All posts by Gary Stockton

Small Businesses remain resilient amid rate uncertainty and signs of job market weakness May 2025 Index Value (Apr): 45.2 Previous Month: 43.2 MoM: +2.0 YoY: -9.8 (May 2024 = 55.0) Last month’s dip was short-lived as May's economic figures remained strong, showcasing the continued resilience of the U.S. economy. Reduced tariffs, especially on China, eased market concerns amid ongoing trade talks. The unemployment rate remained steady at 4.2% and wages continued to rise. New business starts remained stable at 447K in May, close to the monthly average of 441K since July 2020, and still well above pre-pandemic levels. Consumer sentiment and small business optimism increased after recent declines, though uncertainty still affects these surveys. Consumer sentiment was 98.8 in May, a 3-point increase over April, but 11% lower than a year ago. Inflation news was mixed: overall and food inflation saw slight upticks, while core inflation stayed flat and rent inflation dropped to its lowest since November 2021. The Fed's cautious approach persists, but predictions of a rate cut in the coming months are growing as inflation remains relatively steady and potential signs of job market weakness emerge. Explore Experian Small Business Index

Experian Commercial Pulse Report reveals decline in total number of ecommerce businesses, strong revenue, and fewer credit inquiries.

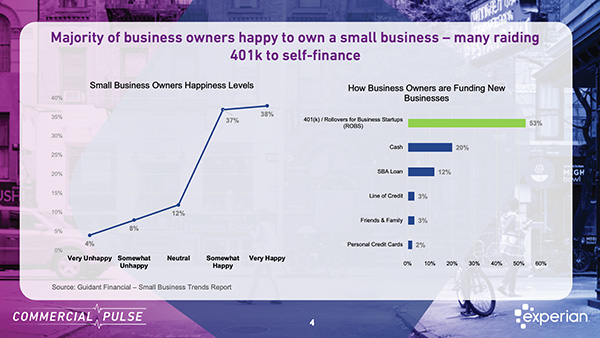

Commercial Pulse Report | 6/17/2025 Economic uncertainty is often seen as a deterrent to growth, but for many Americans, it’s become the fuel for a fresh start. As inflation wavers and traditional employment structures shift, more individuals are stepping out of corporate roles to pursue business ownership. In this week's Commercial Pulse Report, we take a closer look at what's driving this wave of entrepreneurial activity. Gen X Leads the Charge Toward Self-Employment According to Guidant Financial's 2025 Small Business Trends report, Generation X is leading the charge. Many in this age group are opting out of traditional career paths, motivated by a desire for autonomy, flexibility, and a more purposeful work life. According to Guidant’s report, Gen X holds the largest share of U.S. small business ownership, with a significant portion of these entrepreneurs transitioning from established careers. What’s driving this shift? Dissatisfaction with corporate life and a strong desire to be one’s own boss are leading motivators. It’s a story of experienced professionals reevaluating priorities and seeking more control over their financial future. And it appears to be a fulfilling decision—75% of small business owners report being happy with their choice to go independent. Retirement Savings Power New Ventures A surprising—but telling—statistic in ’s report: 53% of new business owners used 401(k) retirement funds to launch their ventures. This trend underscores a growing willingness to invest personal wealth into long-term entrepreneurial aspirations. Known as Rollovers as Business Startups (ROBS), this approach allows individuals to use retirement funds without early withdrawal penalties. It’s a bold move, signaling high confidence among business owners—but also highlighting gaps in access to traditional funding channels. Entrepreneurs are taking on more personal risk, in part because institutional capital isn't always accessible to young businesses. Interestingly, 56% of all new businesses are either newly founded or existing independent ventures, showing a diverse range of entrepreneurial approaches—from solo startups to revitalized legacy brands. The Credit Dillema for Young Businesses Experian’s data shows that businesses under two years old account for more than 50% of new commercial card originations. These companies are opting for credit cards over term loans due to fewer barriers to entry, but this often means lower funding limits. Meanwhile, newer businesses face steeper challenges securing traditional loans. They now represent just 15% of term loan originations, down from 27% in 2022. For lenders, policy makers, and service providers, these trends underscore the need to rethink how we support emerging businesses. From alternative funding tools to better credit-building pathways, there’s a growing opportunity to empower America’s newest entrepreneurs. Stay Ahead with Experian ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

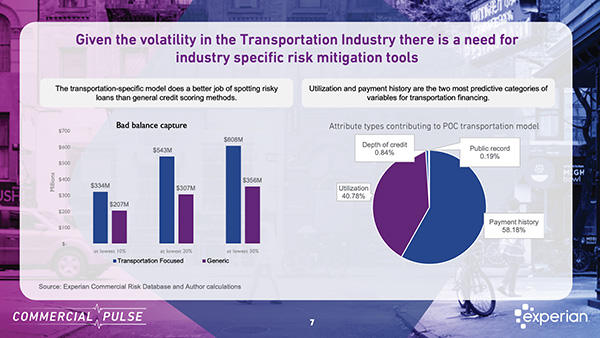

Commercial Pulse Report | 6/3/2025 The latest Experian Commercial Pulse Report provides a sharp look at how recent economic shifts are impacting small businesses across the U.S., with a special focus on supply chains, specifically the transportation industry, which is experiencing fallout from changing trade policies. Are industry-specific models effective in mitigating risk? Inflation, Employment, and Consumer Outlook April inflation cooled slightly to 2.3%, marking the lowest increase since February 2021. While this might suggest some price relief, the overall sentiment in the market tells a more cautious story. Unemployment held steady at 4.2%, and wages continued to climb, signaling that the labor market remains resilient. However, optimism is waning. The NFIB Small Business Optimism Index dropped to 95.8, its lowest point since October 2024. Meanwhile, consumer sentiment fell to 50.8 in early May, reflecting growing concern over the economic outlook. Together, these indicators suggest that although the job market remains stable, confidence — both among businesses and consumers — is eroding. A Dip in the Small Business Index April saw a drop in Experian’s Small Business Index, falling from 47.2 to 43.2, with a year-over-year decline of 11.9 points. This marks the first decline in four months and highlights the early impact of broad tariffs announced on April 2nd. While the dip was modest, it reflects growing pressure on small businesses as they navigate cost increases, supply chain uncertainty, and changing consumer behavior. Encouragingly, despite the turbulence, several economic indicators remained steady. Mortgage rates held below 7% for the 17th straight week, and business formation remained strong with over 449,000 new businesses launched in April. Transportation Industry: First to Feel the Hit This month’s report shines a spotlight on the transportation sector, which has been uniquely sensitive to recent tariff activity. As a major driver of the U.S. economy — contributing 3.3% to GDP and employing over 4% of the workforce — transportation is often the first industry to feel the ripple effects of economic change. And the response was swift. After trade tariffs were announced in early April, shipping volumes from China to the U.S. dropped by more than 60% year-over-year. Just weeks later, following a temporary 90-day lift on tariffs, volumes rebounded sharply, jumping over 28%. This volatility underscores the sector’s dependence on global trade — and the speed at which policy shifts can influence business activity. Rising Risk — and Smarter Tools Financial stress in the transportation industry is rising. Businesses are carrying higher credit balances, delinquencies are increasing, and commercial credit scores have fallen from 44 to 36 since 2015. These trends point to a sector that’s struggling to adapt amid changing economic conditions. To help lenders better manage risk, Experian developed a transportation-specific credit model that significantly outperforms generic scoring models. By focusing on variables like credit utilization and payment history — which are particularly telling in this industry — the model offers a more accurate picture of which accounts using transportation financing are most likely to default. In today’s uncertain environment, such targeted tools are crucial for staying ahead of risk. Generic models aren't enough For credit professionals and risk leaders, the message is clear: in times of volatility, generic models aren’t enough. Tailored strategies — like Experian’s transportation-specific scoring model — provide the clarity needed to make smarter, faster decisions. Read this week's report for more details. Stay Ahead with Experian ✔ Visit our Commercial Insights Hub for in-depth reports and expert analysis. ✔ Subscribe to our YouTube channel for regular updates on small business trends. ✔ Connect with your Experian account team to explore how data-driven insights can help your business grow. Download the Commercial Pulse Report Visit Commercial Insights Hub Related Posts

While the small business index experienced a decline in April, the decrease was modest due to the continued resilience of the U.S. economy.

Navigating Credit and Policy Crosswinds Experian is very pleased to announce the release of the Q1 2025 Main Street Report. Watch Brodie Oldham present the latest insights on small business from the Q1 Main Street Report. Watch Q1 Quarterly Business Credit Review Webinar Small business performance strong in the face of significant challenges: As economic crosswinds continue into 2025, Experian’s Q1 Main Street Report offers a sharp lens into the evolving risk landscape for U.S. small businesses. With stable credit utilization, modest delinquency trends, and over 449,000 new business applications in April alone, the data points to a cautiously optimistic outlook. For risk leaders, this report provides critical insights into regional and sectoral credit behavior, the growing role of alternative data in underwriting, and emerging areas of exposure and opportunity, equipping you to recalibrate strategies in real time. Download the latest report for more insight. Download Q1 Main Street Report Related Posts

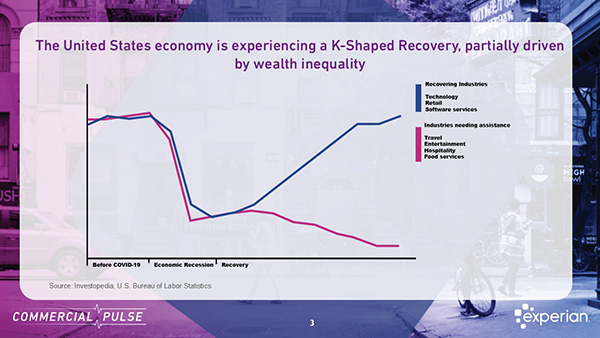

Discover highlights from Experian’s March 2025 Commercial Pulse Report: GDP dip, small business growth, and rising income inequality.

Get the latest insights on small business credit performance. During this webinar, Experian discussed small business credit conditions and presented key findings from the latest Main Street Report for Q1 2025 during the Quarterly Business Credit Review. Originally Presented:Date: Wednesday, May 28th, 2025Time: 10:00 a.m. (Pacific) / 1:00 p.m. (Eastern) Our lead presenter, Brodie Oldham, shared his insights on the macroeconomic environment and delved into the latest Main Street Report and the most recent small business credit data to examine what it revealed about small businesses' performance. We concluded the session by taking questions from attendees. Why Attendees Found Value in This Webinar: Leading Experts on Commercial and Macro-Economic Trends Credit insights and trends on 30+ Million active businesses Industry Hot Topics Covered (Inclusive of Business Owner and Small Business Data) Commercial Insights you cannot get anywhere else Peer Insights with Interactive Polls (Participate) Discover and understand small business trends to make informed decisions Actionable takeaways based on recent credit performance Get Notified About Future Webinars

Small Business Resilience Being Tested in Changing Tariff Conditions The Experian Small Business Index™ rose by 1.8 points in March, reaching 47.2, marking the third month of modest gains. Index is down 9.3 from the same period one year ago. March 2025 Index Value (Mar): 47.2 Previous Month: 45.4 MoM: +1.8 YoY: -9.3 (Mar 2024 = 56.5) March reading points to continued resilience in economy Positive indicators for the overall economy persist: unemployment remained low at 4.2% in March, core inflation decreased to 2.8%, rent inflation dropped to 4.0%, and March retail sales were up 1.4% from February. Consumer and business owner optimism continues to decline, signaling uncertainty about the economy's sustained strength. Fed Chair Jerome Powell has highlighted the country’s solid economic position while also expressing concerns about the effects of tariffs, suggesting they will proceed with caution when determining changes to rates for now. Despite some economic headwinds and uncertainty among consumers and small business owners, small business owner optimism remains above the historical average. The rate of new business starts has remained very high since the pandemic, and in March the 452,255 new business starts represents a 6.4% increase from February. The three-month increase in the index suggests that the environment for small business owners is strong, indicating their likely continued investment in their companies. Explore Experian Small Business Index