What’s the Red Flags Rule?

The Fair and Accurate Credit Transaction Act (FACTA) is an amendment to the Fair Credit Reporting Act (FCRA) and includes the Red Flags Rule, implemented in 2008. The Red Flags Rule calls for financial institutions and creditors to implement red flags to detect and prevent against identity theft. Institutions are required to have a written identity theft prevention program (ITPP) to govern their organization and protect their consumers.

What’s a red flag?

The FTC defines a red flag as a pattern, practice or specific activity that indicates the possible existence of identity theft. FTC guidelines include 26 examples of patterns that should be considered in an identity theft prevention program. These examples fall into the following categories:

- Alerts and notifications from reporting agencies and third parties

- Presentation of suspicious documents or identifying information

- Unusual or suspicious account activity

- Notices from customers, victims or law enforcement agencies

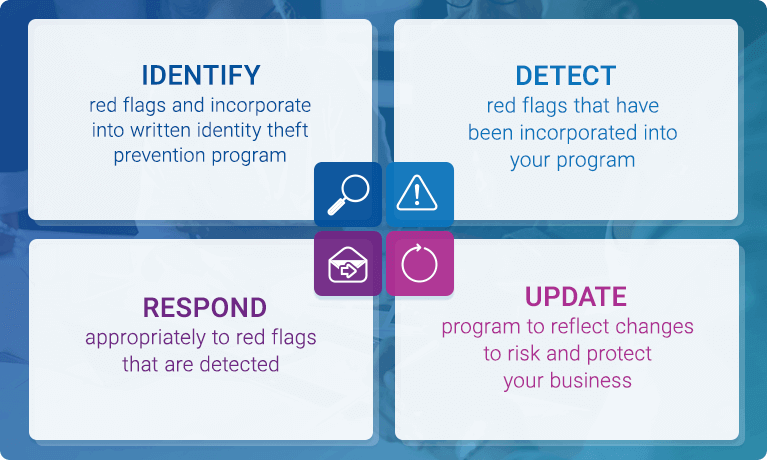

Elements of an identity theft prevention program

Ensure compliance

With smarter identity theft strategies, you can build a Red Flags Rule program and ensure compliance.

Fraud management

Identify, detect and respond to fraud with a multilayered approach and mitigate risk.

Transaction monitoring

By monitoring account activity, you can better protect your business when suspicious activity arises.

Speed and accuracy

Run red flag checks on individual transactions easily and separate from the credit profile to maximize efficiency while ensuring compliance.

Product sheet: Red Flags Rule

Learn how to identify your customers and meet regulatory requirements without friction.

Download nowWe are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Solutions

- Advanced analytics and modeling

- Collections and debt recovery

- Credit decisioning

- Credit profile reports

- Customer engagement and retention

- Data reporting and furnishing

- Data sources

- Data quality and management

- Fraud management

- Global data breach services

- Identity solutions

- Marketing solutions

- Regulatory compliance

- Risk management

- Workforce management