Customer Identification Program (CIP)

Meet identity verification requirements across the customer lifecycle

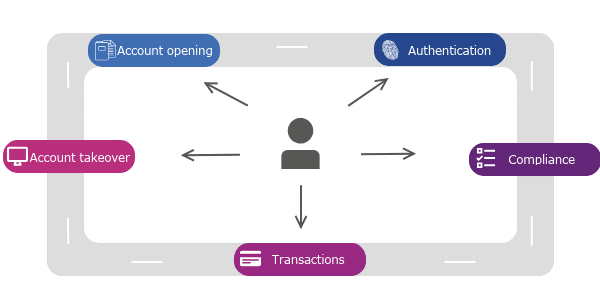

Know your customer (KYC) policies must include a robust Customer Identification Program (CIP). Our identity verification solutions can be used across the entire customer journey from initial onboarding through portfolio management. We reduce risk of noncompliance and provide seamless authentication.

Our proprietary and partner data sources and flexible monitoring and segmentation tools allow you to resolve CIP discrepancies and fraud risk in a single step, all while keeping pace with emerging fraud threats with effective customer identification software.

Automate customer identification to reduce manual intervention and verify with a reasonable belief that the identity is valid and eligible to use the services you provide.

Confidently resolve identity discrepancies using low friction step-up authentication processes.

Implement ongoing monitoring to ensure that changes to identity data don’t introduce compliance risks.

CIP refers to regulatory requirements that require financial institutions to verify the identities of their customers. CIP is part of a larger set of regulatory requirements aimed at preventing the U.S. financial system from being used to perpetrate fraud, launder money, finance terrorism and other nefarious activities. Since May 2018, changes to CIP require identity verification of beneficial business owners and require CIP programs to cover events that trigger reverification.

We can help you decrease the need for manual intervention, access verification data in real time, define a “match” for identity elements, execute step-up authentication when necessary, and consolidate the costs related to CIP and fraud risk scoring.

KYC goes beyond CIP to include the assessment of fraud risk in new and existing customer accounts. Financial institutions are required to incorporate risk-based procedures to monitor customer transactions and detect potential financial crimes or fraud risk. KYC policies help determine when suspicious activity reports (SAR) need to be filed with the Department of Treasury’s FinCEN organization. The following organizations have KYC oversight: Federal Financial Institutions Examinations Council (FFIEC), Federal Reserve Board, Federal Deposit Insurance Corporation (FDIC), National Credit Union Administration (NCUA), Office of the Comptroller of the Currency (OCC) and the Consumer Financial Protection Bureau (CFPB).

According to the FFIEC, a KYC program should include:

If you have questions or issues related to your personal credit report, disputes, identity theft or fraud alerts, visit Experian.com/help.

We are unable to address personal credit report and/or membership inquiries via this business form. Visit Experian.com/help or call 888-397-3742 for consumer assistance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.