Small Business Credit Insights

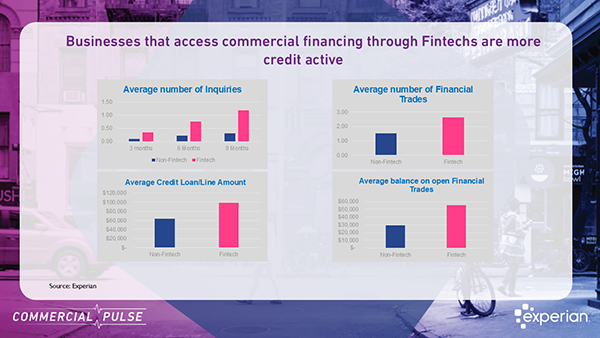

Explore how fintech growth impacts credit managers: increased credit activity, higher loan balances, but with greater delinquency risks in business financing decisions.

Get the latest Commercial Insights from Experian's October 2024 report—covering inflation, job growth, and why 75% of small businesses remain underinsured.

The Fall Beyond The Trends report offers a unique view into the challenges hitting small businesses, and how to navigate a cooling economy.

In this week’s Commercial Pulse report, we take a closer look at the burgeoning population of Women-owned businesses.

Population and business growth in the Southern U.S. have outpaced other regions since 2021, but both are now slowing.

Download the Main Street Report for in-depth analysis on recent small business credit performance.

I’m excited to share the current Experian Commercial Pulse Report with you. I have the opportunity each week to analyze data on the millions of U.S. small businesses in Experian’s database and discover actionable insights that benefit our clients. Making these discoveries is rewarding work, and we utilize these insights to guide our recommendations. I thought I would share what I am watching through Experian’s bi-weekly Commercial Pulse Report (just bookmark the link; we will update it on a bi-weekly basis). This week's report contains some compelling insight into commercial fraud. In 2002, a Trustpair Institute for Finance & Management survey reported 56% of businesses had reported some sort of fraud attempt, in 2023 the survey shows 96% of businesses reporting fraud attempts. What I'm watching: The growing financial fraud problem: Consumers lost a staggering $10 billion to fraud in 2022, marking a 14% increase from 2021. Already, a shocking 5 billion records were found on the dark web this year, matching the 2023 total. The economy grew 2.8% in Q2. The Fed leaves interest rates flat but leaves the door open for a potential cut at the September meeting. That’s a quick take – Download the latest report. Download Commercial Pulse Report Commercial Insights Hub Related Posts

Experian delivered the latest insights on small business credit conditions and presented key findings from the Main Street Report for Q2 2024 during the Quarterly Business Credit Review. Our lead presenter, Brodie Oldham, shared his perspective on the macroeconomic environment and then conducted a deep dive into the Q2 Main Street Report and the most recent small business credit data, highlighting what it indicated about how small businesses were performing. The session concluded with a Q&A segment, where we addressed participant questions. Webinar highlights: Expert analysis on commercial and macro-economic trends Credit insights and trends across 30+ million active businesses Industry hot topics, including business owner and small business data Exclusive commercial insights not available elsewhere Interactive peer insights through live polling In-depth exploration of small business trends for strategic decision-making Actionable takeaways based on current credit performance data Get Notified of Future Webinars

Experian Summer Beyond The Trends Report Now Available We are excited to announce the release of the Summer 2024 Beyond the Trends report. The report offers a unique view of the small business economy based on what we see in the data. With up-to-date information on over 33 million active businesses and how they perform from a credit standpoint, in this report, Experian shares insights and commentary on how economic conditions, public policy, and other factors might shape future small business performance. Here's our V.P. of Commercial Data Science, Brodie Oldham with his quick take. Overall, the sentiment among small businesses regarding growth is cautiously optimistic. Optimism Despite Challenges There is a general sense of optimism reflected in the U.S. Chamber of Commerce Small Business Index, which has risen to 69.5. Additionally, 73% of small businesses expect higher revenues, and 46% plan to increase investments, indicating positive growth expectations despite facing persistent challenges such as inflation, worker shortages, and rising operational costs. Government Support and Initiatives Various government programs and initiatives are bolstering small business growth by improving access to capital and providing targeted support. These initiatives include the Investing in America Small Business Hub, expansion of Women’s Business Centers, and improvements in the 7(a) and 504 Loan Programs, all aimed at facilitating job creation, growth, and sustainability. Technological Adaptation The adoption of AI and other advanced technologies by small businesses is enhancing operational efficiency and cutting costs. A significant increase in the use of AI-driven systems, such as CRM and automated inventory management, indicates that small businesses are leveraging technology to drive growth and stay competitive. Resilience Amid Economic Pressures Despite facing economic headwinds like tighter credit conditions due to higher interest rates and ongoing supply chain disruptions, small businesses have shown resilience. They continue to navigate these challenges by employing innovative strategies and adapting to the evolving economic landscape. Download your copy of the latest report and check out more insights on small businesses on our Commercial Insights Hub where you can subscribe to updates. Download Beyond The Trends Report Commercial Insights Hub