Collections Optimization

Boost revenue, streamline patient financial assistance, and reduce collection costs.

Below is an update from the Experian Health Support Team. Network & System Performance Last six months: Upgrades to the network, compute and storage infrastructure have improved performance and scalability. Enhanced alerting and reporting to strengthen proactive measures for issues remediation Next six months: Data Center move and consolidation will localize production communications to improve efficiencies Automation improvements to reduce on-boarding times for new clients Subscribe to Receive Product Support Updates Opt in to receive emails about significant product updates or changes. Access the Experian Health Product Dashboard here.

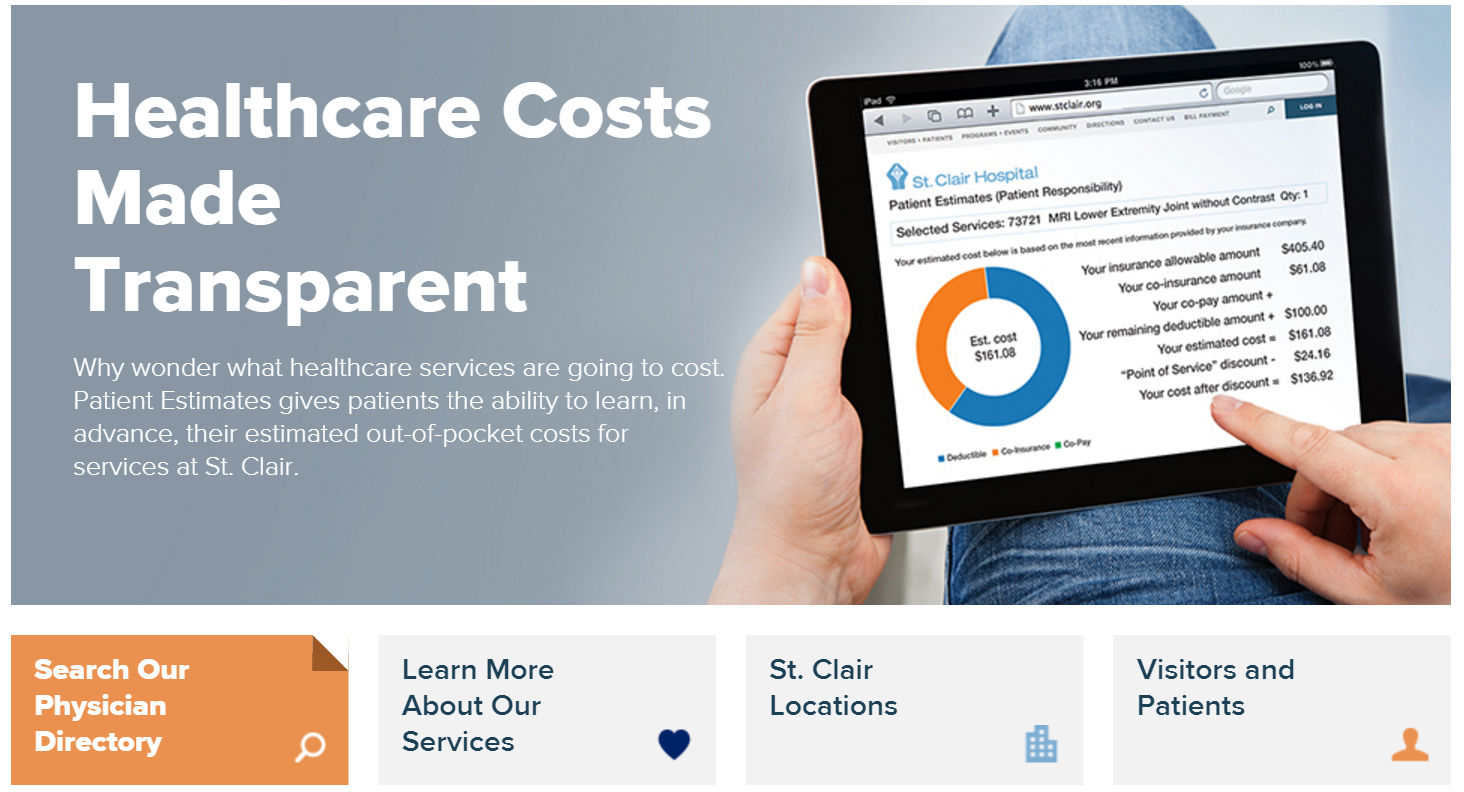

Our congratulations and admiration go out to all Experian Health clients who were recently recognized by Hospitals and Health Networks (H&HN) magazine with the prestigious 2016 “Most Wired” distinction: http://www.hhnmag.com/articles/7393-2016-most-wired-themes. Following are two (of the MANY) Experian Health clients who were honored. Altru Health System has been recognized in the Advanced Category in this year’s HealthCare’s Most Wired™ survey. The survey, released on July 6 by the American Hospital Association’s Health Forum, is a leading industry barometer measuring information technology (IT) use and adoption among hospitals nationwide. It examined how organizations are leveraging IT to improve performance for value-based healthcare in the areas of infrastructure, business and administrative management, quality and safety, and clinical integration. St. Clair Hospital’s Patient Estimates tool, the only one of its kind in the greater Pittsburgh region, has garnered the Mt. Lebanon-based medical center Hospitals & Health Networks (H&HN) magazine’s prestigious Innovator Award for its co-development of the cost transparency software. Patient Estimates, which was made available to the public earlier this year at www.stclair.org, gives patients the ability to learn, in advance, what their estimated out-of-pocket costs will be for services at St. Clair or the Hospital’s Outpatient centers. Patient Estimates is highly accurate and based on information provided by each patient’s health benefit plan. Please contact us to add your organization’s Innovative Achievements to our future Shout Outs!

In case you missed them, below are some great tools to help you address key business challenges. Enjoy the read! Press Releases Innovative Mindset Enables Experian Health to Deliver New Capabilities Experian Health Rises to 45 On The 2016 Healthcare Informatics 100 List White Paper Why Start the Payment Process Prior to Service? As a patient’s financial obligation grows, it’s imperative to tailor payment strategies to each unique situation. In pre-service stages, data-driven solutions provide a higher likelihood of securing patient payment. Flexible patient payment plans contribute to a positive billing, payment, and overall engagement experience, as well as a provider’s financial health. Read our white paper to learn more about the importance of the Personalization in the Healthcare Consumer Payment Process. Read Now Article: Healthcare IT Transformation - How Has Ransomware Shifted the Landscape of Healthcare Data Security? Read Now

Experian Health has launched Coverage Discovery® on demand, which is integrated into Epic’s EMR. We are the first-to-market with this functionality for Epic. In addition to Coverage Discovery’s batch reclassification of uncompensated care by finding previously misidentified patient coverage across both government and commercial payers by using advanced analytics, multiple data sources and a proprietary coverage optimization engine, the “on demand” feature provides Epic clients with additional opportunities to find coverage early in the revenue cycle—reducing additional downstream processes. By adding the on demand option, Experian Health’s clients can now run Coverage Discovery within their Epic workflow, which will help to reduce errors, save time and ultimately improve their revenue cycle. Every dollar found in our proactive, automated Coverage Discovery solution is a dollar that our clients are not spending pursuing patients for payment, paying for expensive collection agencies, or writing off to bad debt. Coverage Discovery is also available via eCare NEXT®, OneSource and Batch for non-Epic users. Coverage Discovery is providing significant results for over 300 Experian Health clients. In 2015, the solution discovered coverage associated with over $1.1 billion in charges. According to Murry Ford, Director, Revenue Strategy at Grady Health System, “Coverage Discovery consistently delivers value to our organization. Since our June 2015 go-live of the batch product and November 2015 go-live of the on demand product, Coverage Discovery has protected $2.3 million in reimbursement, $509,000 of which resulted from Coverage Discovery on demand queries for inpatient admissions over a two month period.” Read our latest press release, which further highlights Grady’s success using this solution.

Welcome Katie Zibelin, Experian Health Marketing’s newest team member. Katie made her Experian debut in August 2015 as an intern where she supported client events, tradeshows and proposal efforts behind the scenes. Upon securing her advertising degree from the University of Texas at Austin in December 2015--one semester ahead of schedule--Katie joined the team full time this February. In her current role as a Marketing Coordinator, Katie is responsible for tracking projects, managing vendor activities, conducting tradeshow and vendor research, developing new vendor relationships, coordinating and supervising tradeshow activities and communicating programs and events. Katie also serves as the project leader of our 2016 Regional User Conferences. In her first solo performance at our Southeast Regional Conference in New Orleans, Katie received rave reviews for demonstrating project management and event planning maturity and grace under pressure. Fun Fact: Katie is also an accomplished contemporary dancer/performer/instructor. Please do not hesitate to reach out to Katie with questions regarding any of the upcoming Regional User Conferences at Katie.Zibelin@experianhealth.com.

Did you know? In 2015, Experian Health helped nearly 700 provider clients screen over 51 million patients for financial assistance. That’s important for healthcare providers that are ramping up to meet 501r regulation requirements this year. Experian Health’s Patient Financial Clearance automates the financial screening process prior to service or at the point of service, to determine if patients qualify for Medicaid, charity or any assistance program, while auto-enrolling eligible patients. This new solution can help you: Meet 501r regulatory requirements Increase staff productivity by expediting financial assistance decisions Improve point-of-service collections Reduce overall AR days Patient Financial Clearance uses a proven combination of consumer data, patient-provided information and provider policies to automate the screening process and empower patient access staff to be more productive and effective. Help your patients while protecting your bottom line. Contact us today at experianhealth@experian.com or 1 888 661 5657 to find out how Patient Financial Clearance can help you.

Experian Health is pleased to announce that its Patient Estimates solution has joined the athenahealth® Marketplace, also known as the More Disruption Please (MDP) program. Experian Health has participated in this program since the launch of the marketplace in 2013 (starting with our Contract Management offerings) and has worked with athenahealth to integrate its industry-leading capabilities into the organization’s growing network of more than 73,000 healthcare providers. Learn more about Experian Health’s Patient Estimates solution. Read the press release To learn more about athenahealth’s MDP program and partnership opportunities, please visit https://www.athenahealth.com/disruption.

Experian Health is pleased to announce that we went live with Patient Estimates at St. Clair Hospital located in Pittsburgh, PA on February 22, 2016. A true representation of vendor and hospital collaboration and commitment, the Patient Estimates cost transparency tool gives St. Clair a competitive edge as the first hospital in its region to offer patients cost estimates in advance. Patient Estimates is not a list of charges, but an interactive and user-friendly tool that provides information that is highly specific to the individual. Estimates are designed to determine, in advance, each patient’s out-of-pocket costs (deductibles, co-pays and co-insurance) for services at St. Clair based upon his/her insurance coverage. The estimates also incorporate St. Clair’s discounts for payment on the date of service and for those without insurance. The estimates remain in the system and can be recalled for future reference. Patient Estimates is simple to use and is conveniently available 24/7 at www.stclair.org. On the home page, patients will select the “Financial Tools” option, then click on Patient Estimates. They will then enter their health insurance information before choosing one of the 100 listed clinical services (e.g., a procedure, treatment or diagnostic test) from the drop-down menu. The tool then provides a customized estimate of their out-of-pocket expenses. Patient Estimates is designed to help insured and uninsured patients get clear, real-time, easy-to-understand cost estimates for St. Clair’s services so patients can make informed decisions about their care. Below are some of the press mentions of St. Clair Hospital's implementation of Patient Estimates: Pittsburgh TRIBLIVE https://bit.ly/1oxlKna Pittsburgh Post-Gazette: https://bit.ly/219dqfd Pittsburgh Business Times: https://bit.ly/1QWfqNa

In the “good old days,” U.S. healthcare was basically free – at least that’s what patients with a good insurance plan believed. You may have had a small co-pay, but if you were employed, chances were that you and your family received comprehensive health insurance that took a barely noticeable bite out of your paycheck. Fast forward to 2014, and that rosy picture is long gone. Changing reimbursement models are compounding the financial risk for healthcare providers by placing a greater payment burden on patients. For example, a growing number of employers are adopting high-deductible health plans (HDHP) and/or health savings accounts. The number of people with HDHPs has risen from 19.2 percent in 2008 to 33.4 percent in 2014, as reported by the Centers for Disease Control and Prevention. Out of necessity, providers are finding themselves in the collections business if they are to protect the bottom line. One of the best tools at their disposal to increase full and fair payment for healthcare services, and which has long been employed by collections agencies? Data and analytics. Real-time information and advanced data and analytics can help identify the most effective and customized collections approach based upon each patient’s financial situation. This data gives healthcare organizations the full picture of a patient, providing continuous monitoring of unpaid accounts for changes in a patient’s ability to pay. Obtaining and effectively leveraging that information is just one best practice for healthcare organizations seeking to enhance their collections methodologies. Additional must-have strategies include: Management of internal collections and agency performance with real-time dashboards and reports, and support evaluation and performance improvement. Use of full-time revenue cycle consultants and data analysts, who work with each account to recommend “best practice” collections and outsourcing strategies, evaluate reports for opportunities and oversee champion/challenger scenarios. Tools that help detect hidden or additional insurance coverage from Medicaid, Medicare and commercial accounts. Creation of customized patient statements that go beyond traditional statements by facilitating financial counseling, education and greater patient engagement. Simplified and streamlined payment processes by collecting patient open balances anywhere and at any time through eChecking, signature debit, credit, recurring billing, cash, check or money orders. Times may be changing, but employing a well-coordinated, proactive approach to addressing the self-pay patient and capturing the balance after insurance has paid doesn’t have to be challenging. Learn how Experian Health and Passport’s patient collections tools work together to help you obtain payment certainty even with today’s new reimbursement models, by combining unmatched insight, real-time data and innovative collections solutions.