Business Information Blog

The latest from our experts

The Experian Small Business Index shows signs of stability with a slight decrease month over month amid low unemployment and rising wages.

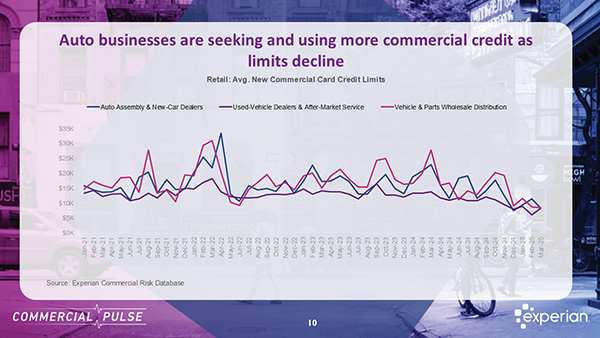

Experian’s latest Commercial Pulse Report reveals rising car prices drive demand for used vehicles as commercial credit lines for b2b decline

Experian Small Business Index shows small businesses remaining resilient amid rate uncertainty and signs of job market weakness

Experian Commercial Pulse Report reveals decline in total number of ecommerce businesses, strong revenue, and fewer credit inquiries.

Blended credit scores combine personal and business data. Learn how they boost financial inclusion and help lenders make smarter decisions.

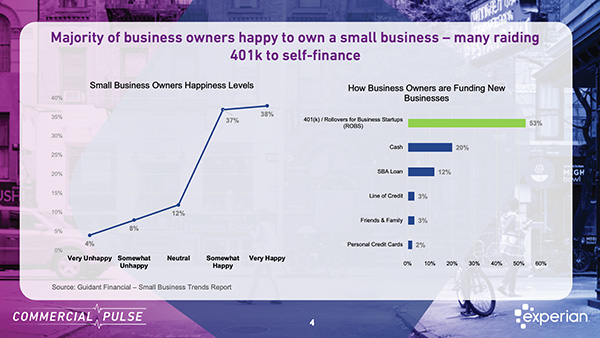

Economic uncertainty is often seen as a deterrent to growth. What’s driving this wave of entrepreneurial activity?

Learn how blended credit data aggregates help B2B firms build custom risk models, evaluate solopreneurs, and deepen customer relationships.

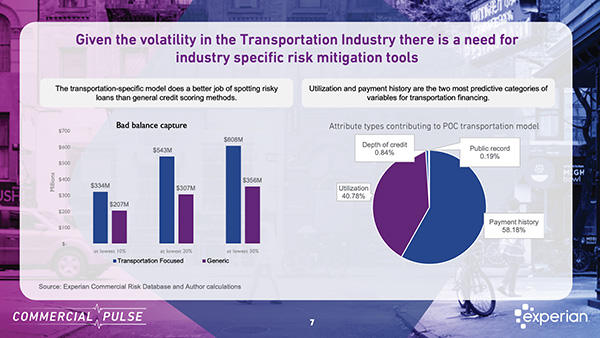

Discover how industry-specific risk models do a better job of assessing transportation financing risk in the latest Commercial Pulse Report.

While the small business index experienced a decline in April, the decrease was modest due to the continued resilience of the U.S. economy.

Explore key Q1 2025 small business credit trends, risks, and growth signals with insights tailored for today’s data-driven risk leaders.

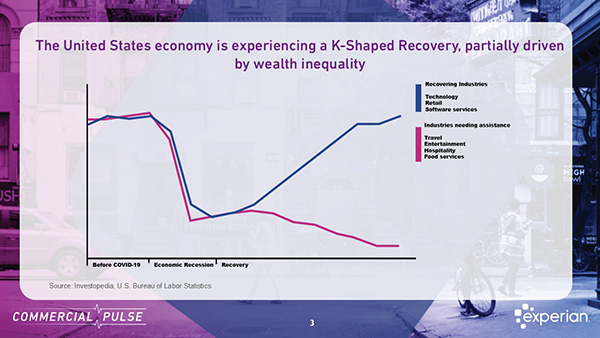

Discover highlights from Experian’s March 2025 Commercial Pulse Report: GDP dip, small business growth, and rising income inequality.

Hear the experts from Experian review Q1 2025 small business credit performance and offer an outlook on economic conditions.