At A Glance

Addressable advertising helps you reach addressable audiences with relevant messages across digital, TV, and streaming. As signals fragment across browsers, apps, and platforms, AI customer segmentation and privacy-first identity separate guesswork from accuracy. Experian brings trusted data, identity resolution, and activation partnerships together so you can connect with people in ways that feel relevant, respectful, and measurable.In this article…

A decade ago, you could buy media by broad categories and call it a day. But today, your audience lives in a curated world. They watch what they want, skip what they don’t, and expect what they see to match their interests. Research shows that when ads are tailored to households, people pay more attention, stay engaged longer, and are more likely to remember your ads.

That shift in expectations is why addressable advertising continues to grow. It’s a practical response to how media works today, with audiences moving fluidly across platforms, streaming spread across services, and measurement spanning screens and environments. Under these conditions, reaching the right people depends on clarity, not approximation.

Artificial intelligence (AI) strengthens that clarity. When applied responsibly, AI helps connect signals, deepen audience understanding, and deliver relevant messages while protecting consumer data. The result is advertising that feels more human, not less.

What is addressable advertising?

Addressable advertising is the ability to deliver personalized ads to specific individuals or households and measure results using privacy-safe data and identity. It works across digital, connected TV (CTV), linear TV, and over-the-top (OTT) streaming and relies on strong identity resolution and accurate data inputs to ensure your audience definitions remain consistent across channels and over time.

Benefits of addressable advertising

Addressable advertising changes how advertising performs by delivering messages to defined audiences, reducing wasted impressions, and making results simpler to measure.

| Benefit | What it means for you |

| Clarity | Reach the right audience with the personalized messages they want, instead of hoping the right people are watching |

| Efficiency | Avoid wasted impressions by focusing spend where interest already exists |

| Higher ROI | Improve conversion by delivering messages that feel relevant |

| Omnichannel consistency | Carry the same message across digital and TV without starting over |

| Measurable impact | Connect exposure to actions so performance is clear |

| Privacy and compliance | Activate audiences responsibly using privacy-safe data, clear governance, and compliant practices |

These are some of the reasons that addressable advertising has moved from a niche tactic to a core strategy. When audiences are clear, identity is connected, and measurement is built in, advertising becomes relevant, accountable, and easy to improve over time.

Addressable advertising vs. traditional advertising

Unlike traditional advertising, addressable advertising doesn’t depend on broad exposure or assumptions. It’s personalized by design and measurable by default, making it possible to connect ad exposure to outcomes. Another distinction is in how addressable delivers advertising to audiences and how performance is measured.

| Traditional media buys | Addressable advertising buys |

| You pay for broad reach | You pay for relevant reach to defined audiences |

| Ads run by placement or program | Ads are delivered to known households or individuals |

| Personalization is limited | Personalization is built into delivery |

| Measurement indicates trends, not who actually acted | Measurement connects exposure to actions by linking ads to defined audiences across channels |

But before you can activate addressable advertising, you need to understand who you’re actually trying to reach.

What is an addressable audience?

An addressable audience is a group of people you can identify and reach using data-based targeting. In other words, they’re not anonymous “maybe” viewers. They’re a defined audience you can activate across channels.

Here’s what typically builds addressable audiences:

| Factor | What it is | Why it matters |

| First-party data | Data from your own relationships (site activity, app activity, CRM, emails, purchases) | It’s your most direct view of existing customers and prospects |

| Third-party household and individual data | Demographic, behavioral, lifestyle, interest, and intent attributes from trusted providers | It fills gaps so your audience definitions don’t collapse when your own data is limited |

| Identity resolution | A privacy-first way to match people across devices, households, and channels | It improves accuracy so you don’t over-message the same people or miss them entirely |

| Contextual signals | Page-level, content, or viewing context where ads appear | It reinforces relevance in the moment and complements addressable targeting when identity signals are limited |

How Experian helps with addressable audiences

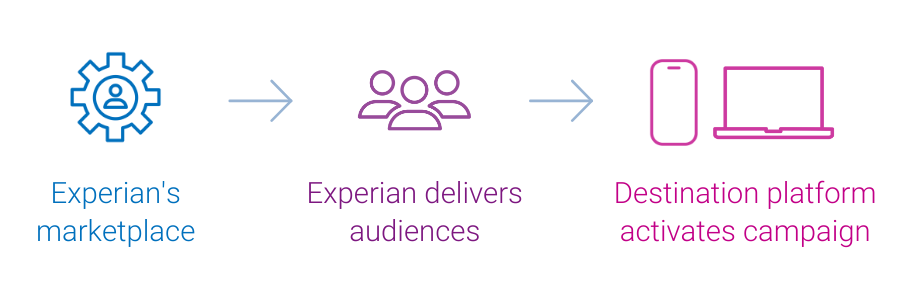

Experian helps you build and activate addressable audiences at scale without losing accuracy or trust. With more than 3,500 syndicated audiences available, you can activate consistently across 200+ destinations — including social platforms like Meta and Pinterest, TV and programmatic environments, and private marketplaces (PMPs) through Audigent.

That means reaching people based on who they are, where they live, and their household makeup, using data governed with care. Our approach is built on accuracy first, which is why Experian data is ranked #1 in accuracy by Truthset for key demographic attributes.

And when standard customer segments aren’t enough, Experian Partner Audiences expand what’s possible. These unique audiences are available through Experian’s data marketplace, within Audigent for PMP activation, and directly on platforms like DIRECTV, Dish, Magnite, OpenAP, and The Trade Desk.

The evolution of addressability and why it matters more than ever

As the media ecosystem shifts, reaching people across browsers, apps, CTV, and streaming platforms has become more complex. Signals are fragmenting everywhere as expectations for relevant, personalized experiences continue to rise, while reliable identifiers become increasingly challenging to access.

In response, addressability is shifting from a channel-specific tactic to an identity-driven approach to reach and measure defined audiences across screens.

That evolution puts new pressure on performance. Marketing budgets require accuracy and accountability, which means targeting must deliver measurable reach and outcomes you can trust.

At the same time, the growth of CTV and streaming is expanding addressable TV opportunities. As CTV inventory grows, so does the need for cross-channel, identity-based activation that works consistently and supports reach, frequency, and measurement in one connected view. That’s why identity has become the foundation for making addressable advertising work today.

When to apply addressable advertising

You don’t need addressable for everything, but it shines when you need your spend to go farther with accurate targeting and resonant messaging.

| Scenario | Why addressable helps |

| Product launches and seasonal pushes | Reach people who are more likely to care without flooding everyone else |

| High-consideration purchases (auto, travel, financial services) | Focus on likely intent and suppress audiences that don’t fit |

| Cross-channel campaigns (digital, TV, mobile) | Keep messaging consistent across screens |

| When using first-party data with AI | Use AI customer segmentation to scale responsibly and improve performance without sacrificing accuracy |

| Regulated categories | Rely on compliant data practices and clearer controls for regulated industries |

Addressable advertising is one way to put relevance and respect into practice — but it shouldn’t be the only time these principles apply. Marketers are expected to be thoughtful about who they reach, how often they show up, and how data is used across every channel. Addressable simply makes it easier to live up to that standard when accuracy, accountability, and scale matter most.

Addressable advertising and third-party data

There’s a common misconception that third-party data is no longer useful, but what’s really changed is the environment around it.

In the early days of digital advertising, third-party data often felt like the Wild West. Today, modern third-party data is more transparent, better governed, and held to far higher standards with:

- Clear data sourcing

- Documented consent practices

- Regular quality audits

- Strict limits on how data can be used

Used responsibly, third-party data plays a critical role in addressable advertising by complementing your first-party data and keeping audience strategies flexible as signals change.

Benefits of third-party data

When paired with identity resolution, high-quality third-party data helps you:

- Fill first-party gaps: Add demographic, behavioral, and interest-based insight when your own data is limited.

- Expand prospecting: Reach new audiences through modeling and lookalike expansion.

- Enrich segmentation: Combine household, behavioral, and interest signals to tailor creative, offers, and messaging to interests for more accurate and personalized activation.

- Support cross-channel addressability: Maintain consistent audience reach across devices and channels even as individual signals change.

Why work with Experian for your data needs?

At Experian, we approach third-party data with the belief that trust comes first. Our data is privacy-compliant, ethically sourced, and governed by strict standards so you can use it confidently.

Accuracy matters just as much. Our identity and data-quality framework verifies that the data behind your audiences holds up in the real world — a key reason Experian is ranked #1 by Truthset for key demographic attributes.

And because addressable advertising only delivers value when audiences move seamlessly from planning to activation, our audiences are interoperable by design. You can activate them across digital, social, and CTV platforms without rebuilding or reformatting your strategy for each channel.

How AI is redefining customer segmentation

Addressable advertising depends on audiences that stay accurate as people move across devices, platforms, and moments. Traditional segmentation built on static rules and snapshots in time can’t keep up with that reality.

AI customer segmentation analyzes massive sets of household and individual data (such as intent, household demographics, purchase behavior, and content consumption) to identify patterns, predict intent, and group people into addressable audiences.

As the AI advertising ecosystem continues to mature, reflected in industry frameworks like the LUMA AI Lumascape, segmentation and identity have become foundational layers rather than standalone tools. Those audiences update as conditions change, so they stay relevant instead of aging out.

Here’s how AI-driven segmentation supports addressable advertising.

| What AI enables | Why it matters |

| Predictive, intent-based audiences | Analyze behavioral and transactional data to group people based on likely next actions |

| Broader audience availability | As more data signals are incorporated responsibly, AI makes it possible to support a wider range of addressable audience options without sacrificing accuracy |

| Deeper insights from data | Discover what people care about, how intent is forming, and which signals are most important with larger, more diverse data sets |

| Real-time audience updates | Keep segments aligned as behaviors change, not weeks later |

| Higher accuracy, less guesswork | Rely on data-driven patterns for decision-making instead of assumptions |

| Ongoing optimization | Refine audiences throughout the campaign lifecycle as performance signals come in |

We’ve used machine learning and analytics for decades to support responsible segmentation — balancing performance with privacy and transparency.

That foundation now supports addressable advertising that adapts in real time while staying grounded in trust.

Addressable TV: Targeting in the streaming era

TV has become an addressable channel powered by data and identity resolution. CTV and OTT streaming are booming, while linear TV continues to decline, reshaping how people watch and how advertising works alongside it. For the first time, CTV spending is expected to outpace traditional TV ad spending in 2028, reaching $46.89 billion and signaling that addressable TV is now central to the media mix.

With CTV and OTT platforms, advertising can now be delivered at the household level. That means two homes watching the same show can see different ads based on who lives there and what they like. This is what makes addressable TV possible.

Benefits of addressable TV

As streaming inventory continues to grow, addressable TV creates new ways to bring relevance and accountability to a channel once defined by broad exposure. Experian links identity data across streaming, linear, and digital platforms to help you manage frequency, attribution, and household-level insights in one connected view.

Addressable TV also raises the bar. To manage reach, frequency, and measurement across streaming and linear environments, addressable TV depends on identity resolution that connects households across screens.

Here’s how addressable TV helps you when identity is in place.

| What addressable TV enables | Why it matters |

| Household-level targeting | Deliver messages that reflect who’s watching, not just what’s on |

| Frequency control across screens | Reduce overexposure and improve viewer experience |

| Cross-channel measurement and attribution | Connect TV exposure to digital actions, site visits, and conversions |

| More efficient use of TV spend | Bring accuracy, accountability, and outcome-based insight to premium inventory and improve reach of streaming-first, harder-to-reach viewer segments |

Ultimately, addressable TV isn’t a replacement for linear TV, but it is an evolution. As streaming becomes the default viewing experience, the ability to engage TV audiences with the same care and clarity as digital is essential.

Use cases for addressable advertising

Addressable advertising works across industries because it adapts to how people make decisions. The examples below are illustrative scenarios that show how addressable audiences, identity resolution, and AI-driven segmentation can come together in practice using Experian solutions.

Retail: Seasonal promotions

A home décor retailer could use identity resolution and AI-driven segmentation to build addressable audiences, such as holiday decorators and recent movers, who are more likely to engage during peak seasonal periods.

Campaigns could then be activated across CTV, display, and social, helping the retailer stay visible across screens while tailoring creative to seasonal intent.

Automotive: In-market car buyers

An auto brand might identify consumers nearing lease expiration using automotive-specific data tied to household and individual attributes.

By suppressing current owners, the brand could avoid wasted impressions and activate addressable audiences across OTT and mobile to reach likely buyers during active consideration.

Financial services: Credit card launch

For a new credit card launch, a national bank could use modeled financial segments to reach credit-qualified prospects.

Addressable digital advertising campaigns could apply frequency controls and personalized messaging, balancing reach with relevance while seamlessly measuring response.

Streaming media: New subscriber growth

A streaming platform looking to grow subscriptions could use an identity graph to exclude current subscribers.

Likely viewers could then be targeted across CTV based on content preferences and viewing behavior, keeping spend focused on net-new growth.

Media and entertainment: Audience expansion for a new release

Ahead of a new release, a film studio could use behavioral and lifestyle data to identify likely moviegoers and fans of similar franchises.

Addressable campaigns across CTV and digital video could help drive awareness and opening weekend attendance.

Travel: High-value traveler acquisition

A travel brand could use travel propensity data and household-level demographics to identify frequent flyers and family vacation planners.

Personalized offers could then be activated across display, social, and programmatic channels to increase bookings while keeping spend focused on higher-value travelers.

How Experian enables more effective addressable campaigns

Addressable advertising is most effective when identity, data, and activation are connected from the start.

Experian brings trusted household and individual data, privacy-first identity resolution, and broad activation partnerships together so you can move from audience insights to activation with minimal friction. Here’s how that comes to life across our core offerings.

Identity resolution with Consumer Sync

Consumer Sync connects devices, emails, digital identifiers, and offline data into a single, privacy-safe identity foundation. This connection helps your audiences stay consistent across streaming, linear TV, mobile, and digital despite changing signals.

Audience insight and segmentation with Consumer View

Consumer View supports clear segmentation, prospecting, and enrichment across industries. It combines demographic, behavioral, and interest-based data to help you build accurate, intent-driven audiences that reflect real people, not assumptions. Data is continuously updated and governed for accuracy.

Omnichannel activation with Audience Engine

Audience Engine enables direct activation of Experian audiences across CTV, digital, social, and programmatic platforms. It supports suppression, frequency management, and cross-channel consistency to keep messaging aligned and exposure controlled.

More efficient media through curation and Curated Deals

Curation combines data, identity, and inventory through Experian Curated Deals. These deal IDs, available off-the-shelf or privately, make it easier to activate high-quality audiences and premium inventory in the platforms you already use without custom setup.

AI-enhanced segmentation and optimization

Our AI-enhanced models analyze large data sets to create and refresh addressable audiences in real time, supporting intent-based targeting and ongoing optimization throughout the campaign lifecycle. These models work seamlessly with demand-side platforms (DSPs), ad platforms, and data clean rooms, so audience insights flow directly into activation and measurement without added complexity.

Seamless integration with your ecosystem

As an advertiser, you want addressable advertising to fit naturally into how you already plan and buy media. That’s why integration matters as much as insight.

Experian integrates with leading DSPs, ad platforms, and data clean rooms, so you can activate addressable audiences in the environments you already use without reworking your strategy or adding complexity. This approach helps you:

- Build and activate addressable audiences: Reach the people you want with accuracy and respect.

- Activate across channels: Keep messaging consistent across digital, TV, and streaming.

- Optimize with data ranked #1 in accuracy by Truthset: Improve performance using the industry’s most reliable data.

When identity, data, AI, and activation come together, addressable advertising does what it’s supposed to do: deliver relevance naturally, measure impact clearly, and give you confidence in every decision along the way.

That’s the foundation for campaigns people want to engage with.

Start creating campaigns audiences want to see

Experian can help you apply addressable advertising in ways that respect consumers, perform across channels, and stand up to real-world measurement.

Connect with our experts today to explore how addressable audiences, AI-driven segmentation, and identity-powered activation can work together in support of your goals.

FAQs about addressable advertising

Addressable data-driven advertising involves delivering personalized ads to specific individuals or households using privacy-safe data and identity.

An addressable audience is a defined group of consumers you can identify and reach based on known household or individual attributes.

Advertising becomes addressable when it’s possible to identify the audience by linking devices and households to people through identity graphs. This allows you to measure ad performance at the audience level and provide more personalized advertising.

Addressable advertising isn’t just for TV; it also works across digital, mobile, streaming, and social channels.

AI improves addressable advertising by analyzing large data sets to predict intent, build more accurate audiences, boost performance over time, and improve your ability to find and build your audiences.

Yes — identity resolution and first-party data are key to cookieless addressability.

Experian supports addressable advertising by providing trusted consumer data, privacy-centric identity resolution, and curated audience segments that activate across CTV, digital, mobile, and streaming platforms.

Latest posts

Experian’s solution for commerce media networks connects first-party shopper data with trusted identity, audience, activation, and measurement capabilities.

Explore how real-time data from Experian and Captify can revolutionize personalized advertising to enhance campaign effectiveness.

Learn what 2023 Black Friday data reveals about 2024 consumer trends. Discover key behaviors shaping 2024’s holiday marketing strategy.