What are FinCEN customer due diligence (CDD) requirements?

According to the Financial Crimes Enforcement Network, or FinCEN, banks, brokers or dealers must comply with the final rule under the Bank Secrecy Act that strengthens customer due diligence requirements. This final rule went into effect on May 11, 2018. The Bank Secrecy Act requires that financial institutions keep customer records that aid in criminal, tax or regulatory investigations or protect against international terrorism.

Why are they important?

The U.S. Treasury estimates that $400 billion dollars in illicit proceeds are generated annually in the United States due to financial crimes. Identifying beneficial owners, or persons with at least 25 percent equity interest in the legal entity, will prevent evasion of sanctions, improve risk assessment, facilitate tax compliance and meet international standards.

Customer identification

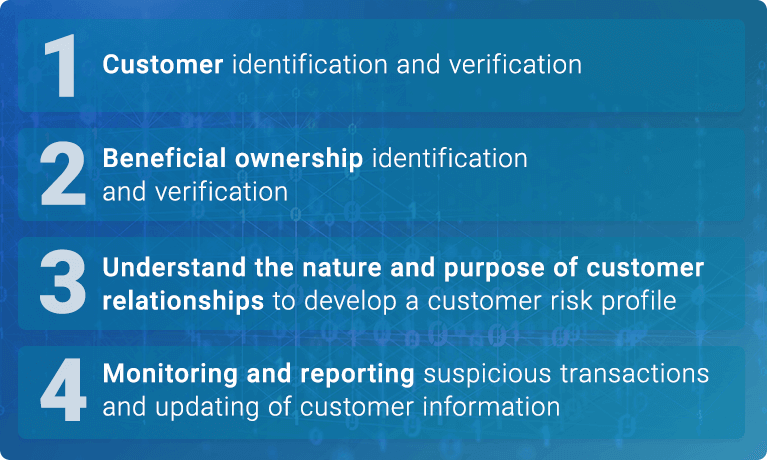

Identify and verify your customers and beneficial ownership.

Transaction monitoring

By strategic monitoring, you can identify and report suspicious transactions and customer information updates.

Data access

With greater data, you can understand the nature and purpose of customer relationships to develop a customer risk profile.

- Perform robust risk-assessments on identities.

- Monitor for changes across your entire customer portfolio after initial account opening.

- Access advanced scoring, decisioning, high-risk alerts and verification details.

- Identify data linkages and the velocities across the Experian**®** identity and credit network.

- Access to credit and demographic data to build trusted customer profiles.

- Verify both the business and multiple business owners through a single transaction.

We are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

- Solutions

- Advanced analytics and modeling

- Collections and debt recovery

- Credit decisioning

- Credit profile reports

- Customer engagement and retention

- Data reporting and furnishing

- Data sources

- Data quality and management

- Fraud management

- Global data breach services

- Identity solutions

- Marketing solutions

- Regulatory compliance

- Risk management

- Workforce management