At A Glance

As commerce media reshapes digital advertising, the line between first- and third-party onboarding is blurring. Whether you’re activating data for your own campaigns or helping partners reach new audiences, how that data is used matters more than ever. This article explores what happens when first-party data becomes third-party, how the new environment changes activation, and how Experian helps brands navigate it all with privacy-led identity, efficient modeling, and seamless ecosystem connections.In this article…

In the past, first-party onboarding focused on activating a brand’s own customer data, while third-party onboarding allowed advertisers to tap into external audiences. But the rise of commerce media networks (CMNs) — which now influence over 14% of all digital ad spend — has blurred those once-clear lines.

CMNs, retail media ecosystems, and brand partnerships are reshaping how data is shared, accessed, and activated. Today, the question isn’t just who owns the data but why it’s being used. Whether to strengthen customer relationships or create new revenue opportunities, intent now shapes how data must be governed, shared, and measured.

For brands with strong first-party data, this shift creates opportunities to deliver more personalized, privacy-safe campaigns to their own audiences and to extend that data’s value by enabling partners to reach new segments.

In this connected ecosystem, data onboarding enables brands to activate, scale, and monetize their data responsibly, turning first-party insights into privacy-led growth opportunities. Trusted onboarding partners like Experian can help marketers activate first-party audiences with accuracy while scaling and connecting those audiences across the ecosystem for compliant, revenue-generating collaboration.

What is data onboarding?

Data onboarding moves offline consumer data — like CRM records, loyalty details, or transaction histories — into digital environments for activation and measurement. It connects real-world insight with digital engagement across display, social, search, connected TV (CTV), and commerce media. Data onboarding is now a strategic pillar for marketers managing signal loss, disconnected data, and rising privacy expectations.

The approach you take and who owns the data determine what kind of onboarding it is:

- First-party onboarding: A brand activates its own customer data across digital platforms.

- Third-party onboarding: A brand enables others to use its data, often monetizing it — common in CMNs or commerce media ecosystems.

Experian helps marketers succeed in both models. With AI-driven identity resolution, persistent identifiers, and privacy-first infrastructure, we make onboarding accurate, compliant, and scalable, regardless of who owns the data.

Why do marketers need data onboarding?

Even the most data-rich brands often have a limited view and reach when it comes to their audiences. They’re confined to the data they collect directly and to the owned channels they use to engage those people. Customer files may reveal who’s already in the ecosystem, but not always where those people spend time, how they behave across channels, or why they make certain decisions.

Onboarding bridges that gap. It transforms offline data into digital activation power, allowing marketers to connect insight with action. Experian makes this possible at scale with trusted identity resolution, data ranked #1 in accuracy by Truthset, audience modeling expertise, and seamless data integration across platforms, helping marketers activate confidently and compliantly.

With Experian’s onboarding solutions, marketers can achieve:

- Unified customer identity across devices, channels, and touchpoints.

- Cross-channel personalization with consistent, relevant messaging wherever customers engage.

- Scaled, privacy-compliant reach beyond owned channels without sacrificing control or consent.

- Better insights and audience creation by blending first-party and Experian Marketing Data for a deeper understanding.

- Cross-channel activation with deep integrations into the advertising ecosystem.

Core steps in the onboarding process

While onboarding can vary across use cases, the core process remains consistent. Experian’s AI-enhanced identity infrastructure streamlines every stage of data migration and activation, making each step safer and faster:

- Data ingestion: Transfer the data into the onboarding environment using privacy-safe encryption and consented parameters to protect sensitive information responsibly from the start.

- Transformation: Cleanse, standardize, and format records to align with digital identifiers. This eliminates inconsistencies and makes every record easier to recognize and activate later.

- Identity resolution: Link offline identifiers (names, emails, addresses) to hashed digital equivalents like mobile advertising IDs (MAIDs), CTV IDs, and universal IDs via Experian’s Offline and Digital Graphs. Identity resolution connects customers to their digital presence without exposing personal information.

- Identity matching: Match hashed emails, MAIDs, and device-graph identifiers to activation partners for each audience across demand-side platforms (DSPs), social, and CTV platforms. This expands your audience reach while maintaining accuracy and privacy.

- Activation: Deliver privacy-safe audiences to DSPs, social, search, or CMN shelves from third-party data providers (not the CMN’s own data) — or directly to an advertiser’s seat for immediate activation. You’ll turn insights into action and be able to reach the right people with relevant, compliant messaging.

Behind this flow is Experian’s identity graph, which links 250 million U.S. individuals, 900 million hashed emails, and 4.2 billion digital identifiers refreshed weekly. It’s the foundation that keeps onboarding accurate as the signal landscape shifts.

First-party vs. third-party onboarding

Every digital marketing data point has a story, but whose story it tells depends on who’s using it. That distinction defines the difference between first-party and third-party onboarding. Both are essential to modern marketing, but they carry different expectations for control, consent, and accountability.

First-party onboarding: Activate your own data safely and strategically

First-party onboarding starts with the data a brand earns directly from its own customers through trusted relationships. This data belongs to the brand, as customers have given consent, and the brand has the responsibility (and opportunity) to use it well.

That data might include:

- CRM records

- Loyalty-program data

- Purchase or transaction histories

- Website or app interactions

- Email subscribers or reward members

How first-party onboarding works in practice

The onboarding process connects this offline data to digital identity so marketers can reach their existing customers across channels.

For example, a credit card company might take its CRM file of cardholders, hash the email addresses, and upload that file to a DSP via Experian’s Audience Engine. Experian’s identity graph resolves those emails to privacy-safe digital identifiers like MAIDs, CTV IDs, or universal IDs. The result is a ready-to-activate audience that can be reached on CTV, social, and display without exposing raw personally identifiable information (PII).

Why control matters in first-party onboarding

The advantage of first-party onboarding is control; the brand decides what to share and how to use it. It’s a powerful way to:

- Personalize messages for known customers

- Re-engage lapsed buyers or loyalty members

- Suppress existing customers from prospecting campaigns

- Measure performance with closed-loop attribution

Doing first-party onboarding responsibly

That control comes with responsibility. Even consented customer data that has been consented to can pose risks if handled carelessly or shared with unverified partners. Experian’s First-Party Onboarding sits on a privacy-first identity foundation, governed by decades of compliance leadership under laws like the Gramm-Leach-Bliley Act (GLBA) and Fair Credit Reporting Act (FCRA).

We connect data and identity responsibly, so marketers can activate with confidence while protecting consumers.

Why first-party onboarding matters

First-party onboarding is the cornerstone of responsible marketing. It allows brands to deepen relationships they already have, using data that customers have freely shared. And with Experian’s secure First-Party Onboarding, that data stays encrypted, compliant, and under the brand’s control from start to finish.

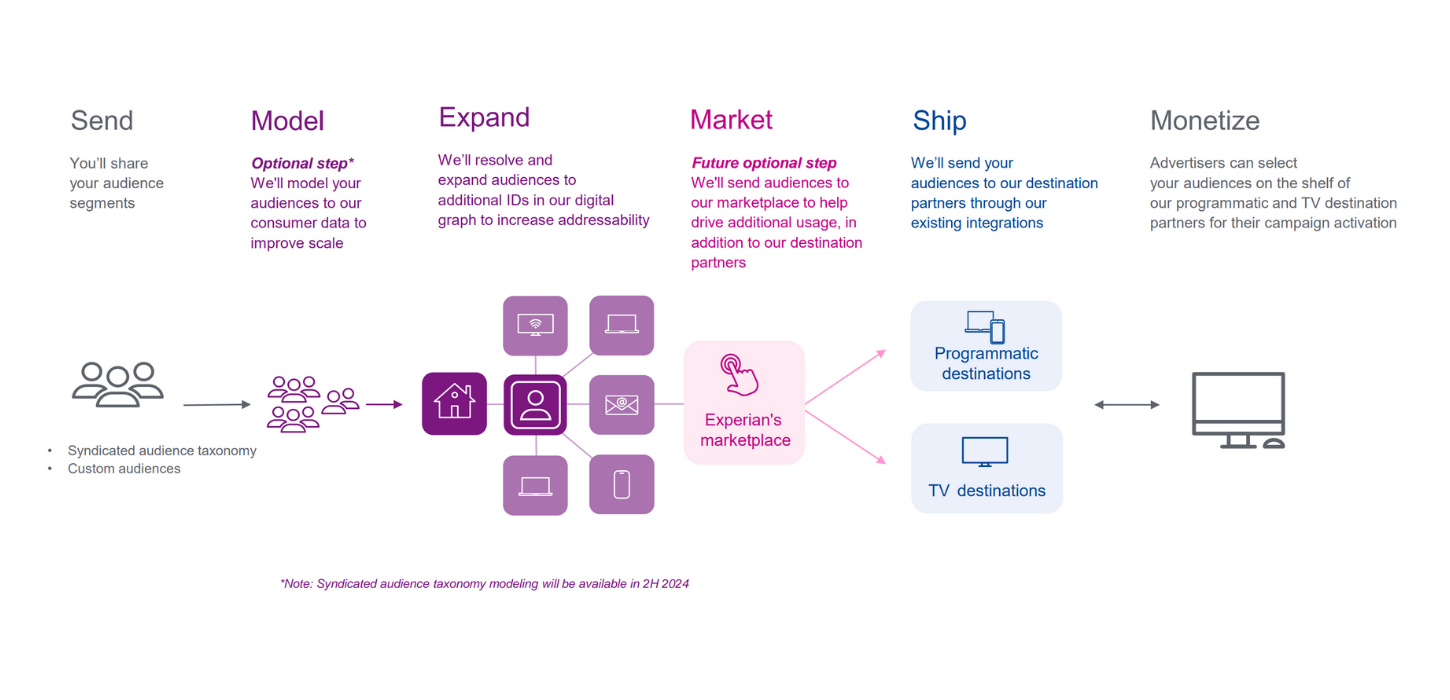

Third-party onboarding: Share and monetize data responsibly

Third-party onboarding begins when a brand allows someone else to use its data. It’s how data providers, publishers, and especially CMNs monetize their audiences — turning first-party customer insights into addressable, privacy-safe segments that advertisers can buy and activate across digital channels.

How third-party onboarding works in practice

Think of it as data collaboration at scale. Let’s say a retailer collects first-party shopper data like product purchases, loyalty card usage, and store visits. Then, they partner with Experian to make that audience available to outside advertisers, such as a consumer packaged goods (CPG) brand.

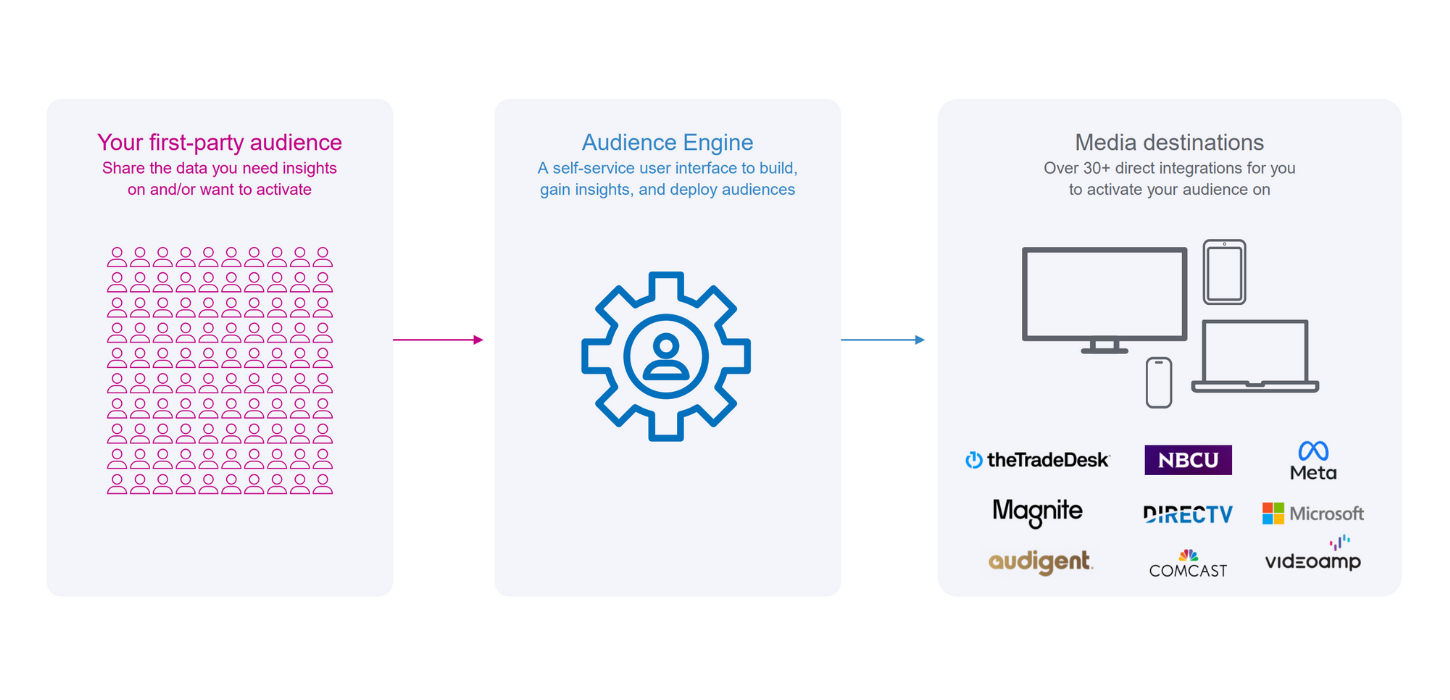

Through Experian Third-Party Onboarding, those audiences are resolved, privacy-protected, and distributed to integrated destinations such as The Trade Desk, Magnite, or NBCUniversal for activation.

- To the retailer, it’s their first-party data.

- To the CPG, it’s third-party data they can use for targeted campaigns.

- To Experian, it’s an opportunity to ensure the entire exchange is accurate and compliant.

Why scale matters in third-party onboarding

The benefit of third-party onboarding is scale. It enables data owners to monetize their insights, while giving advertisers access to richer audiences they couldn’t build on their own. It’s the engine behind CMNs, commerce media, and the growing data-sharing economy.

With a partner like Experian, that scale becomes even more powerful. Our advanced modeling and identity solutions help brands expand their audiences responsibly using lookalike and predictive modeling to identify high-value segments, increase reach, and maximize performance across every activation channel.

The responsibilities of data sharing in third-party onboarding

As data ecosystems grow, so does the opportunity to collaborate responsibly. Once data leaves its original owner’s ecosystem:

- Consent obligations become more complex.

- Control over downstream usage can blur.

- Regulatory oversight increases, especially around transparency and consumer rights.

With the right governance in place, these responsibilities can help strengthen partnerships, protect consumers, and create a foundation for sustainable growth.

Experian’s ethical enablement role in third-party onboarding

Experian’s enablement role is both technical and ethical. Our deep expertise enables us to partner with brands and support their monetization efforts, helping them derive new value from their data while maintaining the highest standards of privacy and compliance. Meanwhile, our infrastructure ensures third-party data onboarding happens securely and transparently:

- Identity resolution expands reach without overexposing identifiers.

- Data verification and governance ensure partners meet strict privacy standards.

- Revenue-share structures maintain fairness without hidden costs.

- Cross-channel integrations enable you to onboard your data once and activate it everywhere (programmatic, CTV, or social) through Experian’s 30+ direct and 200+ indirect destination partnerships.

Why third-party onboarding matters

Third-party onboarding is the foundation of modern data collaboration. When done through Experian, it becomes a trusted extension of your brand’s identity governed by the same privacy, consent, and accuracy standards that strengthen your first-party ecosystem. We help brands uncover new opportunities for growth, partnership, and responsible innovation.

When first-party onboarding turns into third-party onboarding

When data ownership shifts, privacy expectations change, and the rules of onboarding start to look a little different. This stage can feel complex, but with the right approach, the crossover becomes clear. It’s a natural evolution that helps brands connect data more effectively and collaborate confidently.

Here’s what that can look like in practice. A retailer uses its own first-party data to engage loyal shoppers through its website, app, or email program. The data is secure, consented, and fully under the retailer’s control. Then comes collaboration. The retailer decides to partner with a brand, like a CPG company, to reach those same shoppers across connected TV or the open web.

In that moment, the retailer’s first-party data becomes the CPG’s third-party data. Ownership doesn’t really change, but accountability does, along with new privacy and compliance considerations.

This “crossover moment,” when first-party onboarding turns into third-party activation, is a small shift with big potential that can lead to new reach, deepen collaboration, and strengthen customer connections across the marketing ecosystem when managed responsibly.

Why clarity matters in the crossover between first- and third-party onboarding

When data starts flowing beyond owned channels, questions naturally come up. Marketers want to know things like:

- Who “owns” the audience once it’s shared with a partner or DSP?

- Whose privacy notice applies — the retailer’s, the brand’s, or both?

- How do we keep match accuracy without overexposing PII?

- Who’s responsible for opt-outs and suppression compliance downstream?

These are the right questions to be asking, and they’re signs of a mature, data-driven strategy. Asking them is what helps brands strengthen governance, build trust, and get more value from collaboration. With the right framework in place, what could feel complicated becomes clear, opening the door to more confident growth across CMNs and other shared-data environments.

How Experian brings clarity and control to the first- and third-party onboarding crossover

As a neutral, privacy-first partner, we provide the infrastructure that keeps data secure, compliant, and meaningful wherever it flows. Our onboarding solutions help both sides of the partnership — retailers and advertisers — maintain trust through:

- Clear ownership and consent management: Experian enforces data-handling rules that preserve each party’s control. Every record is matched and activated in accordance with strict consent parameters and Global Data Principles that exceed industry standards.

- Accurate, privacy-safe identity resolution: Our Offline and Digital Graphs connect people to their devices, households, and behaviors using hashed identifiers, ensuring match precision while protecting individuals.

- AI-powered contextual intelligence: Experian’s AI models analyze real-world behavior and contextual signals to enhance match quality and extend reach without reliance on cookies. For CMNs, that means better off-site activation, targeting the right shoppers in the right environments while maintaining compliance.

- Trusted integrations and transparent reporting: With direct integrations into 30+ programmatic and TV destinations, Experian delivers consistent match rates and unified measurement through solutions like Activity Feed and Experian Outcomes.

This is how Experian transforms complex data challenges into seamless, scalable collaborations that give marketers the confidence to expand responsibly into commerce media and commerce ecosystems.

The new standard of responsible AI and commerce media

Commerce media represents the future of audience activation, but only if the transition is managed responsibly. As the lines blur between data ownership and activation rights, Experian’s AI-driven, privacy-first identity framework acts as the connective tissue between retailers, brands, and platforms.

We help CMNs:

- Enrich shopper data with Experian Marketing Attributes for deeper insights.

- Extend addressability off-site using privacy-safe identity resolution.

- Optimize activation through real-time, contextually aware audience expansion.

- Measure results transparently through privacy-compliant feedback loops.

In short, we ensure that when your first-party onboarding becomes third-party activation, trust and performance stay intact.

Why choose Experian’s onboarding solutions?

Many view onboarding as a data transfer, but we treat it as a trust process where accuracy, privacy, and performance align. Here’s why marketers choose us:

1. Unmatched data and identity foundation

When brands struggle with incomplete or siloed customer data, Experian’s unified foundation connects fragmented records into a single, accurate identity.

Our Offline and Digital Graphs link households, individuals, and devices with persistent accuracy. Updated weekly and built on decades of historical data, our graphs maintain 97% household coverage across the U.S., even through signal loss.

2. Privacy-first and compliance-led

Given tightening regulations and growing consumer expectations, privacy compliance is essential. With decades as a regulated data steward, we apply the same rigorous controls from our financial operations to marketing data.

Every data partner is verified for transparency and compliance with consent requirements, and all consumer data is governed by Experian’s Global Data Principles, which exceed industry standards. We help brands meet their privacy and consent obligations confidently while maintaining the data integrity that drives results.

3. Real-time, contextual activation

Experian’s industry-leading Offline and Digital Graphs are widely adopted across the advertising ecosystem, powering identity resolution and audience activation for the world’s top marketers. Our integrations span 30+ direct and 200+ indirect activation platforms, including leading DSPs, CTV networks, and commerce environments.

With real-time, AI-driven contextual intelligence, Experian enables privacy-safe targeting even in signal-limited environments through solutions like Contextually-Indexed Audiences that deliver reach without reliance on cookies or personal identifiers.

4. Platform flexibility

Modern marketing requires interoperability. Experian’s onboarding framework is technically integrated across multiple platforms, offering brands and data providers the freedom to activate where they choose.

Whether through self-service onboarding in Audience Engine for first-party data or managed onboarding for third-party monetization, Experian scales with your organization, providing transparent pricing, seamless delivery, and dedicated support teams to ensure every connection performs.

5. Human-centered innovation

Marketing should strengthen relationships and build trust. Our AI-driven identity systems are designed to protect privacy, respect individuals, and create real human value — helping brands connect with people meaningfully. They aren’t built to collect more data but to make better use of the data you already have by connecting insights responsibly and ethically.

Every innovation at Experian is guided by the principle of balancing personalization with compliance.

Top use cases for Experian’s onboarding solutions

Our onboarding solutions are transforming how brands operate across industries every day. Whether you’re deepening loyalty, expanding reach, or proving performance, Experian helps connect data responsibly to drive measurable results.

Here’s where we make the biggest impact:

- Automotive: Connect purchase intent data with digital identifiers for more efficient targeting.

- Commerce media: Use both first- and third-party onboarding — first-party for on-site activation and owned marketing, third-party for off-site activation and monetization —all while maintaining compliance and accurate attribution.

- CPG: Activate shopper data through retailer partnerships to drive off-site reach and stronger brand collaboration.

- Data providers: Monetize audience segments across Experian’s programmatic and TV integrations.

- Financial services: Deliver compliant, personalized cross-channel offers with unified identity.

- Healthcare: Use National Provider Identifier (NPI) onboarding to reach healthcare professionals compliantly.

- Retail: Power loyalty personalization, partner monetization, and CMN audience activation.

Across each use case, Experian’s privacy-first identity foundation turns data onboarding into a trusted driver of growth and stronger customer relationships.

Navigate the new data economy with Experian

Data onboarding has come a long way, mirroring the changes in marketing itself. We’ve moved from relying on third-party cookies to empowering first-party data, and now to building collaborative ecosystems like CMNs.

At Experian, we’re right in the middle of that evolution. With decades of data expertise, privacy leadership, and AI-driven activation, we help marketers connect more responsibly, measure what matters, and grow with confidence.

Want to see what that looks like for your brand? Let’s build safer connections together.

Start connecting responsibly

Data onboarding FAQs

Experian First-Party Onboarding helps brands take the customer data they already own, like CRM lists or loyalty files, and use it safely across digital channels for targeting, personalization, and measurement. Experian Third-Party Onboarding helps retailers, publishers, and data providers share or monetize their audiences responsibly with partners through secure, privacy-first activation.

Both are powered by Experian’s trusted identity foundation that keeps every connection accurate, compliant, and privacy-safe.

The difference between first- and third-party onboarding is who’s using the data. First-party means a brand is activating its own customer information, while third-party means that data is being shared or used by another advertiser or partner.

First-party onboarding becomes third-party onboarding most often in CMNs or commerce media. When a retailer monetizes its first-party shopper data for use by CPGs or advertisers, the use case shifts to third-party onboarding.

First-party onboarding helps brands reach and understand their existing customers, while third-party onboarding helps expand reach, enable partnerships, and monetize data responsibly.

Latest posts

Trustworthy AI depends on AI data governance. Learn how responsible automation begins with privacy-first AI data governance that supports transparency, compliance, and long-term sustainability.

Discover how addressable advertising uses AI and trusted data to deliver clear messages to real audiences. Learn why it’s important for digital and TV in 2026.

CES 2026 highlighted three priorities for marketers: data quality for AI, mainstream curation, and unified activation and measurement through identity.