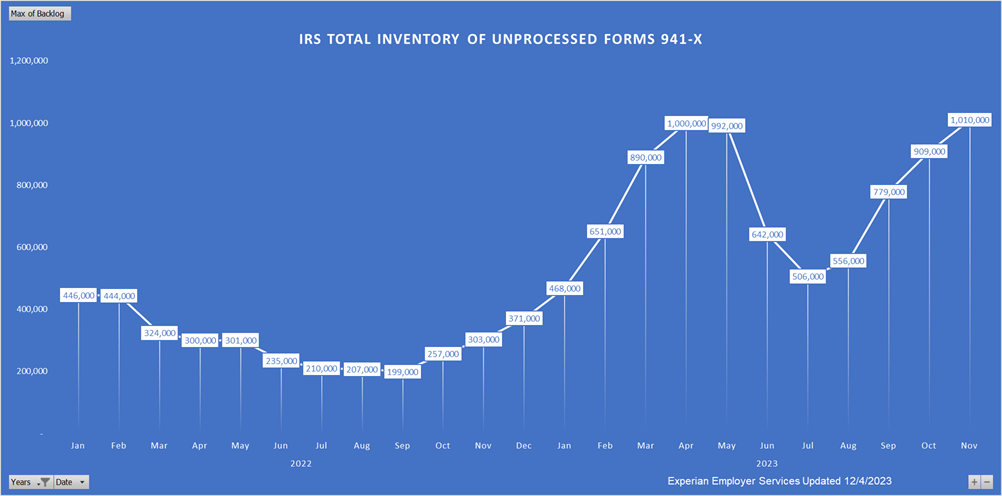

At the end of November, the number of unprocessed Forms 941-X at the IRS, most of which represent ERC claims, reached 1.01 million. This is the highest backlog number since the IRS began reporting the volume in 2021. This volume has increased by almost 300,000 since the IRS announced a moratorium on ERC processing on September 14.

The National Taxpayer AdvocateErin Collinstold Tax Noteson December 1, “TheIRS’sERCclaims processing has been a mess. Since the inception of the credit, theIRShas struggled to timely process claims.” These delays can have significant repercussions according to Collins. “The bottom line is that employers that filed legitimate claims are being forced to wait far too long and potentially are enduring financial hardships as the IRS tries to separate out the valid claims from those not eligible or potentially fraudulent,” added Collins.

These concerns were echoed in a letter dated December 1 to IRS Commissioner Danny Werfel from five Democrat members of Congress from the Colorado delegation. The Representatives said that they were writing “to express concerns surrounding the current moratorium on Employee Retention Tax Credit (ERTC) claims and the potentially damaging impact this pause may place on Colorado businesses and workers.” While Werfel noted in the moratorium announcement that processing times would be extended from 90 days to 180 days, the Representatives note that “However, many employers in Colorado have yet to hear any update on the status of their ERTC claim. Businesses have contacted our offices regarding applications submitted in 2021 that have still yet to receive a response.”

Tax Notes also reported that on December 1, an IRS official said that the IRS had not decided whether the ERC processing moratorium would end on December 31.

The September moratorium announcement included previews for an ERC withdrawal option for taxpayers who had filed claims but had yet to receive payment and an ERC claim settlement option for taxpayers who had already received ERC refunds but now wished to reverse those claims. Details on the withdrawal option were published on October 19. On October 24, Commissioner Werfel told reporters that the details for the settlement program would be completed “in the coming weeks.”