Tag: price transparency

Providers can improve the customer experience and bottom line with the power of data and analytics. Introduction In an increasingly competitive and consumer-driven healthcare marketplace, it’s no surprise that providers are working harder to acquire and retain customers. Higher out-of-pocket expenses combined with more choice and control in when and where consumers receive care are driving more retail-like shopping behavior. As a result, healthcare organizations are looking for ways to slow or stop customer churn, drive audience engagement, and redefine how they interact with their customers instead of seeing them through a clinical transactional lens. Providers understand that they must deliver a positive overall experience to maintain a favorable brand in the community and earn customer loyalty, key factors in maintaining their financial solvency. While there are many facets to consider in providing customers a great experience during their healthcare journey, there hasn’t been much attention paid to the intersection between the clinical and financial sides of this experience. According to findings from an Experian Health study among 1,000 consumers and select providers, the greatest pain points and opportunities for improvement around the complete customer healthcare journey center on the financial aspects, from shopping for health insurance to understanding medical bills. This means organizations that want to meet the new demands of consumerism in healthcare and improve the holistic customer experience must address the end-to-end revenue cycle. Typical consumer healthcare journey* *Consumers revealed 137 “jobs” or “needs” associated with their healthcare experience, with varied levels of importance, difficulty and satisfaction. Money matters give consumers high levels of discomfort Using a “jobs to be done” methodology, qualitative insights were gleaned as to the jobs, or microtasks and decisions, consumers associate with a healthcare journey. Despite the staggering number and complexity of different “jobs” consumers must undertake just to access the care they need, patients’ biggest dissatisfaction centers on the process of paying for their care. Of all the activities included in a consumer’s healthcare experience — from acquiring health insurance to making appointments with providers to receiving treatment — the top “pain points” relate to money matters. Specific issues for patients surveyed include: Understanding how much is owed for services and if the amount is a fair market price Making sure they have money available to pay for services Determining what financial support is available (e.g., a payment plan) Ensuring that what is owed to the provider is accurate Understanding the amount covered by their health insurance [click on image to enlarge] Providers also feeling the sting from unpaid collections, lack of customer service The most glaring opportunity for improvement in the patient experience comes early in the journey — price transparency. Patients are understandably confused about what their health insurance covers. They can’t always understand medical bills, and they have difficulty finding out how much their out-of-pocket charges will be and what payment options are available to them. Providers are also suffering — from unpaid collections, low customer satisfaction levels and an inability to address issues holistically. Here’s what providers had to say: We’re addressing the patient experience in one-off initiatives. Help us holistically improve the end-to-end patient journey. Providers said key impediments to progress include lack of clear and consistent prioritization, significant interoperability issues, and complicated organizational structures. They are frustrated by how hard it is to execute holistic changes efficiently. We need to measure our customer experience better. We want to standardize an approach that will drive progress and impactful change. Providers don’t have a clear path to move from customer experience as a concept to a measurable discipline. It’s a priority for them, but few are using a measurement system they feel is helping them understand and improve their patient experience. Patients are suffering, in part due to a lack of understanding of their charges. We want to set better expectations and make the charges and the value of our services easier to understand. Rising patient responsibility and the proliferation of high-deductible health plans drive the desire for full transparency in costs. Managing expectations at each step is crucial to providing the most accurate information to the patient. We’re not equipped to address customer acquisition and loyalty. Help us efficiently attract more consumers and keep them with us long-term. The focus has always been on healing people, with less attention to the business and marketing aspects of providing care. Providers need to focus efforts on acquisition and loyalty, but they’re generally understaffed and lack the skills to do so. There’s no doubt that healthcare organizations want to evolve and are thinking differently about how they deliver services and the value associated with those services. Ultimately, those that see driving customer engagement and redefining how they interact with their customers as a necessity, rather than a luxury, will succeed. Revenue cycle solutions for today’s consumerism environment Where to start? Key areas that can be addressed in the healthcare financial journey include: Comprehensive data – One of the core components of a patient-centric revenue cycle begins with the ability to use reference data to address duplicate medical records, understand a patient’s propensity to pay and identify social determinants of health. Incorporating this type of outside data into the revenue cycle won’t just create better patient experiences from the moment patients begin interfacing with staff, it will also optimize revenue for health systems while enabling a revenue cycle that puts the patient at the center of care. Patient identification – As hospitals must now deal with hundreds of thousands of electronic patient records, spanning multiple systems and departments, the traditional technologies for managing patient information are no longer sufficient. Using sophisticated matching technology and outside data sources can improve patient identification and prevent duplicate or overlapping records that result in inappropriate care, redundant tests and medical errors — as well as improving data accuracy for clinical, administrative and quality improvement decision purposes. Insurance reconciliation – Organizations can use automated technology to monitor claims data, real-time eligibility and benefits information, payer contracts, and charge description master (CDM) information to ensure that payers are meeting their obligations fully and achieve accuracy and transparency in healthcare costs. Closing the gap in payer contracts and reimbursement allows organizations to focus on providing transparent cost estimates throughout every patient’s continuum of care and helps patients know their costs so they are better prepared to pay them. Price estimates – Providing accurate patient estimates is quickly becoming the norm for health organizations. But to ensure patient satisfaction rates are being met, health organizations need to empower patients with a frictionless financial experience. By incorporating credit data into the patient billing process, health organizations can enable a people-first product design to price transparency and collections that extends benefits to more people by understanding the unique financial needs of each patient. Self-service portals – One way to engage patients is with an online and mobile-optimized experience that’s proactive, smooth and compassionate to empower patients to set up payment plans, apply for financial assistance, estimate the cost of care and review insurance benefits. Conclusion With so much to consider when addressing the evolving patient/customer journey, providers are well-served to start by improving their customers’ financial experience. As the link between customer satisfaction and a health organization’s revenue continues to grow, efforts to create a better financial experience are crucial. Using comprehensive data and analytics to power the revenue cycle and customer relationship management initiatives will allow health systems to encompass the end-to-end customer journey to ensure streamlined operations, measure and improve performance with payers, and provide accurate insights into each unique customer and their needs. The key to establishing this customer-centric mindset is embracing the power of data and analytics. From offering access to automated, personalized tools to providing price estimates to informing about charity aid options and offering payment plans — all these innovations help customers feel they can make better decisions about their care and how to pay for it. The result is more satisfied customers and an improved bottom line for providers.

Experian Health will be at HFMA ANI again this year–booth 1025–at the Venetian-Palazzo Sands Expo in Las Vegas, Nevada. Kristen Simmons, Senior Vice President, Strategy, Innovation, Consumer Experience, and Marketing, with Experian Health, chatted with Joe Lavelle of IntrepidNOW to provide her insights on this year’s HFMA ANI conference, consumerism in healthcare and much more! Excerpt below: Experian Health booth activities "[In our booth this year at HFMA ANI, we want to focus] around peer to peer learning and exchanges, so we are doing less selling and more engaging and more understanding. Understanding folks problems and helping to collectively arrive at solutions. We are doing a lot this year in terms of hands on demos of our solutions. We'll be showing some of our patient engagement products which include, self-service portals and mobile options for getting price estimates for applying for charity care, and setting up payment plans. Likewise, on the revenue cycle management side to automate orders with patient access functionality, contract management claims and collections, all those types of things that we do to improve efficiency and increase reimbursement for our clients. We'll also be showing off some of our identity management capabilities to match, manage, and protect patient identities so we can safe guard medical information and reduce risks for our clients. And on the care management side, our early support and sharing of post acute patient care information to help providers succeed as we all move forward into a value based paradigm." How Experian Health is addressing the need for consumerism in healthcare "When it comes to consumerism, it's interesting when you're a company that has a lot of data and a lot of capabilities to say, 'Hey what can we do for people?' One of the things we really wanted to look at for our consumer approach, was to say, 'What is it that needs to be done?' We had some great hypotheses coming in and a lot of those were borne out but we actually undertook a big national study to take a look at what consumers biggest pain points were. It has a qualitative and a quantitative component. But, we basically looked at the entire healthcare journey so we weren't just asking them about the administrative and financial aspects of care, but also the clinical aspects. As we walked through the journey and were able to get a lot of quantitative data about all these different aspects of their healthcare journey, what actually turned out to be the most painful for the most people, were all the things around the financial equation. And, so clearly there can be pain in a clinical side, especially if you're unhealthy, you've got something chronic, you've got something terminal. There's all kinds of awful situations there but, really affecting almost everyone is a lot of the pain around the financial aspect of healthcare. So, we were able to look closely at some of those pain points and decide on some of the biggest ones that we wanted to tackle." How Experian Health is helping providers address financial pain points for patients and providers "Some of the big pain points for people is just the fact that you don't know what you're going to owe and as the patient portion of responsibility increases, understanding what you're going to be paying becomes more and more important to a consumer. So, understanding what I owe earlier, being transparent, and then helping me pay, those are some of the areas. And there are others but those are some of the absolute biggest pain points. And as you pointed out with some of our propensity to pay analytics, and some of the other capabilities that we have, we're able to help providers understand the financial situation patients are in much earlier in the process so they can get them to the right kind of funding sources. They can give them peace of mind so that they know what they're paying upfront, which may impact when they choose to go in for a major procedure or how they might want to save up for it or how they might want to access different funding sources." Listen to the full podcast

Making phone calls, filling out paperwork, and chasing down debt shouldn’t take up the bulk of a healthcare organization’s daily schedule. Now more than ever, physicians have little time to provide high-quality care to their patients. In 2015, the American College of Physicians (ACP) put forth the Patients Before Paperwork initiative to address the burdens that these administrative tasks create for physicians and their staff. The ACP states that defining and mitigating administrative tasks is essential to improve an organization’s workflow and reduce physician burnout. Through utilizing healthcare workflow automation, you can improve productivity without overextending employees' duties. Instead, your team can spend more time caring for patients and helping them with the financial side of their experience, which is something both patients and doctors prefer. Easier access with automated healthcare solutions In the new wave of consumerism, there is a high demand for convenience and transparency in every transaction. Healthcare providers and organizations also face this pressure, but the industry has been slower to transform because patient care transactions are infinitely more complicated than online retail purchases. Despite the slow go, healthcare workflow automation technology and organizations are starting to catch up. For example, engagement is a defining factor for today’s healthcare consumers. However, engagement must be mindfully catered to specific situations. When it comes to scheduling appointments, patients actually prefer an automated healthcare workflow approach over talking to a human. Regardless of its form, engagement is still essential in all aspects of the care continuum, and physicians can find it hard to engage when every administrative task has to be completed by hand. If you’re still devoting time and resources to manual patient access tasks, you're not only falling behind in the competitive healthcare industry, but you’re also missing an opportunity to enhance the overall patient experience. Fortunately, countless tasks — scheduling, preregistration, registration, and admissions — are no longer paper-based and don’t require nearly as much hands-on involvement as they used to. Given this reality, automated healthcare solutions can and should take are of scheduling and other mundane tasks. Ultimately, automation will allow administrative employees to focus on other areas of engagement, like financial counseling for patients. Employees will have more time to help patients understand their financial obligations and perhaps set up a payment plan before procedures, avoiding the sticker shock of a surprise bill months later. The touchless approach In the Patients Before Paperwork initiative mentioned above, the ACP concluded that “excessive administrative tasks have serious adverse consequences for physicians and their patients.” At Experian Health, our automated healthcare solutions reduce those consequences by creating a touchless approach that only requires human intervention for exceptional cases. A touchless, automated healthcare workflow makes patient access predictable so you can spend more time serving patients. For example, our eCare NEXT® solution is a single platform that automates every step of the revenue cycle. Users only work on prescreened accounts with actionable follow-ups. Touchless Processing™ takes care of the rest through intelligent automation. You can effectively implement Touchless Processing throughout the rest of your organization by integrating eCare NEXT with Experian's other solutions: Registration QA When eCare NEXT is integrated with Registration QA, for instance, you can automatically access patients’ insurance eligibility in real time and identify registration inaccuracies early in the revenue cycle. This significantly reduces claims denials that can cut into revenue and take up more time to correct and resubmit. Payer-specific information can also be stored and automatically updated to ensure accuracy every time that payer comes up. Authorizations You can carry the touchless approach even further by expanding your suite of solutions with our Authorizations.The platform automates authorization management using the payer authorization requirements already stored and updated in the system. Authorization completes inquiries and submissions without user intervention to further reduce denials and expedite reimbursements. When done manually, administrative tasks related to orders, scheduling, preregistration, registration, and admissions are a drain on any healthcare organization’s resources. Minimizing staff involvement in these tasks improves the experience for physicians and patients alike, but it requires automated healthcare workflow solutions that can be seamlessly integrated into the workflow. With Experian Health’s Touchless Processing solutions, providers can exercise greater control over these tasks and significantly improve revenue recovery. This will give physicians and employees more time to focus on creating a more efficient, effective, and positive experience for everyone involved.

As the health industry faces extraordinary changes, how can leaders better drive efficiency and optimize resources? Recently President for Experian Health, Jennifer Schulz, sat down with The Business Debate to answer this pressing question. In short, the best way to get there is to turn to data-driven technology. In this interview, Jennifer touches on some of the main barriers to efficiency in health systems: Patient financial payments and identity management. Here are some excerpts from her interview. To watch the video and read Jennifer’s editorial, please click here. Patient financial payments and price transparency “The use of technology in healthcare is slim. When a consumer in a retail experience or a financial service experience uses their mobile device, or goes online, that experience doesn't translate into healthcare. Experian Health is very focused on improving the transparency of healthcare from a financial perspective. We've launched things like patient estimators because there’s no other large purchase you make in your life that you don't know what you're about to buy. And healthcare, for the most part, this all happens after the transaction, and that type of transparency in healthcare can come with the use of technology.” Universal patient identification “Another issue is identity isn't the same when you go from system to system. Every hospital, every provider looks at you as an individual, and puts a number associated with you. That number is within their system only, and so you may go across systems, but there is no view of identity. One of the solutions we've launched here at Experian Health is the universal identity manager, and we're offering that with no charge to our clients because we think identity is the one key to provide transparency across systems.” As we have done for other industries, Experian is at the forefront of bringing this type of consumerism to healthcare. Through our data assets and technology, we empower our clients to connect with consumers through a tailored approach that is personalized along the patient journey. To learn more, visit www.ExperianHealth.com.

Almost every day, new developments come from Washington, D.C. regarding the U.S. healthcare system. From the Affordable Care Act and Medicaid expansion to laws and regulations governing cost transparency and debt collection — there's constant fluctuation. This affects healthcare organizations across the country. They don’t know what rules they’ll be operating under in the future, but they do know they’ll have to meet these changing laws and regulations to avoid fines or lost revenue. Consequently, a crucial question emerges: How do you comply without overburdening employees? Compliance with laws and regulations: 3 ways Experian Health can help The answer is in technology. Healthcare organizations need systematic changes and IT solutions that help establish stability and security. For example, Experian Health’s data-driven technologies help organizations remain compliant with laws and regulations while improving the population's health and ensuring more successful collections. Here are three ways Experian Health can help: 1. Early and accurate cost transparency Nearly 30 states have current laws and regulations that require and govern healthcare price transparency. This list will continue to grow, so organizations need to thoughtfully prepare. Even if it weren’t legally required, patients are now demanding more transparency as they bear more healthcare costs. Historically, the problem stems from patients not receiving accurate, upfront cost estimates. They’re surprised and dismayed when medical bills arrive weeks or months after treatment. If patients are unable to successfully budget for these high costs, then collecting payment becomes more difficult. Experian Health’s Patient Estimates solution solves this by producing fast, highly accurate estimates based on a variety of data. Employees don’t need to manually update price lists, which eliminates the guesswork that leads to outdated, inaccurate estimates. Patients can even self-request treatment estimates through a self-service portal or mobile app. When patients know what to expect before they receive treatment, they’re more willing and able to adhere to payment plans. With our Power Reporting feature, organizations can also accurately judge potential and actual revenue recovery to vastly increase the rate of successful upfront collections. 2. Ensured compliance of third-party vendors Accurate and upfront estimates make capturing revenue easier, but they don't eliminate the need for collections. With patients paying higher percentages of medical costs, healthcare organizations now rely more on agencies to collect debt on their behalf. However, if an agency doesn’t comply with all healthcare laws and regulations that govern debt collections, then it could be liable for its practices. The Fair Debt Collection Practices Act (FDCPA), the Telephone Consumer Protection Act (TCPA), and the Truth in Lending Act (TILA) are examples of these regulations. In addition to maintaining overall compliance in your organization, being responsible for a collection agency working on your behalf can be burdensome. This burden increases when a large percentage of your patients live out of state, making them harder to manage. 3. EMV-optimized payment solutions With more payments coming directly from patients, the risk of credit card fraud is exponentially higher. Healthcare organizations can be held liable for any fraud that occurs on their watch if they haven’t upgraded their systems to be compliant for EMV payments. To help avoid credit card fraud or liability, we offer state-of-the-art card acceptance devices. These are powered by our PaymentSafe technology to provide a patient payment solution that is highly secure and EMV-ready. Because PaymentSafe is processor agnostic, it can be integrated with Experian Health’s eCare NEXT suite of products to leverage the data created at other points in the revenue cycle. It also works in a standalone environment and can be used at a kiosk, through a patient portal, or on a mobile app to accept all forms of tender. PaymentSafe and other Experian Health solutions make up an advanced, integrated revenue cycle that consumes and displays information from a wide variety of sources. The goal is to increase collection opportunities and cash flow, lower the costs of collections, allow staff members to use their time more efficiently, and increase patient satisfaction. It also makes it easier to adapt to compliance regulations that can only be met with the help of advanced technology. The country's healthcare laws and regulations may be in flux, but Experian Health continues to help hospitals and medical groups keep up with safe and secure solutions. By providing increased price transparency, better oversight over debt collectors, and highly secure payment solutions, Experian Health’s suite of products can make navigating complex compliance laws and regulations a breeze. For more information about current laws and regulations in the healthcare industry, please visit: S. Department of Health & Human Services — Laws and Regulations overview Health Insurance Portability and Accountability Act (HIPAA)

Experian Health is pleased to announce that its Patient Estimates solution has joined the athenahealth® Marketplace, also known as the More Disruption Please (MDP) program. Experian Health has participated in this program since the launch of the marketplace in 2013 (starting with our Contract Management offerings) and has worked with athenahealth to integrate its industry-leading capabilities into the organization’s growing network of more than 73,000 healthcare providers. Learn more about Experian Health’s Patient Estimates solution. Read the press release To learn more about athenahealth’s MDP program and partnership opportunities, please visit https://www.athenahealth.com/disruption.

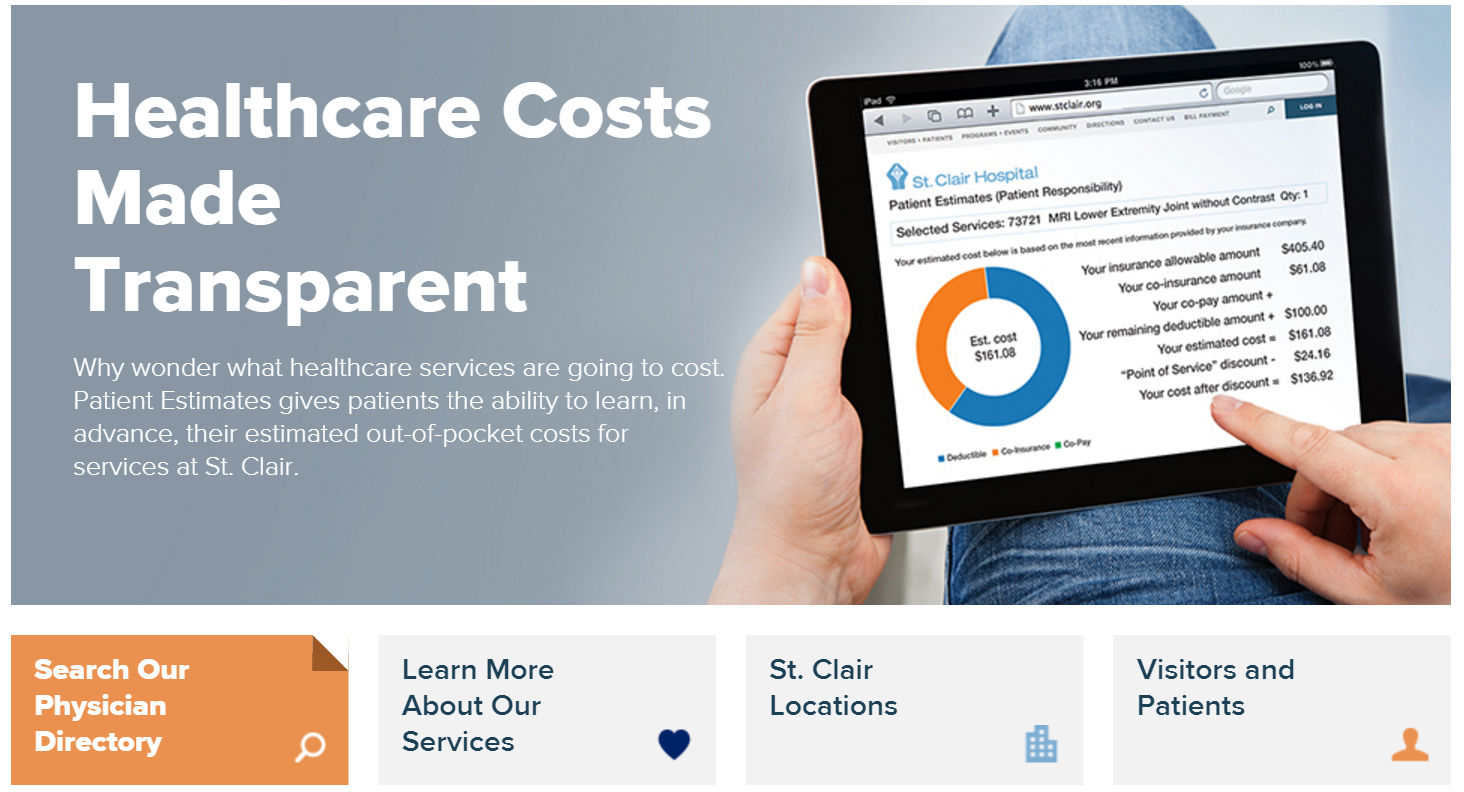

Experian Health is pleased to announce that we went live with Patient Estimates at St. Clair Hospital located in Pittsburgh, PA on February 22, 2016. A true representation of vendor and hospital collaboration and commitment, the Patient Estimates cost transparency tool gives St. Clair a competitive edge as the first hospital in its region to offer patients cost estimates in advance. Patient Estimates is not a list of charges, but an interactive and user-friendly tool that provides information that is highly specific to the individual. Estimates are designed to determine, in advance, each patient’s out-of-pocket costs (deductibles, co-pays and co-insurance) for services at St. Clair based upon his/her insurance coverage. The estimates also incorporate St. Clair’s discounts for payment on the date of service and for those without insurance. The estimates remain in the system and can be recalled for future reference. Patient Estimates is simple to use and is conveniently available 24/7 at www.stclair.org. On the home page, patients will select the “Financial Tools” option, then click on Patient Estimates. They will then enter their health insurance information before choosing one of the 100 listed clinical services (e.g., a procedure, treatment or diagnostic test) from the drop-down menu. The tool then provides a customized estimate of their out-of-pocket expenses. Patient Estimates is designed to help insured and uninsured patients get clear, real-time, easy-to-understand cost estimates for St. Clair’s services so patients can make informed decisions about their care. Below are some of the press mentions of St. Clair Hospital's implementation of Patient Estimates: Pittsburgh TRIBLIVE https://bit.ly/1oxlKna Pittsburgh Post-Gazette: https://bit.ly/219dqfd Pittsburgh Business Times: https://bit.ly/1QWfqNa

There’s a unique dichotomy in healthcare that’s not found in other service industries. For example, when you go out to eat at a restaurant, you don’t expect the server to ask you to pay before the meal is served. Conversely, you also don’t expect to walk out of the restaurant after the meal without paying. However, if you have ever ordered the special of the day and been shocked when the check arrives and the item costs twice as much as other menu items, you can certainly understand the patient’s viewpoint. How can a patient make informed choices about his or her healthcare without knowing the cost? Price transparency – one of today’s hottest healthcare topics – offers significant benefits to both providers and patients, including: Empowering the patient to make well-informed decisions on healthcare treatments Improving patient satisfaction and involvement with their care management Allowing appropriate upfront collections based on realistic estimates Serving as a foundation for establishing payment plans or seeking charity The difficulty of providing a reliable estimate has hindered efforts to collect from patients at the point of service, when they are most likely to pay. In order for the estimate to be relevant and timely, it must bring together financial data from the chargemaster, claims history and payer contract terms, and integrate that with the patient’s insurance benefits. Thankfully, this is a task that is ideally suited to technology. Not only can you use a payment estimator to quickly and easily create a targeted estimate, healthcare organizations can also eliminate the need to manually update price lists, as well as remove guesswork and tedious searches through potentially outdated patient information. An estimator is the base of an effective upfront collections strategy, and is complemented by the ability to determine if a patient is eligible for charity care in addition to their propensity to pay. An additional complement is to streamline the payment process by facilitating the collection of patient open balances through eChecking, signature debit, credit, recurring billing, cash, check or money orders. The ability to create price transparency that is applicable to each patient’s individual situation is critical to a healthcare organization’s financial performance.