At Experian, we understand the critical role that audience targeting plays in the success of marketing campaigns. That’s why we’re excited to share this curated list, aimed at helping agencies and media buyers plan their campaigns and effectively reach their audiences with precision and confidence.

What separates Experian’s syndicated audiences

- Experian’s 2,400+ syndicated audiences are available directly on over 30 leading television, social, programmatic advertising platforms, and directly within Audigent for activation within private marketplaces (PMPs).

- Reach consumers based on who they are, where they live, and their household makeup. Experian ranked #1 in accuracy by Truthset for key demographic attributes.

- Access to unique audiences through Experian’s Partner Audiences available on Experian’s data marketplace, within Audigent for activation in PMPs and directly on platforms like DirectTV, Dish, Magnite, OpenAP, and The Trade Desk.

Here’s a look at the Experian audiences that were the most popular in Q2 2023. Which ones will you add to your Q2 campaign planning?

Our top 10 audiences for Q2

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

In-store high spender on baby products

Retail Shoppers: Purchase Based > Shopping Behavior > Baby Products: In Store High Spenders

Has a bachelor’s degree

Demographics > Education > Bachelor Degree

In-market for an SUV and CUV

Autos, Cars and Trucks > In Market-Body Styles > SUV and CUV

In-market for a mid-size truck

Autos, Cars and Trucks > In Market-Body Styles > Mid-Size Truck

Homeowner

Demographics > Homeowners/Renters > Homeowner

In-market for a small, mid-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Small Mid-Size SUV

In-market for a full-size truck

Autos, Cars and Trucks > In Market-Body Styles > Full-Size Trucks

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Household income level

Demographics > Household Income (HHI) > $75,000+

Our top 5 audiences by vertical

Which audience segments were the most popular by advertiser vertical?

Advanced TV

Household income level

Demographics > Household Income (HHI) > $75,000-$99,999

Interested in dogs

Lifestyle and Interests (Affinity) > Pets > Dogs (FLA / Fair Lending Friendly)1

Homeowner

Demographics > Homeowner/Renter > Homeowner

Household income level

Demographics > Household Income (HHI) > $100,000-$124,999

Interested in arts and entertainment

Lifestyle and Interests (Affinity) > Art and Entertainment > Visual Art and Design (FLA / Fair Lending Friendly)

Agency

Dog owner

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owner

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Active investor

Lifestyle And Interests (Affinity) > Investors > Active Investor

Mutual fund investor

Lifestyle And Interests (Affinity) > Investors > Mutual Fund Investor

In-market for a full-size SUV

Autos, Cars and Trucks > In Market-Body Styles > Full-Size SUVs

Auto

In-market for a new car

Autos, Cars and Trucks > In Market-New/Used > New Car

In-market for a used car

Autos, Cars and Trucks > In Market-New/Used > Buyer Used

In-market for a Honda

Autos, Cars And Trucks > In Market-Make And Models > Honda

In-market for an auto loan

Financial FLA Friendly > In Market Auto Loan

In-market for an auto lease

Financial FLA Friendly > In Market Auto Lease

Did you know?

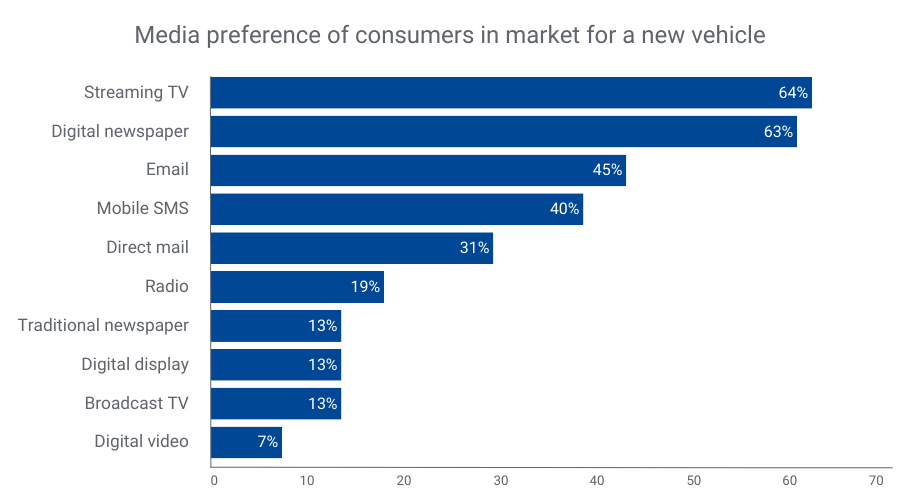

Consumers looking to buy a new vehicle prefer streaming TV, digital newspapers, and email for communication2. By merging our TrueTouchTM engagement channel audiences with our Auto in-market audiences, you can effectively target these consumers through their preferred channels. TrueTouch facilitates personalized advertising campaigns by predicting consumer preferences, ensuring messaging styles align with the right channels and calls to action.

By understanding what types of media people prefer, you can match the best way to talk to them with what to offer, using the right channels for personalized ads. No consumer is the same – and you need to engage with them on their terms to successfully market to them.

Financial

Active in the military

Lifestyle And Interests (Affinity) > Occupation > Military – Active

In-market for a credit union loan

Financial FLA Friendly > In Market Credit Union Loan

40-49 years old

Demographics > Ages > 40-49

30-39 years old

Demographics > Ages > 30-39

Small business owner

Consumer Behaviors > Occupation: Small Business Owners

Health

25-29 years old

Demographics > Ages > 25-29

30-34 years old

Demographics > Ages > 30-34

Weight conscious

Lifestyle and Interests (Affinity) > Health & Fitness > Weight Conscious

Moms interested in fitness

Lifestyle and Interests (Affinity) > Moms, Parents, Families > Fitness Mothers

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Retail & CPG

Dog owners

Lifestyle And Interests (Affinity) > Pets > Dog Owners

Cat owners

Lifestyle And Interests (Affinity) > Pets > Cat Owners

Fitness enthusiast

Lifestyle and Interests (Affinity) > Health & Fitness > Fitness Enthusiast

Interested in healthy living

Lifestyle and Interests (Affinity) > Health & Fitness > Healthy Living

High spenders at vitamin/supplement stores

Retail Shoppers: Purchase Based > Health and Fitness > Vitamins/Supplements: Vitamins/Supplements

Activate the right audiences with Experian

When you choose Experian’s syndicated audiences, you gain access to over 2,400 audiences that span across 15 verticals and categories. These audiences are directly available for activation on over 30 platforms and can be sent to over 200 media platforms. Experian is ranked #1 for data accuracy (as validated by Truthset) and Experian Marketing Data is the foundation for successful targeting, enrichment, and activation.

For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide. Need a custom audience? We can help you build and activate an Experian audience on the platform of your choice.

Check out other seasonal audiences you can activate today.

Contact us

Footnotes

- Fair Lending Act Friendly audiences: “Fair Lending Friendly” indicates data fields that Experian has made available without use of certain demographic attributes that may increase the likelihood of discriminatory practices prohibited by the Fair Housing Act (“FHA”) and Equal Credit Opportunity Act (“ECOA”). These excluded attributes include, but may not be limited to, race, color, religion, national origin, sex, marital status, age, disability, handicap, family status, ancestry, sexual orientation, unfavorable military discharge, and gender. Experian’s provision of Fair Lending Friendly indicators does not constitute legal advice or otherwise assure your compliance with the FHA, ECOA, or any other applicable laws. Clients should seek legal advice with respect to your use of data in connection with lending decisions or application and compliance with applicable laws.

- Experian looked at our Auto and TrueTouch audience data to understand media preference trends over the past year.

Latest posts

Gen Z is ready to be noticed and become a force to be reckoned with in the market. In the auto market alone, Gen Z made up 3.8 percent of all new vehicle registrations in the first quarter of 2019.

As ever, marketers have to be strategic to reach the right customers. Ensure seasonal messaging reaches the right customers with audience optimization.

With Tapad, part of Experian, technology, AdsWizz AudioMatic is the first Audio buying platform to offer cross-device identity resolution across the U.S. and EMEA NEW YORK and LONDON, July 17, 2019 /PRNewswire/ — Tapad, part of Experian and a global leader in digital identity resolution, today announced a new joint capability with AdsWizz , the leading technology provider for digital audio advertising solutions. The partnership combines Tapad's digital cross-device technology with AdsWizz's AudioMatic buying platform, enabling the ability to connect audio ad experiences across screens. AudioMatic, AdsWizz's audio-centric buying platform, supports programmatic audio buying and entirely new audio ad experiences for listeners. The integration of The Tapad Graph onto its platform enables new opportunities for marketers to reach, engage and measure each interaction with their desired consumers on digital radio and podcasts channels, and across devices. This partnership makes AdsWizz the first audio buying platform to offer this enhanced cross-device identity capability in the US and EMEA markets. "Marketers need privacy-safe digital identity resolution to reach their consumers," says Tom Rolph, VP of EMEA at Tapad. "With audio becoming an increasingly powerful medium for engagement, it's important that our technology extends to this channel, which is why we are excited to announce our integration with AdsWizz's AudioMatic platform." Digital audio is experiencing high growth, with 84% of advertisers and agencies saying it will play a bigger role in their media plans in the future. Today, 60% of digital audio is consumed via a mobile device.* The Tapad Graph is the largest digital identity resolution graph with differentiated global scale. The partnership enables audio advertisers to leverage The Tapad Graph for enhanced attribution, analytics, and targeting. Alexis van der Wyer, CEO at AdsWizz, added, "Digital audio is increasingly becoming ubiquitous in our media consumption and in our daily digital interactions, and because of that, audio advertising offers tremendous opportunity to personally interact with consumers in every moment of their daily lives. By integrating with Tapad, we enable our advertising partners to increase the effectiveness and the relevance of their marketing messages across audio channels." To learn more about Tapad and our digital identity resolution products, visit our identity solutions page. *Digital Audio Exchange, "The Rise of Digital Audio Advertising," https://thisisdax.com/wp-content/uploads/2019/07/DAX-Whitepaper.pdf About Tapad Tapad, Inc. is a global leader in digital identity resolution. The Tapad Graph, and its related solutions, provide a transparent, privacy-safe approach connecting brands to consumers through their devices globally. Our one-of-a-kind Graph Select offering enables marketers the flexibility and freedom of choice to correlate devices to varied objectives, driving campaign effectiveness and business results. Tapad is recognized across the industry for its product innovation, workplace culture and talent, and has earned numerous awards including One World Identity's 2019 Top 100 Influencers in Identity Award. Headquartered in New York, Tapad also has offices in Chicago, London, Oslo, Singapore and Tokyo. About AdsWizz: AdsWizz has created the end-to-end technology platform that is powering the digital audio advertising ecosystem. AdsWizz powers well-known music platforms, podcasts and broadcasting groups worldwide with a comprehensive digital audio software suite of solutions that connect audio publishers to the advertising community. From dynamic ad insertion to advanced programmatic platforms to innovative new audio formats, AdsWizz efficiently connects buyers and sellers in digital audio. AdsWizz is headquartered in San Mateo, California, with an IT Development hub in Bucharest, Romania, and presence in 39 markets around the world. About AudioMatic: AdsWizz Demand Side, audio-centric DSP and audio buying platform, AudioMatic, enables programmatic audio buying and entirely new audio ad experiences that are proven to be more engaging and more effective, and have delivered measurable results for agencies and their brands all over the world. All the biggest ad agencies have used our programmatic trading platform, including Omnicom, GroupM, Havas, Publicis, Mobext, and more. Contact us today