Commercial Pulse Report

The bi-weekly Commercial Pulse provides a directional update on small business credit. It delivers a quick read on current market impacts, high level credit trends, score and attribute impacts, and other market related activities.

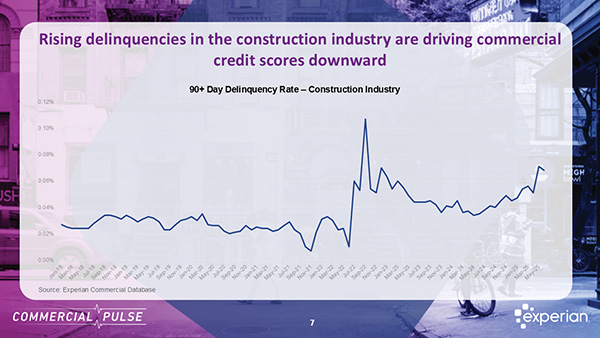

Experian's Construction Industry Risk Model Offers Greater Precision for CRO's Construction is building momentum in 2026 — but capital is becoming more selective just as demand accelerates. For Chief Risk Officers, this is not simply a growth story. It is a risk calibration moment. For Chief Risk Officers and commercial lenders, that combination creates a complex credit environment: expanding opportunity on one hand, rising sector-specific risk on the other. This week’s Commercial Pulse Report highlights why construction deserves close attention — and why traditional risk tools may not be sufficient in the current cycle. Watch The Commercial Pulse Update A Growing Sector with Structural Tailwinds Construction contributes approximately 4.8% of U.S. GDP and remains a foundational industry supporting infrastructure modernization, AI-powered data centers, renewable energy expansion, and multifamily housing demand. Since Q1 2013, the number of construction firms in the U.S. has grown by 28%, reaching nearly 950,000 establishments. Employment in the sector has increased 49% since January 2010, reflecting both demand expansion and increased new business formation. Construction spend peaked at just over $2.2 trillion in April 2024, contracted 3.3% in 2025, and is forecast to rebound 7% in 2026 to exceed $2.1 trillion. Construction businesses seek credit more than twice as often as companies in many other industries — a structural dynamic that fundamentally alters how risk signals should be interpreted. From a growth perspective, the fundamentals remain solid. Non-residential construction is particularly strong, driven by: AI-powered data center buildouts Renewable energy infrastructure Public infrastructure modernization Regional population and job growth For lenders, that growth trajectory signals continued credit demand — especially for working capital, equipment financing, and project-based lending. But growth alone doesn’t define risk. Payment Friction Is Structurally Embedded While construction is expanding, it is also experiencing persistent cash flow strain. According to a 2025 industry study referenced in the report: 70% of contractors regularly face delayed payments 41% have increased their use of credit to manage cash flow 1 in 4 contractors have reduced bidding activity due to financial strain Top contributors to payment delays include: Cash flow constraints Contract disputes Administrative inefficiencies Banking and financing delays Technology and process friction Construction projects are capital-intensive and milestone-driven — meaning liquidity depends on payment timing, not just performance. When developers delay payments, the effects cascade through subcontractors and suppliers. For lenders, this creates a recurring risk pattern: strong backlog with fragile cash flow. For CROs, this creates a distinct risk profile: businesses may show strong top-line growth but experience liquidity stress due to payment timing — increasing reliance on revolving credit and short-term financing. Construction Businesses Seek and Use More Credit Experian data reveals that construction businesses: Seek commercial credit more than twice as often as non-construction businesses Maintain a higher average number of commercial trades Exhibit higher 60+ day delinquency rates compared to other industries At the same time, commercial lenders continue reporting tightened underwriting standards, particularly for small firms. This dynamic — structurally elevated credit demand colliding with tighter credit conditions — increases the need for precise risk interpretation. Elevated inquiries and higher trade counts in construction are not inherently distress signals. In many cases, they reflect the capital-intensive, project-based nature of the industry. The risk is not high credit usage — the risk is misinterpreting what that usage signals. Construction firms are not homogenous. Risk varies significantly across: Trade specialty Project mix (residential vs. non-residential) Business maturity Regional economic exposure Capital structure and utilization patterns Generic commercial risk scores may not fully capture these industry-specific nuances, increasing the potential for both over- and under-estimating risk within construction portfolios. Why Generic Risk Models Fall Short in Construction Construction presents several characteristics that can distort traditional risk assessments: High inquiry and trade activity – Elevated credit usage may reflect normal operating structure, not necessarily distress. Cyclical delinquency patterns – Project-based payment timing can temporarily inflate delinquency metrics. Industry-specific trade relationships – Supplier networks and payment practices differ from other sectors. Material cost volatility – Construction input costs have tripled since the early 1980s and remain elevated relative to pre-pandemic levels. When underwriting models are calibrated to all industries collectively, they may under- or over-estimate risk within construction portfolios. In tightening credit cycles, imprecision compounds faster: Constraining high-quality borrowers Underpricing volatile segments Misallocating capital For CROs, this is not theoretical — it is a margin issue. The Case for Industry-Specific Risk Modeling Addressing this requires industry-calibrated analytics — models built specifically to reflect construction trade behavior and payment dynamics. For example, Experian developed the Small Business Credit ShareTM model for Construction — a purpose-built commercial risk score tailored specifically to businesses with construction trades. The model: Uses advanced machine learning methodology (XGBoost) Predicts the likelihood of becoming 61+ days beyond terms within 12 months Incorporates aggregate business data, public records, trade data, and construction-specific attributes Produces a score range of 300 to 850, where higher scores indicate lower risk Performance testing shows improved KS and GINI separation compared to generic all-industry models, as well as stronger bad capture rates in the lowest scoring deciles. In practical terms, that means: Better identification of high-risk borrowers Improved differentiation among mid-tier applicants More confident credit line sizing Smarter portfolio monitoring For lenders balancing growth objectives with capital discipline, industry-optimized analytics can materially improve decision accuracy. Learn More about Experian SBCS Construction Score Strategic Implications for Chief Risk Officers As we move further into 2026, construction presents a paradox: - Strong sector growth - Elevated credit demand - Tightening lending standards - Persistent payment delays - Increased reliance on alternative capital The strategic question for CROs is not whether to participate in construction lending — it is how to do so with precision. Key considerations include: Are your underwriting models calibrated to sector-specific risk patterns? Are you distinguishing between structural credit usage and distress signals? Are portfolio limits aligned to trade-level risk differentiation? Are you leveraging machine learning where appropriate to isolate “bads” earlier? In a tighter credit market, competitive advantage often comes from accuracy — not volume. Growth Requires Discipline Construction will remain a critical growth engine for the U.S. economy in 2026. Demand is real. Infrastructure investment is accelerating. Capital needs are expanding. But so are constraints. For lenders and risk leaders, the opportunity lies in balancing participation with discipline — using analytics sophisticated enough to separate resilient operators from liquidity-stressed borrowers. The cranes are rising.Capital is tightening. In 2026, growth will be available. Precision will be decisive. Learn more ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub

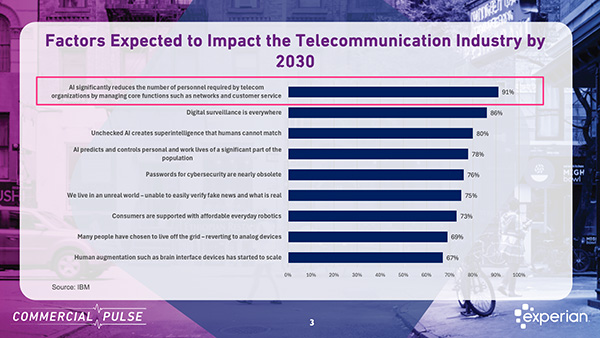

Is AI about to disrupt the telecommunications industry? In this week's Commercial Pulse Report, we explore potential AI disruption in the Telecommunications industry as the transition from analog to digital plays out, and industry consolidation takes hold. Watch The Commercial Pulse Update In 1979, a British new wave band called The Buggles released a song that would become an unlikely cultural landmark. Video Killed The Radio Star wasn’t just catchy—it was prophetic. The lyrics mourned the decline of radio as television and music videos began to dominate how audiences consumed content. Just a few years later, MTV launched, and the shift from audio to visual media was complete. Radio didn’t disappear, but it was permanently changed. One line from the song captures the unease of that moment perfectly “In my mind and in my car, we can’t rewind, we’ve gone too far,pictures came and broke your heart, put the blame on VCR.”The Buggles, 1979 It’s a lament about progress—about technology moving faster than society can comfortably absorb. And it’s a reminder that once disruption takes hold, there’s no rewinding the tape. Fast forward more than four decades, and the irony is hard to miss. MTV itself—once the symbol of disruption—has faded from cultural relevance, ending as it started by playing "Video Killed The Radio Star" on December 31st, 2025. That same cycle defines today’s telecommunications industry disruption, as AI, automation, and consolidation reshape how companies operate and compete. A Familiar Pattern of Disruption Telecommunications has lived through repeated waves of technological upheaval. The shift from analogue to digital fundamentally altered how networks were built, how services were delivered, and how companies competed. That transition drove efficiency, reduced headcount, and accelerated consolidation across the industry. Now, artificial intelligence represents the next inflection point. As highlighted in this week’s Commercial Pulse Report, AI is no longer a future concept for telecom—it’s a near-term operational reality. Industry research shows that a majority of telecom executives expect AI to materially reshape their organizations by automating core functions such as network management, customer service, and fraud detection. Just as video once replaced radio as the dominant format, AI is poised to redefine how telecom companies operate—faster, leaner, and increasingly software-driven. And as history has shown, efficiency gains often come with structural consequences. Consolidation, Scale, and Survival Disruption rarely happens in isolation. It tends to accelerate industry consolidation, and telecom is no exception. Over the past decade, mergers and acquisitions have reshaped the competitive landscape. In wireless, consolidation has resulted in three dominant players controlling the majority of the market. At the same time, the total number of private telecom establishments in the U.S. has declined sharply from its historical peak. This mirrors what happened in media. MTV consolidated attention, then streaming consolidated distribution, and now a handful of platforms dominate content delivery. Each wave reduced the number of viable players while raising the cost of participation. In telecom, AI may lower operating costs—but it also raises the bar for capital investment, data sophistication, and technological capability. Smaller firms face increasing pressure to either specialize, scale, or exit. What the Credit Data Is Telling Us One of the most telling insights from this week’s Commercial Pulse Report comes from telecom credit behavior. Telecom businesses tend to seek credit more frequently than companies in other industries, reflecting ongoing investment needs. However, the average size of credit lines has steadily declined, even as utilization rates have returned to pre-pandemic levels. In other words, telecom firms are doing more with less. This dynamic suggests that businesses may be turning to alternative funding sources, reallocating capital internally, or operating under tighter credit constraints—despite stable demand for connectivity and data services. For risk leaders and growth strategists, this creates a more complex environment. Traditional indicators alone may not fully capture resilience or vulnerability. Understanding industry-specific behavior becomes critical. We Can’t Rewind—But We Can Prepare The line from “Video Killed The Radio Star” still resonates because it captures a universal truth about disruption: We can’t rewind—we’ve gone too far. AI will not undo itself. The telecom industry will not revert to its pre-digital or pre-automation state. Just as radio adapted rather than disappeared, and MTV faded as new platforms rose, telecom companies will continue to evolve—some faster and more successfully than others. The question is not whether disruption will occur, but who is prepared for it. This week’s Commercial Pulse Report explores that question through the lens of macroeconomic conditions, small business credit health, and telecom-specific insights. Together, they offer a clearer picture of how innovation, consolidation, and credit trends are intersecting in early 2026. Because while technology may break hearts along the way, understanding the data helps businesses stay ahead of the next verse. Learn more ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

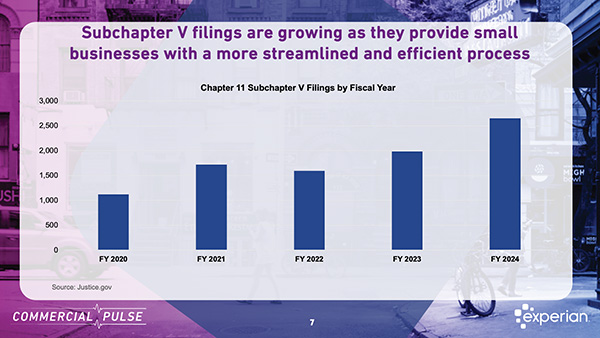

Bankruptcy isn’t just a back-page story anymore, it’s becoming the postscript to the startup surge. The January 27th Experian Commercial Pulse Report reveals a sharp contrast in the small business economy: while business formation remains historically elevated, bankruptcy filings are climbing to levels not seen in a decade. The data points to a critical inflection point—where entrepreneurial growth meets growing financial fragility. Watch The Commercial Pulse Update A Two-Sided Story: Formation and Failure The numbers we see highlighted in the news show a business ecosystem in flux. In December 2025, 497,000 new businesses were launched, a slight dip from November but still 53% above pre-pandemic averages. Since July 2020, an average of 446,000 new businesses have formed each month, underscoring an entrepreneurial surge that has become a defining feature of the post-COVID economy. However, this wave of new businesses comes with significant exposure. Many are lean operations, often led by first-time founders with limited access to capital and minimal financial buffers. These structural vulnerabilities are reflected in rising failure rates. In Q3 2025, business bankruptcy filings hit 24,039—the highest quarterly total since 2016. While some of this activity reflects larger firms restructuring through Chapter 11, a growing share involves smaller, younger businesses taking advantage of Subchapter 5, a newer option tailored for small business reorganization. Understanding Bankruptcy Types: Chapter 7, 9, 11, 12, 13, 15 and Subchapter 5 To better interpret the data, it helps to understand the bankruptcy options available to businesses: Chapter 7 – Liquidation: This is the most straightforward and final form of bankruptcy. Businesses cease operations and a court-appointed trustee sells off assets to repay creditors. Chapter 9 - Municipal Bankruptcy: Exclusively municipalities ( i.e. cities, counties, school districts.) Municipality retains control. No liquidation allowed. No need for disclosure statements. Chapter 11 – Reorganization: This allows a business to continue operating while restructuring its debt under court supervision. Often used by larger or financially complex companies. Chapter 12 - Family Farmer & Fisherman Reorganization: Exclusively for agriculture and fishing operations. Lower cost compared to Chapter 11. Owners keep farm/fishing operation. No need for disclosure statements or creditor committees. Chapter 13 - Individual Reorganization: Primarily for individuals but sometimes used for sole proprietors. Establishes 3 to 5-year repayment plan. Debtor keeps assets and continues operations. Debt limits apply. Chapter 15 - Cross-Border Insolvency: For businesses with assets and creditors in multiple countries. Facilitates cooperation between U.S. courts and foreign courts. Helps protect U.S. assets during international restructuring Subchapter 5 (of Chapter 11): Introduced by the Small Business Reorganization Act of 2019, Subchapter 5 simplifies and lowers the cost of reorganization for small businesses with less than $3 million in debt. Key advantages of Subchapter 5 include: No creditor committee or disclosure statement required Faster court timelines and higher plan confirmation rates Owners can often retain equity Subchapter 5 filings have more than doubled since 2020 and now account for a growing share of all Chapter 11 activity. Who’s Filing—and Why It Matters The report highlights a shift in the types of businesses filing for bankruptcy. These firms are: Small – fewer than five employees Young – under 10 years in operation Low-revenue – earning under $1 million annually These groups now represent the majority of business bankruptcies, showing that financial fragility is highest among the newest and smallest entrants in the market. Early Warning Signs: Commercial Credit Behavior Experian’s commercial credit database reveals clear behavioral patterns among at-risk firms: Higher credit seeking activity: These businesses are 3–4 times more likely to apply for credit before filing. Elevated commercial credit balances: They carry significantly higher balances than non-filing peers. Signs of financial stress: Increased delinquencies and utilization often appear months before a bankruptcy event. This creates an opportunity for lenders to proactively monitor portfolios and identify risk earlier, especially among firms that fit the high-risk profile. What This Means for the Small Business Economy The data paints a complicated picture. New business creation remains strong, driven by structural changes and a resilient entrepreneurial spirit. But these new firms are operating in an increasingly challenging environment, facing inflation, tighter credit conditions, and weakening demand. Subchapter 5 is helping many small businesses stay afloat by making reorganization more accessible. However, rising filings among small and young firms signal that financial strain is becoming more common at the foundational level of the economy. For lenders and risk professionals, the takeaway is clear: track not just the volume of small business activity, but the quality and sustainability behind it. Credit signals remain a powerful early indicator of distress and can help institutions support their small business clients more strategically. Learn More ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

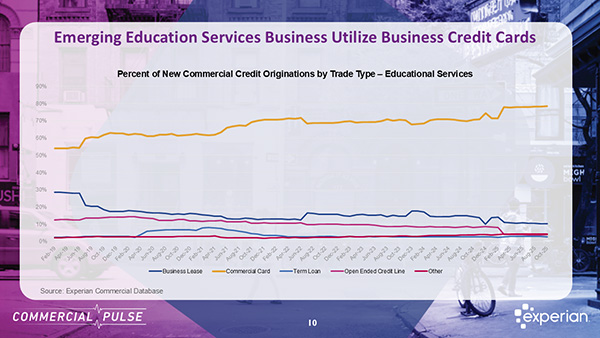

In the just-released Experian Commercial Pulse Report, we focus on a growth small business sector - Education Services, which enjoys healthy, consistent formation, and stable credit management. For Chief Risk Officers navigating an uncertain lending landscape, the question isn't just where growth is happening—it's where growth aligns with manageable risk. The Education Services sector presents exactly that combination, and the numbers tell a compelling story that contradicts conventional wisdom about small business exposure. Watch The Commercial Pulse Update A Sector Transformation Driven by Economic Realities The fundamentals driving Education Services' growth aren't temporary market anomalies; they're structural shifts in how young adults approach career preparation. With youth unemployment rates persistently running more than twice the general population, and young workers facing heightened job security concerns, the demand for skills-based training has fundamentally changed. The traditional four-year degree path is losing its popularity. While bachelor's degree holders still experience lower unemployment rates than those with associate's degrees, the gap has narrowed considerably in recent years. Meanwhile, the escalating cost of traditional college education is accelerating a pivot toward trade schools and specialized training programs, a trend reflected in rising post-secondary enrollment, particularly in trade education. This isn't speculation. Through November 2025, nearly 76,000 new education services businesses have opened— with 7,653 opening in November, the highest level on record. This represents a 205% increase in just two decades. Employment in the sector crossed 4 million for the first time in July 2025. These aren't vanity metrics; they signal sustained, fundamental demand. The Small Business Concentration: Risk or Resilience? Here's where traditional risk models might flash warning signals: businesses with fewer than 10 employees now represent nearly 80% of all educational services firms, up from 63% in 2019. For most sectors, such a high concentration of small businesses would trigger heightened scrutiny and tighter credit controls. But Education Services is defying that conventional risk calculus. Despite this shift in concentration toward smaller operators, credit performance metrics tell a different story—one of discipline and stability that should inform how risk leaders approach this segment. Credit Performance That Challenges Assumptions The credit behavior within Education Services reveals patterns that warrant a fresh risk assessment framework. Commercial credit cards dominate the sector, representing over 78% of monthly originations—a preference that actually provides lenders with valuable visibility into cash flow patterns and working capital management. What's particularly noteworthy: while many industries have experienced tightening credit limits over the past several years, average commercial card limits in Education Services have increased 23% since 2019, now exceeding $19,000. This expansion isn't resulting in overleveraged borrowers. Utilization rates remain relatively low, and average commercial credit scores have held stable throughout this rapid expansion phase. This combination, expanding credit access paired with stable utilization and consistent credit performance, signals something important: disciplined financial management even among newer, smaller operators. For risk leaders, this should prompt a critical question: are your current underwriting models properly calibrated to identify opportunity in this segment, or are they applying broad small business assumptions that miss sector-specific strength signals? Strategic Implications for Risk Leaders The Education Services growth story presents three strategic imperatives for Chief Risk Officers: First, industry-specific risk strategies deliver differentiated insight. Blanket approaches to small business risk assessment will systematically underprice opportunity in sectors like Education Services while potentially overexposing you elsewhere. The stable credit performance despite small business concentration demonstrates that sectoral dynamics matter more than size alone. Second, continuous monitoring beats static underwriting. The rapid composition shift in Education Services—from 63% to 80% small business concentration in just six years illustrates how quickly sector profiles can evolve. Risk strategies built on outdated sector snapshots will either miss growth opportunities or accumulate unrecognized exposure. Real-time portfolio monitoring and dynamic risk modeling aren't optional anymore. Third, growth doesn't automatically mean elevated risk. The Education Services sector challenges the reflexive association between rapid expansion and deteriorating credit quality. In this case, expansion has coincided with improving credit access and stable performance. The key differentiator? Understanding the fundamental demand drivers and recognizing when growth is structural rather than speculative. The Broader Context: Skills-Based Economy Acceleration Education Services isn't growing in isolation. It's responding to, and enabling, a broader economic transformation toward skills-based career pathways. As this transformation accelerates, the sector's role becomes increasingly central to workforce development, suggesting sustained long-term demand rather than cyclical opportunities. For financial institutions, this means Education Services represents more than a near-term growth play. It's a sector aligned with multi-year economic trends, serving businesses that fill a critical gap in how workers prepare for evolving job markets. Moving Forward The Education Services sector demonstrates that growth opportunities and manageable risk profiles can coexist, when you have the right analytical framework to identify them. For Chief Risk Officers, the question is whether your institution's risk infrastructure can recognize these nuances or whether you're leaving opportunity on the table. As 76,000 new businesses enter this sector and credit performance remains stable, the window for strategic positioning won't remain open indefinitely. Competitors with more sophisticated sector-level risk analytics will identify and capture these borrowers first. The data is clear. The opportunity is measurable. The question for risk leaders is simple: what's your strategy for Education Services? ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

Experian Commercial Pulse Report Explores Implications of Rising Premiums As the year draws to a close, one issue looms large for millions of small business owners: the rising cost of healthcare. According to the latest Experian Commercial Pulse Report, small business survival may soon hinge on a single factor — whether enhanced Affordable Care Act (ACA) subsidies are extended into 2026. Watch the Commercial Pulse Update The Clock Is Ticking on ACA Subsidies The American Rescue Plan and Inflation Reduction Act temporarily expanded ACA subsidies, helping make coverage more affordable for millions. But those enhancements are set to expire at the end of 2025 — a policy shift that could unleash a wave of economic strain. The Kaiser Family Foundation estimates that if these subsidies lapse, individuals who purchase insurance through the ACA marketplace could see a 75% increase in premiums. Why does this matter so much for small businesses? Because half of all ACA marketplace enrollees are small business owners, entrepreneurs, or their employees. Coverage Is Shrinking, and Costs Keep Climbing Smaller businesses have historically been less likely to offer health insurance benefits than their larger counterparts. In 2025, only 64% of businesses with 25 to 49 employees offer health benefits — the lowest level ever recorded. And while large employers are still required by the ACA to offer coverage to full-time workers, they too are feeling the pressure. Since 2010, employers have gradually reduced the share of healthcare premiums they cover, even as deductibles have risen by 164% for single coverage plans. The result? Business owners are being squeezed from both sides — by rising insurance costs and a more financially stressed workforce. The Ripple Effects Could Be Widespread If enhanced subsidies aren’t renewed, many small businesses may have no choice but to: Shut down operations Cut staff Shift jobs into larger organizations that can offer coverage That would be a blow not only to small business dynamism but also to broader economic sectors. Reduced consumer spending could hit industries like retail, real estate, and manufacturing, while healthcare providers face payment cuts and job losses due to shrinking coverage pools. What’s Next? With Congress set to vote on subsidy extensions before the end of the year, the stakes couldn’t be higher. The outcome will likely define affordability, access, and entrepreneurship for years to come. For small business owners, now is the time to assess your coverage plans, understand your employee needs, and prepare for potential cost increases. For policymakers and industry leaders, it’s a critical moment to ensure healthcare reforms continue to support the backbone of the U.S. economy — small businesses. Experian continues to provide actionable data to help businesses, lenders, and policymakers navigate uncertainty. To access the full Commercial Pulse Report and explore more insights on small business credit and sector-specific performance: ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

Explore retail industry risk trends for Q4 2025 inventory gaps and credit shifts impact CRO strategies in the latest Commercial Pulse Report.

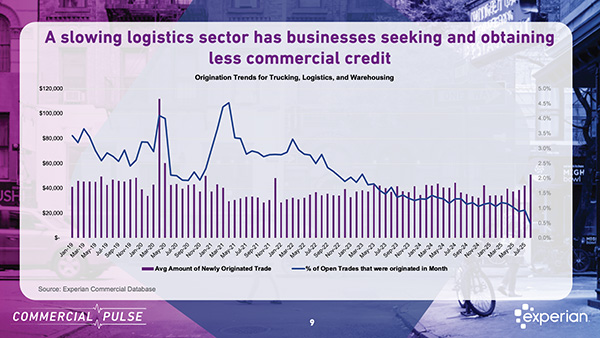

Logistics credit risk is rising according to Experian's latest Commercial Pulse report, signaling financial strain.

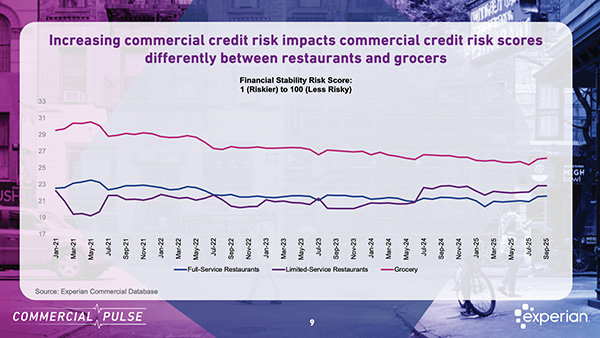

Rising costs are continuing to squeeze American wallets — and perhaps nowhere is that more apparent than in the food sector. According to the latest Experian Commercial Pulse Report (October 14, 2025), food prices are having a profound impact on where and how consumers choose to eat. With the Consumer Price Index for food rising 3.2% year-over-year, both full-service and limited-service restaurants are feeling the heat. Watch the Commercial Pulse Update Specifically, Full-Service Restaurant prices have surged 4.6%, while Limited-Service locations have seen more modest increases of 3.2%, the lowest pace in over a year. As price-sensitive consumers pull back on discretionary spending, Experian’s data shows a notable shift toward more affordable dining options—or a return to eating at home. Credit Demand Is Strong, But Approval May Be Slipping Even with shifting consumer habits, restaurants are not sitting idle. Experian’s credit data reveals that both Full-Service and Limited-Service Restaurants are actively seeking commercial credit — a likely sign of increased working capital needs in the face of inflation and tighter margins. However, access to that credit appears to be narrowing. Commercial inquiries from Full-Service Restaurants have risen to 1.7x pre-pandemic levels. Limited-Service Restaurants follow closely at 1.5x. Yet the number of credit-active Limited-Service establishments has declined, suggesting either a slowdown in approvals or reduced eligibility. This contrast implies that demand for financing is rising faster than approval rates, especially for smaller or newer businesses trying to stay competitive amid rising costs. Shrinking Credit Limits, Rising Utilization Restaurants are not only facing tighter access but also leaner terms. Average credit limits for new commercial card accounts have fallen significantly since 2021: Full-Service Restaurants: Down from $11,500 to under $6,000 Limited-Service Restaurants: Also trending downward Groceries (used as a benchmark for at-home eating): Down from $13,000 to $9,000 At the same time, credit utilization rates are climbing — an early warning sign that businesses are relying more heavily on revolving credit to manage day-to-day operations. Full-Service Restaurants now use 31.9% of available credit, up 4.6 points since 2023. Limited-Service Restaurants trail close behind at 31.8%. Groceries come in at 28.8%, showing increased pressure even in the at-home dining sector. Taken together, this combination of lower credit limits and higher utilization points to a tightening credit environment, which may be challenging for restaurants to navigate through the holiday and post-holiday seasons. Commercial Risk Trends Tell a Mixed Story One of the more nuanced insights in Experian’s report is how different restaurant types are weathering the current environment from a risk perspective: Full-Service Restaurants show only a modest decline in commercial risk scores (–0.8 points), suggesting relative resilience despite financial pressures. Limited-Service Restaurants, interestingly, saw a +1.4 point improvement in risk scores—indicating increased stability and better adaptation to current market conditions. In contrast, grocery retailers—the benchmark for “eat-at-home” sectors—experienced a -1.8 point drop in their risk scores, highlighting greater strain in that segment. This divergence reflects a growing consumer shift toward lower-cost food options like quick-service dining, potentially at the expense of both full-service restaurants and grocers. What It Means for Lenders and Business Strategy These trends carry significant implications for financial institutions, credit providers, and small business advisors: Rising inquiries + shrinking credit limits = greater risk of liquidity stress Stronger risk scores for Limited-Service = opportunity for more targeted lending or product offerings Elevated utilization rates = need to monitor credit performance closely, especially for revolving credit For business owners and operators, understanding these dynamics is crucial to building resilience in a volatile market. Strategic decisions around financing, menu pricing, staffing, and technology adoption will likely make or break performance through the next few quarters. Conclusion: A Sector Under Pressure — but not out While economic headwinds persist, the restaurant industry shows remarkable adaptability. Whether it’s shifting toward leaner operations, targeting lower-income consumers, or increasing credit usage to bridge cash flow gaps, the sector is evolving in real-time. As always, Experian’s insights provide a critical lens into these movements—helping lenders, business leaders, and policymakers make smarter decisions amid uncertainty. For the full analysis, including all small business credit trends, read the latest Experian Commercial Pulse Report. ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

This week Experian focuses on the growing construction industry and early warning risk signals for lenders and risk managers.