Search Results for: DATA AI

Steve Wagner, Managing Director, Global Decision Analytics on Redesigning the future of consumer lending with data and analytics. Find Steve Wagner's interview in Raconteur's Future of data report to discover what businesses need to do to succeed in an increasingly digital world. “The good thing is that technology and data now allow businesses to put the customer journey at the heart of what they’re doing. With the advanced technologies available today, businesses can access relevant data and deliver on customer expectations in their moment of need. Whether it’s access to a loan or mortgage, or to consolidate debts, a real-time view of the consumer is possible.” Read the full article and find out about: Why the digital customer experience, enabled by both data and analytics, is the new battleground for many industries. Consumers reporting they were online 25% more in 2021 compared to a year before. Online retail sales saw four years of growth in just 12 months during the Covid pandemic. Demand for frictionless journeys through biometrics or multimodal authentication mean customers can see the value exchange in sharing personal data. Behavioural biometrics is the next frontier in tackling fraud and providing a seamless customer journey. Technology is allowing us to analyse far more data sources in real time, providing a comprehensive picture of an individual. Open Banking and the democratisation of data are part of the progressive change around data. Importance of extracting the insight lenders and fintech providers need to implement the best customer journey and make the best decisions. Businesses can make credit-risk decisions using automation and advanced analytics. This will lead to more opportunities for credit and better financial inclusion. Harnessing the power of 'insight everywhere' for better knowledge bases. "The application of advanced analytics, artificial intelligence and machine learning is allowing businesses to tailor their services to an audience of one - at scale." Stay in the know with our latest research and insights:

*Stats from Experian Global Insights Research Read related content The evolution of data: Unlocking the potential of data to transform our world Be more open: Results of the 2021 Open Banking survey - Experian Academy Full text: The future of consumer lending in a digital economy With the advanced technologies available today, businesses can access relevant data and deliver on customer expectations in their moment of need. As more people go online and use digital channels, your business must do more to create a seamless and secure experience. Online activity has increased by 25% globally Online retail sales saw 4 years of growth in 12 months Now online, consumers have high expectations for digital experience without sacrificing security, convenience, and privacy. 64% of consumers have abandoned an online transaction in the past 12 months Consumers, regardless of age, now prefer online banking and payments over in-person transactions The future of credit and fraud risk management is integrating data and technology seamlessly to put the customer at the centre of it all. 74% of businesses are adopting AI (2021), up from 69% the year before Businesses can embrace customer-centricity at scale through: Behavioural biometrics within a layered strategy of defence to make it easier to tackle fraud and maintain a seamless customer journey Open source data so businesses of all sizes can build a view of potential customers, minimise credit risk, and bring more people into mainstream financial services Advanced analytics, AI, and machine learning for real-time underwriting, fraud detection and a truly personalised service “The market is now driven by consumer demand for digital services. Those companies that are able to tailor the digital customer journey – so it reflects the best-in-class consumer experience – are the ones that will win.” – Steve Wagner, Managing Director of Global Decision Analytics

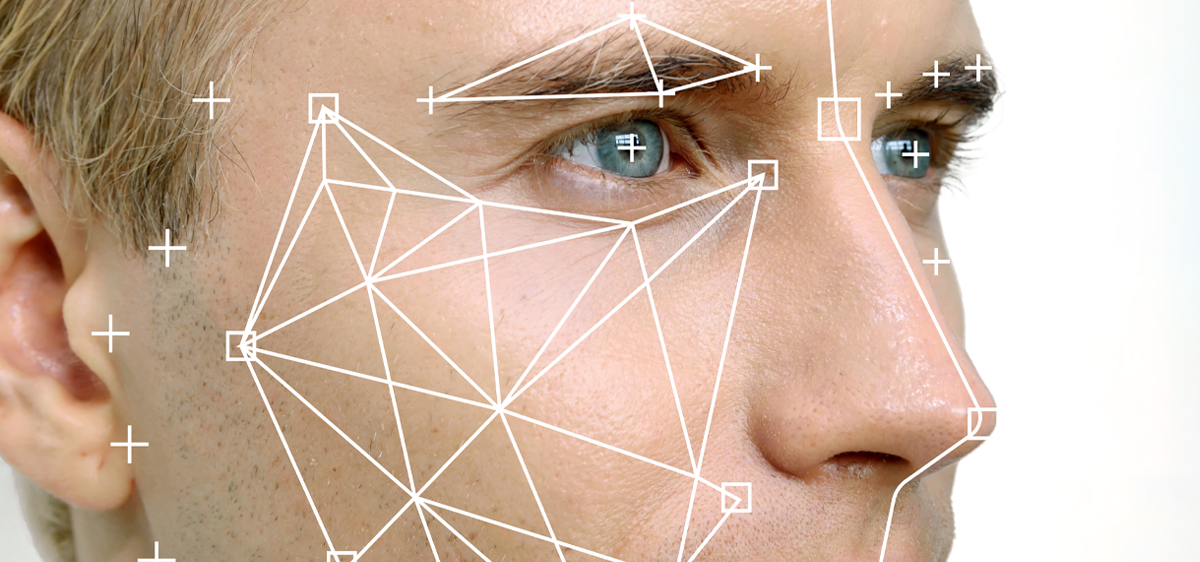

Mike Gross, VP of Applied Fraud Research & Analytics, takes a look at the seven top global fraud predictions for 2022. A new wave of deep fake synthetic identity fraud Fraud-as-a-Service is just a click away Real-time payments = faster fraud Fintech growth comes at a cost The two-fold reality of ransomware attacks Supply chain issues expand marketplace scams Digital identity’s convergence of identity verification and fraud detection Digital acceleration is transforming the way financial services providers connect with consumers. The rise of Fintechs, cryptocurrency, and embedded finance options from alternative lenders has changed the face of the financial services industry, and a secure but seamless customer experience has become the gold standard for businesses. Driving this demand is consumers, led firstly by a natural shift towards digital encouraged by disrupter technology providers and their easy-to-use products, and secondly by the pandemic-induced online boom. But with these changes come opportunities. And not always positive ones. As businesses grapple with how to keep up with digital demand from consumers, they are also dealing with an evolving fraud landscape, with online payment fraud losses alone set to exceed $206 billion between 2021 and 2025*. Fortunately, advancements in fraud detection and prevention methods have also accelerated, with machine learning and AI enabling businesses to keep pace with rapidly evolving fraudsters. But how have such rapid changes in the industry impacted criminal activity in this space? We look at seven key global fraud predictions for 2022. A new wave of deep fake synthetic identity fraud 2021 has seen a surge in deep fake identity fraud, and that looks set to continue. The development of AI to impersonate consumers’ voices and faces is becoming more prevalent, making it challenging for businesses to verify and authenticate identities. With recent advances in deep fake technology, fraudsters can leverage compromised identity data to bypass verification controls, and then either create new synthetic profiles with documents, facial images, and voice cloning to bypass identity authentication requirements for secure exchanges like government benefits sign ups. These deep fake tactics can impact businesses’ ability to recognize consumers across the entire lifecycle, but particularly at the point of enrolment and authentication. Detection and prevention of deep fake identity fraud involves applying a layered strategy of technical defenses along with a vigilant approach. Requiring identity data or documents in isolation is not sufficient. Organizations need to fight fire with fire by capturing digital and behavioral data to complement identity controls, then using AI and machine learning to analyze interactions and spot fraud. Fraud-as-a-Service is just a click away The use of automated bots by fraudsters to impersonate businesses and socially engineer their customers is also growing rapidly. As fraud controls become even more effective at thwarting traditional attacks, fraudsters see an opportunity to evolve their tactics and capitalize on advances in voice bots. In 2022 and beyond, a large portion of fraudulent transactions will be submitted by legitimate consumers who are being socially engineered to not only provide data, but to use their own devices to submit what they believe are legitimate transactions. Banks globally are already witnessing the start of this trend, as fraudsters can now purchase bots to contact consumers, impersonate their banks, retrieve one-time passwords, and forward those codes to fraudsters to complete fraudulent transactions. Historically, fraudsters couldn’t scale this type of attack to manage thousands of calls to consumer victims, but now they can just hire a bot that sounds and acts just like a bank reaching out to their customers. As a result of this success and the cost effectiveness of bots, fraudsters are expanding operations to impersonate every type of business, from retailers to government organizations. Real-time payments = faster fraud Faster money often means faster fraud. Real-time payments (RTP) increased by 41% between 2019 and 2020 and are set to rise again by 23% between 2020 and 2025*. From mobile payments all the way to Buy Now Pay Later, RTPs have provided ample opportunity for fraudsters to quickly monetize and cash-out – converting money to other forms of currency like crypto and then laundering the funds through multiple fraudulently-established accounts. The lack of regulation in cryptocurrency makes it an especially attractive target for fraudulent activity because attackers can more easily remain anonymous and funnel funds across currencies in mere seconds. Crypto exchange platforms have profited from the unregulated environment but are starting to pay the price when it comes to fraud losses. The speed of real-time payments presents unique challenges to businesses because they often can’t be revoked or easily traced, so detection can be more difficult. But the demand for RTP is only increasing, so consistent regulations need to be in place and organizations must be able to accurately verify and authenticate identities and transactions across channels in seconds to detect criminals preying on these faster payment methods. Fintech growth comes at a cost Buy Now Pay Later has exploded over the last year. Alternative lenders now dominate the retail landscape, embedding themselves in customer journeys, offering consumers fast and easy credit, and minimizing fraud liability for merchants. But these disruptive businesses offering tailored financial products based on vast amounts of customer data have the potential to leave the door wide open to criminals. A frictionless customer experience and easy-to-use technology has allowed these nimble businesses to attract millions of customers, and with it, huge volumes of fraud. According to Aite-Novarica Group, Fintechs have an average fraud rate of around 0.30%, which is double that of credit cards that average 0.15-0.20%. 2022 is likely the year that Fintechs put risk at the forefront of strategy. Without the right identity and fraud protections in place across their websites and apps, they not only risk fraud losses, but they could also damage brand reputation. And without quick, comprehensive fraud reporting back to the businesses they serve, they also risk enabling even more downstream fraud attacks. The two-fold reality of ransomware attacks As businesses experience extortion in the form of weaponized malware, the sophisticated nature of AI used in ransomware attacks is rapidly evolving, allowing attackers to be even more successful at extracting data and wreaking havoc. A business’s data is the primary commodity that the fraudsters use to negotiate ransom payments, but the stolen data of that business’s customers is often forgotten, which can be an even greater concern. This growth in ransomware and the availability of sensitive consumer and business data will not only drive attacks in 2022. It will likely change the nature and depth of those frauds using newly-available data such as business financials or consumer medical conditions or employment details in more pervasive attacks. Organizations falling victim to ransomware must understand all of the data that has been compromised and should notify its customers so they can take steps to prevent future identity or other fraud attacks. Supply chain issues expand marketplace scams We expect to see more issues with marketplace fraud as supply chain issues and inflation persist through 2022. Where there are supply gaps, fraudsters will meet the pent-up demand with products that don’t exist, scamming customers to part with money for nothing in return. In the current marketplace environment, it’s easy to set up a fake business with positive reviews. And because consumers have no way to verify the authenticity of a business, they roll the dice on what seems too-good-to-be-true, lose money, and then try to recoup funds from their financial provider. This is another area where BNPL providers will end up bearing responsibility for a lot of retail fraud in 2022, as they take on liability for the fraud and credit losses that fueled their rapid growth. Digital identity’s convergence of identity verification and fraud detection Password-free experiences led by the ubiquitous smartphone and the ability to make real-time payments has resulted in a demand for a seamless, uninterrupted customer journey. But central to all of this is identity authentication. As identity verification and fraud detection continue to converge, the big question is, how can a secure, consumer-friendly approach to digital identity be adopted and regulated, and by whom? The announcement of the European Digital Identity scheme shows that governments are beginning to move in this direction, but there is still a long way to go. As authentication and onboarding systems continue to be targeted by fraudsters, the bid to create secure, reusable digital identities to enable more seamless commerce and to mitigate fraud and criminal activity becomes more critical. This is a concept that is dominating the conversation and one that we expect to play a big role in fraud prevention in 2022 and beyond. *Juniper Research Stay in the know with our latest research and insights:

Transaction data is some of the most valuable data a financial institution holds. By understanding how and where customers are spending money, businesses can leverage that insight to provide exactly the right next service or cross-sell product that a customer will most likely use. With open banking, this data is becoming democratized. It allows customers to give other institutions and businesses permission to access the data, which helps mid-market lenders and fintechs compete on the same playing field as the larger banks. In addition to spurring competition and innovation, it offers the potential for greater financial inclusion to people who struggle to gain access to credit due to a lack of information on their financial track record. The impact of open banking can’t be understated. According to Accenture, it will account for roughly $416 billion in revenue across the top 20 economies once open banking is fully online. And that day is closer than you might think; a survey by Know-It revealed that 55% of UK credit providers said they plan to adopt open banking in 2021, while 93% of businesses expect to adopt the data-sharing initiative within the next 12 months. While open banking was created to give customers more control over their data, the ability for institutions to leverage shared data creates the potential for data-rich services that the industry is only starting to explore. The more that banks integrate data into their services, and the more that technology firms use data to offer financial services, the more the lines between the two will blur. The role of decision analytics in open banking The key to incorporating a successful open banking approach will be leveraging the right analytics tools for better decisions. Using real-time analytics and advanced decisioning logic so lenders can effectively leverage the data available through open banking initiatives. Here are five ways that decision analytics will enable open banking to create new credit opportunities for customers. Better risk models. Analytical models and scorecards are the lifeblood of risk analysis. Open banking makes it possible to gather far more transactional data to add to credit risk models to better understand the true risk of each customer. More accurate predictions. Transactional insight powered by open banking and decision analytics creates a deeper, fuller view into a customer’s financial profile at origination. By using advanced analytics to determine credit scoring, affordability, income verification and other factors, institutions can make more accurate predictions about how much a customer can reasonably afford to borrow and pay back when issuing credit. Fewer risky customers. By leveraging data from across institutions, lenders can also look beyond common metrics like credit scoring and income verification to dig deeper into a borrower’s background. Sophisticated decision analytics can uncover unseen red flags for a specific borrower that may require the lender to take action. Increased revenue. Looking beyond origination, open banking can help organizations leverage decisioning analytics on an ongoing basis to better understand the needs of their customers. By continuing to analyze their data, institutions can then identify more relevant cross-sell and upsell opportunities, increasing the lifetime value of the customer. They can also create customer cohorts that allow them to identify which segments will be more likely to accept specific promotional offers across the customer journey. Better customer experience. Open banking can use decision analytics to power automation so customers can get credit decisions faster. For example, an institution can leverage this ability to automatically approve credit upgrade requests from an app instead of requiring a customer to call or come into a branch. By making it faster and easier to make these types of decisions, customers will feel better about your brand and more likely to continue giving you their business. In addition, this automation reduces time-consuming tasks, allowing service staff to focus on more complex customer requests. What does it take to leverage open banking? By its nature, open banking requires large volumes of data from multiple sources so that businesses can make real-time decisions about creditworthiness and risk. Breaking down traditional data silos is central to powering analytics and increasing credit opportunities. For traditional banks relying on legacy, on-premises infrastructure to manage data, internal data silos may be a problem, limiting the use of the data available. Many of these institutions are turning to cloud solutions to reap the benefits of open banking. Cloud integrations enable automatic, daily updates and upgrades to maintain compliance. Data security is provided by the cloud vendor, not internal IT staff, so most importantly, the cloud makes it easy to reduce operational silos by connecting data through integrations, allowing businesses to maximize the potential of open banking. The future is open Open banking has the potential to revolutionize the way financial institutions and customers think about financial services. A modern decisioning solution can leverage data across the cloud to give you the power and flexibility to incorporate open banking into operations, turning complex data into actionable insight. Download the 2021 Open Banking Survey (EMEA) Stay in the know with our latest research and insights:

As holiday shoppers flood online to finish up last-minute gift-buying, there's a high chance that they're paying attention to not just product prices or shipping times but also the security of their transactions. In 2020, with many stores still closed down due to the pandemic, digital sales over the holidays increased by 20%. Though we're still awaiting figures from this year, all signs point toward an increase in digital transactions that's here to stay. But as online transactions have ramped up, so have consumer concerns about the safety of their online activities. The recent Global Insights Report showed that 42% of consumers are more worried now about online safety than they were last year. The concern is understandable—as more people head online, we've seen a record number of breaches. However, now more than ever, businesses need to integrate security into their customer experience, taking a layered approach that provides added protection without additional hassle. Heading into the new year, those that can show they prioritize security as part of the customer experience—and not adjacent to it—will earn the trust and business of a rapidly expanding online customer base. More activity, more risk We've been tracking consumer and business activity online over the course of the pandemic. Our most recent research, drawn from surveys done in October, reveals a 25% increase in digital transactions worldwide since the beginning of the pandemic. It's a figure that's remained constant, even as covid-related restrictions wane and people venture back out to physical stores and banks. This massive digital shift happened in response to a crisis. Businesses such as financial services, restaurants, medical organizations, and retailers suddenly experienced a flood of online business and digital demand. Their option: Respond or be left behind. But as the dust settles, the enormity of the shift and how fast consumers normalized digital behavior is quite astounding. Someone who may have never considered online grocery delivery now uses it regularly. People who habitually visited their bank branch may now bank on their mobile devices. The examples are infinite. Consumers that made the online shift did so initially for physical safety reasons. They didn't want to be close to crowds or strangers because of the virus. Online felt safer. But now that digital transactions are part of many people's daily activities, consumers are awakening to the risks of online transactions. Many may have already experienced a breached account or received a notice that their data was compromised. Indeed, we saw a significant increase in attacks over the year across industries. Ransomware attacks alone are on track to reach 700 million by the end of 2021, a 1,300% increase from the year before. Best practices for better online security in 2022 More consumers are transacting digitally, and that's good news—businesses can expand their reach, grow their revenues, and introduce new digital products. But the question is: How can you leverage the growth while still keeping customers safe—and importantly, not impeding, their online experience? The answer rests part in mentality and part in action. Let's start with the first. Understandably, security guidance in the past often split the onus of safety between the business and customer. Who hasn't reminded customers that they need good password hygiene, device security, and personal data practices, or they may put themselves at risk. Indeed, customers paid attention; they ranked security as their number one priority. But the days of relying on customer actions are over. Businesses that gain customer trust in the future will be those that empower customers to improve their security while actively working to ensure that even if customers fail—their systems do not. You can achieve this by: 1. Beginning everything with a security mindset Businesses need to make security part of their growth strategy. That way, when they do experience planned — or unplanned — surges in activity, their security systems scale to meet them. Coordinating security across functional teams in the event of anticipated demand increases is another smart way to keep customers safe as your business grows. For instance, if marketing is planning a major campaign to spur online purchases, then IT and security need to know about it ahead of time. 2. Developing a multi-layered security strategy There is no magic bullet for preventing cyberattacks, account takeovers, or data breaches. But you can create hurdles for bad actors at every single turn. Combining device recognition, document and identify verification, and behavioral identification makes it that much harder for cybercriminals to impersonate your customers. Our research shows that customers are increasingly willing to provide more personal information to businesses if it means increasing their online security. They're eager to double-down if you are. 3. Utilizing vendors that keep you competitive The security space is evolving rapidly, and it's difficult for individual businesses to mind their own digital operations and keep pace with cybersecurity trends. Fortunately, high-quality vendors can do that for you, providing updated systems, education on new threats, and access to emerging technologies that keep your company and customers safe. The added benefit of these best practices is that they improve the customer experience along the way. Our research shows that customer loyalty to specific online brands is dipping—61% say they're interacting with the same companies online, which is a decrease of 6 percentage points from the previous year. Add in supply chains issues that are impacting inventory, and consumers are primed to find alternatives to their favorite online businesses. But the problems we’ve faced during the pandemic don’t have to define our digital future. Combine security with a quality experience in 2022, and you can attract and retain online customers that come for your product or service and stay because they feel safe. Stay in the know with our latest research and insights:

Historically, identity graphs were used to drive marketing for businesses, allowing marketers to understand and target their audience with relevant content. But in recent years, identity graphs have emerged as a useful tactic to help businesses detect and prevent fraud due to the magnitude of data they collate and analyse. As fraud continues to evolve, businesses need to get creative and resourceful when it comes to fighting online fraud to keep pace with the fraudsters. Identity graphs allow businesses to map multiple data points to create individual customer profiles while highlighting connections across all customer profiles in their current portfolio. Download our latest Global Identity and Fraud Report How do identity graphs work? Identity graphs are databases that create a consolidated unique customer profile. Information is collected from different platforms, both online and offline, and merged into a single view. This process of gathering and merging information is known as identity resolution. The primary goal of identity resolution is to create a real-time, holistic view of an individual. How identity graphs can be used across different types of fraud Account Takeover: Identity graphs make it simple to tell when the same individual is logging into multiple accounts or when all data associated with a particular user account suddenly changes. Identity graphs can screen customer accounts that are suspected of having been compromised by takeover attacks. Credit Card Fraud: Identity graphs collate data from both online and offline means. Having access to this data can be hugely beneficial in preventing counterfeit credit card transactions. Identity graphs will map common links between cardholders and data such as point of sale locations or historic transactional behaviour. Understanding these behaviours means identity graphs can uncover suspicious transactions, helping to expose compromised credit cards and prevent fraud. Referral Fraud: Many businesses offer reward incentives to their customers to help drive engagement. While good intended, businesses that offer referral rewards may expose vulnerabilities to referral fraud. In referral fraud attacks, fraudsters will take advantage of the offered rewards without ever meeting the conditional requirements. Identity graphs make it possible to uncover referral fraud, for example, highlighting multiple referrals from one household. Gaming Fraud: Fraudsters will make multiple online gambling accounts to take advantage of any sign-up offers the vendor may offer. Likewise, fraudsters will often use multiple accounts to bet against themselves, ensuring they always win. Identity graphs can help track and highlight these instances flagging relationships between the multiple accounts. Synthetic ID Theft: Recently fraudsters have been turning to synthetic IDs to commit fraud, as opposed to sourcing legitimate IDs as per traditional identity theft. Fraudsters will combine personal data from multiple victims to create a new, non-existent identity that they can then use during online transactions. These new personas, and the inconsistencies they contain, can be easier spotted when identity graphs are applied. Anti-Money Laundering (AML): When fraudsters illegally obtain funds, they will recruit individuals to pass these funds from one source to another, making their origin hard to trace. Identity graphs can help organisations track financial transactions, providing a clear image of the journey the funds have taken, all the way from origin to destination. Innovative ways identity graphs are helping to detect and prevent fraud Cross-device Identification: Identifying customers through PII and digital data, through both deterministic and probabilistic matching, allows organisations to better identify the same user across multiple devices. This allows them to be treated as a single entity, highlighting suspicious anomalies in behaviours. Real-time: Our digital world is notoriously fast paced, and not known for standing still. Identity graphs operate by collating data and updating the associated customer profiles in real-time. Ensuring we always make decisions on accurate and up-to-date customer information is crucial for both regulatory and risk reasons. Fraud Rings: Identity graphs collect and link a vast magnitude of data. Examining each data point in tabular form can be a laborious task for investigators and spotting suspicious connections can prove difficult. When connections are presented within a graph, they can easily present powerful insights that can uncover fraud rings that could otherwise be missed. Stay in the know with our latest research and insights:

Did you miss these November business headlines? We’ve compiled the top global news stories that you need to stay in-the-know on the latest hot topics and insights from our experts. Online retailers work to turn pandemic buyers into loyal customers Digital Commerce 360 cites that only 73% of U.S. consumers say they're loyal to the brands they shopped with before the pandemic, down from 79% last year, according to Experian's latest wave of Global Insights research. So what does this mean for businesses? Donna DePasquale on Using Tech to Modernize Financial Services In this podcast, Donna DePasquale, EVP Global Decisioning Software, talks to eWeek about how the use of data analytics has evolved in the financial sector, the challenges involved, where we are at now, and what the future might look like. Was that for real? Delving into the deepfake reality Digital Journal spoke to David Britton, VP of Industry Solutions, on deepfake learning benefits and risks, focusing on how bad actors can deceive or manipulate consumers and businesses - and what they can both do to mitigate the dangers. Experian Finds 25 Percent Increase in Online Activity Since Covid-19 Business Information Industry Association looks at Experian's latest research and why the pandemic-accelerated increase in digital transactions is here to stay and how businesses must continue to transform their operations as they head into 2022. Stay in the know with our latest research and insights:

What increasing expectations of the digital customer experience mean for your business and technology investment Economic recovery and waning customer loyalty are creating new opportunities 59% of businesses globally say they’re mostly or completely recovered from the pandemic 61% of customers engaging with the same companies they did a year ago, down 6% in twelve months Data, analytics and decisioning technologies help provide customers with a secure and convenient digital experience Consumers are prioritising security, privacy and convenience when engaging online 75% of consumers feel the most secure using physical biometrics Scalable software solutions give companies of all sizes the ability to better manage risk and digitally transform the customer experience 50% of businesses are exploring new data sources 7 in 10 businesses say they’re frequently discussing the use of advanced analytics and AI, to better determine consumer credit risk and collections 76% of businesses are improving or rebuilding their analytics models “Dwindling customer loyalty along with heightened customer expectations and increased competition could mean potential revenue loss or gain. Businesses must find integrated credit and fraud solutions to improve digital engagement and customer acquisition.” Steve Wagner, Global Managing Director, Decision Analytics, Experian We surveyed 12,000 consumers and 3,600 businesses across 10 countries as part of a longitudinal study that started in June 2020 Read the full report to find out where businesses are focusing their investments

In this eSpeak podcast, eWeek’s James Maguire talks to Donna DePasquale, EVP of Global Decisioning Software, about the use of technology in financial services, and how it can satisfy the ever-increasing demand for real-time intelligence. Listen to the podcast to hear Donna DePasquale discussing: Data and decisioning challenges involved with helping financial institutions reduce risk Helping lenders make better decisions about their customers by providing simplified and streamlined services. Consumers have more choice than they’ve ever had before when it comes to credit, this, along with high expectations for their online experience, is driving businesses to invest in digital transformation and automation solutions. Growing diversity among populations in terms of spending means financial services are working to provide more personalised, real-time, meaningful experiences. Consumers want secure and convenient experiences online without compromise. Evolution of data technology Businesses can now deploy new types of analytics and new types of data services in order to serve customers. Digital transformation allows automation and insights to work together improving credit risk analysis and assessment, smoothing out the customer journey throughout the lifecycle. Access to new data types and advanced analytics. AI and analytics is not a static process, it’s a dynamic process. AI and machine learning allow for constant updates and enhancements to strategy. Future of data analytics and the credit markets Financial inclusion is a very important to the future of data analytics, especially when thinking about those growing economies around the world. We believe that all consumers deserve fair and affordable access to credit, and using alternative data sources to improve credit profiles will directly impact this. Customer experience and credit risk analysis should coexist seamlessly – asking clients to do less without sacrificing the security, convenience, relevance, and privacy of consumer experiences. Stay in the know with our latest research and insights:

It’s no secret that the pandemic created a level of economic uncertainty that makes it incredibly tricky for lenders to understand their risk on a customer-by-customer basis, and therefore its impact on decision management. It’s no wonder they’re uncertain; the customers themselves are just as unsure. According to the Global Decisioning Report 2021, one out of every three consumers worldwide are still concerned about their finances even as the second anniversary of the COVID-19 outbreak approaches. While some consumers were able to easily work from home during the pandemic, others suffered job losses, cut wages, or increased expenses due to lost childcare or having to care for a loved one. As the impact of the pandemic continues to be felt – especially as government support programs begin to conclude – financial institutions will have to figure out how to navigate the uneven recovery. By leveraging advanced data and analytics, financial institutions can better understand their risk and improve their decision management. In turn, many financial institutions are creating predictive models to target their best customers and reduce exposure to unnecessary risk. However, a model is not always the end-all, be-all solution for reducing risk. Here’s why: a model requires of the right data in order to work effectively. If there isn't a data sample over a long enough time frame, the risk of creating blind spots that can leave businesses on the hook for unexpected losses can be high. Also, there will always be the need for a strategy even with a custom model. A global financial institution likely has more than enough data to create accurate, powerful custom models. However, financial institutions like local or regional credit unions or fintechs simply don't have enough customer data points to power a model. In addition, many outsourced model developers lack the specific financial industry domain expertise required to tweak their models in a way that accounts for the nuances of regulations and credit data. Finally, the pandemic continues to change the economic picture for customers by the minute, which can make a model designed for today outdated tomorrow. When a strategy makes more sense For many financial institutions, it can make more sense to focus on building out a decision management strategy instead of leveraging custom models. While a model can provide a score, it can’t tell you what to do with it. By focusing on a decision management strategy, you can leverage other information and attributes about different customer segments to inform actions and decisions. In an ideal world, of course, the choice wouldn't exist between a model and a strategy. Each has an important role to play, and each makes the work of the other more effective. However, strategy is often the smart place to start when beginning an analytics journey. The benefits of starting with strategy include: Adaptability: A strategy is much easier to change than a model. While models often have rigorous governance standards, a strategy can be adapted with relatively little compliance impact. This helps businesses adapt to changes in goals, vision, or shifts in the marketplace in a bid to attract the ideal customer. In a world that changes by the day, the ability to adjust risk tolerance on the fly is crucial. Speed: A custom model can take weeks or even months to build, test, deploy, and optimize. As a result, this can put businesses behind in analytics transformation while leaving them unnecessarily exposed to risk. On the other hand, a strategy can be developed and deployed in a relatively rapid manner, and then adapted on an ongoing basis to reflect the realities on the ground. Consistency: A strategy helps drive improvement across operations by allowing team members to ‘sing from the same songbook,’. In smaller organizations where work is still done manually by a handful of people, a strategy allows for automated processes like underwriting so businesses can scale decisioning. Strategy or model? Three questions to consider Do you need a strategy or a model? Again, in an ideal world the answer is ‘both’ due to the unique role each plays, but in the real world it depends on the institution. Here are three questions to ask in order to determine where to focus time and resources: “How different are the people I am lending to than the national average?” If the institution is lending to segments that look just like everyone else, leveraging existing third-party data sources will allow the use of generic models. In this case, the focus would be on using those generic models to power the strategy. However, for businesses that serve a niche population, a national average might skew results; in this case, it may make more sense to build a custom model. “What is my sample size?” Take a close look at the number of applications coming in each month, quarter, or year. In addition, compare it to periods dating back years to understand growth rates. This will indicate the if the data inflow required exists to power a custom model. Don’t forget to analyze how many of those applications eventually become delinquent; because some smaller financial institutions have conservative policies, they may have low delinquency rates. While this is good for the institution’s bottom line, it can make it difficult to build a model that will be able to detect future delinquencies. Therefore, even a large application sample size might not have enough variance to create an accurate custom model. “What are my long-term future goals?” This is the most difficult question to sometimes answer, as many financial institutions remain focused on navigating today’s challenges. As market conditions change, goals naturally adapt. That said, some goals might require custom models in order to effectively achieve the business vision. For example, if the plan is to enter new markets, create new partnerships, or offer new products that are different than what has been done in the past, a custom model could provide a more accurate understanding of potential risk. Our research also shows that nearly half of businesses report that they are dedicating resources to enhancing their analytics, with one-third of businesses planning on rebuilding their models from scratch. Rapid changes in consumer needs and desires means there’s less confidence in consumer risk management analytics models that are based on yesterday’s customer understanding. By focusing on a decisioning strategy, businesses can be empowered to effectively leverage analytics today to take action while creating a steppingstone for more sophisticated model-based analytics tomorrow. Stay in the know with our latest research and insights:

What is a deepfake? Fraudsters can distort reality by manipulating existing imagery to replace someone’s likeness. How does AI deepfake technology work? Artificial neural networks are computer systems that recognise patterns in data. A deepfake can be created by feeding hundreds of thousands of images into the artificial neural network, which tarins the data to identify and reconstruct face patterns. Adoption of more advanced AI means less images and videos are needed allowing fraudsters to use these tools at scale. How to detect a deepfake Jerky movement. Shifts in lighting from one frame to the next. Shifts in skin tone. Strange blinking or no blinking at all. Poor lip synch with the subject's speech. What businesses can do Use emerging authentication technology in video. Deploy AI and machine learning to detect deepfakes. Apply a layered fraud defence strategy to better identify deepfakes.

The pandemic accelerated the number of digital interactions in finance. Typical methods of managing finances, connecting with lenders, and buying goods and services were much harder due to lockdown measures, so consumers went digital, including large numbers of non-digital natives. As the demand for online banking and services has intensified – moving from a necessity to a preference for many - pressure on businesses is twofold. They must rapidly build new and better models to onboard customers and create a more dynamic customer journey. In many markets, doing so is the biggest competitive differentiator right now. Creating a dynamic digital journey and understanding the customer With Millennial customers becoming a bigger influence in the space, organizations were always going to have to plan for a slicker and quicker digital customer experience to keep up with expectations. The pandemic simply accelerated this, forcing businesses to rapidly react. In fact, although 9 in 10 businesses have a digital customer journey strategy, 49% of those businesses only put this in place as Covid-19 began according to research in our Global Decisioning Report 2021. This did help them improve in some areas, including access to quicker customer service responses online. But without the right technology in place, it is not surprising that 55% of customers surveyed said they expect more from their digital experiences. Such a rapid shift has exposed weaknesses around agility, leaving traditional institutions trailing Fintech competitors further down the digital transformation road. However, whilst Fintechs have the benefits of agility, traditional, established lenders have large amounts of customer data from which they can target and tailor existing customer journeys more effectively. Improve the digital onboarding process Optimizing the digital experience for new customers from the beginning encourages usage and, ultimately, loyalty. A stress-free and fast onboarding process is an expectation for the younger generation but can also capture the ‘new to digital’ group migrating online. Bio-metric recognition technology, instant document verification, and auto-filling customer data are far more appealing than entering hundreds of data points, and can boost efficiency and reduce friction. The problem is businesses rightly want to make sure they can remove any bad actors to reduce risk and prevent fraud. The key is doing so without disrupting the genuine, low risk customers. Building better models to onboard customers Covid continues to shift population demographics due to factors such as job losses, furlough schemes and migration of workers to alternative sectors. There is also the realization of pent-up demand for property and vehicles, in particular - among those fortunate enough to be less impacted - such as those able to save more as they work from home. This has led to a change in the demand for finance with a need to tailor experiences to specific customer requirements. As the number of credit needs grow, lenders must have a structure in place that allows them to scale and handle the increased volume. New models must also be introduced to allow organizations to access extensive data insights and ensure they are reflecting the ‘new normal’. As businesses move away from sampling towards models that are based on full populations there must be a marriage of technology with data. Data is ultimately captured for the benefit of the lenders, helping them to gauge risk and tackle fraud. But a blended, multi-layered approach in which customers are only asked for the information specific to their individual circumstances – at the appropriate time – can provide a positive and tailored onboarding process. Having solutions in place that combine risk-based authentication, identity proofing, credit risk decisioning and fraud detection into a single platform ensures all checks can be carried out in one place with minimal disruption to the onboarding journey. Putting businesses in first place Online experience and credit and fraud risk management need to be more closely entwined. As the demand for a simple and fast experience intensifies, a digital-first approach that puts businesses ahead of the game must involve embracing the right technology that supports the entire customer journey. Download a copy of the eBook here. Stay in the know with our latest research and insights: