Financial Services

For many Chief Risk Officers, credit portfolio management can feel like a constant exercise in damage control. A spike in delinquencies is reported in the monthly update. A sector suddenly underperforms. The board asks whether the risk appetite still holds, after the fact. This reactive posture isn’t the result of poor risk discipline. It’s the result of portfolio management approaches built for a slower, more predictable credit environment. Today’s commercial and small business portfolios move faster, fragment across industries, and respond quickly to macro and behavioral shifts. To stay ahead, CROs must evolve credit portfolio management from firefighting to forecasting. Why Traditional Credit Portfolio Management Keeps CROs in Reaction Mode Many portfolio management programs still rely on legacy practices: - Lagging indicators such as delinquency and charge-off trends- Static, periodic reporting rather than continuous insight- Limited segmentation that masks pockets of emerging risk- Manual analysis that slows decision-making The result is a cycle CROs know well: risk becomes visible only once it has already materialized. By then, options are fewer, and corrective actions are more disruptive to growth and customer relationships. In volatile economic conditions, especially within small business portfolios, this approach exposes institutions to unnecessary risk and earnings volatility. The CRO’s Mandate Has Changed Modern CROs are no longer measured solely on loss avoidance. They are expected to: - Enable profitable growth while maintaining discipline- Translate risk appetite into day-to-day decisions- Anticipate risk before it shows up in losses- Communicate forward-looking insights to executives and boards That requires a fundamentally different approach to credit portfolio management; one that emphasizes early signals, segmentation, and scenario analysis, not just historical performance. What “Forecasting” Looks Like in Credit Portfolio Management A forecasting-oriented portfolio management framework rests on four pillars: Risk Appetite That Is Operational, Not Theoretical Effective forecasting starts with a clearly defined risk appetite that is embedded into portfolio segmentation, exposure limits, score bands, and monitoring thresholds. CROs move beyond static policy statements to measurable guardrails that guide growth and risk-taking in real time. Granular, Dynamic Portfolio Segmentation Rather than viewing the portfolio as a single aggregate, CROs segment by:Industry and geographyBusiness size and lifecycle stageCredit score bands and blended risk profilesProduct, tenure, and exposure concentrationThis level of segmentation allows risk leaders to spot early deterioration in specific pockets, before it becomes a portfolio-wide issue. Early-Warning Signals and Ongoing Monitoring Forecasting depends on identifying changes in behavior, not just outcomes. Shifts in payment performance, utilization, score trends, or public records provide valuable signals that risk is evolving. When these signals are monitored continuously and tied to clear action thresholds, CROs gain time, the most valuable asset in risk management. Scenario Analysis and Forward-Looking Analytics True forecasting requires asking “what if?”• What happens if rates stay higher for longer?• What if a key sector experiences a sudden demand shock?• How would losses and capital needs change under stress?Forward-looking portfolio analytics allow CROs to test assumptions, model outcomes, and guide strategic decisions before conditions deteriorate. Turning Portfolio Data Into Predictive Insight One of the biggest challenges CROs face is not a lack of data, but a lack of integrated analytics that turn data into insight. Portfolio forecasting requires: Access to high-quality commercial and small business data The ability to blend internal performance data with external risk indicators Flexible analytics environments where teams can test, validate, and refine models Dashboards that surface trends and outliers without weeks of custom reporting This is where modern analytics platforms become essential. How Experian Supports Predictive Credit Portfolio Management Experian’s Ascend Commercial Suite™ is designed to help risk leaders move beyond static portfolio reviews toward continuous, insight-driven portfolio management. Ascend Commercial Suite is an integrated analytics platform that brings together data, modeling, benchmarking, and portfolio analysis in a single environment. Key capabilities that support forecasting-oriented portfolio management include: Portfolio Performance Monitoring and DashboardsAscend enables risk teams to create interactive dashboards that are directly connected to portfolio and market data. This allows CROs to: Monitor portfolio performance continuously Identify emerging areas of strength or concern Reduce reliance on manual, recurring reports Advanced Analytics and Model Development With access to Experian’s proprietary commercial and small business data, along with client-owned data, risk teams can: Develop and validate new credit and risk models Monitor existing models for performance and stability Meet regulatory expectations for ongoing model validation Blended and Small Business Risk Analysis For portfolios that rely on personal guarantees or serve small and micro businesses, Ascend supports blended analysis using both commercial and consumer credit data. This provides a more complete view of risk and supports more accurate segmentation and forecasting. Benchmarking and Peer Analysis Ascend’s benchmarking capabilities allow CROs to compare portfolio performance against peer populations and market segments, helping to contextualize risk trends and identify opportunities for adjustment before performance diverges materially. Together, these capabilities help CROs replace reactive portfolio reviews with proactive, data-driven risk steering. "Looking at how similar businesses performed across the broader market helped us move from reactive decisions to forward-looking ones, especially when evaluating new segments and understanding expected loss rates before expanding."Arun Narayan, Chief Product Officer From Firefighting to Confidence When credit portfolio management is built around forecasting rather than reaction, CROs gain: Earlier visibility into emerging risk Smoother, more deliberate policy adjustments Greater confidence in growth strategies Stronger, more credible communication with boards and regulators The goal isn’t to eliminate risk, that’s impossible. The goal is to see risk forming early enough to manage it on your terms. Talk with Experian’s commercial risk experts about strengthening your credit portfolio management strategy with forward-looking analytics and insights. Get In Touch Learn more about how Experian Ascend Commercial Suite can help you monitor, analyze, and forecast portfolio risk with confidence. Learn more Related Posts

Explore how the rapid rise in new business formation presents a unique opportunity for firms to expand digital relationships, automate small business credit processes, and stay ahead in a transforming economy.

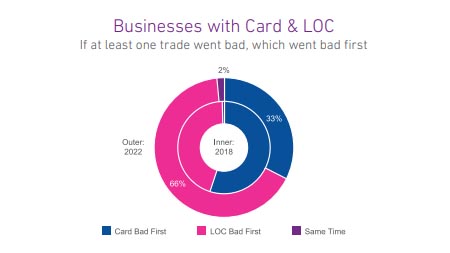

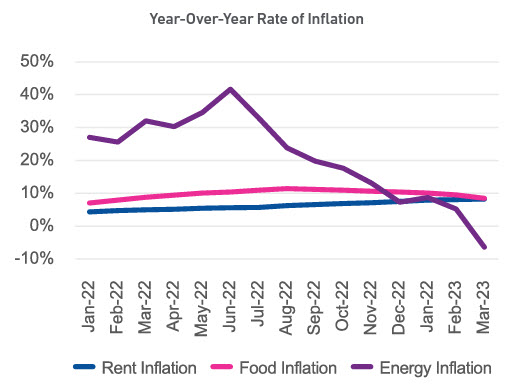

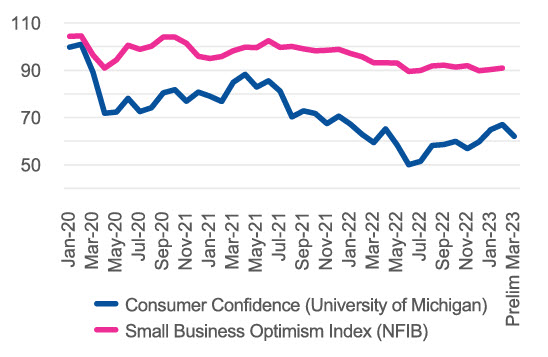

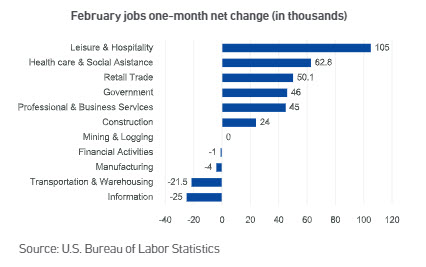

Since January 2021, a seasonally adjusted average of 444K new businesses opened each month, 52% higher than the pre-pandemic 2018-2019 monthly average. In light of the influx of new businesses, and in a higher-interest rate environment, the goal of this week’s analysis was to evaluate if commercial credit usage and payments by product shifted pre- and post-pandemic. Businesses with two different trade types were evaluated as of 2018 (prepandemic) and 2022 (post-pandemic). The two-trade-type combinations observed were Card + OECL (open ended credit line), Card +Term Loan, Card Lease, and Card + LOC (line of credit). Despite more younger businesses entering the market and lenders tightening credit policies over the past two years, businesses with two-trade types had higher lines/loans post-pandemic. Delinquencies also increased post-pandemic for all the two-trade type combinations except businesses with a Card & OECL. Commercial Cards are the most prevalent type of credit for businesses. As businesses grow, they seek additional credit for business needs such as expansion, new facilities, and acquisitions. When businesses seek additional credit, it is most often in the form of commercial loans, leases and credit lines which compared to cards, generally provide higher levels of funding, longer terms and higher monthly fixed payments. For businesses that had two types of accounts, including a commercial card with another commercial credit product, the commercial card stayed current longer and more often the non-card product went delinquent first. Businesses rely on commercial cards for day-to-day operating expenses and lower dollar financing needs. Furthermore, commercial card balances are significantly lower than any of the other commercial trade types allowing for a lower monthly minimum payment to keep the card in good standing. What I am watching: Federal Reserve Chairman Powell stated in last week’s Congressional hearings that the Fed will act slowly and cautiously in terms of cutting interest rates. With inflation declining but still persistent and the labor market still robust, rate cuts may not occur until the second half of the year. Download Report Download the latest version of the Commercial Pulse Report here. Better yet, subscribe so you'll get it in your inbox every time it releases, or once a month as you choose.

The Commercial Pulse report provides a bi-weekly directional update on small business credit. It delivers a quick read on macroeconomic conditions, high-level credit trends, score and attribute impacts, and other market-related activities.

Recent news of the SVB collapse highlights the vulnerability of small banks and their crucial role in serving local communities. Small and medium-sized financial institutions should prepare for additional interest rate hikes.

Bankruptcies and collections are on the rise since mid 2022. Pandemic-related relief and forgiveness suppressed collections for most of 2021 and the first half of 2022.

In this post we discuss reject inferencing and how it can help credit departments grow commercial accounts without taking on more risk.

Heading into the holiday season, we'll see if consumers continue to spend at high levels, or if higher prices, higher interest rates and lower savings create a drag on sales.

In our Business Chat, Greg Carmean shares how the latest SBFE attributes help lenders better assess small business risk and tap into growth opportunities.