Search Results for: covid-19

Anniversary Showcases Groundbreaking Innovations for Businesses and Consumers This year marks a major milestone for Experian as its Innovation Lab in North America celebrates 15 years of driving technological transformation. Over the past decade and a half, the Lab has been at the forefront of data and AI-driven solutions, helping our clients reshape industries and expanding financial inclusivity. A Legacy of Innovation The Experian Innovation Lab has played a critical role in advancing AI-driven credit risk models, fraud detection systems and no- and low-code AI tools. A groundbreaking achievement is the development of the Ascend Analytical Sandbox™, the industry’s first Big Data architecture-based commercial product. This tool evolved into the Experian Ascend Platform™, revolutionizing data analysis with advanced visualization, seamless model development and deeper consumer insights. The Lab’s commitment to innovation is exemplified by its work to help develop Experian Assistant, a Generative AI-powered tool using natural language processing to expedite model development and address complex data challenges. By incorporating agentic AI, Experian Assistant enhances credit scoring accuracy for a broader consumer base for financial services clients—aligning with Experian’s mission to foster financial inclusion. Transformative Technological Milestones Throughout its 15-year journey, the Experian Innovation Lab has worked on numerous industry-first advancements, including: AI-Driven Marketing & Fraud Detection – Leveraging AI for personalized marketing and real-time fraud detection. Machine Learning for Identity Resolution – Enhancing security and efficiency in identity verification. Generative AI for Consumer Products – Transforming how individuals manage credit and make informed financial decisions. Shaping the Future of AI and Data Science At its core, the Innovation Lab thrives on exploration and collaboration. Engaging leadership and fostering grassroots innovation accelerates progress through prototyping and employee-driven ideas. This dynamic approach ensures Experian remains a leader in AI, machine learning and data analytics. The Lab’s success has inspired additional innovation centers in the UK and Brazil, further amplifying Experian’s global impact. AI for Good: Innovation with Purpose Beyond financial services, the Lab has harnessed AI for societal impact. The Experian COVID-19 Outlook and Response Evaluator (CORE), an interactive heat map, helped healthcare organizations identify communities most at risk. By analyzing de-identified health data, this tool helped provide insights for pandemic response. Additionally, the Lab has used AI to analyze data and generate insights to help combat human trafficking, underscoring Experian’s dedication to addressing social challenges. As the Experian Innovation Lab enters its next chapter, it remains committed to pushing the boundaries of technology and data science, ensuring its innovations continue making a meaningful impact. Related Posts

Let’s be honest. Most of us didn’t learn about credit scores or budgeting in school, and for a lot of people, money wasn’t exactly dinner table conversation growing up. That’s why we started #CreditChat, a space to talk openly about the life events and financial choices that affect all of us. Experian might be known for credit reports, but we’re so much more than that. We’re a global data and technology company working to create opportunities. We help people reach their goals, save time and money, and feel more confident about their financial lives. We work across industries like healthcare, finance, insurance, and more. But at the end of the day, we’re here for you. We want to help you break down complicated topics and cheer you on as you build your financial future. So come hang out with us every Wednesday at 3 p.m. ET on X (formerly Twitter) for #CreditChat. We cover real topics, share real tips, and hear from real people just like you. No judgment. No jargon. Just real talk. Because you deserve to feel good about your money. Follow us on Threads @Experian.us! Check out our exciting podcast #CreditChat Live featuring expert insights on a variety of financial topics! Here’s how to join our next chat: Topic: Love & Money: Navigating Financial Hurdles with Your Partner Where: Join the live hashtag discussion.If you have questions, please DM us on X (formerly Twitter). Upcoming Personal Finance & Credit Discussions: February 11: Love & Money: Navigating Financial Hurdles with Your Partner February 18: Break Up With Bad Money Habits: Letting Go of What’s Holding Your Finances Back February 25: Tax Time Decisions: How to Use Your Refund (or Manage a Bill) Wisely March 4: The Caregiving Credit Crunch: How Women Can Protect Their Finances While Caring for Others March 11: Make Your Own Luck: Building a Strong Credit Foundation March 18: Spring Break Spending for Students: Credit Basics They Should Know March 25: Spring Cleaning Your Finances: Streamlining Accounts, Subscriptions, and Debt Past Topics include: Building Wealth, Not Just Credit: How Credit Fits into Long-Term Financial Success Was It the Mistletoe? Preparing Your Finances for a Fall Baby Credit, Cash, or Debit? How to Choose the Right Tool for Every Purchase Post-Holiday Damage Control: Smart Ways to Recover From Seasonal Spending Setting Up Your 2026 Money System: Budgets, Automations, and Credit Checkpoints Better Credit Starts Now: Kick Off the New Year with Smart Money Moves Money Lessons from 2025 and Habits We’re Keeping in 2026 Setting Boundaries With Money: Saying “No” Without Guilt This Holiday Season This Year Financial Gratitude: Reflecting on Your Money Wins This Year Giving Back Wisely: Charitable Donations and Financial Scams to Avoid Giving Back Wisely: Charitable Donations and Financial Scams to Avoid Preparing for Black Friday and Cyber Monday Safely Budget-Friendly Holidays: Giving Without Going Broke Financial Frights: How to Spot and Escape Predatory Practices That Haunt Your Wallet Don’t Fall for It: Spotting and Stopping Money Misinformation Get Smart About Credit Day Digital Danger: How to Protect Your Finances from Online Threats and Sca Understanding Bankruptcy: What It Means and How to Rebuild Financially What Are the Hidden Costs of Pet Ownership? How to Identify Unhealthy Financial Behaviors Before You Find Yourself in a Money Freefall Game Day Goals: How to Support Your Team(s) Without Overspending Steps to Take If You Are Struggling With Credit Card Debt Labor Day on a Dime: Fun Without the Financial Hangover How Much Is Enough? A Realistic Look at Retirement Readiness Money Moves of the Future: Budgeting Trends That Work Holiday Budgeting Starts Now: How to Plan Ahead and Save More Smart Credit Habits for Teens and College Students Side Hustles & Summer Gigs: Turning Seasonal Work into Long-Te Mid-Year Money Check-In: Are You on Track with Your 2025 Financial Goals? How to Build an Emergency Fund on a Tight Budget Freedom to Dream: Setting Financial Goals That Inspire You Back-to-School Budgeting: Tips to Beat High Inflation Keys to Success: Financial Strategies for Buying a Car Planning for College as a Family: Saving, Budgeting, and Smart Borrowing Thriving Financially When You're Self-Employed: Tips for Managing Money, Credit, and Cash Flow Insurance 101: What You Need to Know About Being Properly Insured Financial Tips for Military Households During Military Appreciation Month Preparing Financially to Rent an Apartment or Buy a Home Budgeting for Summer Fun: Camps, Trips, and Family Adventures Financial Literacy for the Future: Skills Every Young Adult Should Master The Truth About Credit: Debunking Common Credit Myths Conquering Debt: Tips for Financial Empowerment This Financial Literacy Month America Saves Week 2025: Saving for Major Milestones Mastering Your Money: Financial Literacy 101 Spend, Save, Invest: Strategies for Getting the Most Out of Your Tax Refund or Windfall Retirement Planning for Women: Securing Your Future AI and Your Money: How AI is Impacting Access to Financial Knowledge and Success Spring into Action: Financial Cleaning Tips for March Preparing for Tax Season: Essential Steps to File Your Taxes Generational Wealth and Financial Health: A Black History Month Discussion Breaking Up with Bad Spending Habits: A Financial Detox Plan Stretching Your Dollars: Practical Tips to Cut Costs and Save More Identity Theft Awareness Week: Know the Risks, Protect Yourself Turn Small Habits Into Big Savings! How to Find a Savings Strategy That Works for You Mapping Your 2025 Financial Journey with SMART Goals Your Money Snapshot: Steps to Measure Financial Wellness and Start the Year Strong Building Financial Confidence: Creating a Healthy Money Mindset in 2025 Set, Plan, Achieve: Your Roadmap to Financial Success in the New Year! Countdown to Savings: Smart Tax Moves for December Simplify the Season: Focusing on the Essentials for a Joyful Holiday Season Maximizing Your Savings This Black Friday, Cyber Monday and Beyond Transitioning to Civilian Life: Financial Considerations for Veterans Breaking the Money Taboo: Open Conversations for Talk Money Week Don't Get Spooked: Managing Your Money Without Fear Securing Your Future: The Benefits of Long Term Care Planning Domestic Violence Awareness Month: Rebuilding Financial Independence After Abuse Balancing Budgets and Emotions: Navigating Mental Health and Finances Protecting Your Finances Online: Cybersecurity Strategies for Everyday Users Investing 101: Making Your Money Work for You Retirement Ready: Planning for Your Future Today Credit Confidence: Understanding and Improving Your Credit Score Back to Basics: Building a Strong Financial Foundation Financial Anxiety and Stress: Coping Mechanisms for Managing Money Worries Women’s Equality Day: Realities and Remedies for the Gender Wage Gap Financial Resilience: Building a Safety Net to Weather Life's Unexpected Challenges Scrolling Wisely: Tips for Managing Your Finances in the Era of Social Media Influencers and Trends Navigating Finances After High School: A Beginner's Guide Going for Gold: Managing Your Finances Like an Olympian Meal Planning Mastery: Saving Time and Money on Back-to-School Groceries Beating Inflation: Effective Ways to Save on Back-to-School Shopping Financial Freedom through Minimalism: Simplify Your Life, Grow Your Wealth Evaluating Needs vs. Wants in a High Inflation and High-Cost Environment Sunshine and Side Hustles: Maximizing Your Earnings This Summer Mid-Year Money Check: Are You on Track with Your Financial Goals? Thrifty Traveler's Guide: Making the Most of Your Summer Adventures Empowering Our Heroes: Financial Education and Credit Insights for Military Appreciation Month Building a Strong Financial Foundation: Money Management Advice for Recent Grads Relocating on a Budget - Tips and Tricks for Cost-Effective Moving Navigating Small Business Credit: Tips for Startups and Entrepreneurs Financial Literacy Month: Resources and Tools That Can Boost Your Financial Health Financial Literacy Month: Navigating Credit and Debt Financial Literacy Month: Budgeting and Saving 101 Financial Literacy Month: The Role Financial Literacy Plays in Building a Strong Foundation First Quarter Financial Goal Check-In Decluttering Your Finances: Tips for Spring Cleaning Your Budget Taking Control of Your Financial Destiny: Minimizing Reliance on Luck International Women’s Day: Let’s Explore the Complex Relationship Between Women and Money Getting a Head Start on Your Tax Prep Black History Month: Let’s Talk Business Credit and Ways to Support and Invest in Minority-Owned Businesses From Roses to Credit Scores: Discussing Credit and Financial Health on Valentine's Day Credit Touchdowns: Ways to Score Big with Smart Credit Plays Identity Theft Awareness Week: Safeguarding Your Personal Information Automating Your Finances in the New Year Strategies for Tackling Your Holiday Debt Best Financial Habits to Adopt in 2024 Credit Myths You Should Leave in 2023 New Year, New You: Setting Money Resolutions for 2024 Protecting Your Finances from Predatory Practices During the Holidays From Gifts to Goals: Setting Financial Priorities as a Couple for the Holidays Ways to Save on Holiday Shopping Breaking Down Today’s Personal Finance Trends Spreading Cheer, Not Debt This Holiday Season: The Power of Money Mindfulness Deck the Halls: Budget-Friendly Holiday Decorating Ideas Navigating Credit and Finances After Service: Essential Tips for Veterans Cybersecurity and Identity Theft Awareness- For the Holiday Season and Beyond From Rookie to MVP: Playing the Money Game Get Smart About Credit Smart Ways to Budget for the Holiday Season Financial Empowerment: Breaking the Chains of Domestic and Financial Abuse The Importance of Winterizing Your Finances Navigating the Future: Let’s Talk Estate Planning and Investing Habits That Can Improve Your Financial Health Celebrating the Fruits of Your Labor on Labor Day: Ways to Reward Yourself for Reaching Financial Milestones Women’s Equality Day: Financial Equality for Women in the Workplace and at Home Back to Basics: Your One-Hour Crash Course in Credit Financial Resilience: Identifying and Healing From Financial Trauma Ways to Prepare for and Save on College Living Expenses Holiday Planning in July: Time to Prep Those Holiday Budgets Let’s Get a Head Start on Back-to-School Shopping How to Keep Your Financial Cool in the Dog Days of Summer Strategies for Achieving Financial Independence It’s Wedding Season: Let’s Talk Savings Tips for the Happy Couple and Their Wedding Party Let’s Perform a Mid-Year Financial Check-In Pride Month: Financial Empowerment for the LGBTQ+ Community Tips for Protecting Your Identity While Traveling This Summer Financial Readiness for Your Military Family Let’s Talk About Gen Z, Millennials and Money What to Consider When Planning to Purchase a Car Finding the Right Side Hustle and Avoiding Scams Congrats Grad! Let’s Chat About Your Financial Future Getting a Head Start on Summer Planning Ways to Stretch Your Dollars in This Economic Environment What You Should Know When Getting Ready to Buy or Sell a Home Spring Cleaning Your Monthly Expenses Tax Season 101: What You Need to Know Before Filing International Women’s Day: Embracing Financial Equity Today and Every Day Bills, Bills, Bills: Simple Ways to Reduce Your Monthly Expenses Tips for Weathering a Financial Storm Black History Month: Celebrating Trailblazers in the Black Community Love and Credit: Managing Your Credit in a Relationship How to Align Your Physical Fitness Goals With Your Fiscal Fitness Goals Moving Out On Your Own: How to Prepare Your Finances for Renting Ways to Reduce Your Credit Card Debt in 2023 Ways to Reduce Your Spending in 2023 Establishing Good Financial Habits for 2023: Start With a Financial Health Check-In Financial Tools That Can Set You Up for Success in 2023 Identity Theft Awareness Month: Tips for Protecting Your Identity This Holiday Season How to Get Your Credit Ready for Your 2023 Goals Use It or Lose It: Maximizing Your Benefits Before 2023 Ways to Give Back or Pay It Forward This Holiday Season Smart (and Not So Smart) Ways to Pay for Holiday Gifts Financial Tips for Military Families How to Fight the Winter Blues Without Blowing Your Budget Hocus Pocus Financial Focus: There’s Nothing Magical About Money Get Smart About Credit Day Answering Your Common Credit Questions From Social Media Ways to Identify and Protect Yourself from Financial Abuse in a Relationship How to Protect Yourself Against Credit Fraud and Identity Theft Online Head Start on the Holidays: Preparing Your Budget and Savings for the Holidays Thinking Outside of College: Successful Career Opportunities That Don’t Require a College Degree Aligning Your Career Goals with Your Financial Objectives Peer Pressure and Money: How to Not Let Your Financial Decisions Be Influenced by Others Student Loan Repayment Options and Updates You Should Know About Smart Ways to Pay for College Making Sure Economic Challenges Don’t Lead to a Financial Doomsday Preparing Your Budget for Back-to-School Shopping Grocery Shopping for the Family on a Budget Enjoying the Great Outdoors on a Budget How to Achieve Freedom from Financial Burdens and Stress Tips for Decluttering Your Finances Financial Tips for Same Sex Couples and the LGBTQ+ Community Moving Season: Tips for Saving Big on Your Next Move Half-Year Financial Check-In Summer Prep: Keeping the Family Entertained During the Summer Graduation Season: Preparing for Life’s Next Big Adventure May the 4th Be With You: Financial Lessons from Star Wars Steps You Can Take to Incorporate Financial Literacy in Your Daily Lives Championing Financial Literacy Month: Organizations That Are Making a Difference Maximizing Your Credit Scores During Financial Literacy Month April is Financial Literacy Month: What is financial literacy and why is it so important? Spring Credit Bootcamp Series: What to Do If You’ve Been a Victim of Credit Fraud Spring Credit Bootcamp Series: How to Fix Bad Credit Spring Credit Bootcamp Series: How to Fix Bad Credit Spring Credit Bootcamp Series: How to Fix Bad Credit Spring Credit Bootcamp Series: Credit Scores and How to Improve Them Spring Credit Bootcamp Series: How to Establish Credit Spring Credit Bootcamp Series: What is Credit and Why It’s Important America Saves Week 2022: Building Financial Resilience Black History Month: Building Wealth and Financial Health in 2022 Valentine’s Day on Budget Identity Theft Awareness Week: How to Protect Your Identity in 2022 How to Establish Credit for the First Time Making a Plan to Tackle Your Holiday Debt How to Review Your Personal Finances and Prepare for the New Year The Importance of Gratitude and Mindfulness with Your Finances Investing in Your Health This Holiday Season and Into the New Year Planning for Uncertain Holiday Travel National Identity Theft Prevention and Awareness Month: Protecting Your Identity This Holiday Season Managing Holiday Spending and Gift-Giving When Products are in Short Supply Gifts and Goals: Creating Your Holiday Financial Checklist How to Make the Most Out of Thanksgiving Week Sales Preparing Your Finances for Winter Emergencies Credit Mistakes That Can Haunt You Get Smart About Credit Day How to Protect Your Finances From Cybersecurity Threats Retirement 101: How to Ensure You Are Ready for Retirement Helping Communities Achieve Financial Inclusion Financial Considerations for Caregivers of Aging Family Members Hispanic Heritage Month: Financial Inclusion for the Hispanic Community State of Credit: Behaviors That Can Impact Your Credit Scores Planning Ahead: How to Prep Your Holiday Budget Women’s Equality Day: How Women (and Men) Can Continue to Strive for Financial Equality How to Make Your Side Hustle Your Full Time Career Financial Tips for College Students Financial Considerations When You Get Your First Job Smart Ways to Build Your Credit History Back to School Budgeting: How to Prepare for the Return to Classrooms How to Set Your Wedding Budget and Stick to It Separating Facts and Myths About Credit Reports and Scores Achieving Financial Independence Frugal Summer Activities for the Family Dads, Dollars and Debt: Financial Topics for Father’s Day Protecting and Maintaining Your Finances As We Emerge From COVID-19 Personal Finance for the LGBTQ+ Community Financial Planning for Military Spouses and Families What to Know When Shopping for a Home in a Seller’s Market Credit Advice for College Grads Best Financial Advice For or From Moms Closing the Financial Literacy Gap in Underserved Communities How to Talk to Your Children About Money Ways to Manage Our Emotions When Making Financial Decisions Financial Literacy Month: Why Is Financial Education Crucial and How Do We Do It? Military Saves Month: Budgeting for Military Families Planning & Ensuring Financial Well-Being for Future Generations Strategies for Improving Your Credit Scores How to Juggle Debt Payoff and Investing for Retirement Creating Gender Equality in Personal Finance America Saves Week: Simple Ways to Save Even More Money Overcoming Barriers to Financial Services for Underserved Communities Money Management Advice for Committed Couples Ways to Support Black-Owned Small Businesses Smart Strategies to Help You Pay Off Student Loans How to Start (And Stick) to Your 2021 Budget Creating Financial Goals You’ll Achieve in the New Year Debt Resolutions: Paying off Old Debt in the New Year Ways to Celebrate the Holidays on a Tight Budget How to Protect Yourself from Identity Theft Social Media’s Impact on Financial Wellness Money Moves You Will Be Thankful For Practical & Budget-Friendly Organizing Solutions Money-Making Pandemic Hobbies Looking at the Bright Side: Positive Effects of the Pandemic Budgeting for a New Pet How to Make Extra Money During COVID-19 How to Boost Your Credit Score How to Form a Financial Plan Moving Tips to Save You Time and Money How to Financially Prepare Before Having Kids Paying for College Saving and Investing for Retirement Income Disparity: Friendships & Financial Inequality Women and Money: Guide to Financial Empowerment Pay it Forward & Giving Back How to Build Financial Stability & Prepare for Your Future Declutter & Simplify Your Finances Building Credit From Scratch Budgeting When Broke: Ditching Debt & Investing for the Future Eating Healthy & Staying Fit on a Budget Frugal Ways to Enjoy Your Summer During COVID-19 Financial Independence: Steps to Break Free from Debt The Art of Minimalism: Enjoying More with Less Father’s Day: Financial Wisdom Coping with Anxiety & Financial Stress During Tough Times Ways to Give Back & Support to Our Communities How to Deal with Unemployment Side Hustles: Legit Ways to Make Extra Money at Home How to Manage our Finances & Credit During This Coronavirus Pandemic How to Handle Higher Bills, Unexpected Expenses & Debt Shame During the Pandemic How to Talk to Your Kids About Coronavirus & Saving Money How to Manage Your Time, Money & Emotional Wellbeing While Working Remotely COVID-19 Help: Emergency Financial Assistance Resources & Services to Know About Creative Ways to Support Your Favorite Small Businesses How to Invest & Prepare for the Future in a Volatile Market Frugal Family Tips for Maximizing Savings (And Reduce Debt) Awkward Money Moments and How to Handle Them Essential Tips to Consider Before Buying a Car Common Questions About Credit How to Talk Money in a Relationship Paying for College How to Spend Valentine’s Day on a Budget How to Avoid a Personal Financial Disaster A Game Plan to Boost Your Credit Score Smart Ways to Save While Raising a Family Saving vs. Investing Treat Yourself Without Blowing Your Budget New Year, New Financial Goals Strategizing to Pay Down Your Debt in the Next Year New Year’s Resolutions to Improve Your Finances Reviewing Your Year in Credit: What Could You Have Done Better? How to Protect Your Identity This Holiday Season Teaching Kids About Money The Importance of Giving Back During the Holidays Ways to Optimize Your Spending During the Holidays Financial Tips All Veterans Should Know Raising Money-Smart Kids Loans 101: The Basics of Borrowing Credit Scores 101 Money and Mental Health Finances After Death Creating and Building an Emergency Fund What’s the Deal with Financial Inclusion? Financial Tips for Raising a Pet Road to Retirement Financial Tips for College Students How to Teach Your Kids Financial Literacy Save Money on Back-to-School Shopping The Everyday Bucket List with Karen Cordaway Financial Tips to Help You Move Out Side Hustles to Help You Increase Your Wealth Ways to Improve Your Credit Score All About Retirement Throwing a Summer Party on a Budget Buying Your First Car How to Protect Parents from Financial Scams with Cameron Huddleston Happy Father’s Day: Old School Money Tips Dad Taught Me How to Save the Most Money on Your Vacation What to Expect (Financially) When You’re Expecting Don’t Let Your Wedding Break the Bank #CreditChat with Experian Boost Ambassador & Award-Winning Actor, Hill Harper What You Can Learn From a Military Mom Budget Small Business Credit Tips for Home Buying Seeking Financial Advice Tips to Help You Improve Your Credit Score Tips to Help You Spring Clean Your Debt Investing 101: Ways to Make Your Money Grow Ways to Fatten up Your Thin File Ways to Prepare for Tax Season Women’s Financial Success–Breaking Down Barriers America Saves – Maintaining Your Financial Health as a Couple Military Saves – Managing Money When You’re on the Move How Important is Financial Transparency with Your Partner? All About Love & Money Ways to Save on Valentine’s Day Financial Planning How-To’s for Millennials and Generation Z How to Establish and Build Credit Ways to Minimize Your Debt This Year Fitness on a Budget Hello 2019! Tips to Help You Set the Right Financial Goals This Year Tips to Improve Your Credit Score in the New Year Planning Ahead: Money Moves to Make Before the End of the Year How to Strategize and Save on Holiday Parties and Gift Giving Ways to Hustle and Make Extra Cash for the Holidays Smart Ways to Protect Your Identity This Holiday Season How to Save Money & Stick to Your Budget This Holiday Season How to Avoid Compulsive Spending This Holiday Season Financial Advice for Veterans Financial Topics That Keep People Up at Night Get Smart About Credit: Credit 101 for Kids and Teens Important Financial Moves to Make Before Retirement Pets and Finances: How to Save on the Cost of Pet Ownership Prepare for the Worst: The Importance of Estate Planning Kids and Money: Best Financial Tips for Gen Z Emotions and Finances: How to Get Your Emotional Spending in Check How to Get Out of and Avoid Credit Card Debt Important Tips to Help You Protect Your Children From Identity Theft The Money Talk: Breaking the Taboo of Talking About Money College Life: Financial Tips Every College Student Should Know Money Saving Tips for Back to School Shopping What to Know About the Home-Buying Process Retirement 101: Best Planning and Saving Tips Your Mid-Year Financial Goals Check-in Dark Web 101: How to Protect Your Identity What Does Financial Freedom Mean to You? Budget-Friendly Summer Activities for Families and Kids Important Financial Issues Facing The LGBTQ Community Summer Travel on a Budget If I Knew Then What I Know Now: What We Learned From Our Mistakes Congrats Grads! Ways to Be Smart With Finances After Graduation Smart Strategies for Buying a Car Financial Accessibility: Increasing Credit Literacy and Tips to Help Improve Scores Honoring Mom: The Best Financial Advice Mom Gave Us Financial Advice for Military Families Emotions and Money: The Difference Between Your Net Worth and Self-Worth Kids and Money: Important Financial Lessons to Teach Kids Crucial Things to Know About Your Student Loans and Repayment Financial Literacy 101: How We Can Make a Difference This Month What to Know Before Filing Your 2017 Tax Return How to Reduce Financial Stress Through Minimal Living How to Prep for the Future with Investments Her Money: Top Financial Tips for Women America Saves Week: The Importance of Establishing Your Rainy Day Fund Military Saves Week: Best Practices for Establishing Your Emergency Fund as a Servicemember Say Yes to a Wedding Budget: Saving Tips for Your Big Day Love and Money: The Good, The Bad and The Ugly Valentine’s Day on a Budget How to Eat Healthy on a Budget 2018 State of Credit Strategies to Conquer Debt in the New Year How to Use Apps to Achieve Financial Success Tips to Improve Your Credit Health Key Habits to Build for Financial Success Creating Financial Goals for the New Year How to Reduce Financial Stress and Anxiety During the Holidays How to Throw a Great Holiday Party on a Budget Creating Abundance and Peace with Habits of Gratitude and Charity Smart Ways to Map Your Shopping and Avoid Overspending on Black Friday Money-Saving Holiday Travel Tips Important Financial Tips and Benefits for Veterans Make Those Lists and Check Them Twice: Tips for Budgeting for the Holidays Frightful Financial Topics and How to Overcome Them Get Smart About Credit with American Bankers Association The Importance of Investing in Your 20s and How to Get Started Planning Your Estate: A Guide to Wills and Trusts Important Things to Consider When Combining Finances in a Relationship

Home ownership has been found to be one of the greatest drivers of generational wealth, but the dream of owning a home can seem out of reach for millions of Americans. At Experian Mortgage, we believe our commitment to diversity, equity and inclusion, and leveraging the power of data, analytics and technology creates a better tomorrow for all. Our team is 100% committed to helping expand homeownership opportunities to populations traditionally left out of the market. For me personally, diversity, equity and inclusion – in all regards – is a personal passion. That’s why it’s especially thrilling and humbling to receive the Mortgage Bankers Association (MBA) 2022 Residential Diversity, Equity and Inclusion (DEI) Leadership Award in the Market Outreach Strategies Non-lender category. Diversity, equity and inclusion is more than just a program for us. It drives our company’s mission of financial inclusion. We are proud to partner with nonprofit organizations including HomeFree-USA, the Urban Institute, UnidosUS and the National Urban League to break down barriers to homeownership through financial and credit education. Through our United for Financial Health program, we established the Home Preservation Grant to assist Black and African American homeowners at risk of losing their homes due to the negative impact of COVID-19. To date, homeowners in Atlanta, Chicago and the greater Washington, D.C. areas have benefitted. As a member of the MBA, Experian enthusiastically signed the Home for All Pledge, furthering its commitment to be a champion for change in addressing the barriers to sustainable housing for persons and communities of color. Additionally, several members of the Experian Mortgage team participate in the Housing Affordability Convergence in support of MBA’s initiative to facilitate new solutions to the nation’s rental and housing affordability challenges. For Experian Mortgage to be recognized by the MBA for our market outreach efforts is tremendously rewarding. It helps confirm we’re on the right track and we still have more to do. We look forward to providing partnership and support to clients and the industry to join us in our mission of financial inclusion. Click here to learn more about our commitment to diversity, equity and inclusion.

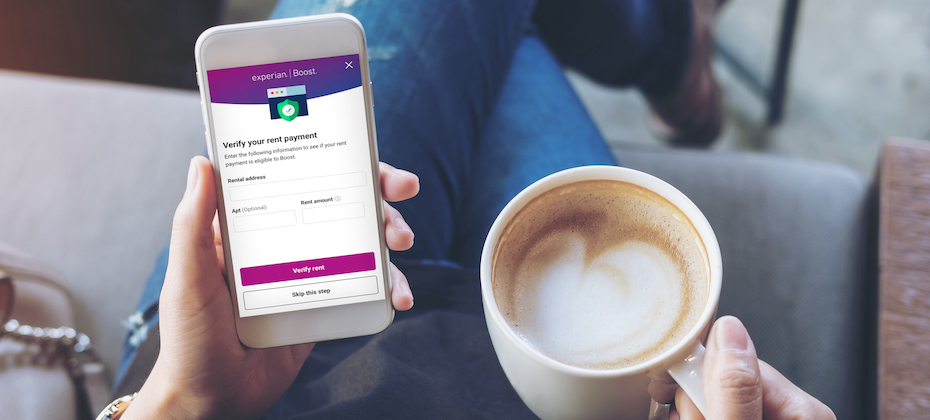

I recently came across a quote that said, “The world you see is created by what you focus on.” As I look back on my last 16 years with Experian, I see a lot of truth in this. While Experian has historically been recognized as a business-to-business organization, over the last several years, we’ve had a transformational shift in focus that’s fundamentally changed our business. This shift has made our world look a lot different than it used to. Today, consumers are at the center of everything we do. They’re the driving force behind our innovation and growth. Every day, millions of consumers come to Experian looking for ways to improve their financial health and we’ve been building one of the largest global member bases. These direct relationships put us in a unique position. We can listen to consumers to hone our focus – and we do. Just like in everyday relationships, listening builds trust and respect. It helps us understand what consumers want and allows us to innovate to meet them where they are on their financial journey. In 2019, we heard consumers’ call for more control of their data and responded with Experian Boost®[1]– a first-of-its-kind feature that allows consumers to contribute information directly to their Experian credit file. To date, we’ve helped 8.6 million consumers instantly improve their FICO® Scores[2] with an average increase of 13 points. Since launch, we’ve continued to listen and enhance the feature to maximize the number of consumers who can benefit. Shortly after we brought Experian Boost to market, we wanted to ensure consumers who paid their monthly telecom and utility bills from their savings or credit cards could benefit alongside those who paid these reoccurring bills through their checking account, and we did. Against the backdrop of the COVID-19 pandemic, at a time when television streaming had skyrocketed, we wanted to ensure consumers who subscribed to video streaming services, including Netflix®, Hulu™, HBO Max™, Disney+™ and others, could use these monthly payments to build their credit histories, and we did. We regularly connect new streaming service partners to Experian Boost. Most recently, consumers who subscribe to Paramount+, Peacock, Showtime® and ESPN+ can also contribute their on-time bill payments directly to their Experian credit file through Experian Boost. Earlier this year we introduced Experian Go™ - a free, first-of-its-kind program to help “credit invisibles,” or people with no credit history, begin building credit. Within minutes, credit invisibles who enroll in the program can have an authenticated Experian credit report, tradelines and a credit history by using Experian Boost and instant access to financial offers through Experian Go. Since launch, more than 84,000 consumers have established an Experian credit report through Experian Go and become visible to potential lenders. As a next step, today we’ve announced a new beta release of Experian Boost that allows consumers to contribute qualifying, “positive” residential rent payments directly to their Experian credit file. This capability makes Experian Boost the only feature that can instantly improve a consumer’s FICO® Score 8through positive rent payments at no cost. This is the next step in our commitment to helping consumers get the credit they deserve. With the beta release, consumers who rent from over 1,500 of some of the largest U.S.-based property management companies, and who pay their rent directly to their property management company or through platforms like AppFolio Property Management, Buildium®, Yardi® Breeze and Zillow® Rental Manager, can add qualifying positive rent payments to their Experian credit file through Experian Boost. Based on preliminary analysis[3] highlighting the potential impact of positive residential rent payment reporting through Experian Boost, we estimate 66% of consumers will see an instant increase to their FICO® Score 8, a FICO® Score 8 improvement of nearly 10 points on average for those who receive a boost and are new to using Experian Boost. And we’re not done yet. To ensure more renters can benefit, we’ll continue to add new property management companies over time. In later phases, we’ll update the feature further to add individual landlords and smaller property management companies over time. I’m proud of what we’ve accomplished so far and, as we look ahead, I’m excited for the ways we can help consumers that are yet to come. With our focus on consumers and our ability to listen and innovate, I believe we’ve just scratched the surface in terms of our capacity to help bring financial power to all. [1] Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost®. Learn more. [2] Credit score calculated based on FICO® Score 8 model. Your lender or insurer may use a different FICO® Score than FICO® Score 8, or another type of credit score altogether. Learn more. [3] Analysis completed using FICO® Score 8 with Experian data. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures.

Back in October 2021, we announced our partnership with Code First Girls, who teach women to code for free and develops female talent in tech. We have shared their journey where four female students worked as paid interns with Experian while studying for their Code First Girls’ Nanodegree for the last nine months. My colleagues in the UK will be continuing the partnership with Code First Girls this year. As part of the partnership, Experian will be sponsoring four courses in Python and Data, and our employees are volunteering to co-lead these courses. Experian will also be sponsoring 10 Code First Girls’ Nanodegrees, with the aim of hiring these 10 graduates via our Software Engineering graduate programme in the UK. The four interns who recently completed their internships with us came from diverse backgrounds and introduced fresh perspectives. They've helped to drive our financial inclusion agenda by working on our United for Financial Health programme in South Africa and Italy, amongst other innovative projects. Watch the videos where our interns talked about their internship experience: Nicole Ngina, born, raised and currently in Kenya, and a recent diploma graduate of Strathmore University where she studied Business Information Technology. Betty Abate, originally from Ethiopia but grew up in the UK. Chelsi Goliath, a Computer Science student from South Africa. Kamile Sudziute, originally from Lithuania, but studied in London, where she just graduated from King’s College London with a degree in Philosophy, Politics and Economics. We are committed to developing women in tech and I’m pleased to welcome more talented young women to start their careers in tech with us. This year’s extension of our partnership with Code First Girls enables us to create a better tomorrow for more women to kickstart their careers in tech. Stay tuned for more updates on our journey with Code First Girls by following us on Facebook, Instagram, LinkedIn and Twitter.

Simplifying healthcare for all - that seems like a tall task to accomplish considering the last two years. What we once considered simple activities in our daily lives, such as going to the store to buy groceries or getting children to school, was upended by a global pandemic. Factor in the massive changes in healthcare operations, and it is clear the system needs to continue to evolve. It also cements my belief that Experian Health’s mission is even more relevant and achievable today than it was pre-COVID 19. In fact, this aspiration of simplifying healthcare for all is top of mind for me and Experian as we go into HIMSS22, the premier healthcare conference being held in Orlando this week. The healthcare industry has undergone massive changes since the fateful announcements in early 2020. While adapting to the pandemic was a huge undertaking for many organizations at the onset, those who opted to embrace change saw the payoff as they simplified administrative tasks and created efficiencies for both providers and patients. We saw organizations eagerly adopt technology and tools to take paperwork digital, streamlining the patient intake process and improving the accuracy of the data received. Instead of phone calls, patients and providers scheduled appointments and communicated online through secure portals saving time and manpower. The use of telehealth appointments allowed providers to see more patients and do so safely. Who would not want the simplicity of carving out just a few minutes from the comfort of one’s home for a non-urgent appointment? We are proud to have been a part of this evolution helping healthcare organizations pivot in the face of such a daunting predicament. For example, through our digital front door solutions, patients were able to schedule and pre-register for appointments online avoiding extra time spent in waiting rooms. We verified hundreds of thousands of identities quickly as Americans lined up for COVID-19 testing and vaccines. Our mobile payments system served to make the financial aspects of care easier to fulfill. Providers turned to us to help recoup costs from the government and insurers for COVID-19 care with our insurance discovery solution. Experian will not stop here, and we will continue to innovate high-tech, data-driven approaches to simplify healthcare for all; I hope the industry doesn’t stop either in tackling tough operational challenges using the power of technology and data. With this in mind, I look forward to hearing about the lessons learned by the industry as well as future innovations from the participants at HIMSS22. It’s the “can’t-miss healthcare conference of the year,” and we are pleased to be a sponsor and exhibitor once again. For those attending, visit us at Booth #3059. Taking the conference playbook of a hybrid approach with both digital and in-person participation, the healthcare industry should follow suit. Let’s certainly keep valuable in-person mechanisms in place, but not forget about the last two years and the incredible progress made that moved the industry forward. At Experian, we strive to help clients operate more quickly, smoothly and efficiently across the healthcare journey. With a new mindset in the industry and the tools available to act on change from providers like Experian, simplifying healthcare for all is not just a mission but an outcome we must achieve. Tom Cox is President of Experian Health.

The past few years have sparked a swift digital transformation that subsequently drove a rapid increase in fraud. In fact, fraudsters have gotten more creative, putting businesses and consumers at risk now more than ever. At Experian, we predict that more intricate challenges lie ahead and are dedicated to helping businesses combat fraud threats. Here’s what we expect in 2022: 1. Buy Now, Pay Never – The Buy Now, Pay Later (BNPL) space has grown massively recently. In fact, the number of BNPL users in the US has grown by more than 300 percent per year since 2018, reaching 45 million active users in 2021 who are spending more than $20.8 billion . Without the right identity verification and fraud mitigation tools in place, fraudsters will take advantage of some BNPL companies and consumers in 2022. Experian predicts BNPL lenders will see an uptick in two types of fraud: identity theft and synthetic identity fraud, when a fraudster uses a combination of real and fake information to create an entirely new identity. This could result in significant losses for BNPL lenders. 2. Beware of Cryptocurrency Scams – Digital currencies, such as cryptocurrency, have become more conventional and scammers have caught on quickly. According to the FTC, investment cryptocurrency scam reports have skyrocketed, with nearly 7,000 people reporting losses totaling more than $80 million from October 2020 to March 2021 . In 2022, Experian predicts that fraudsters will set up cryptocurrency accounts to extract, store and funnel stolen funds, such as the billions of stimulus dollars that were swindled by fraudsters. 3. Double the Trouble for Ransomware Attacks – In the first six months of 2021, there was $590 million in ransomware-related activity, which exceeds the value of $416 million reported for the entirety of 2020 according to the U.S. Treasury's Financial Crimes Enforcement Network . Experian predicts that ransomware will be a significant fraud threat for companies in 2022 as fraudsters will look to not only ask for a hefty ransom to gain back control, but criminals will also steal data from the hacked company. This will not only result in companies losing sales because of the halt caused by the ransom attack, but it will also enable fraudsters to gain access and monetize stolen data such as employees’ personal information, HR records and more – leaving the company’s employees vulnerable to personal fraudulent attacks. 4. Love, Actually? – Because more consumers went on dating apps and social media to look for love during the pandemic, fraudsters saw an opportunity to create intimate, trusted relationships without the immediate need to meet in-person. The FBI found that from January 1, 2021 — July 31, 2021, the FBI Internet Crime Complaint Center received over 1,800 complaints, related to online romance scams, resulting in losses of approximately $133 million. Experian predicts that romance scams will continue to see an uptick as fraudsters take advantage of these relationships to ask for money or a “loan” to cover anything from travel costs to medical expenses. 5. Digital Elder Abuse Will Rise – According to Experian’s latest Global Insights Report, there has been a 25 percent increase in online activity since the start of Covid-19 as many, including the elderly, went online for everything from groceries to scheduling health care visits. This onslaught of digital newbies presents a new audience for fraudsters to attack. Experian predicts that consumers will get hit hard by fraudsters through social engineering (when a fraudster manipulates a person to divulge confidential or private information) and account takeover fraud (when a fraudster steals a username and password from one site to takeover other accounts). This could result in billions of dollars of losses in 2022. As a leader in fraud prevention and identity verification, Experian offers a full suite of automated tools that harness data and analytics to prevent fraud and mitigate losses. Learn more about Experian's fraud management tools.

For the ninth year, the Orange County Register has named Experian North America as a Top Workplace, securing the #1 ranking for the second consecutive year. The award, which is based on employee feedback in a survey of hundreds of leading companies in Orange County, recognizes our company’s culture of inclusion, and our commitment to employees and communities. Orange County is the home of our North America operations, and we are especially honored to be recognized again for our inclusive work environment and achieving higher performance while giving back. This honor demonstrates the talent and compassion of all the people who work at Experian. Thank You All our decisions are driven by our desire to ensure our employees feel valued and protected. As part of this, we issued a ‘Thank You’ Share Award to all employees at the beginning of this year to recognize perseverance through the pandemic, giving thousands of employees an equity stake in the company. Coming Together Our Employee Resource Groups (ERGs) continue to grow and support employees in different ways, which include activities that bring employees together internally to serve their communities externally. For example, our Asian American ERG worked closely with Pan-Asian leadership organization Ascend to support the Asian American community and employees, considering increasing discrimination and xenophobia during the pandemic. Together they kicked off Feed Your Hospital, which facilitated the delivery of meals to frontline COVID-19 healthcare workers by supporting local Asian restaurants. Meals were purchased at the restaurants and delivered to participating hospitals. The campaign raised funds for hospitals in Orange County. Social Good This year, we also awarded two OC-based organizations with major grants – the OC Hispanic Chamber of Commerce and TGR Foundation (a Tiger Woods Charity). For the OC Hispanic Chamber of Commerce, we funded and facilitated credit education initiatives for the Youth Chamber Program – funds went towards scholarship awards and event costs. We also added credit education to the ‘Pre-Venture Business Program’ curriculum – with funds going into marketing, training, one-on-one consulting, and event costs offered in both Spanish and English. For the TGR Foundation grant, we are working on ongoing projects with the foundation to support credit education, small business entrepreneurship, homeownership, and financial inclusion efforts. In total, employees volunteered more than 900 hours to Orange County-based nonprofits and Experian matched funds to those organizations that employees volunteered with and donated to. Our employees continue to help people who are facing unprecedented and unforeseen challenges. Different groups and employees of all levels are working together to help our clients, customers and communities persevere. We are honored that the Orange County Register continues to recognize our tireless efforts to make a difference in the communities in which we live and work.

Over the past 18 months, we’ve monitored insights related to consumer and business economic outlooks, financial well-being, online behavior and more. One of the most significant insights was the accelerated shift toward e-commerce and digital financial services. In fact, there has been a 25% increase in digital transaction across the globe since the start of the pandemic including shopping, banking, and transacting online. Our latest 2021 Global Insights Report found that the increase in online activity held steady, even with the return of physical shopping and banking. The study also found that consumers are spending again. Nearly 10% of consumers are spending more and putting less away in retirement or emergency savings than from one year ago. However, even though customers are spending more, loyalty to online businesses is declining. We found that 61% of consumers say they are staying with the same online service provider they used prior to COVID-19. This a decrease of 8% from one year ago. The continued increase in online activity, coupled with heightened consumer expectations, dwindling customer loyalty, and increased competition, could lead to potential revenue loss or gain. Businesses must find solutions to improve digital engagement and customer acquisition. Fortunately, improving digital engagement and customer acquisition are companies’ top priorities as they maneuver the pandemic-accelerated boost in digital transactions. They are leveraging advanced technologies like digital credit risk decisioning, passive authentication, and artificial intelligence to improve the digital customer experience and grow their business. According to Experian’s report, 90 percent of companies are investing in business automation, 76 percent are improving or rebuilding their analytics models and 65% intend to increase fraud budgets. Adoption of AI has risen from 69% to 74% and machine learning from 68% to 73% in one year. We also found that 50% of companies are exploring the use of expanded data sources. To develop the study, Experian surveyed 3,000 consumers and 900 businesses across 10 countries around the world including Australia, Brazil, Germany, India, Italy, Japan, Singapore, Spain, United Kingdom and United States. This report is part of a longitudinal study and published series that started in June 2020 through October 2021 exploring the major shifts in consumer behavior and business strategy throughout COVID. Access all global research reports here. To learn about more findings, download the Global Insights Report and visit the Global Insights blog.