The Form I-9 consists of two main sections: Section 1 is completed by the employee and Section 2 is completed by the employer after examining the employee’s original documents. These documents, from the list of Form I-9 acceptable documents, are one document from either List A or List B and one document from List C. This seemingly simple form requires close attention to details, as the I-9 could be deemed incomplete or fraudulent if the audit detects any errors, and even the ones technically and easily avoidable may result in hefty fines.

When it comes to Form I-9 Section 2 completion with an ADIT (Alien Documentation, Identification, and Telecommunication) I-94, there are specific steps and considerations to ensure a smooth and accurate completion of the Form I-9.

What is an ADIT I-94?

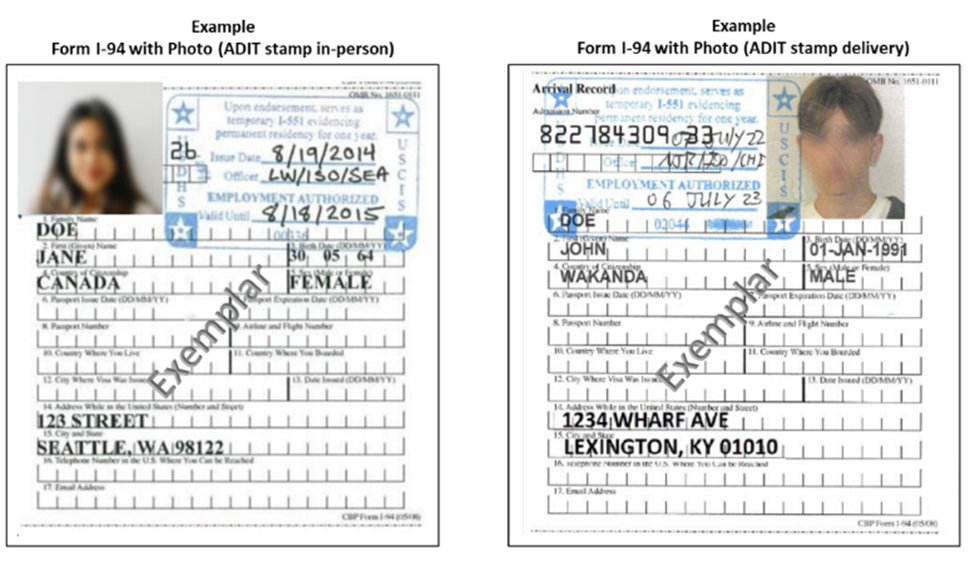

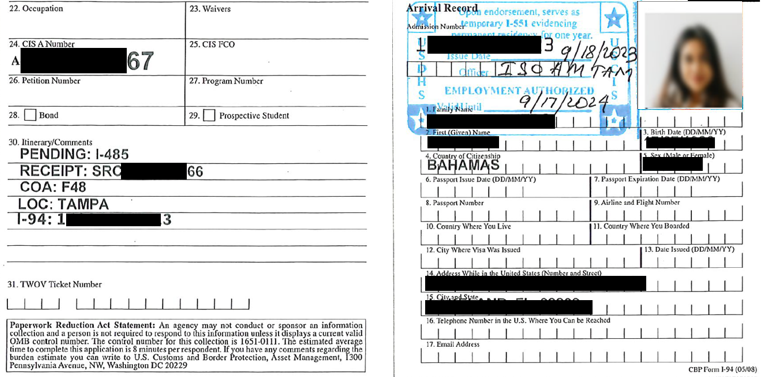

ADIT, often referred to as the I-551 stamp, offers temporary proof of an individual’s status as a lawful permanent resident. It is the arrival portion of Form I-94 (Arrival-Departure Record) containing a temporary Form I-551 ADIT stamp and a photograph of the individual.

Permanent residents are eligible to receive an I-551 stamp if:

- They do not have their Form I-551-Permanent Resident card also known as Green Card; or

- They have filed anI-90(Application to Replace Permanent Resident card),or

- I-751(Petition to Remove Conditions on I-551), or

- N-400(Application for Naturalization) and the application is still pending with United States Citizenship and Immigration Services (USCIS), and their I-551 or the extension notices have expired.

Previously, permanent residents who wanted to obtain written evidence of their status were required to make an appointment and go in person to a USCIS field office in order to receive an ADIT stamp, also known as an I-551 stamp.But, per an alert on March 16, 2023, lawful permanent residents may receive temporary evidence of their lawful permanent resident status by mail rather than physically visiting a field office.

Steps to Complete Form I-9 with ADIT I-94

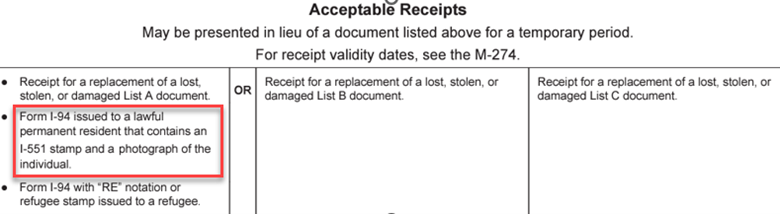

ADIT I-94 is acceptable Section 2: List A receipt for Form I-551, Permanent Resident Card.

Lawful permanent residents may present this List A receipt instead of their Form I-551, permanent resident card (Green Card) to show evidence of both identity and employment authorization.

You can use it as a List A

- Document Title: Receipt for Form I-94 issued to Lawful Permanent Residents that contain I-551 stamp and a photograph of an individual.

- Issuing Authority: USCIS or United States Department of Homeland Securities (USDHS).

- Document Number: 13 character’s alpha-numeric receipt number.

- Expiration Date: This receipt is valid until the expiration date on the stamp, or 1 year after the issuance date if the stamp does not contain an expiration date.

OR

List B and C

- List B: Any acceptable photo ID document.

- List C (Item 7): Employment Authorization Document issued by Department of Homeland Securities and using either I-94 or receipt number as the document number.

When the ADIT stamp expires, employees must provide their permanent resident card.

E-Verify with ADIT:

Employers must create the E-Verify case by the third business day after the employee is hired if the employee presents the following receipt:

- The arrival portion of Form I-94/I-94A with a temporary Form I-551 Alien Documentation, Identification & Telecommunications (ADIT) stamp and a photograph of the individual.

Form I-94 issued to Lawful Permanent Residents that contain I-551 stamp and a photograph of an individual is a List A receipt for I-9 purposes and will need to be reverified by completion of I-9 Supplement B: Reverification and Rehire upon expiration of the ADIT stamp but employers must run E-Verify case by third business day from the first day of employment.

Completing Form I-9 with an ADIT I-94 requires attention to detail and adherence to specific guidelines set forth by USCIS and E-Verify. By following the steps outlined above, both employers and employees can ensure compliance with federal laws and maintain accurate and up-to-date records of employment eligibility.

To navigate these intricacies, employers must consult with legal counsel well-versed in Form I-9 compliance. This step can assist in ensuring that prepopulating practices adhere to present laws and regulations, thus mitigating the potential for costly errors.

Adopt an automated solution and avoid the common Form I-9 errors. Ensuring electronic management, storage, and handling of information will eliminate the compliance risk, and save your time and resources.