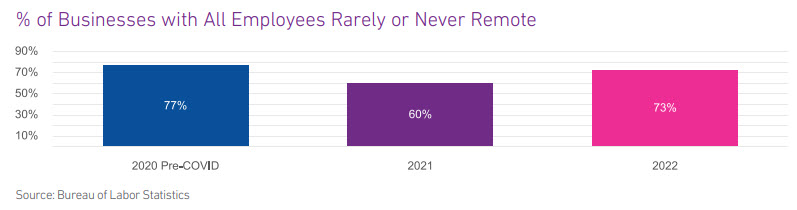

Remote working has been around for a long time, but became vastly more prevalent during the COVID-19 pandemic when people were required to stay home but employers wanted to continue business operations. As the height of the pandemic gets farther in the rearview mirror, more employers are requiring employees to come back to the office. However, more workers are still working remotely, at least part of the time, than before the pandemic.

With fewer people going into offices, there is a shift of population clustering in metro-centers where office buildings are located to areas outside of the metropolitan-core in more suburban and rural areas. With more people spending more time closer to their homes, they patronize businesses near their homes, driving the post-pandemic growth rate of businesses opening to be much greater outside of the metropolitan-core areas.

The labor market continues to be robust. 339K jobs were created in May, the most in four months, and way above market forecasts of 190K. On the flip side, unemployment ticked up in May 3.7% from 3.4% in April, and is now the highest level since October 2022.

What I am watching:

The high rate of post-pandemic new business openings is fueled by small businesses with fewer than 20 employees. Some of the businesses are even home-based side jobs by individuals working remotely for their primary job. It will be interesting to see how many of these small businesses can survive through the expected upcoming economic slowdown or recession. With higher interest rates and commercial lenders tightening criteria, businesses that are struggling will have a tough time securing financing to weather any upcoming storms.

Now that the Federal government raised the debt-ceiling and averted a government default, all eyes will turn back to the Federal Reserve’s battle to fight inflation. They indicated a pause in interest rate increases starting with their June 14th meeting. However, with the labor market still robust, the Fed’s decision may be a swayed by the May inflation report that is scheduled for release on June 13th.

Download your copy of Experian’s Commercial Pulse Report today. Better yet, subscribe so you’ll always know when the latest Pulse Report comes out.