Business Information Blog

The latest from our experts

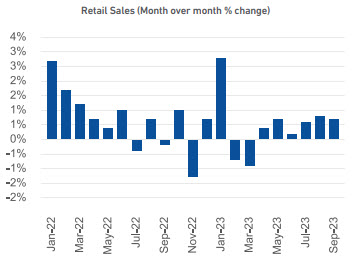

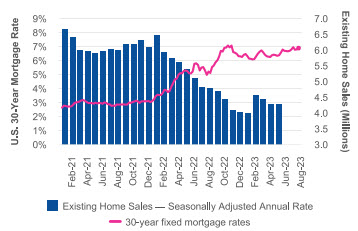

The perception of economic conditions among small business owners grows more pessimistic with the NFIB optimism index still well below the 49-year average and a persistent belief that access to borrowing is likely to get worse. With inflation coming in at 3.7%, still stubbornly above the Fed’s 2% target, it is possible there will be more rate hikes in the coming months, which will make the cost of borrowing even higher. At the same time, small businesses are facing higher financing costs, the cost of labor continues to increase as workers can demand higher wages as employers struggle to find qualified workers for all their open positions. Meanwhile, there are still many signs pointing to a strong economy despite these challenges. Unemployment is still very low by historical standards as noticed by employers trying to fill open positions. Consumer spending continues to be strong with retail sales experiencing their sixth month-over-month gain in a row. As for credit tightening, both businesses and lenders report tightening but it may not be as bad it seems. Regular borrowing by small businesses on a monthto-month basis has recovered to pre-pandemic levels suggesting that even as borrowing costs are higher, small businesses still do have access to credit. New term loans are showing the average loan amount increasing and the number of new originations is only down 3% from the last quarter. Revolving accounts are faring less favorably but are also more likely to have variable interest rates that are sensitive to the increase in Fed rates. What I am watching: The Fed will have a difficult decision to make about interest rates at their next meeting on November 1 and in the coming months. Inflation has come down dramatically from its peak, but progress has stalled in the last few months. Unemployment is still very low and consumer spending is strong, but consumer and small business optimism is down. Housing costs are very high and high interest rates have slowed home sales as the cost to enter is high and existing homeowners are reluctant to sell. All these mixed signals make the path forward to achieve the coveted soft landing difficult to navigate and different Fed chairpersons have indicated different ideas on the matter. How the economy continues to fair in the coming holiday season and the response of the Fed to those conditions will be very closely followed as a result.

New Report: Will the 2023 holiday season hinge on generosity? The latest Beyond the Trends report offers evidence it may.

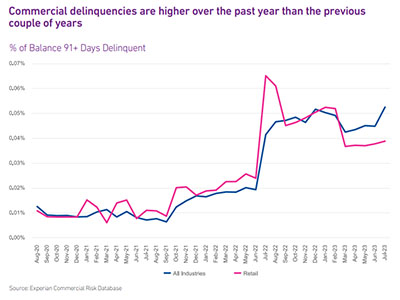

The labor market remains robust with low unemployment (3.8%) and 366K new jobs created in September. Job openings in the U.S. were 9.6MM as of the end of August, an increase of 690K or 5.8% since July. Retail sales in August had a month-over month increase for the fifth consecutive month. As we head into the holiday shopping season, despite headlines of large retailers struggling, the retail industry appears poised for success. It is likely that those retail businesses that survived the difficulties of the pandemic are the most financially sound and are driving the statistics. Over the past year, retailers are seeking less credit and taking on less debt than the previous few years. Despite inflation, consumers are still spending, and retailers are benefitting. Commercial delinquencies have been increasing over the past year. Delinquencies within the retail sector were trending above overall commercial delinquencies until just a few months ago when retailers exhibited lower rates than overall. These are all positive signs heading into the holiday shopping season which tends to make or break a retailer’s year. The September labor report was stronger than expected. Unemployment remained low at 3.8% and 366K new jobs were created which was the highest amount since January. In addition, the jobs created in July and August were revised upward significantly. What I am watching: With the labor market still tight, it will be interesting to see if the retail sector will be able to staff accordingly to support the holiday crunch. If staffing is difficult, retail stores may struggle to keep up with demand. Now that the student loan moratorium has ended, it will be important to monitor the impact to consumer spend. The increased expense of the student loan monthly payments will likely leave individuals with less discretionary income to spend on retail purchases. In addition, business owners who have student loans will have less money to invest in their business

These uncertain economic times are challenging for credit managers. Learn about the benefits of a holistic portfolio management approach.

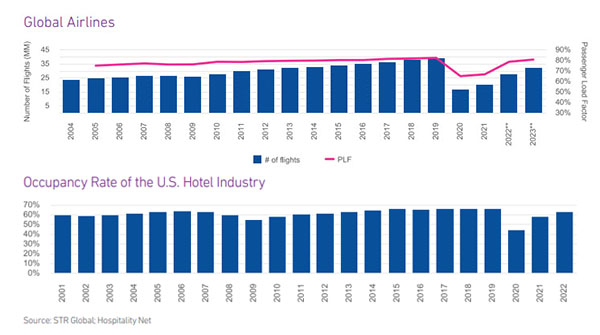

Now that most worldwide travel restrictions have been lifted, the industry is rebounding. It appears that travel businesses relied on more commercial credit to weather the storm of the pandemic and raised prices to help recove

Catch the latest brew on fraud strategy at our 15-minute Sip and Solve session hosted by Bonnie Gerrity, sharing best practices over coffee.

Experian discusses record business creation and fraud strategy with Credibly Founder and Co-CEO Ryan Rosett.

This post highlights recent commercial fraud insights from Experian and the advantages of taking a multi-layered approach to fraud strategy.

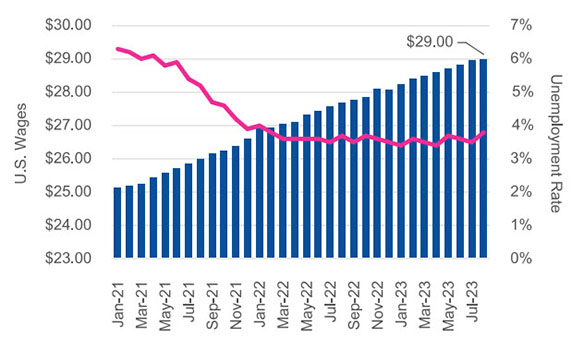

Since the height of the COVID-19 pandemic, the commercial real estate market is experiencing a paradigm shift as office professionals acclimated quite well to working from home, and many balk at going back to the office. As vacancy rates for offices hit record highs, supply of office space is greater than demand, reducing the value of many commercial properties. In parallel, The Federal Reserve’s 500bps of interest rate increases since March 2022 have made it more expensive for property owners to borrow and has left commercial real estate (CRE) lenders fearing greater risk of default will occur in the near future. August unemployment increased to 3.8% from 3.5% in July and is the highest since February 2022. Low unemployment continued to drive wages up with August wages reaching $29 per hour In anticipation of higher losses, CRE lenders are tightening their lending criteria, requiring higher down payments, shortening the loan term, and selling off or diversifying their CRE portfolios. Contrary to recent trends in office space pricing, and also contrary to impressions driven by media coverage focusing on increasing mall vacancies and mall closures, retail real estate appears to be rebounding since the pandemic. The average monthly rent per square foot for retail space has been increasing across the United States since the start of the pandemic. What I am watching There has been interest in re-purposing vacant commercial spaces into multi-family rental properties. As vacancies rise in office buildings and in some large urban malls, more CRE buildings are transitioning to hybrid residential/commercial spaces. A significant increase in residential living spaces should drive housing costs down, which would be a tremendous benefit to the public and help curb inflation. The labor market remains resilient but there are signs of weakening. While unemployment remained low at 3.8% in August, it is the highest since February 2022. The three-month moving average of jobs created in the U.S. declined to under 150K for the first time in a few years. If the labor market continues to weaken, employees will have less bargaining power and it is possible that employers will require workers to come back to work in-person in offices full time. If that comes to fruition, CRE owners and lenders will be in a much better position. Download Full Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

Since the height of the COVID-19 pandemic, new businesses are opening at a record pace. New businesses tend to be smaller based on number of employees as well as annual revenues. While new businesses make up a greater portion of new commercial credit accounts, they receive less credit.

The Federal Reserve’s efforts to tame inflation with aggressive interest rate hikes over the past 15 months appear to be working with July’s core inflation rate reaching the lowest level since October 2021. The U.S. labor market remains strong with low unemployment and 187K knew jobs created in July. As inflation eases and the economy continues to be strong, it is becoming more likely that we could experience a soft landing.

Gain insight on small business credit conditions by attending our quarterly webinar.