As the vibrant colors of spring emerge, so do opportunities for marketers to engage with their audience in fresh and meaningful ways. Crafting effective spring advertising campaigns requires a deep understanding of your target audience. In this blog post, we’ll explore five key audience categories, each presenting unique opportunities for impactful spring advertising campaigns.

What separates Experian’s syndicated audiences

- Experian’s 2,400+ syndicated audiences are available directly on over 30 leading television, social, programmatic advertising platforms, and directly within Audigent for activation within private marketplaces (PMPs).

- Reach consumers based on who they are, where they live, and their household makeup. Experian ranked #1 in accuracy by Truthset for key demographic attributes.

- Access to unique audiences through Experian’s Partner Audiences available on Experian’s data marketplace, within Audigent for activation in PMPs and directly on platforms like DirectTV, Dish, Magnite, OpenAP, and The Trade Desk.

Spring cleaning and home improvement

Embrace the energy of renewal associated with spring cleaning. Target audiences interested in home improvement and organization with Experian syndicated audiences like “Gardening Mothers” or “Home Improvement & DIY Frequent Spenders.” Share tips, hacks, and products that align with the desire for a fresh start, turning mundane chores into exciting opportunities for your brand to shine.

Here are 6 audience segments that you can activate to target consumers focused on spring cleaning and home improvements:

- Purchase Transactions > Household Goods > Frequent Spenders

- Purchase Predictors > Shoppers All Channels > Home Maintenance and Improvement

- Purchase Transactions > DIY and Advice Seekers > High Spenders

- Purchase Transactions > Home Improvement/DIY > High Spenders

- Retail Shoppers: Purchase Based > Home Improvement & DIY > Hardware & Home Improvement

- Retail Shoppers: Purchase Based > Shopping Behavior > Big Box and Club Stores: Walmart Frequent Spenders

Gardening

Spring is the time when consumers are investing in gardening equipment for lawn care. Here are a few audience segments you can activate to target consumers focused on gardening:

- Retail Shoppers: Purchase Based > Home Improvement & DIY > Garden & Landscaping Stores: Frequent Spenders

- Lifestyle and Interests (Affinity) > Hobbies > Gardening

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Gardening Mothers

- Purchase Predictors > Shoppers All Channels > Lawn and Garden

Movers and new homeowners

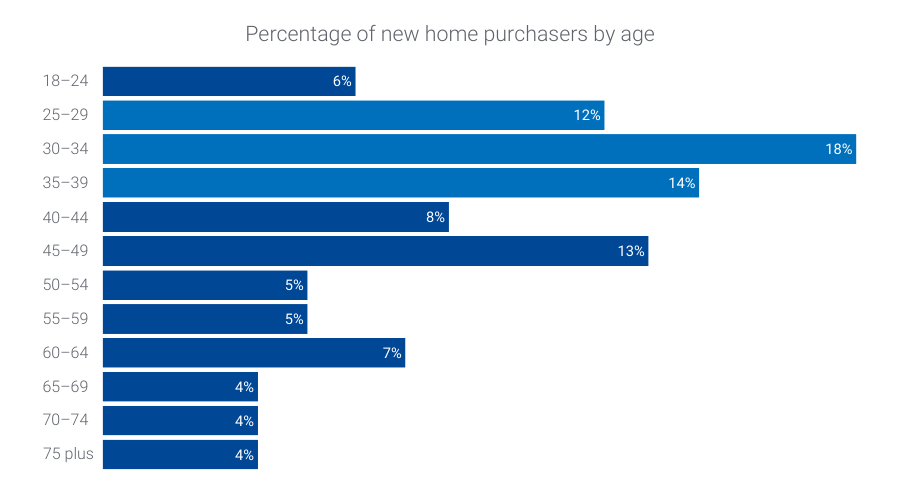

Did you know?

44% of new homeowners are between the ages of 25-39*.

Improve engagement for your spring targeting by pairing our new homeowner audiences with our Demographics > Ages > 25-29, 30-34, and 35-39 syndicated audiences. Here are a few you can activate now:

- Life Events > New Homeowners > Last 6 Months

- Life Events > New Movers > Last 12 Months

Mother’s Day: Unveil the perfect gift

Appealing to the emotion of gratitude and love, Mother’s Day is a significant occasion for marketers. Activate Experian syndicated audiences such as “Mother’s Day Shoppers” and “Florists & Flower Gifts High Spenders” to tailor your spring advertising campaign toward those likely to purchase heartfelt gifts. Share ideas and promotions that resonate with the nurturing and caring spirit of this celebration.

Here are 6 audience segments that you can activate to target consumers getting ready to celebrate Mother’s Day:

- Retail Shoppers: Purchase Based > Seasonal > Mothers Day Shoppers Spenders

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Mothers with 2+ children

- Mobile Location Models > Visits > Mothers Day Shoppers

- Lifestyle and Interests (Affinity) > Moms, Parents, Families > Moms Age 25-54

- Mobile Location Models > Visits > Jewelry Retail Stores

- Retail Shoppers: Purchase Based > Shopping Behavior > Florists & Flower Gifts: High Spenders

Father’s Day: Celebrate Dads in style

Highlighting the significance of paternal bonds, Father’s Day is an excellent opportunity to showcase thoughtful gifts and experiences. Engage the “Father’s Day Shoppers” or “Growing and Expanding families” with content and products aligned with their interests. Craft a campaign that acknowledges the varied roles fathers play and the unique gifts they would appreciate.

Here are 6 audience segments that you can activate to target consumers getting ready to celebrate Father’s Day:

- Retail Shoppers: Purchase Based > Seasonal > Fathers Day Shoppers Spenders

- Mobile Location Models > Visits > Fathers Day Shoppers

- Mosaic – Personas – Lifestyle and Interests > Group M: Families in Motion > M45 – Growing and Expanding (Young, working-class families and single parent households that live in small city residences)

- Geo-Indexed > Demographics > Presence of Children: Ages: 7-9

- Lifestyle and Interests (Affinity) > Activities and Entertainment > Home Improvement Spenders

- Life Events > New Parents > Child Age 0-36 Months

Plan for the 2024 TV Upfronts

When gearing up for the 2024 upfronts, you can expand your TV planning by incorporating diverse audience categories into your spring advertising campaigns. It’s not just about targeting a demographic; it’s about captivating your unique audience. Whether it’s cord cutters, ad avoiders, avid streamers, or households that watch TV together, understanding and engaging with these distinct segments is paramount. To maximize impact, use comprehensive TV data that goes beyond broad demographics.

Here are 6 audience segments that you can activate as part of your TV planning strategy:

- Retail Shoppers: Purchase Based > Entertainment > Streaming/Video/Audio/CTV/Cable TV: Cable/Broadcast TV: Cord Cutters: Recent

- Retail Shoppers: Purchase Based > Entertainment > Streaming/Video/Audio/CTV/Cable TV: Streaming Video: High Spenders

- Television (TV) > Ad Avoiders/Ad Acceptors > Ad Avoiders

- Television (TV) > TV Enthusiasts > Paid TV High Spenders

- Television (TV) > Ad Avoiders/Ad Acceptors > Ad Acceptors

- Television (TV) > Household/Family Viewing > Pay TV/vMVPD Subscribers Households

To find consumers who are most likely to engage with your TV ads, you can layer in our TrueTouchTM engagement channel audiences:

- TrueTouch: Communication Preferences > Engagement Channel Preference > Digital Video

- TrueTouch: Communication Preferences > Engagement Channel Preference > Streaming TV

Summer preparation: Anticipate the fun ahead

As spring transitions to summer, help your audience gear up for the upcoming season. Target “Summer break travelers” or “Memorial Day Shoppers” with offerings that align with their summer plans. Whether it’s fashion, travel essentials, or outdoor gear, position your brand as an essential companion for their summer adventures.

Here are 6 audience segments that you can activate to target consumers getting ready for summer:

- Mobile Location Models > Visits > Summer Break Travelers

- Retail Shoppers: Purchase Based > Seasonal > Summer Sales Event Shoppers: Independence Day Shoppers

- Retail Shoppers: Purchase Based > Travel > Vacation/Leisure Travelers: Summer Trips

- Mosaic – Personas – Lifestyle and Interests > Group B: Flourishing Families > B09 – Family Fun-tastic (Upscale, middle-aged families with older children that live in suburban areas and lead busy lives focused on their children)

- Mobile Location Models > Visits > Memorial Day Shoppers

- Retail Shoppers: Purchase Based > Seasonal > Summer Sales Event Shoppers: High Spenders: Memorial Day Shoppers

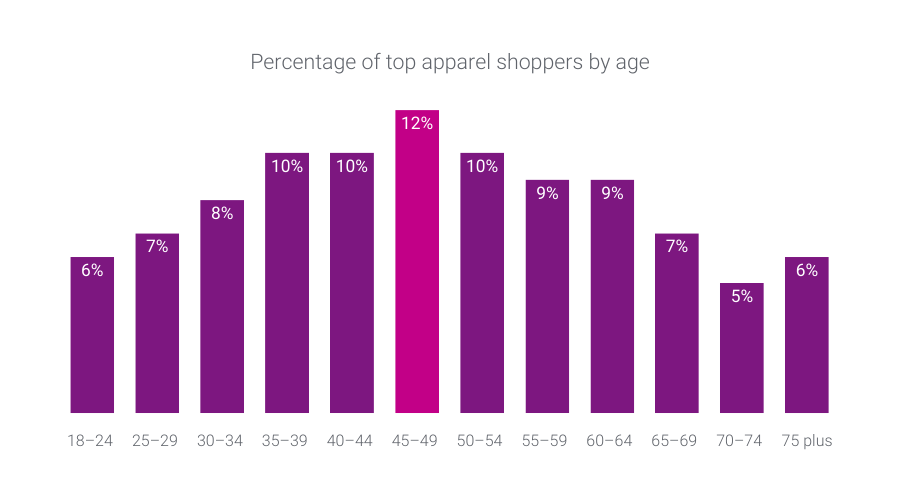

Did you know?

Consumers between the age of 45-49 make up the largest percentage of top apparel shoppers*.

Improve engagement for summer apparel shopping targeting by refining your audience with our Demographics > Ages > 45-49 syndicated audience.

Spring into effective advertising with Experian’s syndicated audiences

For spring advertising campaigns, understanding your audience is the key to success. By activating Experian’s syndicated audiences, you can refine your approach and resonate by activating specific segments. Embrace our syndicated audiences so you deliver campaigns that not only capture attention but also build lasting connections with your audience. As you embark on this spring marketing journey, remember – the possibilities are as endless as the blossoming flowers.

Need a custom audience? Reach out to our audience team and we can help you build and activate an Experian audience on the platform of your choice. Additionally, work with Experian’s network of data providers to build audiences and send to an Audigent PMP for activation.

You can activate our syndicated audiences on-the-shelf of most major platforms. For a full list of Experian’s syndicated audiences and activation destinations, download our syndicated audiences guide below.

Check out other seasonal audiences you can activate today.

Footnote

*Experian looked at our demographic and purchase-based data to understand retail trends over the past year. Our demographic and purchase-based data covers credit and debit card usage across 500 top merchants.

Latest posts

Experian’s 2024 Holiday spending trends and insights report covers consumer spending trends for the holiday season.

In our Ask the Expert Series, we interview leaders from our partner organizations who are helping lead their brands to new heights in adtech. Today’s interview is with Georgia Campbell, Head of Strategic Partnerships at Kontext. What types of audiences does Kontext provide, and what are some top use cases for these insights in marketing strategies? Kontext leverages its 1st-party, deterministic shopping data to generate real-time online audiences. What sets Kontext apart is our ability to see the entire consumer journey, from shopping interest to intent and purchases, at a SKU-level. This comprehensive visibility allows us to create purchase-based audiences across various consumer verticals, such as frequent online shoppers, consumers shopping for beauty, segments using Mastercard, or Black Friday enthusiasts. Our data engine, built on a foundation of approximately 100 million consumer profiles and over 10 billion full-funnel, real-time shopping events, enables the creation of precise audience segments. This real-time 1st-party shopper data is invaluable for partners aiming to understand and engage with consumers more effectively. Whether a brand wants to activate past shoppers in a specific category or reach new audiences with a propensity to buy, Kontext provides the insights needed to make informed decisions. Some examples of audience types include these (and hundreds more): In-Market Shoppers: Consumers showing high intent to purchase specific categories, like skincare or electronics, based on recent online behavior. Past Purchasers: Shoppers who have made verified purchases within specific time frames, such as beauty products in the last 18 months. Frequent Shoppers: High-frequency buyers identified through repeated purchasing behaviors. Seasonal Shoppers: Consumers active during key shopping seasons, like Black Friday, Mother’s Day, Valentine's Day, etc Premium Buyers: Shoppers who used a premium CC (eg. Amex) and a higher AOV (average order value) Beauty Buyers: an audience that has indicated intent to purchase beauty products (deterministic past purchasers also avail) By using Kontext data, brands can identify the right audiences across multiple verticals, such as retail, CPG, health & wellness, auto, business, energy & utility, financial, and travel. Additionally, our collaboration with Experian allows further refinement of these audiences through layered data from specialty categories like demographics, lifestyle & interests, mobile location, and TV viewing habits. How is Kontext’s data sourced, and what differentiates it from other data providers? Kontext’s data is unique because it is deterministic, 1st-party, and collected as transactions occur. We capture the entire path-to-purchase, down to the SKU-level product detail, across 100 million consumer profiles and more than 10 billion real-time shopping events. Our proprietary technology, embedded in widgets across our 5 million premium online destinations, tracks the full consumer journey—from reading an article of interest to clicking on our dynamic commerce modules, adding items to cart, and completing purchases. This real-time data collection ensures there is no lag between digital events and their connection to consumer profiles. Unlike other providers, we do not aggregate data from multiple platforms; instead, we focus on building our models and insights based on authentic online consumer behavior. Our data stands out due to its: Deterministic Nature: We capture 1st-party data as transactions occur (all in real time) Full-Funnel Coverage: We capture consumer journeys from awareness to purchase, providing a complete view of consumer behavior. Real-Time Insights: Our data engine processes events in real-time, enabling timely and relevant marketing actions. How does Kontext ensure the accuracy and reliability of its audience data? Kontext ensures accuracy and reliability through our unique technology and direct data sourcing. By not aggregating data from other platforms, we maintain control over the quality and integrity of our insights. Our continuous investment in refining our models around online consumer behavior further enhances the precision of our audience data. What types of brands or verticals might resonate the most with Kontext audiences for activation? Any brand looking to understand and activate online shopping behavior – informed by 1st-party transaction data – will resonate with Kontext audiences. Essentially, any vertical that benefits from understanding real-time shopping behaviors, such as retail, health & wellness, auto, and financial services, will find our data invaluable. We have particularly strong insights in beauty, hair care, health & wellness, and values-based online shopping habits, as well as the food & beverage space. Retail & Consumer Goods: Leveraging shopping behavior data for targeted campaigns. Health & Wellness: Identifying consumers with specific health and wellness interests. Automotive: Targeting potential buyers of electric vehicles or eco-friendly products. Financial Services: Engaging high-value shoppers with premium credit card usage. And many more How does Kontext’s data help advertisers navigate the challenges posed by the deprecation of third-party cookies? As third-party cookies become less reliable, Kontext’s 1st-party data becomes invaluable. Our deterministic data engine, which does not rely on cookies, offers: Direct Consumer Insights: Accurate and consented data directly from consumer interactions. Privacy Compliance: Our data collection methods are fully compliant with privacy regulations, ensuring secure usage. Cross-Device Coverage: We use verified digital identifiers, allowing seamless unification and targeting across multiple devices. What measures does Kontext take to maintain data privacy and compliance, and how does this benefit advertisers? Data privacy and compliance are fundamental to Kontext. We meet or exceed all privacy compliance and security standards, ensuring that our data sourcing and usage are transparent and comply with regulations (CCPA, CPRA, VCDPA, etc). Kontext prioritizes data privacy and compliance through: Consented Data Collection: All data is collected with explicit consumer consent. Robust Security Protocols: Data is encrypted and secured with industry-leading practices. Compliance with Regulations: We adhere to global privacy laws, including GDPR and CCPA. User Control: Consumers have the ability to opt-out and manage their data preferences. Can you share success stories / use-cases where advertisers significantly improved their campaigns using Kontext’s data? To give you a sense of how Kontext data can be applied, here are two use-cases: Beauty Brand Campaign: An agency hoping to activate an audience of beauty purchasers for a Major Beauty Brand could utilize Kontext's custom audience of high-value beauty product purchasers. By targeting those consumers who had bought similar products in the last 12 months and had an average cart size of over $50, the campaign would significantly increase performance and ROAS. Electric Vehicle Launch: For a major auto manufacturer’s EV launch, Kontext could be used to identify eco-friendly consumers who had not yet purchased an EV but had shown interest in sustainable products. This precise targeting could lead to higher engagement and conversion rates for the campaign. Thanks for the interview. Any recommendations for our readers if they want to learn more? For those interested in learning more about Kontext, reach out for a personalized consultation. Contact us About our expert Georgia Campbell, Head of Strategic Partnerships, Kontext In her current role as Head of Strategic Partnerships at Kontext, Georgia plays a pivotal role in shaping the company's strategic direction within the data space. With a deep-seated expertise in leveraging data to drive impact for companies, Georgia has been forging key partnerships that enhance the effectiveness and reach of Kontext's offerings. Georgia comes from a background in emerging technology, where she has been focused on cultivating partnerships and employing data-driven approaches to spearhead market expansion efforts. She started her career in finance, managing investments across equity, debt, and alternative assets at Brown Advisory. In this Q&A, Georgia shares her insights on Kontext's Onboarding partnership with Experian, offering perspective on how Kontext's unique insights can unlock new opportunities for advertisers and brands alike. Latest posts

Experian’s solution for commerce media networks connects first-party shopper data with trusted identity, audience, activation, and measurement capabilities.