearly 9 million consumers have connected to the product. While we are proud of what we have and continue to accomplish with Experian Boost, we know there is more to be done to ensure more consumers can access fair and affordable credit. Improving outcomes for underserved consumers When credit is used responsibly, it can create new opportunities from getting a college degree, buying a car or home and starting or expanding a business. These are milestones that help people establish careers, build wealth and ultimately achieve greater financial freedom. Yet, there are millions of consumers who are unable to participate in the mainstream financial ecosystem today because they don’t have a financial identity. Without an established credit history, these consumers struggle to qualify for everything from an auto loan to a mortgage and even an apartment or employment. This problem more frequently impacts communities of color with 28 percent of all Black and 26 percent of all Hispanic consumers currently unscoreable or credit invisible. Increasing financial inclusion depends on creating opportunities for underrepresented consumers to succeed. And this starts with ensuring all consumers have a financial identity. Bringing financial power to all with Experian Go The challenge is many consumers who are not in the credit ecosystem today are unsure where to start. Today, we reached a pivotal and exciting milestone in our commitment to consumers with the launch of Experian Go™. This new program opens the front door to the financial ecosystem for millions of consumers by helping them establish their financial identity and move from credit invisible to scoreable. Within minutes, credit invisibles can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost™[1], and instant access to financial offers through Experian Go. In fact, early analysis shows 91 percent of consumers with no credit history who connect to Experian Boost, a free feature that allows users to contribute their on-time cell phone, video streaming service, internet, and utility payments directly to their Experian credit report, can become scoreable in minutes with an average starting near-prime FICO® Score of 665[2]. Throughout the experience, we’ll provide ongoing credit education and access to tools like Experian Boost™ to make it easy for consumers to learn how to use and responsibly grow their credit histories. Until now, our industry has struggled to verify the identity of credit invisibles. Over the last several years, we’ve introduced new identity verification technologies to our toolbox. With Experian Go, we’re leveraging these technologies to verify a credit invisible’s identity and get them in the front door to start building credit. No other credit bureau or organization is doing this today. During our pilot, we helped more than 15,000 consumers establish their credit history. This is a great start. Now that Experian Go has launched, I look forward to helping millions more consumers get the credit they deserve. To learn more about Experian Go, visit www.experian.com/go. [1] Results may vary. Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. [2] Experian analysis based on an anonymized and statistically relevant sample of consumer credit reports with only Experian Boost tradelines included and FICO® Scores. December 2021.

It’s a privilege to be recognized for a cause that’s important to so many of us at Experian. I am honored to be awarded a bronze Stevie® Award in the “Women Helping Women – Business” category for supporting women in Decision Analytics (DA) and overseeing our employee resource groups across DA. The award specifically calls out our long-standing Accelerated Development Program (ADP), which identifies and mentors women business leaders within our organization The Stevie Award trophy is one of the world's most coveted business prizes, representing more than 60 countries. The awards have been given to small, medium and large businesses for an array of categories since 2002. In 2018, HR Director Richard Teague and I helped launch ADP, which has identified 44 mid-career, high-potential women on the Global Decision Analytics team in a leadership training program. Around half of the women who participate have been promoted within two years. The ADP program also complements our DEI initiatives, which includes our five employee resource groups that have played a valuable connecting and our engagement our team members during both the pandemic and personal challenges. If you would like to find out more about any of the GDA DEI networks, including how you can get involved, please contact the relevant network lead: Mental Health – Chris Fletcher Disability and Neurodiversity – David Bernard LGBTQ+ - David Gallihawk Gender Network – Marika Vilen or Jen Cosgrove Race and Ethnicity – Shri Santhanam

An industry’s greatest innovators are successful not only because they deliver superior products in the present, but also – and perhaps more importantly – because they continuously solidify their place in the future through a drive to create a better tomorrow that encourages modernization and disruption. With this approach, Experian has been named Most Innovative Company of the Year in the 2021 11th Annual Best in Biz Awards. Over 700 companies entered, and winners of this prestigious honor were chosen by a small group of prominent editors and reporters from top-tier publications like Associated Press, Forbes, CNET, and Wall Street Journal. In their day-to-day reporting, these judges hear about and cover companies which are on the forefront of innovation. Over the last year, Experian has focused on helping consumers and financial institutions with a wide range of challenges. This includes opening up credit to underserved communities, adapting to changing consumer expectations, addressing the growing threat from fraud, and becoming a more agile technology provider in an ever-changing market. We are truly honored to be recognized as Most Innovative Company of the Year by the Best in Biz Awards. Experian embraces a culture of discovery that enables us to grow and evolve while remaining at the forefront of innovation. Of course, the key is to never stop questioning, evolving, and innovating. And we won’t.

Over the past year at Experian, we’ve continued to facilitate innovation in the fintech space – leveraging our expertise and history of helping financial institutions and individuals address a wide range of challenges. We’re thrilled to be recognized for the impact of this important work, being named a global fintech leader in the Center for Financial Professionals (CeFPro) Fintech Leaders 2022 report. One of the most comprehensive international research and ranking programs on the status of fintech in financial services, CeFPro ranks Experian among the report’s top companies within the Fraud Prevention and Credit Risk categories, and in the top 15 Overall Ecosystem Rankings. This recognition showcases the value of fraud and identity management services amid the rise of digital channels, and critical importance of continuing to develop strategies to mitigate risk. At Experian we have a deep history in pioneering tools and services that prioritize improving financial health for all. Through the ongoing development of our core products and continued innovations, we believe improving financial health is how we can make a difference for institutions and individuals alike. Our core products harness the expertise of our people and are examples to others in the industry who look to advance innovation in the fintech space and beyond. We continue to invest in new technology and infrastructure to deliver fresh insights and transform the way businesses and consumers operate. For more than 125 years, we’ve helped consumers and clients prosper. Recognition by the CeFPro report is particularly meaningful to us. The study garners their rankings from the very individuals and institutions that engage with Experian – drawing on market analysis and original research that is also backed by an advisory board composed of 60 international industry professionals. We’re honored and inspired – and look forward to continuing to push the envelope in the fintech space and beyond.

The United Nations identifies removing poverty as one of its 17 Sustainable Development Goals. There’s a reason it’s number one on their list: Access to affordable financial services opens the door to opportunities for people to transform their lives – from homes and healthcare to education and entrepreneurship.. At Experian, our focus is on increasing access to financial services, improving financial literacy and building consumer confidence; we help people take control of their financial health. We are using the power of data innovation to transform lives and help businesses grow, improving financial health for people around the world. We created a dedicated Social Innovation Programme to fund, build and recognize products that will have a positive impact on the financial health of consumers. Between 2013 and April 2021 we have invested over US$8m across 29 product ideas. Eighteen of those products have launched, reaching 61 million people, many of whom are from financially vulnerable backgrounds. In June, we opened applications for our latest round of annual Social Innovation funding and asked teams to come up with new innovative products that positively impact the financial health of our consumers and use data for good. Of these, seven projects were shortlisted and presented to our Social Innovation Committee, which I am privileged enough to chair. It was a tough decision, but we chose three truly diverse projects to receive this year’s Social Innovation funding and we are really excited about what they could achieve. These projects will give millions of people in India access to a more positive loan decision, allow citizens in the UK to manage their vulnerability data across multiple organisations, and help farmers in Brazil to access the credit they need to keep their businesses going. Between them, these three projects alone have the potential to reach over 85 million people in the next five years, which is a truly exciting prospect. We are proud to celebrate our culture of purpose-led innovation. Our social innovation products have reached 61 million people since 2013 and we aim to reach 100 million by 2025. Read more about how we are helping to create a better tomorrow.

It’s hard to believe that Christmas is just around the corner. Many of us will be starting to think about (or if you’re very organised, have already finished) their Christmas shopping. Black Friday sales will kick-off this week’s online bonanza, as bargain hunters pursue the best deals online. However, while we are all busy getting into the spirit of things, it has never been more vital that we do what we can to protect ourselves from identity fraud. As the popularity of the Black Friday sales season has grown, we’ve also seen a marked increase in the volume of fraudulent activity, as criminals use stolen or illegally obtained personal details to apply for credit in someone else’s name. According to our latest analysis of National Hunter Fraud Prevention Service data, the fraud rate for credit card applications has increased by 43% in the last three months to 69 confirmed fraudulent applications per 10,000 applications. It’s expected the rate will rise even more in December, as criminals look to take advantage. It’s naturally worrying if you are a victim of ID fraud. The fraudster will likely have tried to obtain credit in your name – perhaps on multiple occasions – and you’ll be concerned about how and from where they got hold of your information in the first place. Fortunately, there’s a host of things you can do to protect yourself. Checking your credit report on a regular basis is one of the best ways to spot if fraudsters have used your personal information to attempt to access credit, and our dedicated teams can help guide you through the steps if the worst happens and your identity has been stolen. New services and solutions are also helping companies identify and prevent more fraud. In part, the rise in rates can be attributed to better detection, helping fraud teams focus their energy on fraudulent applications, rather than genuine ones. So, while you’re browsing for gifts this festive season, make sure you are mindful of those looking to spoil your Christmas spirit. Help is available and you can read more on how to guard yourself against identity fraud on our website.

Over the past 18 months, we’ve monitored insights related to consumer and business economic outlooks, financial well-being, online behavior and more. One of the most significant insights was the accelerated shift toward e-commerce and digital financial services. In fact, there has been a 25% increase in digital transaction across the globe since the start of the pandemic including shopping, banking, and transacting online. Our latest 2021 Global Insights Report found that the increase in online activity held steady, even with the return of physical shopping and banking. The study also found that consumers are spending again. Nearly 10% of consumers are spending more and putting less away in retirement or emergency savings than from one year ago. However, even though customers are spending more, loyalty to online businesses is declining. We found that 61% of consumers say they are staying with the same online service provider they used prior to COVID-19. This a decrease of 8% from one year ago. The continued increase in online activity, coupled with heightened consumer expectations, dwindling customer loyalty, and increased competition, could lead to potential revenue loss or gain. Businesses must find solutions to improve digital engagement and customer acquisition. Fortunately, improving digital engagement and customer acquisition are companies’ top priorities as they maneuver the pandemic-accelerated boost in digital transactions. They are leveraging advanced technologies like digital credit risk decisioning, passive authentication, and artificial intelligence to improve the digital customer experience and grow their business. According to Experian’s report, 90 percent of companies are investing in business automation, 76 percent are improving or rebuilding their analytics models and 65% intend to increase fraud budgets. Adoption of AI has risen from 69% to 74% and machine learning from 68% to 73% in one year. We also found that 50% of companies are exploring the use of expanded data sources. To develop the study, Experian surveyed 3,000 consumers and 900 businesses across 10 countries around the world including Australia, Brazil, Germany, India, Italy, Japan, Singapore, Spain, United Kingdom and United States. This report is part of a longitudinal study and published series that started in June 2020 through October 2021 exploring the major shifts in consumer behavior and business strategy throughout COVID. Access all global research reports here. To learn about more findings, download the Global Insights Report and visit the Global Insights blog.

I am delighted to have announced our new partnership with Code First Girls, a non-profit organisation that teaches women to code for free, and helps increase the number of women – an under-represented group – working in tech. As a South African woman of Indian heritage, a single parent of two bi-racial girls aged 18 and 22, and a human resources executive with a passion for talent, leadership, and development, I work daily with my team to support Experian deliver on its brand promise of powering opportunities to create a better tomorrow for our people, consumers and businesses globally. So I am personally and professionally very proud of this development. Our partnership means four young women can study for a Code First Girls‘ Nanodegree, while working as paid interns in EMEA for the next nine months. These young talents come from diverse backgrounds, helping us diversify our workforce and bringing fresh thinking and new perspectives. They’ll benefit from our flexible ways of working, being based primarily from home. They’ll gain international experience as they are joining our Data Science and Innovation teams in South Africa and Italy. Moreover, they will help us drive our financial inclusion agenda by working on our United for Financial Health programme. This means we will have four young women working on financial inclusion solutions for women and four 18 to 25-year-olds working on financial inclusion solutions for the same demographic. This is a people-led innovation that contributes to the circular economy and adds purpose to our Company’s commitment to Diversity, Equity & Inclusion in its fullest sense, supporting our sustainable business goals. This isn’t philanthropy or theory. This partnership means our interns will work hard, learn and develop themselves as they prepare for a career in data and tech. It means we will also learn and evolve through this initiative. I’m curious: how do young, fresh talented people experience us? Will this partnership really enable four young women to start sustainable, fulfilling careers in tech, data, artificial intelligence, or software development? Will it help Experian attract and retain the best early tech talent in future? As with every innovative step we take, we’re unsure of the outcome, and that’s OK, as well as exciting. What is important is that we’ve started a new journey together, and I’m excited to see where it takes us. If you’d like to meet our EMEA interns and track their journey, follow us on Facebook, Instagram, LinkedIn and Twitter.

The largest Hispanic civil rights and advocacy organization in the U.S., UnidosUS, held its LatinX IncluXion Summit this week and I had the pleasure of participating as a featured speaker. One of the conference’s themes this year was “Reimagining our Future” and that resonated with me quite a bit. As an immigrant who has had to reimagine my life and career many times over, I shared some advice on how we can reinvent ourselves, become empowered by those opportunities and give back to our communities. Experian’s support of UnidosUS is especially meaningful to me. As co-executive sponsor of Juntos, our Hispanic and Latino employee resource group, I’m proud to be part of our partnership launch that extends beyond the conference. As part of our United for Financial Health initiative, Experian is supporting the organization’s Financial Empowerment Network (FEN) which provides free, financial coaching for Latino families. I have always been passionate about financial inclusion because I believe it helps empower people to be independent and take care of their families. This is especially true for immigrant communities that already must deal with the challenges of acclimating to a new country, culture, language, and more. Since joining Experian, I have been involved in initiatives that look to expand access for disenfranchised consumers, and a huge portion of my volunteerism has been devoted to educating this community about the benefits of intentionally managing their budgets and what are the best ways to gain access and handle credit. It’s not just UnidosUS affiliates and members who will benefit from our cross-cultural work. Our new Spanish-language consumer education e-book, credit education articles in Spanish, and the new monthly #ChatDeCrédito launched during Hispanic Heritage Month are available to all consumers. Having credit education resources available in-language is just one of many ways we can help those who have faced barriers to accessing credit and financial tools. We look forward to our partnership with UnidosUS and continuing to empower the Hispanic-Latino community.