All posts by Gary Stockton

Women led businesses lag behind on venture capital funding, and are turning to commercial loans and lines to bridge the gap Start-ups founded or cofounded by women receive only 44% of financial backing, but generate more revenue. While it is very encouraging to see the progress of women in business advancing, the pace of progress is slow and more could be done to achieve parity. Women’s salaries are slowly catching up, but they are still only about 80% of men’s wages. There are continued barriers to mothers participating in the labor force due to the limited capacity of childcare facilities, the high costs to families for childcare, and the low wages for childcare workers making lower skilled work sometimes more attractive in a tight labor market. These forces disproportionately affect women whether they work for wages or work for themselves as a small business owner. In addition to the issues facing women as workers, there are unique challenges they face as start-up founders as well. There is a known disparity in the funding provided to start-up businesses pitched by a woman versus a man and that is leaving women without the full funding they need to launch new businesses successfully. Added diversity within venture capital and angel investor groups could help change this dynamic so women can access that capital and expertise when launching their businesses at the same rate as their male counterparts. Without this, they are left to rely on self-funding and loans from banks — if they can get approved. The good news is that many women are making it work and the number of successful women-owned businesses continues to climb. What I am watching: The debt-ceiling standoff continues to cause uncertainty in the financial system with no compromise in place and a looming June 1 deadline, according to Secretary Janet Yellen. This situation is going to dwarf all others until there is a resolution, so all eyes are going to be on Congress and the President. Other signs in the economy suggest that inflation may finally be responding to the aggressive interest rate hikes enacted by the Fed. The Fed will have a more difficult decision on whether to raise interest rates one more time in June or hold them steady and wait to see if inflation continues to improve. Subscribe Today Download your copy of Experian's Commercial Pulse Report today. Better yet, subscribe so you'll always know when the latest Pulse Report comes out.

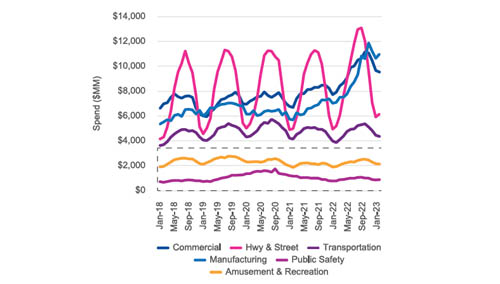

In its continued efforts to tame inflation, the Federal Reserve increased interest rates ¼ point last week, the tenth consecutive increase in just over a year. The cumulative increase is 500bps since March 2022, bringing the Fed Funds rate to 5.00%-5.25%, which is the highest since 2007. While inflation is still above the Fed’s target rate of 2%, they indicated a pause in rate increases. The labor market continues to be strong with April unemployment down to 3.4%, matching the low of January which is the lowest unemployment since 1969. Despite all the efforts by the Fed to have a soft landing, the economy could be upended if Congress does not increase the debt ceiling soon. With inflation slowing, and the labor market strong, a soft landing is possible. Treasury Secretary Yellen said the U.S. could default on debt as early as June 1st. If the U.S. defaults on outstanding debt, many forecast disastrous impacts to the world economy. Despite the recent decline in residential construction spending, construction spend remains strong in both residential and non-residential sectors. The construction industry is one of the few industries that saw a boom throughout the pandemic. Even though over the past few months both residential and non-residential experienced a decline in construction starts and construction spend, the volumes remain above pre-pandemic levels. High construction demand is being met with the formation of many new construction companies. New construction companies are seeking credit at a higher rate, but delinquencies in the construction industry are increasing. Higher risk and higher interest rates are causing commercial lending to tighten, and construction companies are seeing fewer loan originations and smaller loans/lines of credit. What I am watching: The non-residential construction industry is expected to see steady growth in 2023 due to project backlogs but could slow in 2024. Due to higher mortgage rates, the residential construction industry is expected to see a significant decline in housing starts through 2023 with the sector stabilizing in 2024. Aside from the immediate key drivers of interest rates and cost of capital, other areas of focus will be on the labor force and the demand for skilled vs. non-skilled labor. The number of skilled workers is decreasing yet the demand for skilled labor is increasing. The construction industry will have to attract the necessary talent to support the growth. Operational changes in the construction industry will be a driving factor. The construction industry is seeing a shift toward technology in all aspects of construction. Utilization of robotics is increasing which could replace portions of the workforce. Smart Cities, Smart Homes, Green Building are all trending which will materially change construction projects. The Construction Industry is experiencing a noticeable shift and companies will continue to adapt to keep up with demand.

This Experian article goes in depth on automating credit decisions for better efficiency.

Explore how Experian's Ascend Commercial Suite helps risk managers navigate portfolio risk in an uncertain economy with data insights and strategic tools.

If you crave economic insight into small business trends, download the Spring Beyond the Trends report from Experian, a unique outlook on the economy.

A recent credit study of a regional utility found significant numbers of small businesses with no credit profile despite a history of positive payments.

This week Experian and Oxford Economics released the Q4 2022 Main Street Report. The report provides insight into the financial well-being of the small business landscape. Critical factors in the Main Street Report include business credit data (credit balances, delinquency rates, utilization rates, etc.) and macroeconomic information (employment rates, income, retail sales, industrial production, etc.). Report Highlights Consumer sentiment improved in Q4 2022, despite a softening of spending behavior. This positive behavior has contributed to the positive health and growth perspective of small businesses heading into 2023, leading to stable cash flow performance. In addition, commercial lending markets remained open and commercial delinquencies returned to pre-pandemic levels. However, higher goods and services costs may pressure spending as affordability tightens and personal cash flows thin. The US economy grew strongly in Q4 2022, but the core of the economy was soft, indicating that a repeat performance in early 2023 is unlikely. The trend in job growth has decelerated, and the Fed needs to engineer a soft landing. The Fed is pushing back against market expectations of rate cuts and is likely to hike more than expected. Download Q4 2022 Report

Get the latest quarterly small business trends Mark your calendars! Experian and Oxford Economics will present key findings in the latest Main Street Report for Q4 2022 during the Quarterly Business Credit Review. Ryan Sweet, Oxford’s U.S. Chief Economist will share his take on Experian’s most recent small business credit data and a macroeconomic outlook for the coming quarter. Brodie Oldham, Experian’s V.P. of Commercial Data Science, will cover commercial credit trends. Presenters Brodie Oldham, V.P. Commercial Data Science Experian Ryan Sweet, U.S. Chief Economist Oxford Economics Q4 2022 Main Street Report The Q4 2022 Experian/Oxford Economics Main Street report will release at the end of February. If you are not already subscribed to thought leadership updates, be sure to sign up for updates on our Commercial Insights Hub. Event Details Date: Thursday, March 9th, 2023Time: 10:00 a.m. (Pacific), 1:00 p.m. (Eastern) Why you should attend: Leading Experts on Commercial and Macro-Economic Trends Credit insights and trends on 30+ Million active businesses Ask our panel questions in real-time Industry Hot Topics Covered (Inclusive of Business Owner and Small Business Data) Commercial Insights you cannot get anywhere else Peer Insights with Interactive Polls (Participate) Discover and understand small business trends to make informed decisions Actionable takeaways based on recent credit performance Save My Seat

After a busy holiday season, we are pleased to announce the publication of our Winter 2023 Beyond the Trends report. Holiday spending increases by 7.6% Small businesses' health and performance in 2022 was strong as consumers spent beyond their means, to prolong demand behaviors learned in an economy overflowing with stimulus, coming out of the pandemic where personal savings was running lean. Despite impact of inflation on incomes, spending continues Retailers will fight for consumer spending, but consumers will find their purchasing power limited as interest rates increase and assumption of unexpected debt payments. Other highlights Consumer credit overall decreased 16% month over month in the fourth quarter as delinquencies climbed as mortgage markets continue to slow. New unsecured credit card debt rose 4% as thin consumer savings forced more debt to the consumers credit card. New U.S. emerging businesses seeking credit is down 5.7% year over year as new business applications in the U.S. slow and commercial delinquencies rise. Experian saw a 61% YOY increase in the percentage of high risk small business credit inquiries with emerging business seeking credit up 78.5% year over year with limited commercial credit history in the 4th quarter leading to lower-than-normal average credit lines across the industry. Small business lenders will focus on four critical areas in the coming months to ensure their businesses remain stable and continue to grow. Market expansionDeterring fraud Limiting portfolio exposureDeveloping loyalty among profitable customers Download Winter 2023 Beyond The Trends Report