Business Information Blog

The latest from our experts

%%title%% Marsha Silverman has just published a new Commercial Pulse report of small business insights.

Experian Main Street Report says strength in the economy pushes through inflation. Download for analysis on Q1 small business performance.

Experian experts discuss effective marketing strategies for insurance agents and brokers to boost ROI and client engagement.

Explore how API integration transforms business efficiency, enabling seamless data management, automation, and advanced client segmentation for growth and risk management.

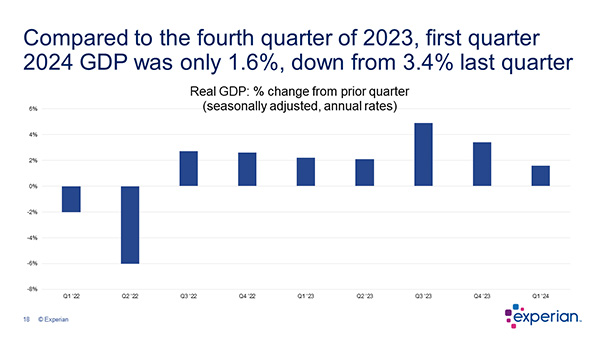

Experts from Experian provide a quarterly business credit review on Q1 2024 credit performance, along with an economic outlook.

The Beyond the Trends report highlights indicators which offer insights on labor, prices, commercial credit and economic conditions.

%%title%% Here are a few quick small business insights from our latest Commercial Pulse Report.

Explore instant decisioning in business automation, an approach to streamline credit decisions integrating data and automating processes.

How batch append credit scores can improve risk management and efficiency in financial services, with insights from Experian’s Erikk Kropp.

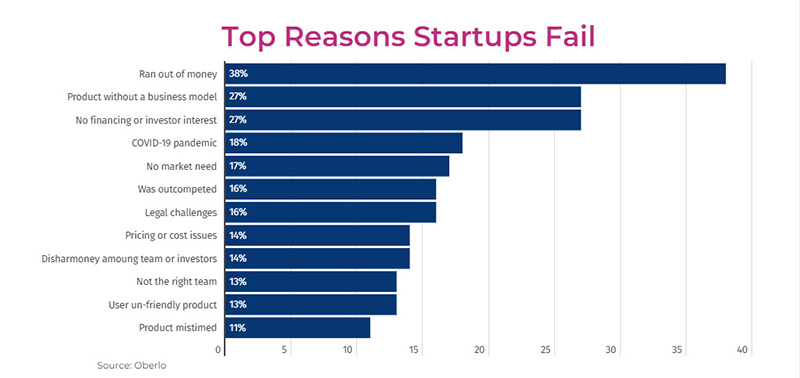

Download our latest Commercial Pulse Report for economic insights and a deep dive on reasons why so many startups fail in first 5 years.

Data is central to modernizing the credit approval process. We discuss useful formats beyond traditional business credit reports and scores.

We’re kicking off a series of posts over the next month on modernizing credit approvals featuring Sr. Product Manager, Erikk Kropp.