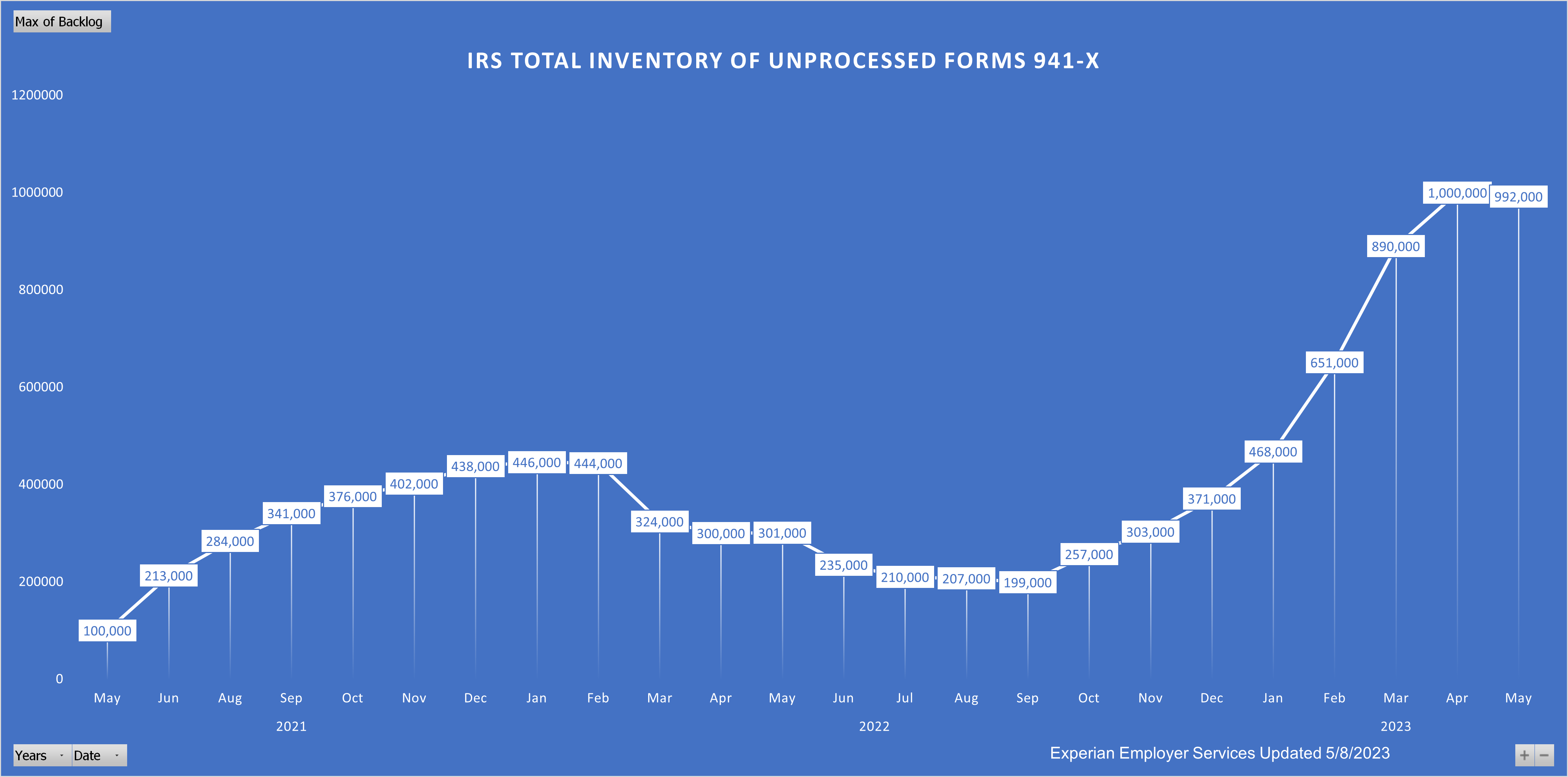

The backlog of unprocessed Employee Retention Tax Credit (ERC) claims at the IRS continues to increase. In recent appearances before Congressional committees, IRS Commissioner Daniel Werfel acknowledged the growing backlog and committed to doubling the rate of processing from 20,000 per week to 40,000 or even 50,000 per week. But even at that volume, Commissioner Werfel acknowledged that new claims outpace the processing.

The number of unprocessed Forms 941-X, a good approximation of the number of ERC claims, has more than doubled since the beginning of 2023. The number actually reached a high of 1 million on April 26 before decreasing slightly in the first week of May.

In a letter to Commissioner Werfel dated May 4, 2023, New York Senator Kirsten Gillibrand said, “I write today to express my concern with the backlog of unprocessed Employee Retention Credit (ERC) claims and to urge the Internal Revenue Service (IRS) to provide updates regarding its work on resolving this significant problem.”

Purpose of Form 941-X

The ERC can only be filed using an IRS Form 941-X, “Adjusted Employer’s quarterly Federal Tax Return or Claim for Refund.” A separate 941-X will be filed for each calendar quarter for which ERC is being claimed. While original Forms 941 are due by the last day of the month that follows the end of each quarter, and amendments to federal tax returns generally need to be filed within three years of the original due dates, 941-X amendments are a little different. Learn more here.